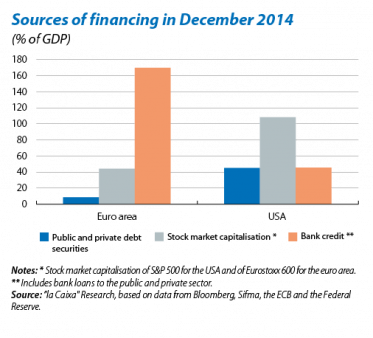

After making significant progress in creating the banking union at a European level, the European Commission has now set its sights on capital markets. The free circulation of capital between member states of the European Union (EU), whose origin dates back to the Treaty of Rome in 1957, is a fundamental principle for the single market to function effectively. However, the financial markets of the EU economies are far from integrated. Moreover, compared with other advanced economies, Europe's capital markets are less developed and their sources of financing are not so diversified (see the graph).

Given this situation, the European Commission has opened a public consultation on the report to create a capital markets union (CMU). The aim is to establish a genuine single capital market, developing more diversified sources of funding for business which will boost the creation of jobs and growth at the same time as offering savers additional investment choices and higher returns on their investments.

Although the plan is to achieve CMU by 2019, the European Commission has selected five priority actions to encourage economic recovery in the short term. For two of these measures it has launched a specific public consultation in parallel with the CMU consultation. The aim of the first is to ensure that the prospectuses issuers must publish before starting to sell securities to the public do not represent a barrier to entry. The second aims to define a regulatory framework to promote a simple, transparent and standardised securitisation market for high quality assets. The other three priority measures are to improve information on the credit quality of SMEs (for example by supporting the creation of standardised rating systems for this kind of firm), encourage long-term investment, especially in infrastructures, and develop a European private placement market so that companies can offer securities to individuals or small group of investors instead of a public issue.

In the long term, the European Commission has identified three broad areas to develop and integrate Europe's capital markets. Measures have been defined for each of these areas, as well as measures acting covering various segments. Firstly it aims to improve access to financing with particular emphasis on SMEs and infrastructure projects. For example, it proposes to develop a common accounting model, simplified and adapted to the requirements of SMEs. Other measures proposed to improve access to financing concern the standardisation of some markets, such as covered and corporate bonds, via a common regulatory framework at an EU level.

A second area of action aims to diversify sources of financing. Here many initiatives are already underway as part of funds for investment, insurance, personal pensions, private equity and venture capital, among others, but the aim is to boost these further by removing the barriers that still impede greater flows of capital between member states. This will make the European market more attractive for international investors.

Lastly, the third large block of measures aims to improve market efficiency, with particular attention to brokers, market infrastructures and the regulatory framework for corporate governance, bankruptcy laws and tax policy. The implementation of this third area will probably be the most problematic due to significant differences in legislation at a national level. Nonetheless, it is noteworthy that CMU, unlike the banking union, does not require decision-making powers to be centralised at an EU level. In fact, one relevant aspect of this proposal is a preference for market solutions rather than issuing new regulations, whenever possible.

In short, the project to create CMU aims to enhance the role of capital markets in financing investments in the EU. The proposal also stresses the decisive role of banks in capital markets and their complementary role as a source of financing. In any case, an efficient, solid banking system is still, and will continue to be, essential in order to support the economic recovery.