International fragmentation in the economic outlook

As the global economy’s landing is turning out to be smoother than anticipated a few months ago, the last few weeks reminded us that the environment continues to be marked by a high degree of uncertainty.

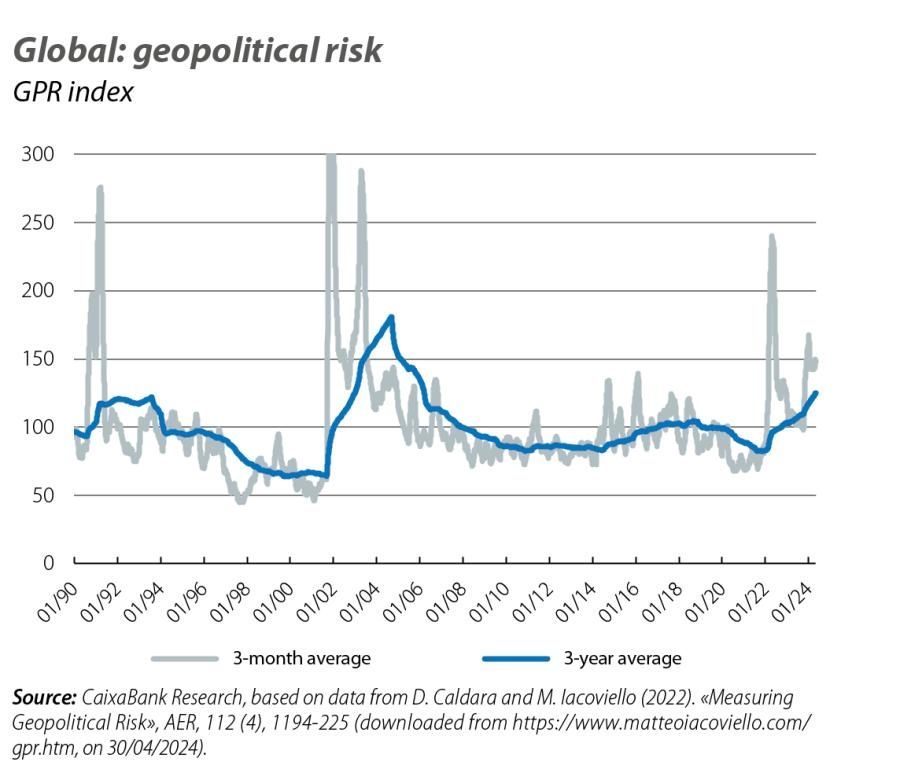

As the global economy’s landing is turning out to be smoother than anticipated a few months ago, the last few weeks reminded us that the environment continues to be marked by a high degree of uncertainty. The direct attacks between Israel and Iran led to a moment of maximum tension in the conflict. Moreover, while the attacks did not escalate further and the scenario of an outbreak of a regional conflict seems to have been avoided for the time being, a further escalation leading to new tensions in the international economy, particularly in commodity markets, cannot be ruled out. The macroeconomic scenario will thus remain subject to geopolitical risks, on various fronts. The GPR geopolitical risk index has stood at around 150 points for the last 6 months (50% above its historical average of 100 points) and its 3-year average exceeded 125 points for the first time since 2006, when we went through a period of «de-escalation» following the historical peaks at the beginning of the century.

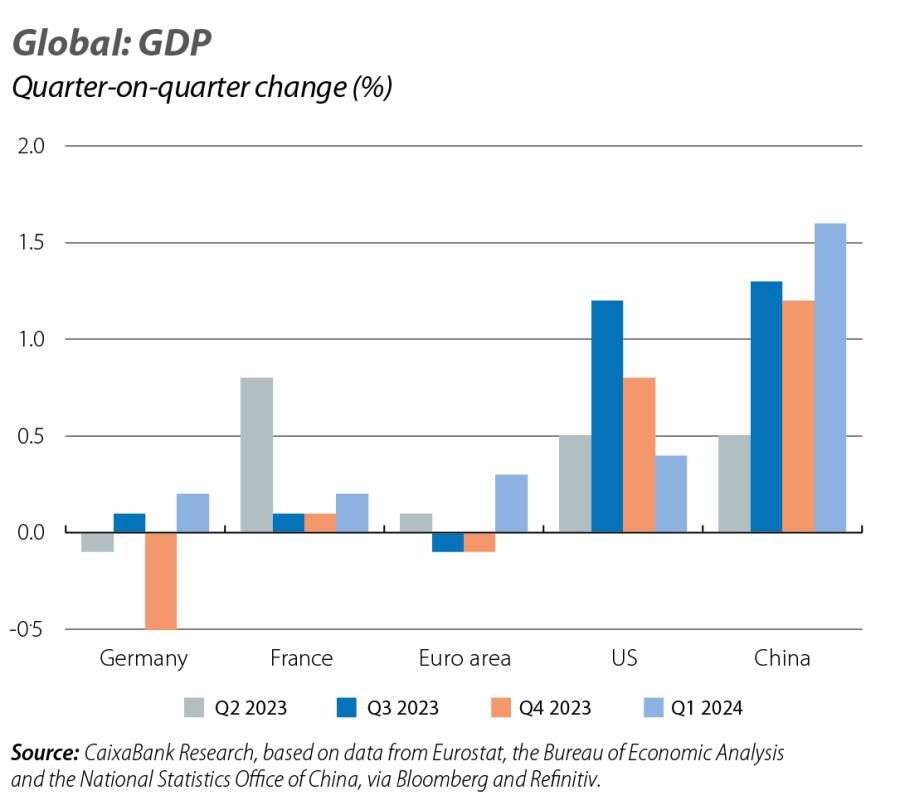

In the US, GDP grew by 0.4% quarter-on-quarter in Q1 2024. Although below expectations, this figure reflects the health of the US economy. The reading at the component level reveals that private consumption grew by a significant 0.6% quarter-on-quarter (vs. 0.8% in the previous quarter) and that investment in fixed capital accelerated (+1.3% in Q1 vs. 0.9% previously). The data thus paint a picture of robust domestic demand, in a context in which foreign demand is cooling. In the euro area, GDP grew by 0.3% quarter-on-quarter, surpassing expectations after having fallen in the previous two quarters and placing the year-on-year growth rate at 0.4%. The large economies accelerated relative to the previous quarter. Germany managed to grow by 0.2% quarter-on-quarter (vs. –0.5% in Q4 2023, revised downwards), France grew by 0.2% (vs. 0.1% previously), mainly due to a solid acceleration in fixed capital investment, while Italy advanced 0.3% (vs. 0.2% previously). Spain stood out above the rest, growing by a significant 0.7% at the beginning of this year (see the Spanish economy economic outlook section). These figures helped to mitigate the divergence between the US and European economies, while the gap in growth between the central and peripheral economies of the euro area persists. However, in a context of persistent weakness in European industry, which is also reflected in the main opinion polls and business climate surveys, the growth expectations remain somewhat modest. In fact, in the latest update of its World Economic Outlook, the IMF highlighted the divergence in growth rates between advanced economies, as well as between this group and developing economies, revising US growth upwards for 2024 and 2025 (2.7% and 1.9%, +0.6 pps and +0.2 pps vs. the previous forecast, respectively) and downwards in the case of euro area growth (0.8% and 1.5%, –0.1% pps and –0.2 pps vs. the previous forecast, respectively).

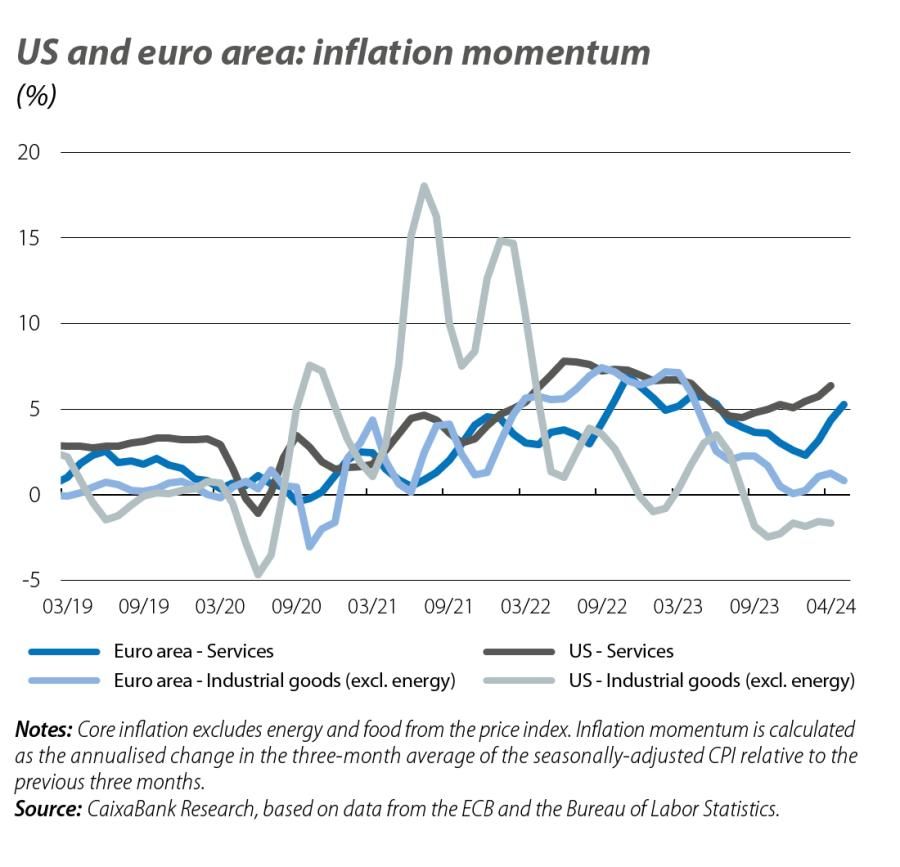

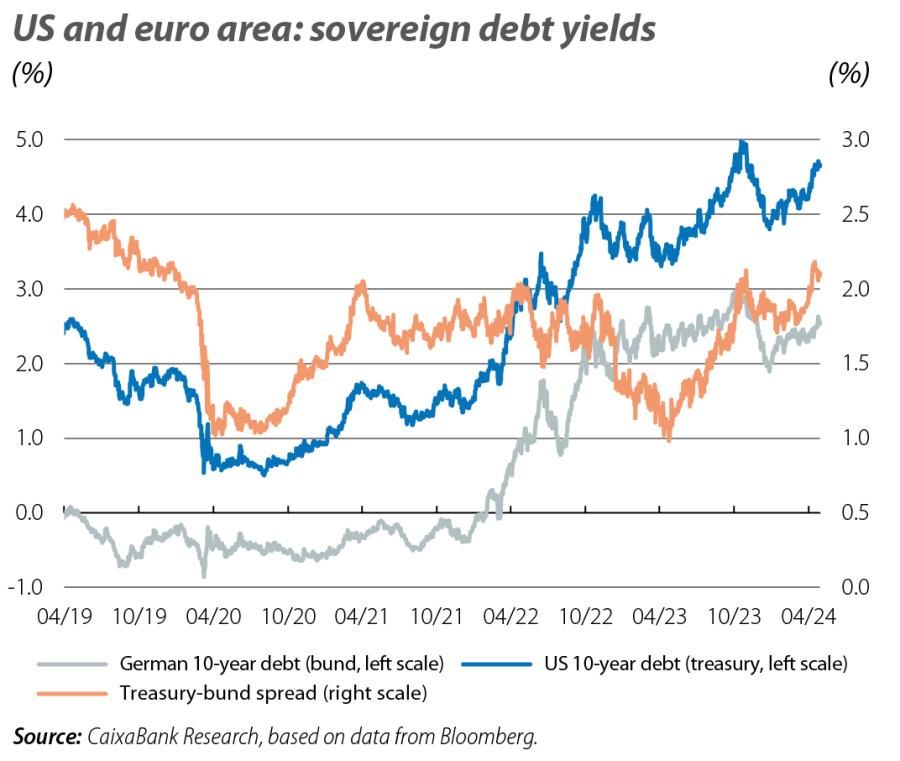

Inflation continues to be a source of concern and remains on the risk map, especially in the US, where the publication of the GDP data not only showed the strength of US consumption but also that of the domestic inflationary pressures. The rise in the GDP deflator (from +2.0% to 3.1% year-on-year) and in the core PCE measure of inflation (from 1.6% to 3.7%) helped to fuel a delay in expectations for rate cuts, both in the financial markets and in the communications from the Federal Reserve itself (for more details, see the Financial markets economic outlook section). This opens up a further source of divergence between the US and European economies, with confidence increasing in the latter case that the ECB could begin to cut rates as early as June. In April, headline inflation in the euro area stood at 2.4%, while the core index fell to 2.7%, marking its lowest point since February 2022. Of particular note was the slowdown in services to 3.7% and the sustained moderation in the inflation of industrial goods. Moreover, in a context of high uncertainty, at its latest meeting the ECB underlined its strategy of relying on the data, not on the Fed.

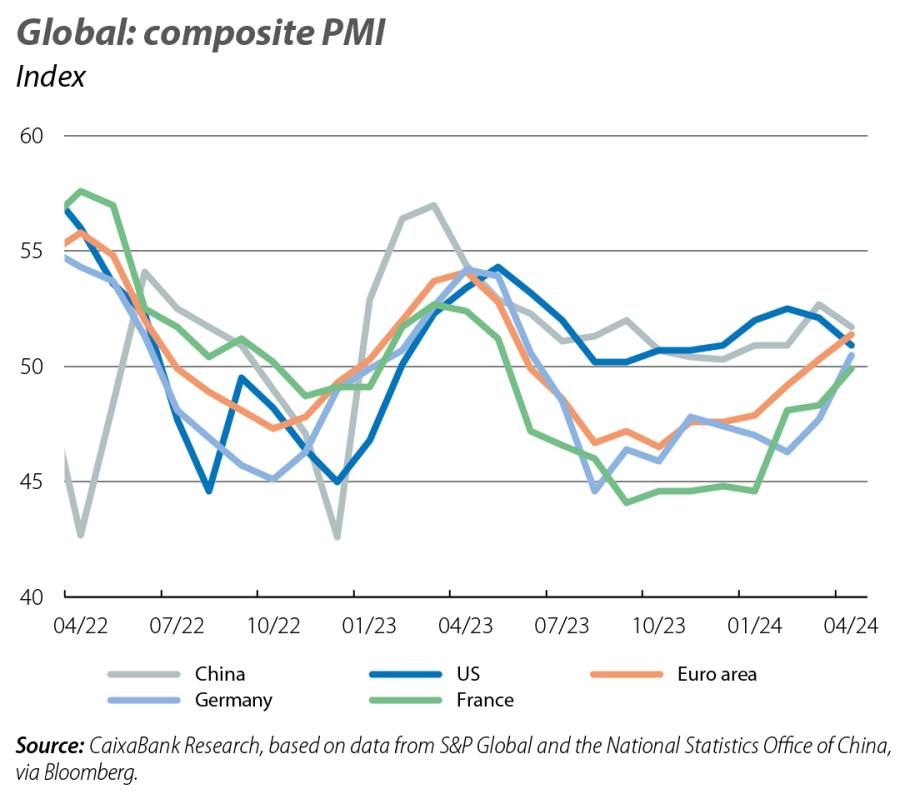

While on the one hand consumption remained strong in Q1 in the US, the decline in April of the composite Purchasing Managers’ Index (PMI) to 50.9 points (vs. 52.1 previously), placing it only just above the 50-point threshold that denotes expansion in production, suggests that economic activity could lose some momentum in Q2. In the euro area, the composite PMI rose again by more than 1 point in April, reaching 51.7 points (vs. the previous 50.3). This increased dynamism is mainly explained by the revival of the services sector (53.3 points vs. 51.5 previously), while the industrial sector has not yet recovered from the crisis triggered by the outbreak of the war in Ukraine (45.7 points vs. 46.1 previously). Germany’s Ifo business sentiment index also climbed 1.5 points in April, to 89.4. This marked its third consecutive increase, although it remains well below the 100-point threshold that denotes growth around its long-term average. On the other hand, the economic sentiment indicator (ESI) declined slightly in the euro area (95.6 points vs. the previous 96.2).

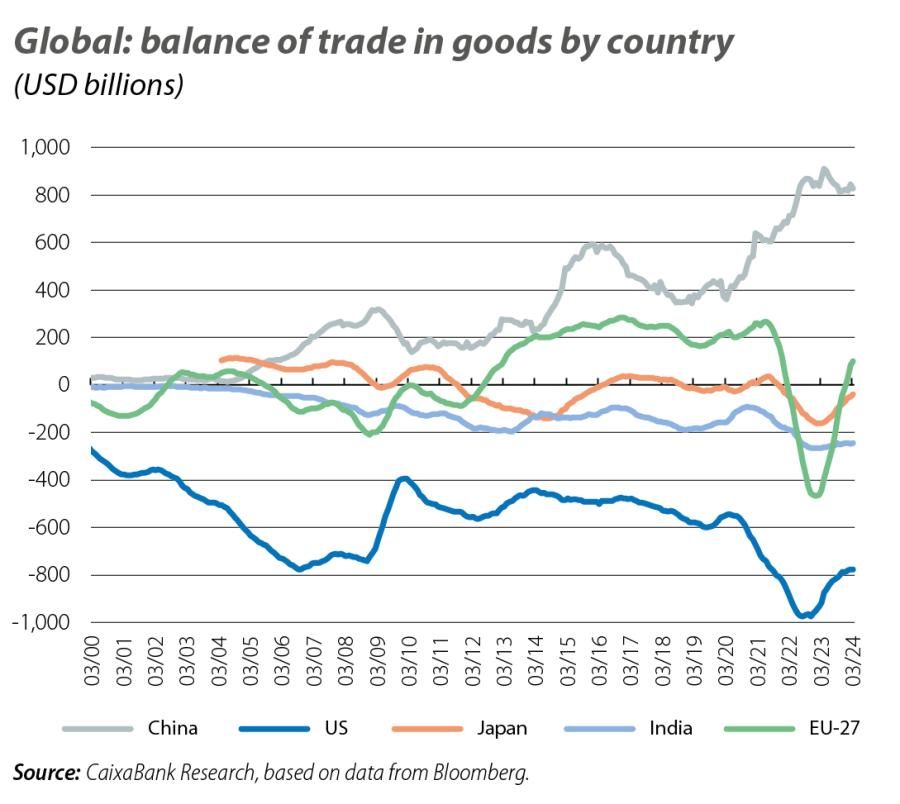

The Chinese economy performed better than expected in Q1, recording quarter-on-quarter growth of 1.6% (vs. 1.2% in Q4 2023). However, it was not all good news. The acceleration observed in Q1 can be attributed above all to the boost in investment, while consumption continues to show signs of significant weakness, indicating a growing fragmentation between the buoyancy of supply and the fragility of demand. The economic activity indicators show a loss of steam in retail sales at the beginning of the year, while the PMIs for April reveal a slowdown in activity at the start of Q2 (the official composite PMI fell from 52.7 points in March to 51.7 in April). This slowdown is particularly concentrated in the services sector, for which the official PMI fell more than 2 points (from 52.4 to 50.3 points). The slowdown in China’s economy is also likely to become more visible in the coming months as the boost provided by fiscal policy loses steam, amid persistent low consumer confidence and overcapacity issues in the country’s industry. Indeed, this overcapacity was the target of criticism from the US treasury secretary, Janet Yellen, after her last visit to China, showing that geopolitics will continue to play a central role in these latitudes as well.