During the recession, weak domestic demand led many firms to look abroad, augmenting the number of exporters from 100,000 to 150,000 between 2010 and 2013. This increase is highly significant because, over the years, some of these firms become regular exporters1 which are, as we will see below, the companies that truly boost growth in exports.

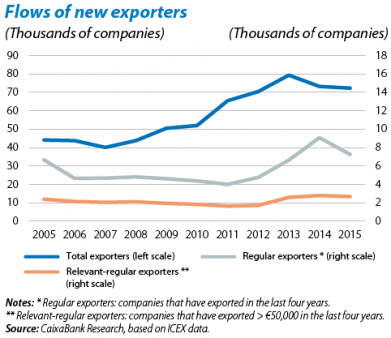

Starting to export is a very risky decision for companies as surviving in the foreign market is highly unlikely in the first few years: more than half the firms that start to export stop doing business abroad during the first two years and most of the failures occur in the first four or five years.2 In Spain, according to our estimates, the survival rate in foreign markets has remained relatively stable over the last ten years at around 12%3 which, together with the strong increase in the number of firms starting to export after the crisis, has resulted in considerable growth both in the flow of new regular exporters and also in new relevant-regular exporters4 over the last three years (see the first graph).

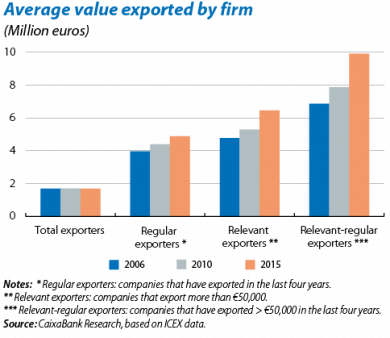

The increase in the number of regular exporters, going from 38,000 in 2012 to 48,000 in 2015, is particularly important because, once companies have passed the four-year threshold and become firmly established in the foreign market, they are more likely to take advantage of economies of scale to increase the number of destinations they export to and boost their sales in those markets where they are already present. In other words they increase both their extensive and intensive margin. Regarding the extensive margin, it comes as no surprise that larger firms export to a larger number of countries but it should be noted that, between 2010 and 2015, these broadened their destinations by five countries on average while small firms remained stable with 1.5 destinations per company. Regarding the intensive margin, since a considerable proportion of the companies starting to export were small in size, the average value exported by all companies has not grown since 2006. But the average value has grown for relevant exporters, by 35%, and especially for relevant-regular exports, by 44% (see the second graph). Among the latter, although it is true that part of this increase is due to large Spanish multinationals boosting their sales, it is also the result of new companies becoming relevant-regular exporters.5

Lastly, this flow of new exporters in 2013-2015, 20% more than in 2010-2015, suggests that, assuming a constant survival rate, the number of regular exporters will increase in the coming years. Since regular exporters tend to enjoy higher growth in their intensive and extensive margins than the rest, they will be able to boost Spain's exports in the future at a high rate such as the present, above the average for the decade prior to the crisis.

1. Companies exporting in the base year and in the three previous years.

2. See Besedes, T. and T. Prusa (2011) «The role of extensive and intensive margins and export growth», Journal of Development Economics.

3. We define the survival rate as the number of companies becoming regular exporters in the period t divided by the number of companies starting to export in t-3. Our estimate is in line with that of other developed economies such as the US and the euro area, according to Besedes and Prusa.

4. Relevant-regular exporters are those exporting more than 50,000 euros in the last four years.

5. Proof of this is the fact that the average value exported by new relevant-regular exports triples that of relevant-regular exporters stopping their export business.