Is the euro area becoming Japanised?: demographics and productivity

The slow rate of growth in Japan's GDP has dragged out a long time, in addition to cyclical factors, underlying or structural forces have also come into play that have a lot of inertia and are difficult to correct. This is the area where the term «Japanisation» becomes particularly relevant insofar as it is aimed at the ultimate causes of low growth and not its transient symptoms. Below we analyse the two main structural factors, demographics and productivity, with a twofold aim: to determine whether the negative view of Japanisation is correct and to evaluate to what extent the slow recovery in the euro area is due to similar factors as those that have affected Japan.

Demographics is a highly significant determining factor in long-term economic growth. And, at times of fast demographic change, its impact can also be felt on the trend in GDP in the short term, such as in the case of a wave of immigration. The transformation undergone by Japan in this area has been extensive and sustained in two respects: longer life expectancy and the fall in the birth rate (migrations are a secondary factor). As a result of this, the population went from growing by 0.6% year-on-year on average in the 1980s to falling by 0.2% in 2014. Even more important is the fact that the working age population went from 85 million in 1990 to 78 million in 2014. The decline in the number of people of working age per elderly person has also been drastic: it fell from 5.7 in 1990 to 3.2 in 2010 and is expected to fall even further, down to 1.6 by 2030.

The best-known consequence of this demographic shift is a drop in the GDP growth rate due to a direct effect via the labour force. Specifically, Japan went from 4% annual growth in the 1980s to 1.0% between 1990 and 2014. Of these 3.0 points of difference, 0.5 are due to the lower rate of growth in the working age population. Moreover, the outlook is not very encouraging given that the population will decrease by an annual rate of 0.7% over the next decade, so the growth capacity of the Japanese economy is likely to continue to shrink if far-reaching measures are not taken. On the other hand, one additional effect of the ageing population on growth, less visible and more difficult to quantify, is the change in the type of financial assets chosen by households for their savings. Older societies tend to be more conservative and savings are therefore placed in less risky instruments (bonds rather than shares, public debt rather than venture capital, etc.) and are ultimately less productive.

One of the main concerns regarding this reduction in the growth rate is whether debt can be sustained, especially public debt. The Japanese economy has the highest public debt of all developed countries: in 2014 this reached 139% of GDP in net terms and 245% in gross terms (without discounting debt held by public sector agencies such as the state pension fund). One argument against such concerns, and which is often mentioned, is that only 8% of this debt is in the hands of foreign investors, although this only partially relieves the problem. Japanese citizens themselves have amassed a large proportion of these bonds to help them in their old age and net demand is therefore likely to fall over the coming years. At the other end of the spectrum, this circumstance could enter into conflict with the need to increase government spending, especially regarding pensions and health, due precisely to the ageing population. All this indicates that, if Japan wants to maintain its current model of public coverage, it must at least offset the impact of ageing by extending working life, expanding female labour force participation or increasing the number of hours worked. All these measures are limited in scope, however.

Sooner or later the euro area is likely to have to take similar measures as its population is also ageing considerably, although the situation is less advanced than in Japan. Specifically, whereas the number of working age people in the euro area was 4.8 to every elderly person in 1990, in 2010 this was 4.1 and it is expected to fall to 2.3 by 2030. However, in addition to the options to reverse the aforementioned demographic phenomenon, in the euro area immigration also looks like being, potentially, a very powerful tool while its effect has been almost neutral in Japan's case to date.

Beyond demographic factors, a second key factor that determines an economy's long-term growth capacity is the trend in productivity. Consequently, first we will look at the trend in labour productivity and then we will analyse in more detail the contribution of the different production factors to growth, with particular emphasis on the evolution of total factor productivity (TFP).

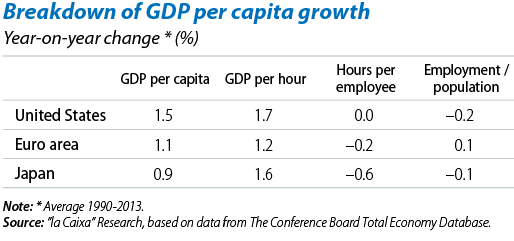

One relatively simple and intuitive way of measuring labour productivity is by breaking down GDP per capita into GDP per hour worked (which measures labour productivity), the number of hours worked per employee and the ratio of the employed population out of the total. Broadly speaking, in 2013 productivity was lower in both Japan (36%) and the euro area (24%) than in the US. The GDP per capita growth rate between 1990 and 2013 shows how Japan has been able to maintain a higher labour productivity growth rate than the euro area, very similar to the one in the US (see the table). In this respect, therefore, the Japanese economy does not seem to have performed badly. However, the reduction in the number of hours worked and in the share of the employed population explains Japan's lower growth in GDP per capita. In the case of the euro area, lower growth in GDP per capita is almost entirely due to the worse trend in labour productivity so that, in this respect, unfortunately the euro area is not becoming Japanised.

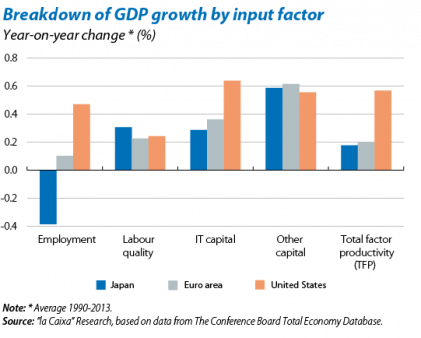

More information can be obtained on the trend in productivity by breaking down GDP growth into the different production factors: the contribution to growth of labour and capital, as well as the quality of the labour force, of capital related to information technologies or IT, of the rest of the capital and the total factor productivity. As can be seen in the graph, discrepancies between the three regions occur, firstly, in the differing contribution made by labour. The contribution of the employed population is negative in Japan and low in the euro area when compared with the United States. On the other hand, there does not seem to be any significant difference between the three regions in terms of labour quality or non-IT capital. However, differences reappear with respect to investment in information technologies, a key factor behind the US's advantage over the euro area and Japan. In Japan's case, the innovative capacity of companies decreased after the crisis in the 1990s, in particular in IT industries and something similar might now be happening in the euro area.

Finally, the last factor behind the weak performance of the Japanese and European economies compared with the United States is the low total factor productivity (TFP), which measures how efficiently an economy makes use of its input factors. In general, the US manages to exploit the economies of scale of its domestic market better. In the euro area, different regulations and the high degree of state intervention split the planned single market into different sub-markets, reducing efficiency and the competitiveness of its companies (see Gual, 2014).1 Arnold, Nicoletti and Scarpetta (2008)2 also note that the excessive regulatory burden in goods and services markets lies behind the lower efficiency of European and Japanese markets, in particular in the most IT-intensive sectors.3

We have seen how, in spite of the differences, the euro area shares some shortcomings with Japan, both in demographics and also in certain measurements of productivity. The remedies that need to be applied in both cases are also similar albeit with their own particular features. Japan needs to go into its structural reforms in depth (one of the pillars of Abenomics) in order to complement the expansionary policies, both fiscal and monetary, that are being implemented. In particular it is vital to enlarge the percentage of the population in employment, for example by increasing the share of women in the labour market, as well as intensify competition to encourage corporate dynamism and investment, particularly in IT industries. In the euro area the crisis has forced many countries to undertake structural reforms that had been postponed, as in the case of Spain, but there is still some way to go. Moreover, it is essential to continue with the project of constructing Europe: without political agreements to promote the creation of true economic union it will be very difficult to resolve the structural problems of the euro area as a whole.

Josep Mestres Domènech

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. Gual, Jordi (2014), «Por qué Europa genera poco crecimiento y empleo?», Documentos de Economía "la Caixa", no. 28, July 2014.

2. Arnold, J., Nicoletti, G. and Scarpetta, S. (2008), «Regulation, Allocative Efficiency and Productivity in OECD Countries: Industry and Firm-Level Evidence», OECD Economics Department Working Papers, N. 616, OECD Publishing, Paris.

3. Arora, A., Branstetter, L. G. and Drev, M. (2013), «Going Soft: How the Rise of Software-Based Innovation Led to the Decline of Japan's IT Industry and the Resurgence of Silicon Valley», Review of Economics and Statistics, 95(3), 757-775.