Election year in the US

On November 5th, the United States will be called to the polls in what will likely end up being a rematch between Biden and Trump for the country’s presidency. In this article we offer some context to shed light on the election race and we set out the effects it may have on the financial markets and the Federal Reserve.

In 2024, more than half of the world’s population is being called to the polls to vote in elections. We have already experienced an election in Taiwan, which was won by the Democratic Progressive Party, the option that marks the biggest distance with mainland China, and before July we will witness elections in Indonesia (14 February), Russia (17 March), India (between April and May), Mexico (2 June) and those of the European Parliament (9 June). However, the one that will likely have the biggest economic impact and also attract the most global media attention will be the US presidential election on November 5th, in which the polls point to a rematch between current President Joe Biden and former President Donald Trump. In this article we will offer some context to shed light on the election race between now and November 5th and we will set out some of the implications it may have for the financial markets and the Federal Reserve.

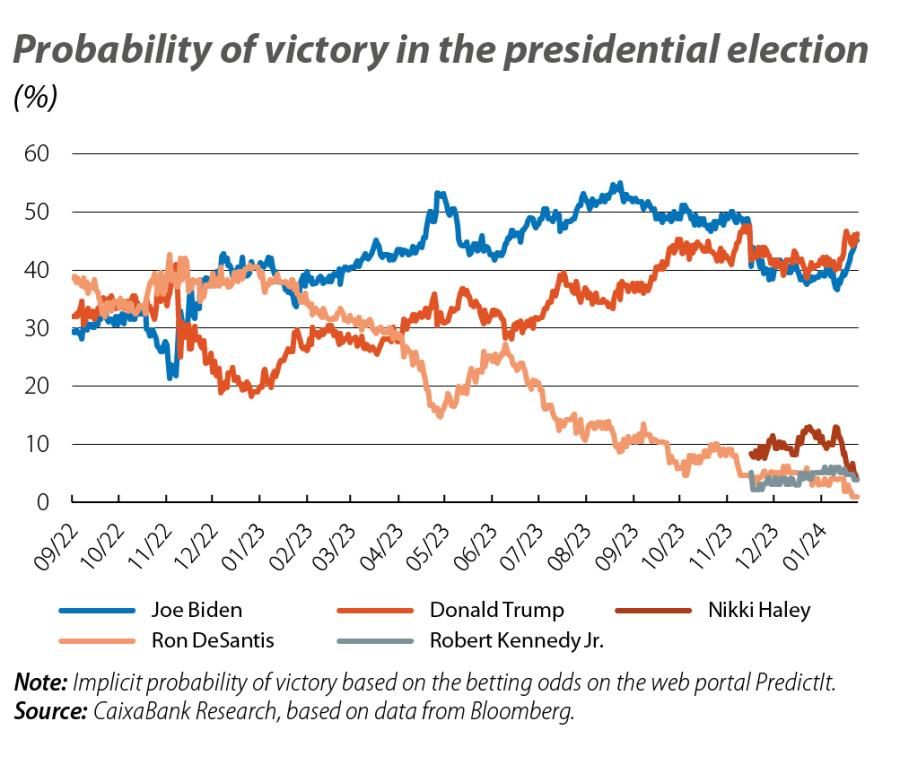

This January the electoral race kicked off with the primaries to determine who will be the Republican Party’s candidate for the presidential election and all the polls indicate that former President Donald Trump will be picked as the party’s nominee. The votes held so far as of the date this article was written have been the Iowa caucus and the New Hampshire primary. In Iowa, Trump won with just over 50% of the votes, after which the second and fourth-placed candidates (Ron DeSantis and Vivek Ramaswamy, respectively) suspended their campaigns and endorsed the former president. In the second contest, in New Hampshire, Trump won again, albeit with a smaller margin over the second and only alternative, the former US ambassador to the UN, Nikki Haley.

If there are no surprises in the judicial sphere and as all the polls suggest Trump’s nomination by Republicans is confirmed, and in the absence of any major shocks in the Democratic Party, we will see a rematch between Joe Biden and Donald Trump. In that scenario, the polls indicate a very equal contest between these two candidates. However, the key will be how each candidate performs in the swing states, which are the ones that end up tipping the balance (the states where the race was closest in 2020 and which ended up handing victory to Joe Biden were Nevada, Arizona, Wisconsin, Michigan, Georgia and Pennsylvania). The latest state polls project a Republican victory in most of these states, meaning that right now the balance would be tipped in favour of Donald Trump. However, some of the key factors that will end up tipping the balance one way or the other include: (i) the presence of independent candidates, such as Robert Kennedy Jr., who according to some polls could garner around 20% of the votes in some states1 and (ii) the economic situation. Should the US economy, and in particular its labour market, approach the election with their current level of buoyancy, and with more moderate inflation, this could favour the incumbent. On the other hand, in the event of a hard landing of the economy or a shift in the inflationary dynamics that pushes it back upwards, the context would be more favourable to the Republican candidate.

- 1. Typically, the popularity of these independents is gradually diluted in the polls as voters appreciate that their vote may not end up being a useful one.

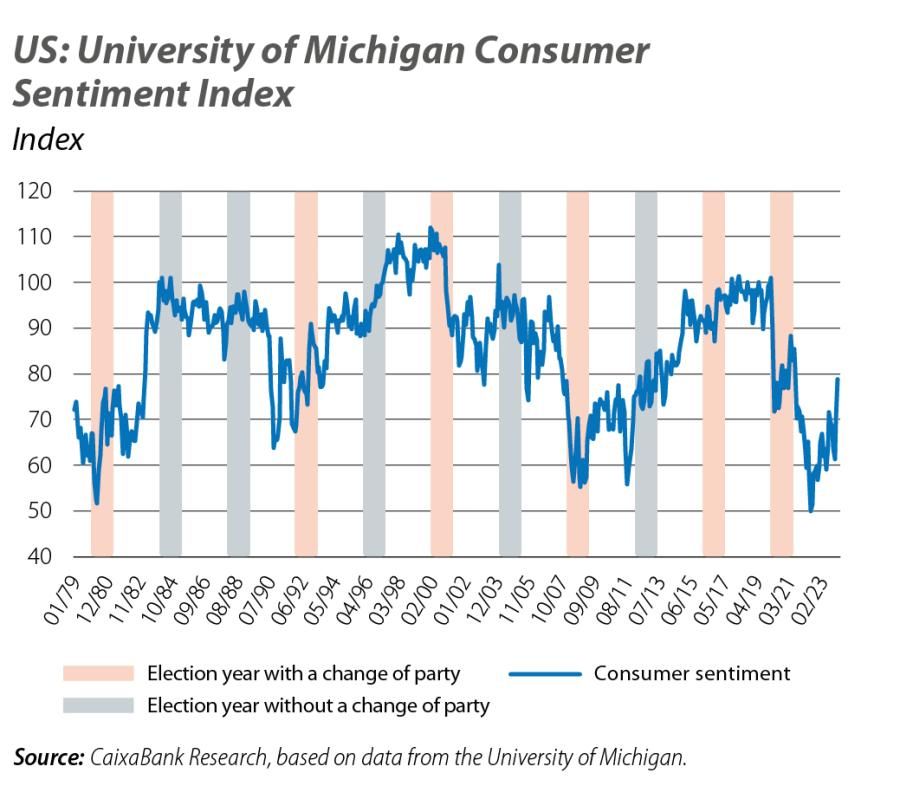

However, beyond the performance of the macroeconomic data, the indicators that could prove decisive in determining the degree of support for current President Biden are those related to economic sentiment. A good example is the University of Michigan’s Consumer Sentiment Index, which seeks to capture the perception that consumers, and ultimately voters, have about recent and expected developments in the economy. As can be seen in the third chart, in elections in which the party holding the US presidency lost, the University of Michigan’s Economic Sentiment Index was, on average, 10 points lower than in the years in which they managed to hold on to the presidency.

Right now, however, the strength of the US economy does not translate into a good perception of it: a study2 explains that consumer confidence is around 20% below what its historical relationship with the labour market, inflation and private consumption would suggest, in what some analysts have dubbed a «vibecession».

- 2. See R. Cummings and N. Mahoney. «Asymmetric amplification and the consumer sentiment gap» in Briefing Book.

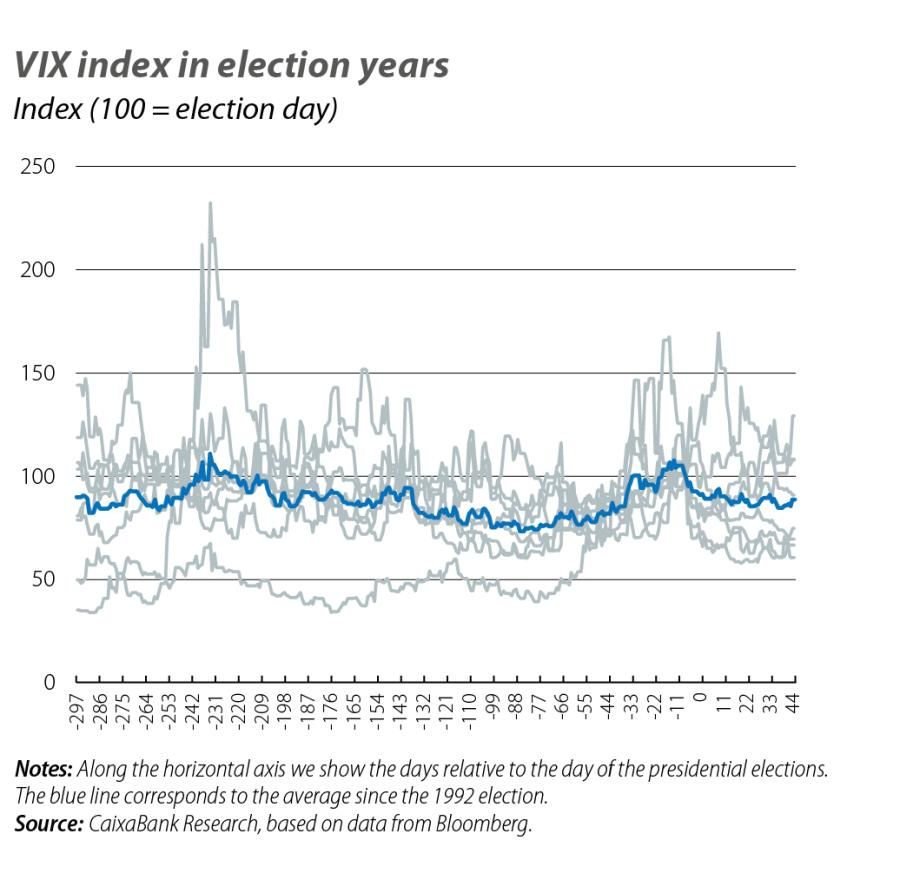

In election years, uncertainty is generated regarding who the next president of the United States will be and what kind of economic, foreign and domestic policy they will pursue.3 Proof of this is how the VIX index, which serves as a proxy for volatility in the US stock market, fluctuates in election years. As can be seen in the last chart, around 60 days before election day, this index tends to spike, reaching close to its annual peaks.

- 3. It is important to note that on November 5th this year voters will also be choosing 34 of the 100 seats in the Senate and all 435 seats in the House of Representatives. Of these 34 seats being disputed in the Senate, 7 of them are currently in the hands of the Democrats and are up for grabs in states where there is a majority support for Republicans, and this could break the current tie at 50 seats each that currently exists in the Upper House. In the House of Representatives, the polls indicate a closer result. In the event of a Republican (Democratic) victory in the presidential election, but where the Senate and House of Representatives are controlled by the Democrats (Republicans), Donald Trump (Joe Biden) would find it more difficult to pass new bills.

One of the implications that the election will have for the Federal Reserve will be related to the nominations for the FOMC. Throughout his or her term, the president-elect will have to select a new chair of the Fed (Jerome Powell’s term as chair ends in May 2026) and two vacant FOMC seats (those of Adriana Kugler, whose term ends in January 2026, and Jerome Powell himself, in January 2028). On the other hand, it is often said that, in the months leading up to elections, the Fed tries to keep interest rates unchanged so as not to add or remove stimulus for the economy and thus to remain neutral with respect to the incumbent and the other candidate.4 However, in view of the current economic situation, the state of inflation and expectations regarding interest rates, we believe that the Federal Reserve will prioritise adapting its monetary policy to the needs of the scenario and, therefore, it could end up cutting rates in the months leading up to the election. Among other reasons, the Fed will want to normalise interest rates along a well-reported downward path, so that the financial markets, businesses and consumers can anticipate it and adjust their behaviour without causing any major shocks.

- 4. In 1996, 2000, 2012, 2016 and 2020, the Fed left interest rates unchanged during the six months leading up to the election.