Resilience will favour the Portuguese recovery

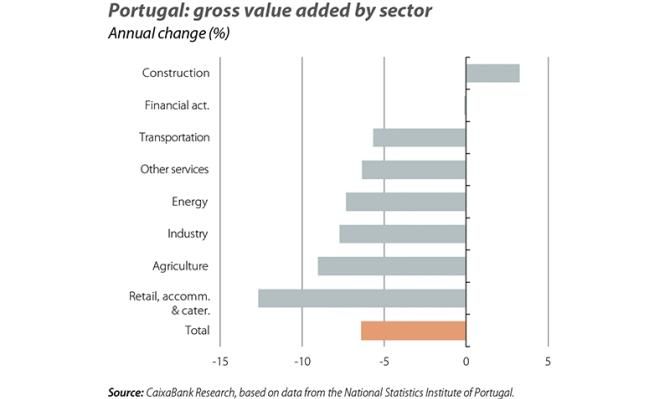

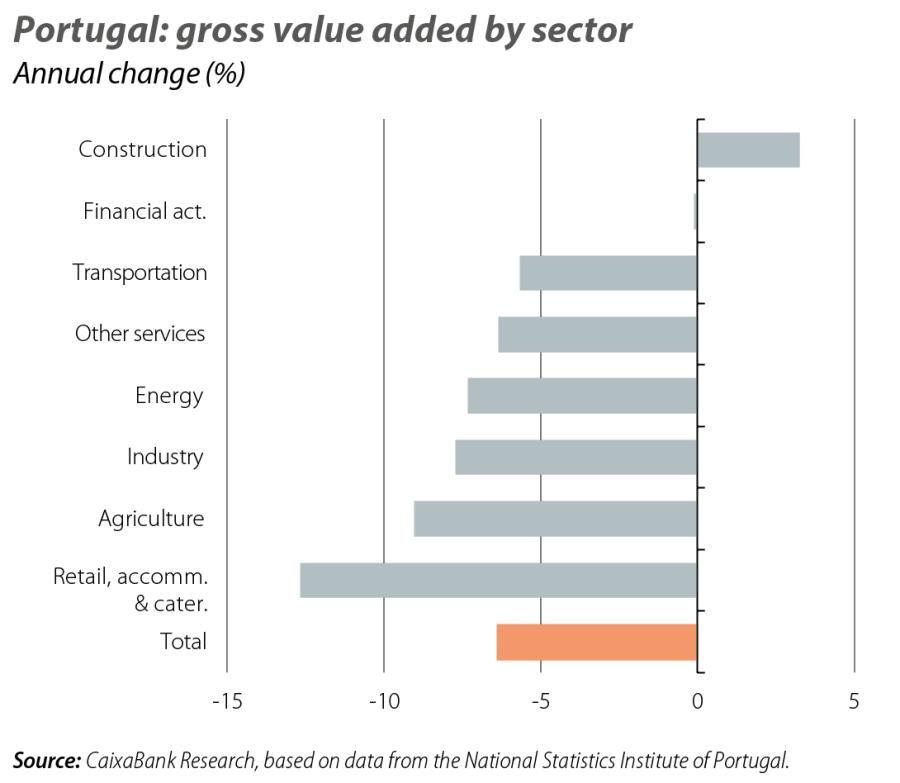

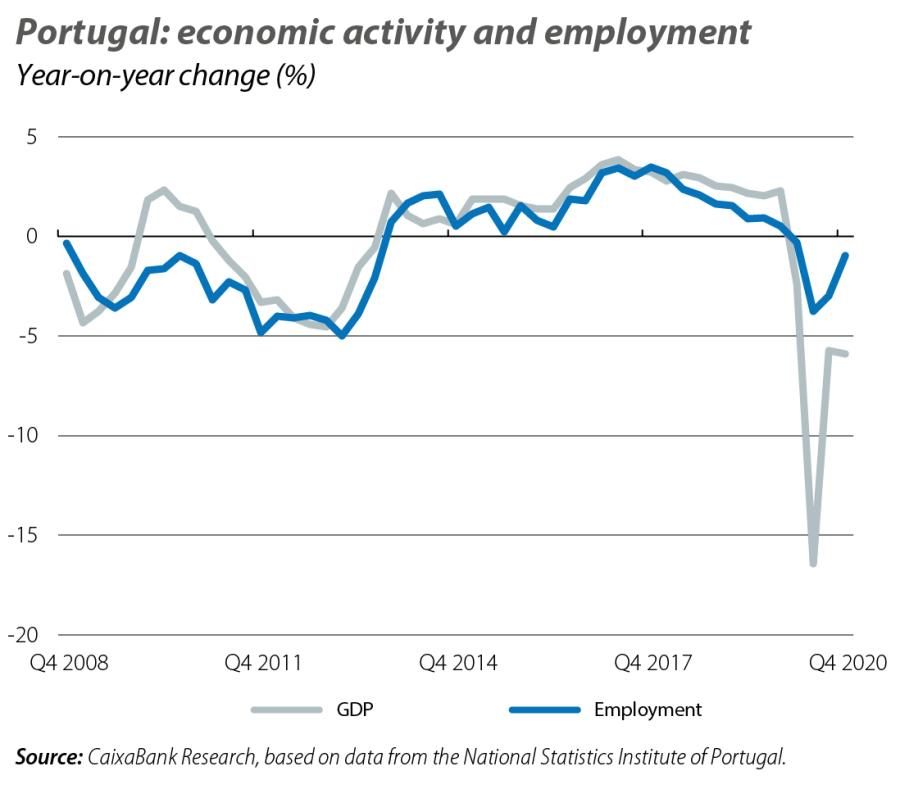

Dragged down by the sharp fall in economic activity in the first semester. In contrast, the significant recovery in the second semester demonstrates the Portuguese economy’s capacity to rebound and its resilience to the restrictions, reinforcing the view that economic activity will resume a stronger recovery once control of the pandemic allows the lockdown to be eased. By productive sector, only construction managed to maintain a positive contribution to growth (its gross value added grew by 3.3%), while all other sectors registered declines for the year as a whole, especially retail and catering (–12.7%), industry (–7.7%) and other services grouped together (–6.4%).

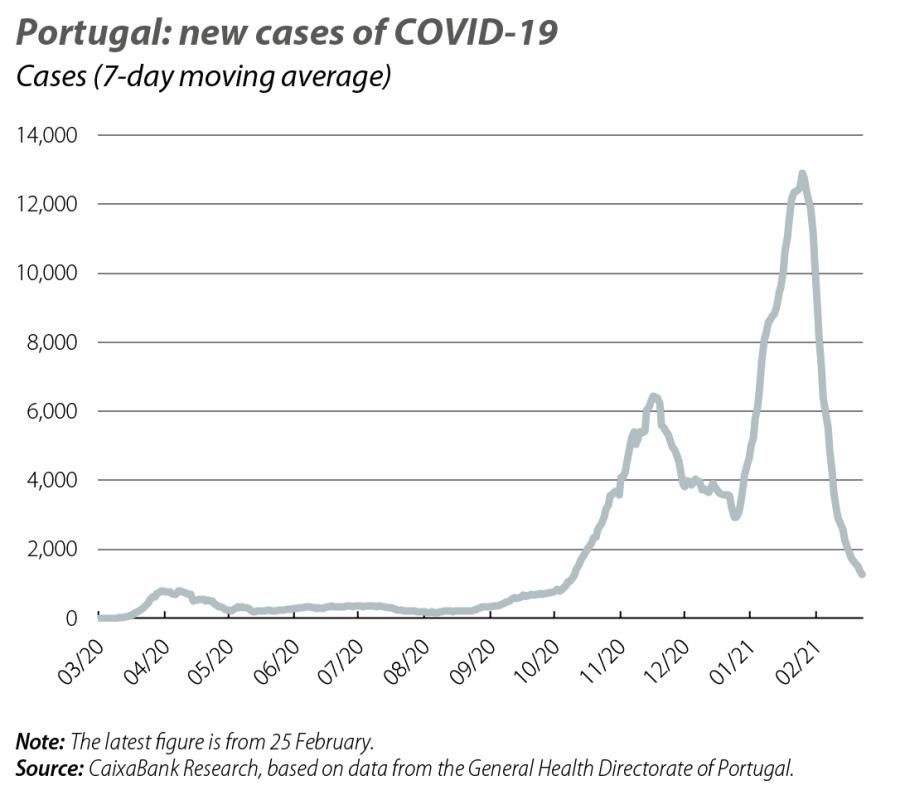

While waiting for the vaccination of the risk groups to relieve pressure on the health system and allow for a more widespread easing of the restrictions, the indicators suggest that the economic recovery has been put on hold by the measures taken to curb the spread of infections in these first few months of 2021. In particular, the Bank of Portugal’s daily economic activity indicator (the so-called DEI, which shows a close correlation with year-on-year GDP growth) has declined to an average of –6.2% so far this year, suggesting a somewhat lower rate of activity than that of Q4 2020 (when the DEI stood at –5.4%). In addition, the confidence indicators for February deteriorated in the consumer category, as well as in the services and trade sectors, while the industrial sector appears more optimistic. This optimism is expected to spread as the vaccinations progress, since this should alleviate the pressure on hospitals and lead to a more sustained recovery in economic activity over the coming quarters.

Employment increased by 59,600 people in Q4 2020 (+1.2% quarter-on-quarter and –1.0% year-on-year) and practically recovered to pre-pandemic levels (–6,400 people compared to Q1 2020). The unemployment rate, meanwhile, fell to 7.1%, compared to 7.8% in Q3, placing the rate for 2020 as a whole at 6.8%. This increase from the 6.5% of 2019 has been much smaller than expected, reflecting the support provided by the measures introduced to protect jobs in the face of the drop in economic activity. Nevertheless, the outlook for the labour market in 2021 remains highly challenging, marked by the deterioration of the pandemic in early 2021, the slow vaccination process and uncertainty surrounding the ability of companies to relaunch their activity once the lockdown is lifted. In this context, the unemployment rate may increase in the second half of the year when the economic support measures in their current configuration expire.

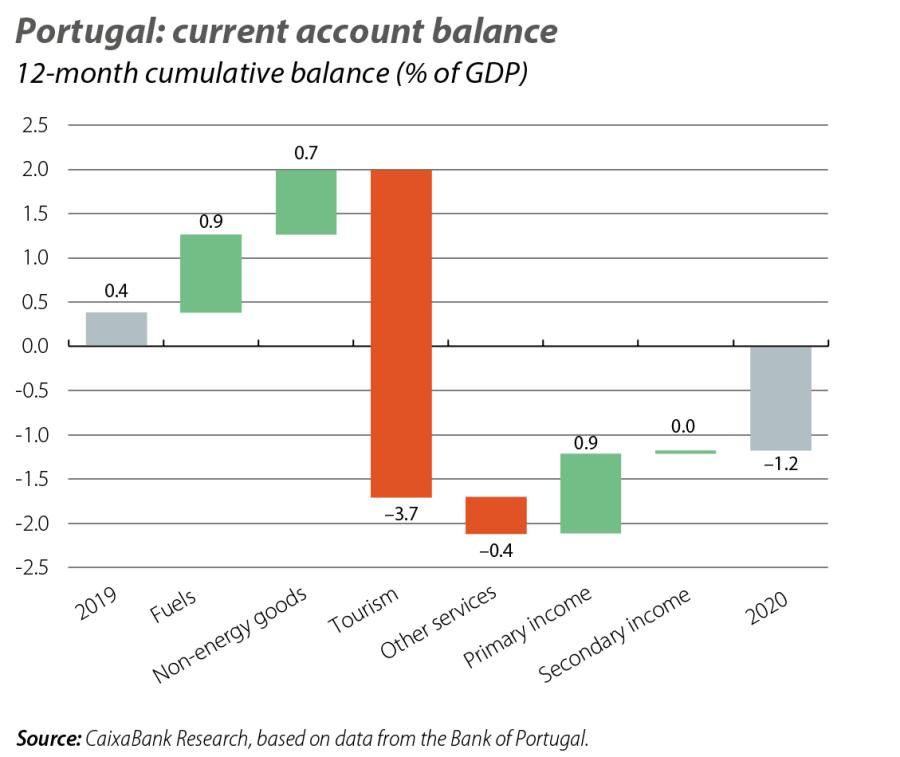

The current account deficit stood at 2,377 million euros, equivalent to 1.2% of GDP, compared to a surplus of 0.4% in 2019. The main factor behind this deterioration was the surplus in the balance of services, which fell to 4.3% GDP (–4.1 pps below the 2019 level) as a result of the slump in international tourism, whilst the deficit in the balance of goods slightly improved (bringing it to –6% of GDP). The capital account balance, meanwhile, increased by 862 million euros to +2,633 million (equivalent to +1.3% of GDP), supported by an increase in revenues from EU funds. This allowed the Portuguese economy to maintain a positive external lending capacity, while waiting for the impact of Next Generation EU and an incipient recovery in tourism to support a certain improvement in the external accounts in 2021.

The number of overnight stays plummeted to 1993 levels, and the total income of tourist accommodation establishments fell to the lowest level since records began (2013), with a year-on-year decline of 66.1% to 1,457 million euros. Tourism suffered a drop both in the number of Portuguese resident guests (–39.2%, down to 6.5 million) and especially in the number of non-resident guests, which plummeted by 76% (to 4 million). The countries with the biggest declines in the flow of tourists to Portugal were Ireland (–89.6%), the US (–87.7%) and China (–82.8%). An incipient recovery in the sector is expected in 2021, supported by the roll-out of the vaccinations. In fact, there have already been some positive signs for tourism in Portugal: following the British Prime Minister’s speech setting out the UK’s process for the easing of restrictions, airlines registered a 600% increase in demand for flights to Portugal, Spain and Greece from the British public, who represent the largest source of tourists visiting Portugal (16.3%).

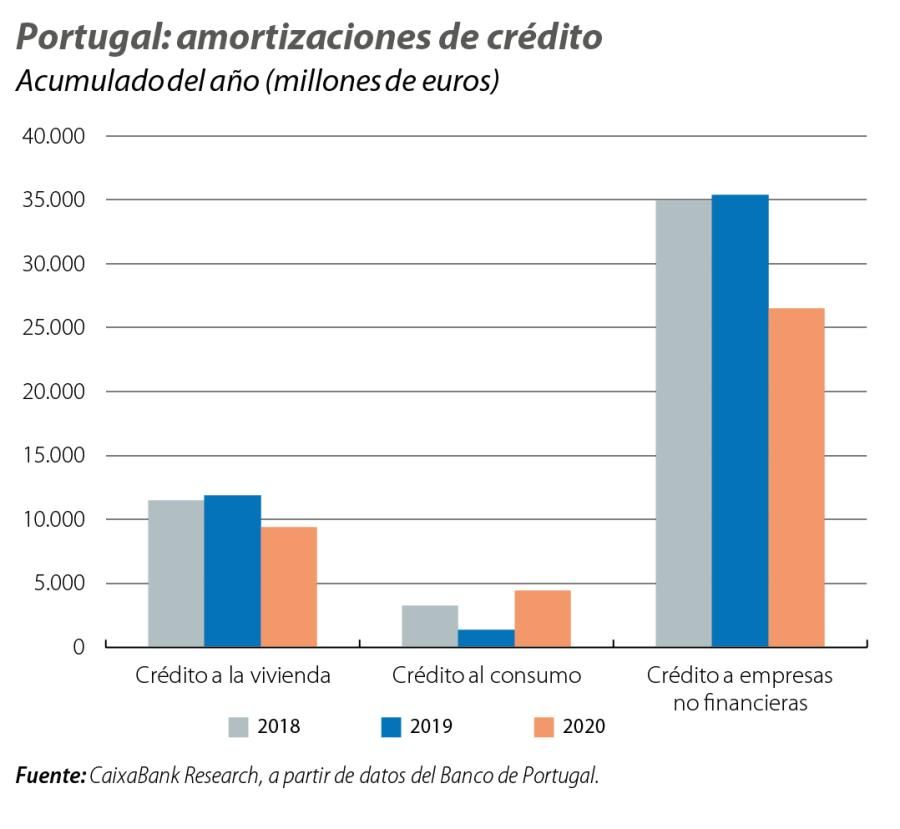

The stock of credit issued to private individuals grew by 1.4% year-on-year in December, down from the beginning of 2020 (2.3%) and with a slight decline in consumer credit (–0.3%). In fact, new lending in this segment fell sharply (–17.4% in the year to date), driven by lower demand from consumers. On the other hand, the stock of housing credit grew by 2.1% year-on-year in December, driven by the buoyancy of new lending (+8.1% in the year to date) and the application of credit moratoria In fact, repayments of housing credit are estimated to have fallen by around 20% in 2020. As for the corporate segment, new lending increased slightly (0.6%) for the year as a whole. After increasing in May and June, when the government-backed credit lines were first introduced, the second half of the year saw a decline in new lending, possibly affected by uncertainty about the economic environment. All in all, the stock of corporate credit increased by 10.4% year-on-year in December, underpinned by adhesion to moratoria (repayments are estimated to have declined by 25% in 20