The Portuguese economy kicks off 2024 better than expected

The indicators for Q1 suggest that economic activity is more buoyant than expected, and that GDP growth in the first quarter could exceed our forecast of 0.4% quarter-on-quarter.

The indicators for Q1 suggest that economic activity is more buoyant than expected, and that GDP growth in the first quarter could exceed our forecast of 0.4% quarter-on-quarter. The Bank of Portugal’s daily economic activity indicator showed an average year-on-year growth of 5.8% in Q1 (with data to 20 March), which represents an acceleration compared to the 5.5% registered in the previous quarter. In addition, the European Commission’s economic climate and economic sentiment indicators also show an improvement over the previous quarter. In this context, the Bank of Portugal has revised upwards its GDP growth forecast to 2.0% for 2024 and to 2.3% for 2025.

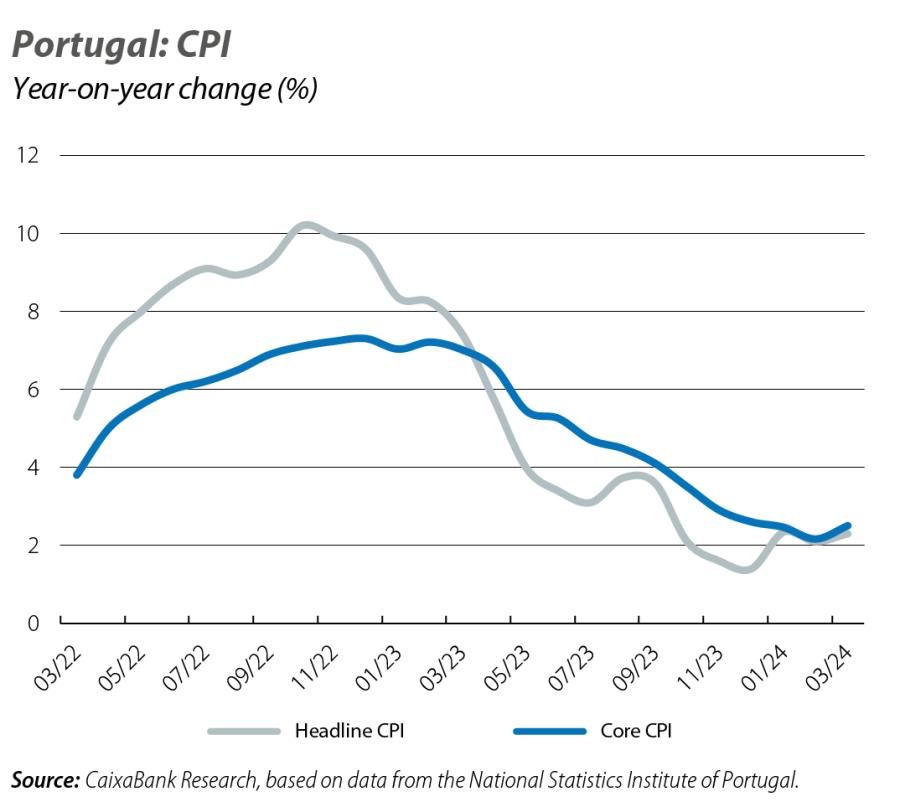

The disinflationary process has been interrupted and is now going through a more volatile phase; headline inflation has rebounded to 2.3% in March, up from 1.4% in December, while core inflation, after falling to 2.1% in February, has rebounded in March to 2.5%, thus truncating 12 consecutive months of declines.

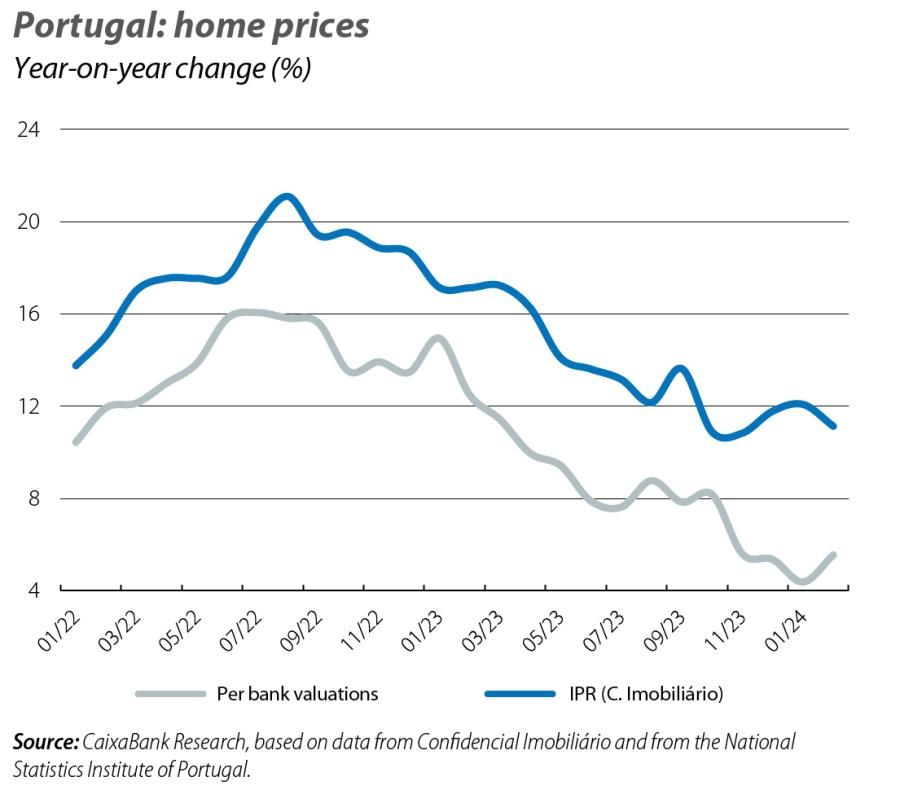

Home prices recorded an average growth of 8.2% in 2023, despite the number of sales falling by 18.7% compared to 2022, to a total of 136,400 homes. The latest available indicators suggest that prices are continuing to grow at a steady pace in early 2024: the price per square metre according to bank valuations rose by 5.5% year-on-year in February, while the residential price index (IPR) recorded an increase of 1.5% up until February compared to the end of 2023.

The budget surplus rose to 1.2% of GDP, thus exceeding the government’s forecast (0.8% of GDP), as well as that of CaixaBank Research (0.7% of GDP), and improving on the figure for 2022 (deficit of 0.3% of GDP). This improvement was driven by the growth of revenues which, at 9.0%, far exceeded that of expenditure, at 5.2%. In this context, the public debt to GDP ratio fell 17.5 pps compared to 2019 and stood at 99.1%, its lowest level since 2009.

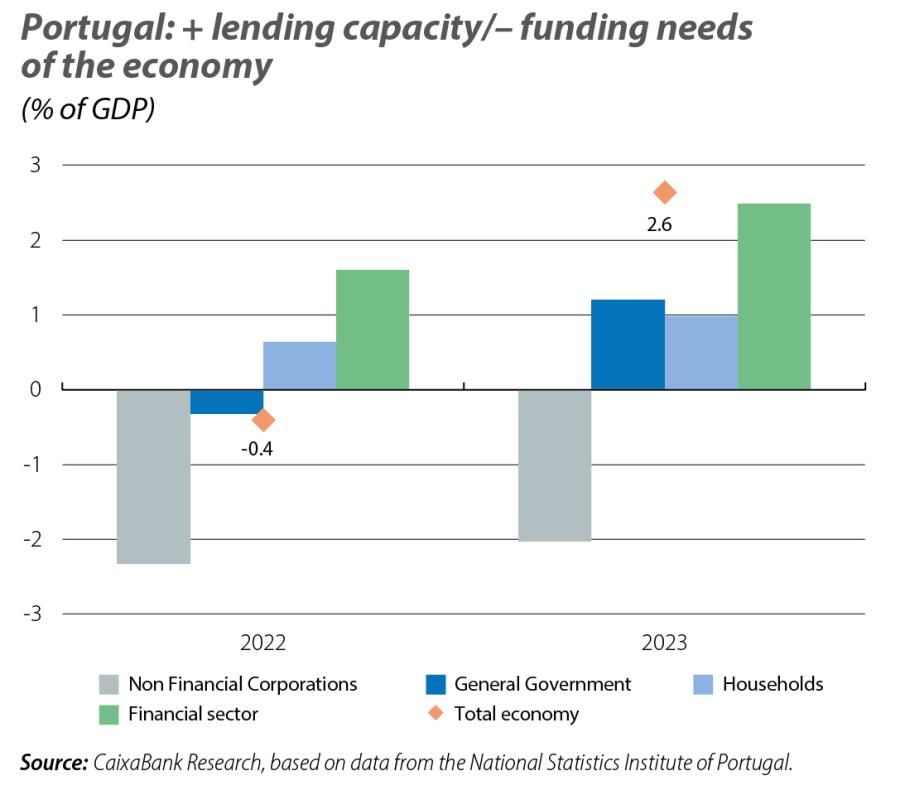

2023 ended with a foreign surplus equivalent to 2.6% of GDP, helping to bring down Portugal’s foreign debt, which nevertheless remains high. The general government was the sector that contributed the most to the surplus, with a lending capacity of 1.2% of GDP, followed by households (1% of GDP, 0.4 pps more than in 2022); non-financial corporations, meanwhile, reduced their funding needs by 0.3 pps to 2% of GDP, in a context of weak investment growth.