Registered workers affiliated to Social Security: situation and outlook across sectors

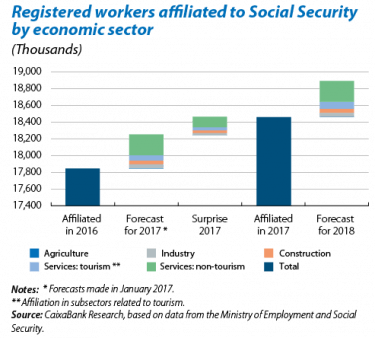

2017 was a particularly good year in terms of registered workers affiliated to Social Security. The increase in the number of workers affiliated, namely 611,000 (a year-on-year rise of 3.4%), was considerably greater than in the previous year (540,000 in 2016, +3.1%). It also outperformed the CaixaBank Research forecast (in January 2017 we predicted its annual increase would be similar to the growth observed in 2016). These good figures were in line with the gradual improvement in our GDP growth forecasts which were also revised upwards throughout the year, from 2.4% in January 2017 to an actual increase of 3.1%.

Most sectors posted good labour figures (see the enclosed chart). The sector with the largest growth in absolute terms was services, posting a cumulative rise of almost 77% in affiliated workers (470,000, up by 3.5%). Services’ good performance is largely due to the buoyancy of economic activities related to tourism,1 pushing up the number of affiliated workers by almost 100,000 (4.1% year-on-year). However, although this increase was substantially higher than the growth of the economy as a whole, there were hints of a slowdown in Q4. Social Security registration in the rest of the services subsectors (those not directly linked with tourism) grew more slowly (3.4% year-on-year) but still outperformed the forecasts published at the beginning of the year.

Construction was also positive, speeding up considerably and posting a notable rise in the number of affiliated workers of 7.4% year-on-year, its largest growth since before the crisis. This sector obviously suffered the most from job losses during the recession and its high growth has therefore occurred from a relatively low level. Indeed, the share of affiliated workers from this sector, namely 6.2%, is still very far from its 14.5% share observed in 2007.

The industrial sector also performed well in 2017 and increased its number of affiliated workers by 3.3% year-on-year, slightly more than expected. In this sector, the number of registered workers affiliated to Social Security is still much lower than in the pre-crisis period. In fact, this situation is widespread across most advanced economies, in part due to the industry’s particularly large gains in productivity thanks to the impact of new technologies.2

With a view to 2018, CaixaBank Research expects the number of registered workers affiliated to Social Security to increase by around 425,000, an annual rise of 2.3%. This strong growth will continue to be supported by a decreasing unemployment rate.3 The breakdown of affiliated workers across sectors is expected to be similar to 2017, albeit with some slight differences. Services, which have been growing steadily since 2015, have now exceeded their 2007 level of affiliated workers. Growth in 2018 is therefore likely to be slightly lower than in 2017, although it will still be substantial (333,000 people, 2.4% year-on-year). With house demand and prices consolidating their upward trend in the real estate sector, the number of affiliated workers from the construction industry should continue to post large increases in 2018 (50,000 people, 4.4% annually). Finally, growth in the number of industrial workers affiliated to Social Security is also likely but at a slightly more moderate rate, continuing the trend of the past few years (46,000 people, 2.1%). The figures for registered workers affiliated to Social Security have already been published for the first two months of 2018 and confirm the good outlook for the year as a whole.

1. The following are considered to be economic activities related to tourism: land and pipeline transport; transport by sea and navigable waterways; air transport; accommodation services; food and beverage services; rental activities; travel agency and tourist operator activities; activities of creative and performance arts; activities of libraries, collections, museums and cultural centres, as well as sports, recreational and entertainment activities. Note that the whole sector is included, unlike the tourism satellite account which determines which jobs are directly attributable to tourism.

2. See the articles in the Dossier «Industry 4.0» in MR11/2016.

3. Forecasts based on ARIMA models.