Global economic activity shows moderate growth

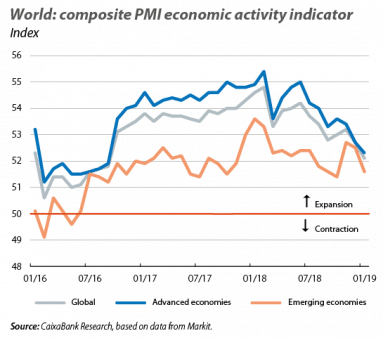

Global economic activity indicators suggest that the slowdown continues at the beginning of 2019. In particular, in January the global composite Purchasing Managers’ Index (PMI) remained in expansive territory (above 50 points), but once again fell. It reached 52.1 points, placing it at its lowest level since September 2016 and indicating a more moderate global growth rate in Q1 2019. All in all, part of this moderation is in response to headwinds that are expected to be temporary (such as the impact of the new European emissions regulations in the automotive sector). On this basis, CaixaBank Research’s scenario predicts a slowdown in global growth from 3.7% in 2018 to 3.4% in 2019, meaning that the global economy is expected to continue to grow at a significant rate in line with the historical average.

Trade and Brexit: two steps forward, one step back. In the United Kingdom, Theresa May decided to delay the new vote on the exit agreement in the House of Commons (12 March was set as the new deadline), while she continues to negotiate with the Union on possible concessions relating to the back-stop clause on Ireland. Furthermore, in case the agreement with Brussels is rejected again, May announced a vote (scheduled to take place on 13 March) on whether or not to approve a no-deal Brexit. If this is also rejected, the next day there will be a third vote on an extension (which would be limited and short) of article 50 until June. However, while the uncertainty surrounding Brexit persists, in February, the US and China took further steps to dissipate their trade tensions. Thanks to the progress achieved in the negotiations between the two countries, Donald Trump postponed the tariff increase from 10% to 25% on 200,000 million of Chinese imports (which was due to take effect on 1 March) until an unspecified date. As such, the positive tone of the negotiations allows us to glimpse a halt to the escalating trade tensions and, therefore, lower global uncertainty in the sphere of trade (at least in the short term).

US

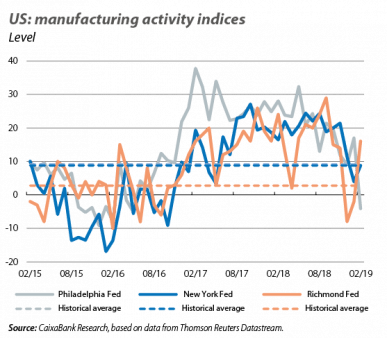

The US grew by a healthy 2.9% in 2018 (2.2% in 2017), favoured by the fiscal stimulus approved at the end of 2017 and the strength of the labour market (which drove the buoyancy of private consumption). All in all, in the closing phases of 2018 a slowdown was noted in the GDP growth rates. Specifically, GDP grew by 0.6% quarter-on-quarter in Q4 2018 (3.1% year-on-year), 2 decimal points below the growth of the previous quarter. This slowdown was partly due to factors we believe to be temporary, such as the effect of the partial US federal government shutdown. This is a factor that could tarnish growth rates in Q1 2019 and will be added to the effects of the extreme cold experienced in the north of the country at the beginning of the year. Nevertheless, the moderation of growth is also a response to the maturity of the business cycle, which represents a more structural force. Therefore, CaixaBank Research projects growth of 2.3% for 2019 as a whole (still a very strong figure, albeit closer to the country’s potential growth rate, which we estimate at 1.9%).

Inflationary pressures in line with the target and the moderation of growth support the Fed’s decision to remain patient. Headline inflation moderated in January down to 1.6%, 3 decimal points below the previous figure. This decrease was largely due to the fall in energy prices, still influenced by the downward trend in oil prices seen in late 2018. Core inflation, meanwhile, remained at 2.2% for the third consecutive month. As such, inflation rates are in line with the Fed’s target, which in a context of global downside risks, offer the monetary institution some margin to remain patient in relation to future changes to its interest rates (see the Financial Markets section).

EUROPE

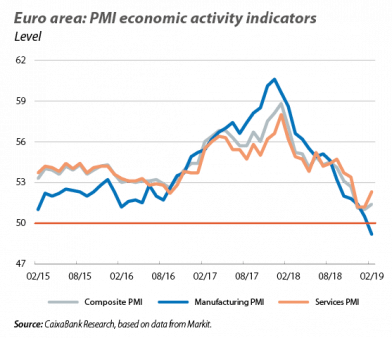

The economic indicators suggest moderate growth at the beginning of 2019. In particular, although in February the composite PMI index of the euro area rose slightly following months of decline (reaching 51.0 points), it still stood at moderate levels due to the contrast between the services and manufacturing sectors. On the one hand, the manufacturing PMI index fell to 49.2 points, its lowest level in almost six years and below the 50-point threshold that separates the expansive and recessive territories. On the other hand, the PMI index of the services sector rose to 52.3 points (its highest value in the last three months). Overall, the indicators suggest that the euro area will grow at a moderate rate in the first few months of the year.

Germany and the United Kingdom show lower-than-expected growth. Germany’s GDP remained stable in Q4 2018 (0.0% quarter-on-quarter and 0.6% year-on-year, after a –0.2% quarter-on-quarter contraction in Q3), placing annual growth at 1.5%. All in all, the German statistics institute suggested that domestic demand maintained a positive tone, hence growth is expected to pick up over the coming quarters. GDP growth in the UK, meanwhile, was lower than expected in the last quarter of 2018 (0.2% quarter-on-quarter), placing it at 1.4% for the year as a whole (its lowest since 2012).

REST OF THE WORLD

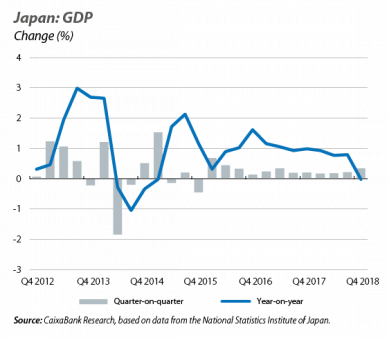

Japan returned to growth in Q4 2018 and ended the year with annual growth of 0.7%. GDP grew by 0.3% quarter-on-quarter in Q4 (0.0% year-on-year), following the fall in the previous quarter caused by the natural disasters that hit the country last summer. The breakdown by component showed solid growth in private consumption and in business investment.

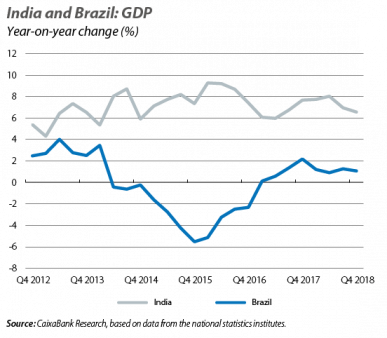

In the emerging markets, China continues to slow down, while Brazil and India also lost some momentum in the closing stages of 2018. In China, exports got back on track in January, with a solid growth of 9.1% year-on-year (in contrast to the 4.4% decline in December), although the full range of indicators continue to point towards a slowdown in economic activity. The publication of India’s GDP, meanwhile, showed a GDP growth of 7.3% in 2018, a significant rate albeit with ups and downs throughout the year. Finally, in Latin America, Brazil grew by 1.1% in 2018, with no improvement compared to 2017 largely due to the loss of momentum in Q4.