US: the never coming recession

In February, we wrote that we could expect to see a cooling of the US economy at some point in 2023, a view shared by most analysts. However, what we have seen in the year to date is an economy that continues to grow with unusual strength considering the current environment of high interest rates.

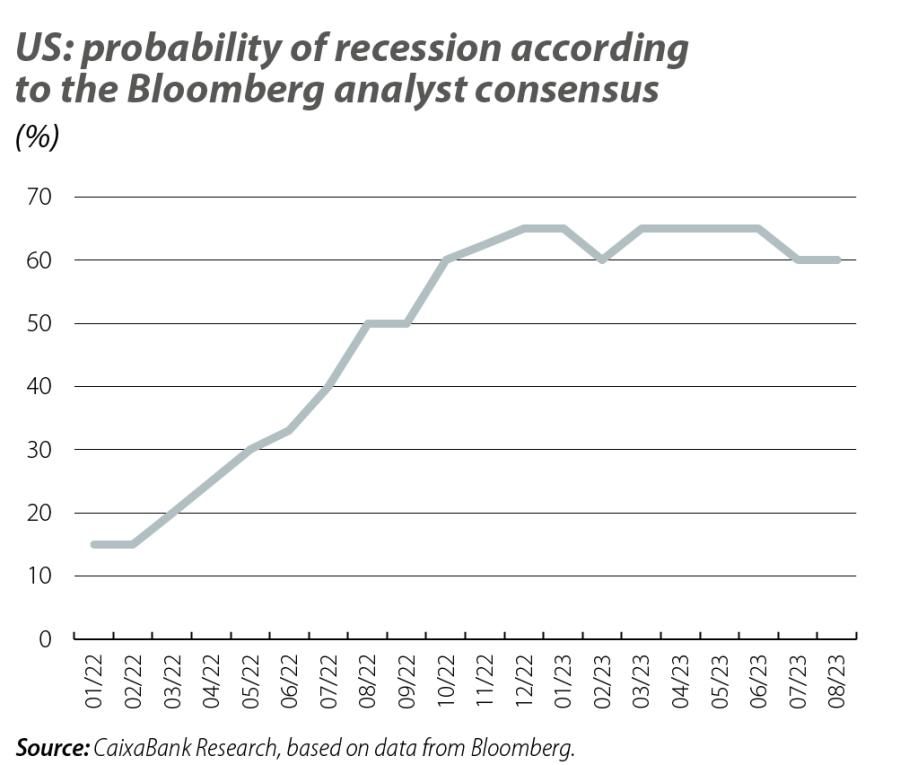

In February, we wrote that we could expect to see a cooling of the US economy at some point in 2023, a view shared by most analysts. The uncertainty layed in how pronounced this cooling process would be and, therefore, whether the economy would make a soft or a hard landing. However, what we have seen in the year to date is an economy that continues to grow with unusual strength considering the current environment of high interest rates. Analysts have thus begun to revise downwards the probability assigned to a recession occurring in the US within the next year (see first chart). Not only this, but the latest economic indicators suggest strong GDP growth in Q3 too, placing it between 0.5% quarter-on-quarter, according to the New York Federal Reserve’s nowcasting model, and 1.3%, according to the Atlanta Fed.

Unsurprisingly, the goal of the Fed’s tightening of monetary policy since early 2022 is to cool an economy that was showing signs of overheating (especially visible in the inflation rally). Since then, the factors related to the pandemic which had caused the mismatch between aggregate supply and demand have been resolved (e.g. bottlenecks in global supply chains, mass pent-up savings and changes in consumption patterns between goods and services) and this has supported a decline in inflation and a moderation in many economic indicators. However, the lags with which monetary policy often affects the economy suggest that there is still further margin for cooling over the coming quarters.1 One of the main channels affected by the central banks’ rate hikes is that of financial and credit conditions. As we described in a previous article,2 credit standards have tightened as the Federal Reserve intended, while demand for credit has also weakened. In fact, our estimates pointed to a tightening of credit conditions that would be associated with a 0.7-pp drop in economic activity.

- 1. It was Milton Friedman who first introduced the now famous concept that monetary policy affects the economy with «long and variable lags». Estimates suggest that these lags could range from between 6 and 12 quarters.

- 2. See the Focus «Is monetary policy managing to cool economic activity? A first assessment» in the MR06/2023.

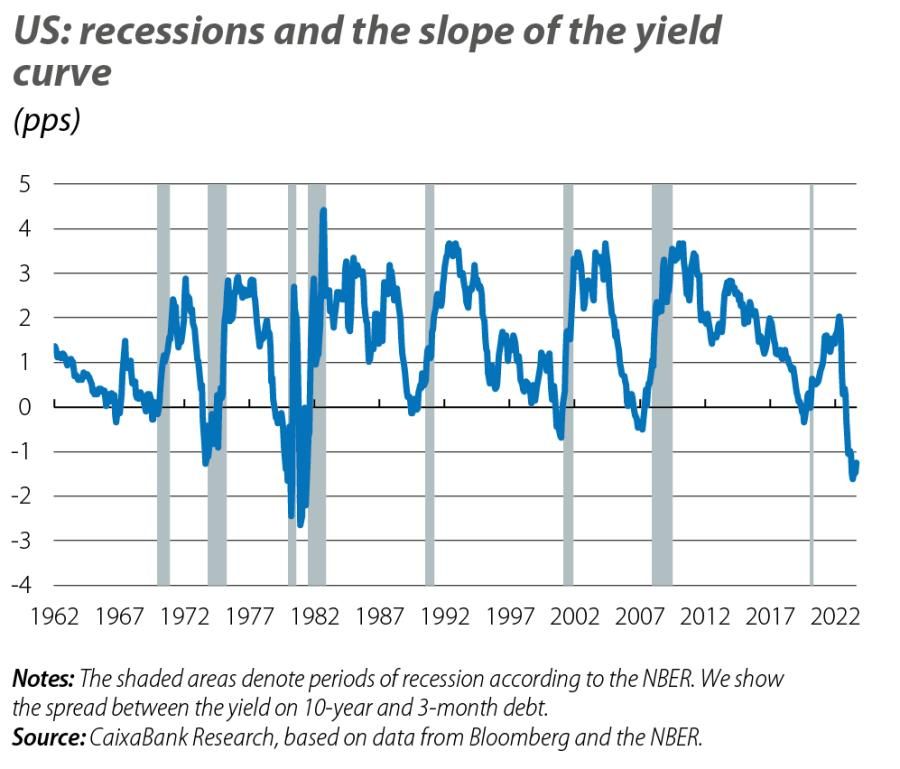

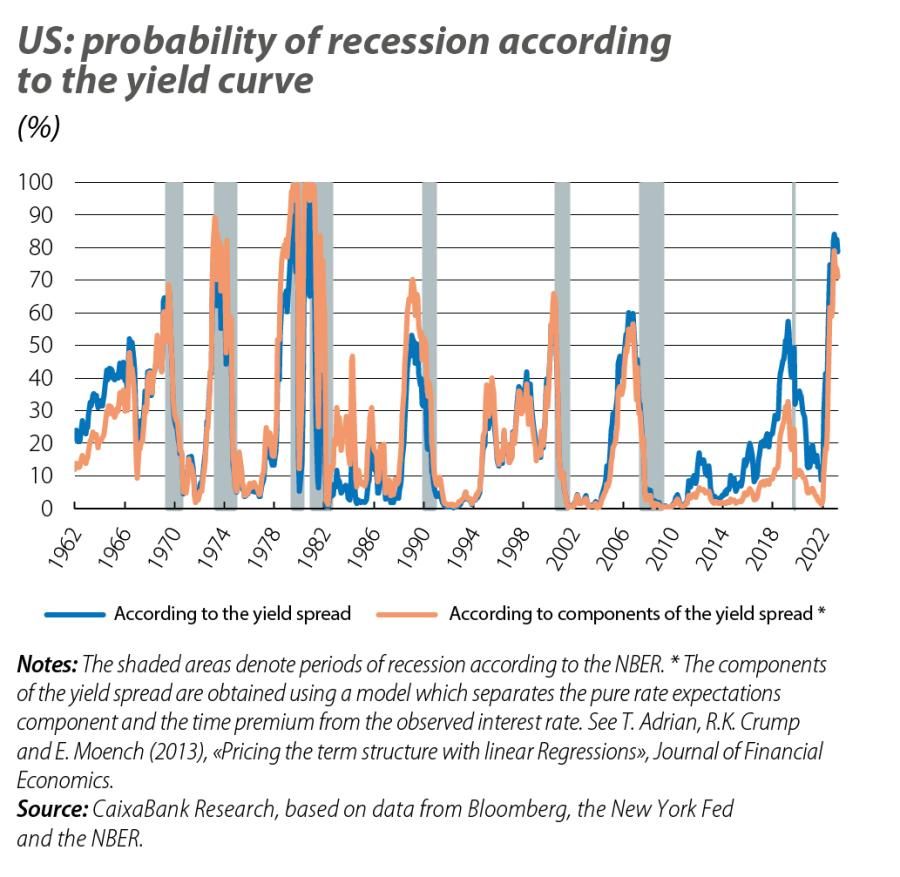

There are also various signals which, when triggered, have historically anticipated forthcoming recessions. One of the most well known is the inversion of the sovereign yield curve. It is now more than 300 days since the spread between 10-year and 3-month treasuries was inverted, which has historically been the best predictor of recessions. In fact, according to our model, the current inversion of the yield curve has an associated probability of recession which fluctuates between 70% and 80%, depending on the specification used.3

- 3. See the Focus «On the likelihood of a recession in the US» in the MR05/2018.

If all the indicators suggest that the US economy ought to be contracting (or doing so soon), what is preventing such a scenario? We can answer this question, firstly, by looking at GDP from different perspectives. If we look at GDP from the demand side, we see how public consumption has served as an important buffer for economic activity, with quarter-on-quarter increases of 1% on average over the past four quarters, the same as non-residential investment. Private consumption, which is often the main driver of the economy, grew in line with GDP, averaging 0.6% quarter-on-quarter, while the foreign sector made a rather more modest contribution to GDP growth. The component that has weighed down GDP growth has been residential investment, which has been declining now for nine consecutive quarters (–22% cumulative decline). On the other hand, if we look at GDP from the supply side and analyse how much value added was provided by the various sectors, the arts and leisure, information and mining sectors stand out as providing the most. At the more disappointing end of the spectrum we find finance and insurance, manufacturing and construction, which represent 19%, 11% and 3%, respectively, of total production and have been stagnant or in decline for four quarters now.

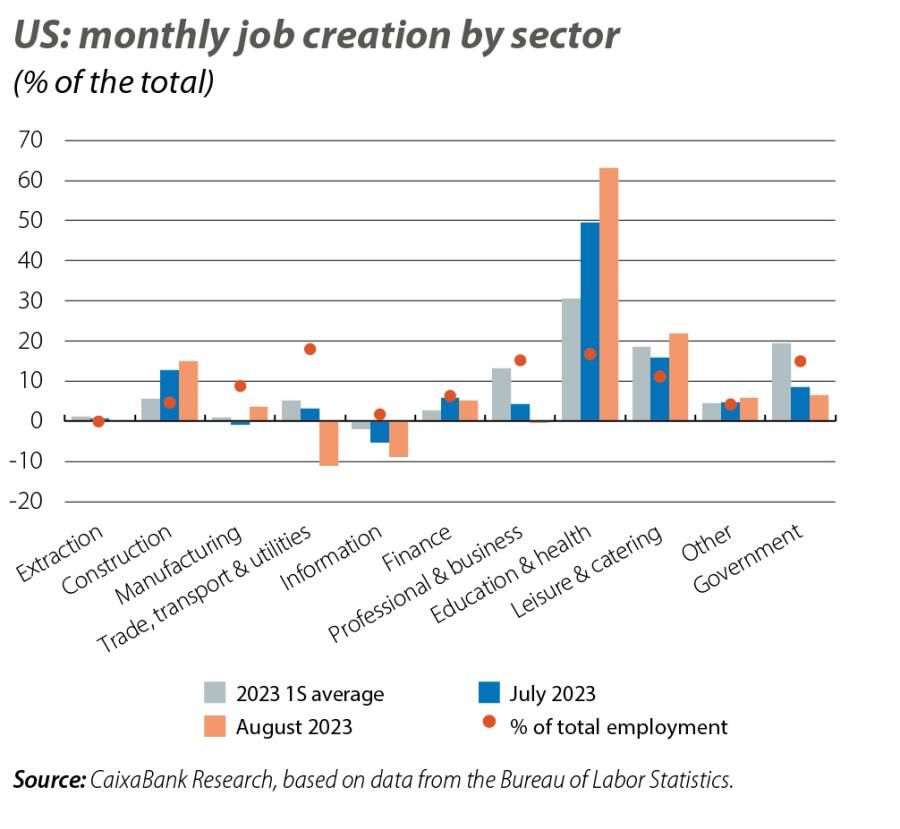

One indicator that also suggests the US economy is in good health is the labour market, with the unemployment rate standing at 3.8% and the ratio of job vacancies per unemployed person at 1.4 (versus a historical average of 0.7). However, we also already find various signs of normalisation, such as monthly job creation, which stands at 150,000 workers on average over the past three months. This is well below the 400,000 average in 2022 and even somewhat below the average between 2015 and 2019 (190,000). Moreover, if we look at the sectors that are contributing to this job creation, we see that education and health, which accounts for 16% of the workforce, is contributing over 50% to new job creation. This is a significant statistic, as the education and health sector is not the best thermometer for measuring the state of the business cycle. Other sectors such as manufacturing, the professional and business sector or catering and leisure could be more indicative of the dynamics and trends in the demand for employment.

The real estate sector, as we have already mentioned, has been on the decline for nine consecutive quarters, first due to expectations of a more restrictive monetary policy and then with its confirmation. However, in recent months we have been witnessing a recovery in its activity: the number of home sales and new construction licences have begun to pick up this summer and could now be emerging from the rut they fell into in early 2022, potentially marking the beginning of the sector’s recovery.

With this cocktail of indicators pointing in opposite directions, forecasting economic growth has become an even more difficult task. All in all, we believe we are going to witness a gradual cooling of economic activity and a soft landing with the US economy remaining close to stagnation for several quarters.