Emerging oil company debt: adding fuel to the fire

Since 2006 global debt, both public and non-financial private, has grown by 35%. This trend has been widely commented but perhaps what is not so well-known is the fact that companies from the emerging countries have played an important part in building up this debt, accounting for 40% of the rise. Given this situation, one sector causing concern is that of the oil companies from emerging countries. These are firms that have not only taken advantage of accommodative international financial conditions, as have many other companies in the emerging countries, but are also in a sector that has been severely shaken by a slump in prices. Besides these two factors, if we also add the fact that these companies are very often public corporations, it becomes even more important to have an accurate diagnosis of their situation.

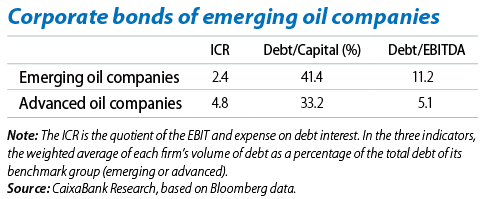

Although precisely gauging the solvency of a company requires a detailed analysis of its balance sheet, we can get an initial idea from three fundamental indicators. A company will be in a comfortable debt position if it can easily meet the financial costs of its debt with its operating profit; if its debt is not excessive in relation to its equity, and if its volume of debt is not very high compared with its profit.1

Looking at the major oil companies listed on the stock market, the average solvency of those from emerging countries is below that that of their peers from the advanced countries because, as can be seen from the table below, they present worse figures for all three of the indicators mentioned.2 Given this situation, the question is whether these indicators for emerging oil companies are so bad as to imply a relatively high risk to their solvency.

One initial answer to this question is provided by the credit rating given by rating agencies: of the 14 companies analysed, seven are below «investment grade». However, as the relationship between a country’s rating and that of its companies is not entirely separate, sometimes a firm’s intrinsic credit rating can be slightly different. To fine-tune our analysis, we can establish a correspondence between the current levels of debt and the credit ratings. Conventionally, a company is deemed to be clearly below «investment grade» when its interest coverage ratio is less than 2 or when its debt to EBITDA ratio is more than 7. Four of the 14 emerging companies analysed are in one of these two situations, two of which have been rated below «investment grade» but the other two not.

Although this may seem a low percentage, the diagnosis is more worrying when we consider that these firms account for 60% of the total debt of the group of emerging oil companies. It should also be noted that, if the need ever arose to recapitalise them using public funds, the potential impact on public finances could be considerable given that the debt of the aforementioned four companies with the poorest solvency account for between 1% and 7% of the GDP of their respective countries.

A second analysis that can be carried out to assess the financial situation of companies is stress testing; i.e. estimating the solvency situation in the case of a series of adverse shocks. Although there is no specific stress test for the oil industry, the IMF has carried out such an analysis of commodities companies (energy and non-energy) in the emerging countries. Specifically, it has studied how debt at risk would evolve (defined as a company’s debt whose ICR is 2 or lower) if a triple shock occurred: an increase in financing costs (of 30%), a drop in earnings (of 20%) and a depreciation in emerging currencies (of 30%).3 In this scenario, the IMF estimates these companies’ debt at risk would amply exceed 30% of corporate debt in the case of Brazil; would be close to 15% in that of Indonesia; would exceed 10% in Hungary and would be around 5% in Argentina and the Philippines.

In summary, when we move from an analysis of general corporate debt to one of the oil sector in particular, perceived risk increases. Nonetheless, and as we have already mentioned, accurately assessing the individual solvency of companies is beyond the overall aim of this article. Moreover, we must also remember that, should the expectations come about of a recovery in oil in 2017-2018, this will ease the pressure on the solvency of oil companies.

1. These three measures take the specific form of three ratios, the interest coverage ratio (ICR), calculated as the quotient of earnings before interest and tax (EBIT) and interest expense; the quotient between debt and capital and, lastly, the quotient between debt and earnings before interest, tax, depreciation and amortisation (EBITDA).

2. Weighted average by volume of debt for each firm compared with the total debt of its benchmark group (emerging or advanced).

3. The stress test was carried out with data up to 2014; i.e. before the slump in oil in 2015, but it should be noted that debt ratios had already been worsening since the mid-2000s. The shocks considered are similar to those occurring during the Great Recession of 2008-2009 in the area of financial costs and earnings and to events in the 1990s with regard to currency depreciation.