The Spanish economy continues to reduce its foreign debt

Spain’s economy has not abandoned the path of correcting one of its traditional imbalances: its foreign indebtedness. Spain has not only racked up 12 consecutive years with a net lending capacity, but in 2023 its net lending also reached a new all-time high of 3.7% of GDP, compared to 1.5% in 2022.

Having overcome the shock of the pandemic, Spain’s economy has resumed the path of correcting one of its traditional imbalances – its foreign indebtedness – in a process largely driven by its recent ability to maintain a high lending capacity. Indeed, Spain has not only racked up 12 consecutive years with a net lending capacity, but in 2023 its net lending also reached a new all-time high (3.7% of GDP vs. 1.5% the previous year).1 This trend is the result of surpluses recorded in both the current and the capital balances (2.6% and 1.1%, respectively): in the case of the former, this reflects the growing competitiveness of our productive sector, while the latter has received a boost from the European funds linked to the NGEU programme. Even with the outbreak of the pandemic and the subsequent energy crisis, Spain’s economy managed to maintain its lending capacity, demonstrating the structural nature of the improvement in its foreign imbalance.

- 1. In contrast, in the period 2000-2008 the economy recorded funding needs of 5.6% of GDP on average annually.

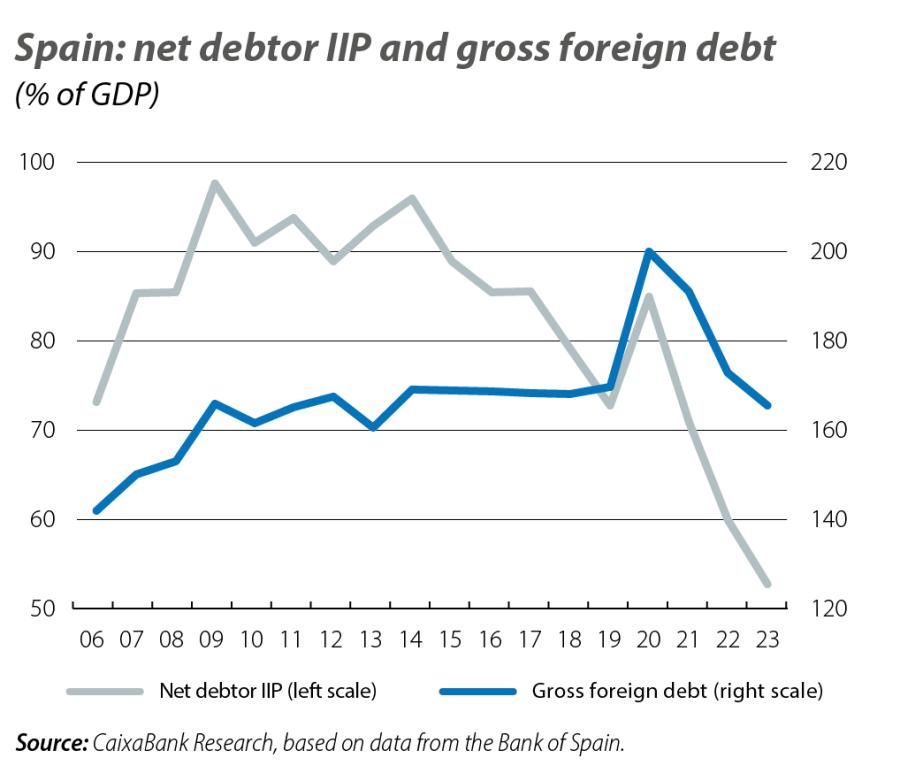

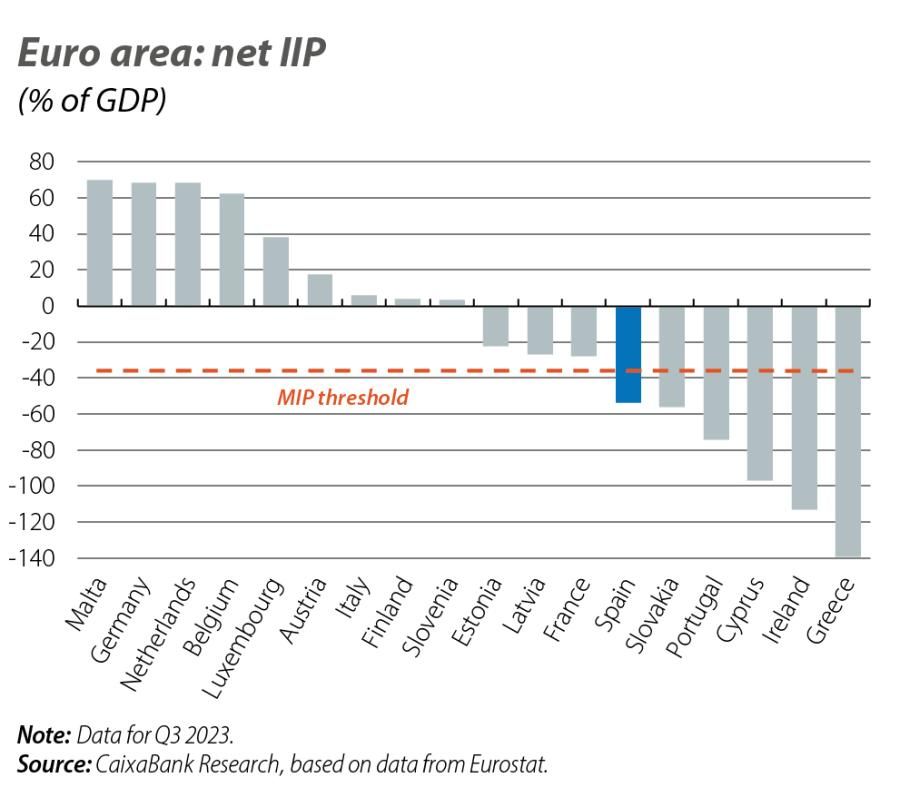

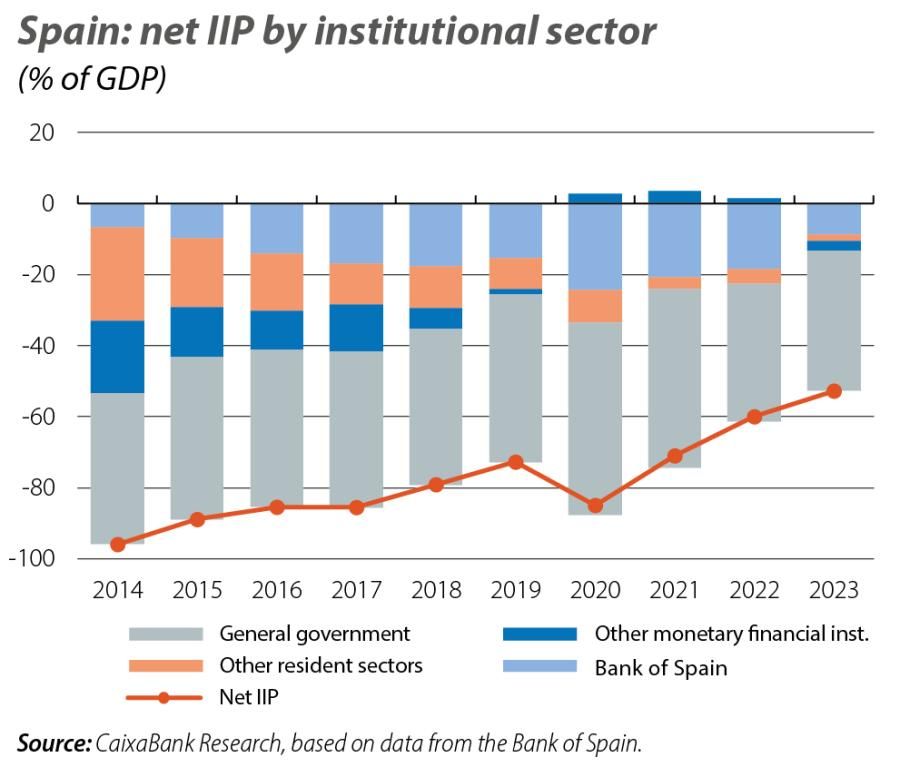

As a result of the above, last year the debtor balance of Spain’s net international investment position (NIIP), which measures the difference between a country’s financial assets and liabilities vis-à-vis the rest of the world, continued to decline and reached just under 771.4 billion euros, or 52.8% of GDP, representing the best figure since 2003 (60.0% in 2022). Although still high and well above the 35.0% threshold set by the European Commission in the Macroeconomic Imbalance Procedure (MIP),2 the cumulative reduction achieved in recent years is significant: no less than 45 points from the peak of 2009.

- 2. A supervisory mechanism established with the aim of preventing and correcting macroeconomic imbalances in EU countries.

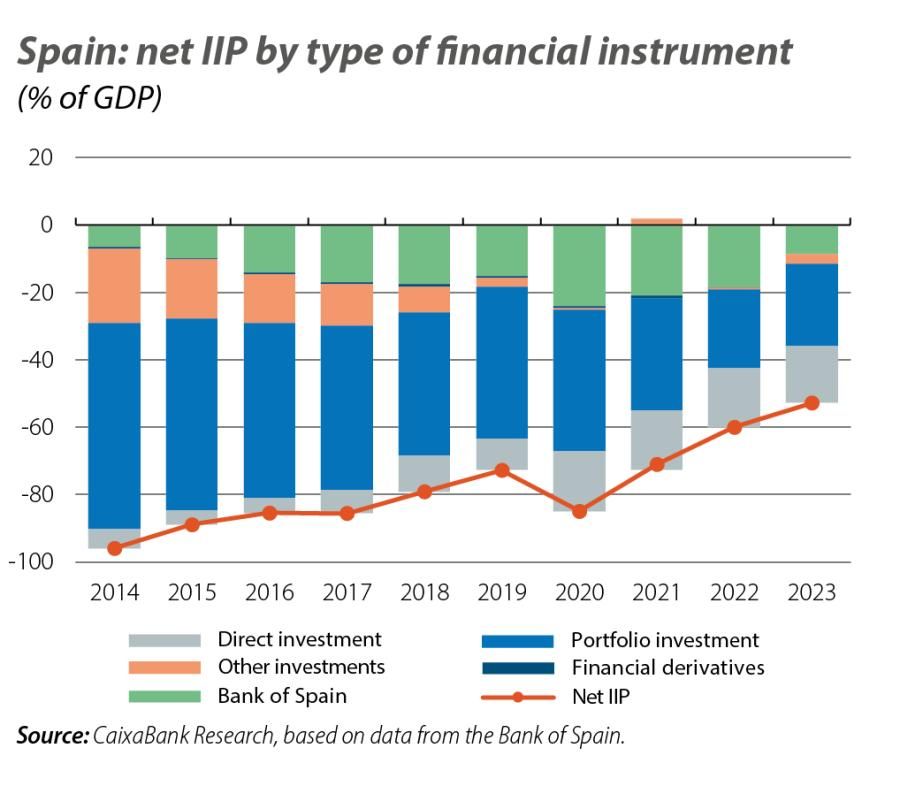

Special mention should be made of the significant reduction in the debtor balance of the Bank of Spain’s NIIP, which went from 18.5% of GDP in 2022 to 8.7% a year later. This improvement has been partially driven by the ECB’s asset purchases coming to an end,3 given the negative impact those purchases had generated in the period 2015-2022 on the Bank of Spain’s IIP through its position vis-à-vis the Eurosystem, which is now beginning to be unwound, as well as being driven by the disbursements of NGEU funds.4

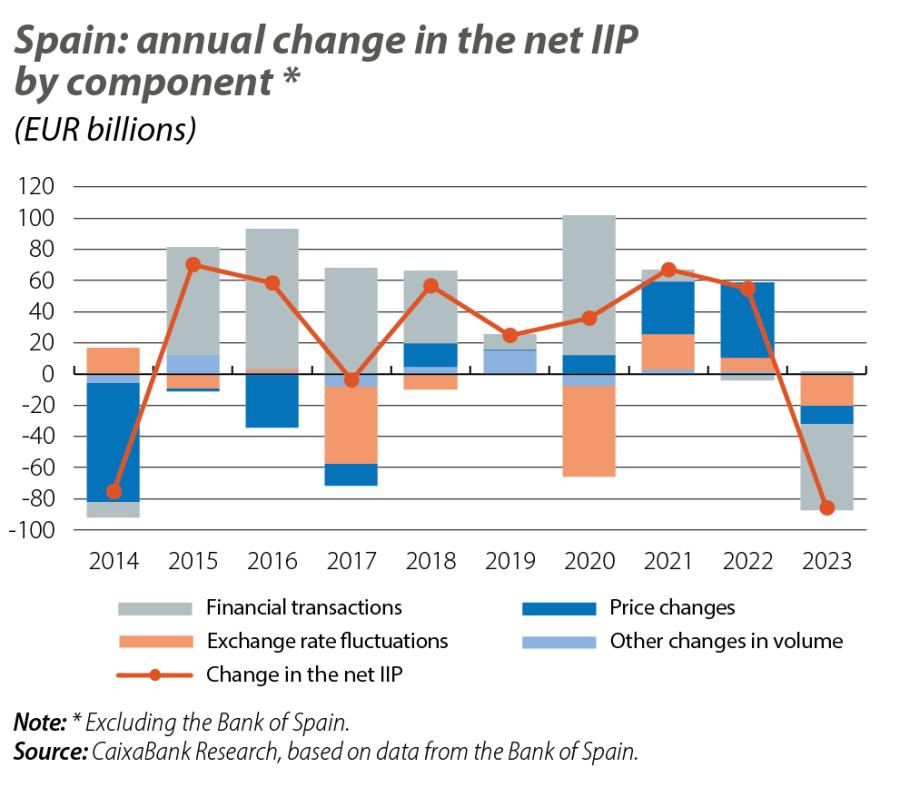

If we exclude the Bank of Spain, the debtor balance of the economy’s NIIP increased in 2023 by more than 85.7 billion euros, something that had not happened since 2017, bringing it to a total of just over 644.1 billion. This deterioration was the result of negative net valuation effects (due to exchange rate and/or price variations), especially the negative value of foreign financial transactions. That is, the net increase in liabilities with other countries was greater than that of assets (net capital inflow) (see third chart). As for the valuation effects, exchange rates had a more intense negative impact on the assets, mainly due to the depreciation of the dollar, which fell sharply in the final stages of the year. In the case of prices, their increase had a greater impact on the liabilities, given their higher volume.

- 3. Net purchases ended in 2022, both under the Pandemic Emergency Purchase Programme (PEPP) and under the Asset Purchase Programme (APP), while gross purchases were brought to an end during 2023 for the APP.

- 4. The inflow of funds in the form of grants has an impact, initially, in the financial accounts of the Bank of Spain (as a decrease in its liabilities) and of the general government (increase in liabilities). See https://www.bde.es/webbe/es/estadisticas/compartido/docs/notaNGEU.pdf

Looking at the breakdown by type of financial instrument, all of them with the exception of derivatives saw their debtor balance expand in 2023, especially portfolio investments, due to the impact of prices and the negative foreign financial transactions (the liabilities grew more than the assets). In the case of direct investment,5 the deterioration was mainly due to the impact of the exchange rate,6 while in the case of other forms of investment7 it was essentially the result of net capital inflows.

- 5. Shares and other forms of equity holdings, reinvested profits, investments in real estate and financing between related companies.

- 6. However, given the significant increase in nominal GDP (8.6%), the debtor balance of direct investment in terms of GDP improved slightly last year (16.8% vs. 17.4% in 2022).

- 7. Mainly loans, repos and deposits.

By sector, only other resident sectors reduced their debtor balance in volume terms, and they did so significantly, recording the lowest balance since the year 2000. On the other hand, both the general government and, in particular, monetary financial institutions (MFIs) saw their positions deteriorate, going from a creditor to a debtor balance.

As for gross foreign debt,8 it resumed the upward path that had been truncated in 2022 and grew sharply, reaching 2.419 trillion euros, up from 2.327 trillion the previous year. However, as a result of nominal GDP growth, the debt-to-GDP ratio continued to fall to 165.5% (172.8% previously), even improving on the pre-pandemic levels (169.7% in 2019). By sector, the reduction of gross debt was concentrated in the general government (44.0% of GDP, just 10 pps less than in 2022), other resident sectors (20.3% vs. 21.6%) and, above all, the Bank of Spain (36.3% vs. 46.9%). In the latter case, once the Eurosystem’s purchases of public debt were completed, a portion of the debt was no longer held by the Bank of Spain and once again lay in the hands of non-residents. In contrast, the debt of MFIs grew by almost 6 points to 46.4% of GDP, the highest ratio since 2012, due to capital inflows mainly channelled in the form of deposits.

In addition to the clear downward path of foreign indebtedness, another piece of good news which helps to reduce the economy’s vulnerability to possible shocks in the financial markets, especially in a context of high interest rates, is the composition of these liabilities: they are largely made up of liabilities issued by the public sector (48% corresponds to debt of the general government and of the Bank of Spain), with long-term maturities, at fixed interest rates and denominated in euros, thus reducing the refinancing, interest rate and foreign exchange risks.9

- 8. Includes the balance of all liabilities that generate future payment obligations (principal, interest or both), i.e. it is composed of the financial instruments included in the liabilities of the IIP, except for equities (shares, other equity holdings and holdings in investment funds) and financial derivatives.

- 9. Bank of Spain (2023): Financial Stability Report, autumn.