'2024 Ageing Report' and pension reform: everything you need to know (and a little bit more)

The recent publication of the European Commission’s 2024 Ageing Report is an important milestone for the Commission’s evaluation of the 2021-2023 pension reform planned for 2025 and will determine whether further measures are needed to ensure the system’s sustainability.

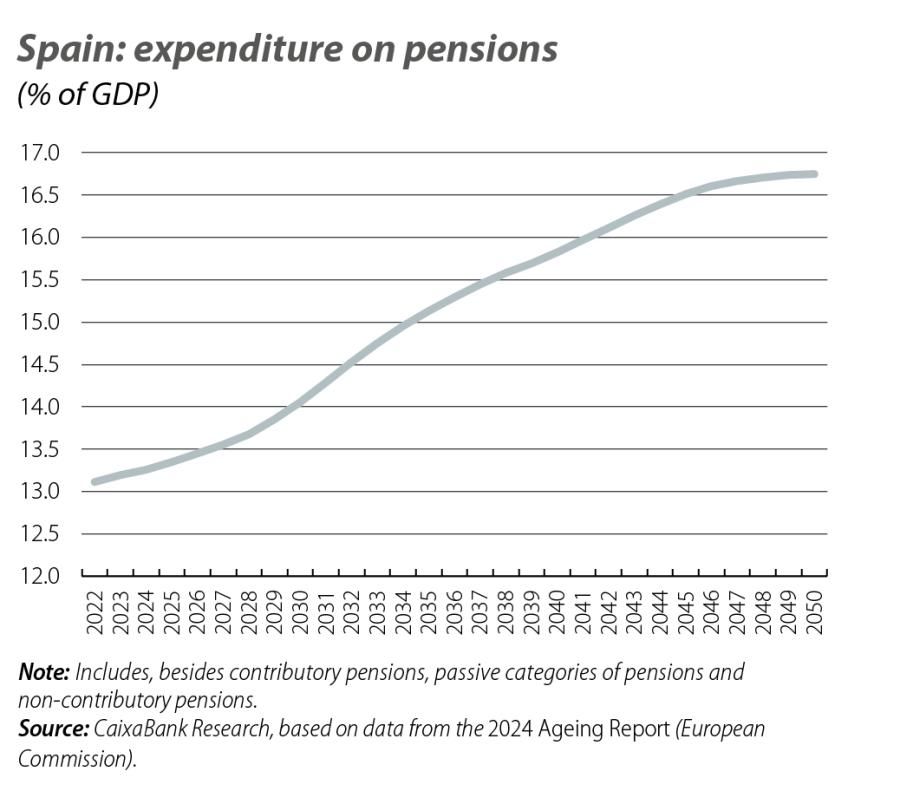

Let’s recall the rules of the game: the government pledged to the European Commission as part of the Recovery Plan that the average expenditure on pensions in the period 2022-2050 would not exceed 13.3% of GDP plus the average contribution of the measures included in the 2021-2023 reforms to boost income levels.1

This rule seems complex, but in reality it is very intuitive: 13.3% is a very similar figure to the expenditure on pensions as a percentage of GDP recorded in 2022. Beyond that, the rule states: if you want to increase expenditure relative to current levels as a percentage of GDP, you have to offset that increase with income measures of a similar amount such that the pension system’s deficit does not increase.

The pension expenditure rule anticipates that AIReF will provide a definitive estimate in 2025 of the expected contribution of these income measures and that, taking into account the expenditure estimate set out in the last ageing report (i.e. the current one, as the next one will not be published until 2027), it will determine whether any adjustments are required in order to fulfil the government’s commitment. So, in the absence of knowing the AIReF’s estimate, this report already offers the pension expenditure estimate that will be used: specifically, 15.1% of GDP2 on average in 2022-2050.

- 1. Increase of 1.2 points in the social security contribution rate in 2029, starting with 0.6 points in 2023 (the so-called intergenerational equity mechanism), increase in the base amounts used to calculate social security contributions, a «solidarity» contribution for high incomes and a new contributions scheme for self-employed workers.

- 2. It remains to be seen whether the figure of 15.1% is taken or it is slightly updated based on the macroeconomic data that will be released over the next year (the report uses the European Commission’s forecasts from autumn 2023).

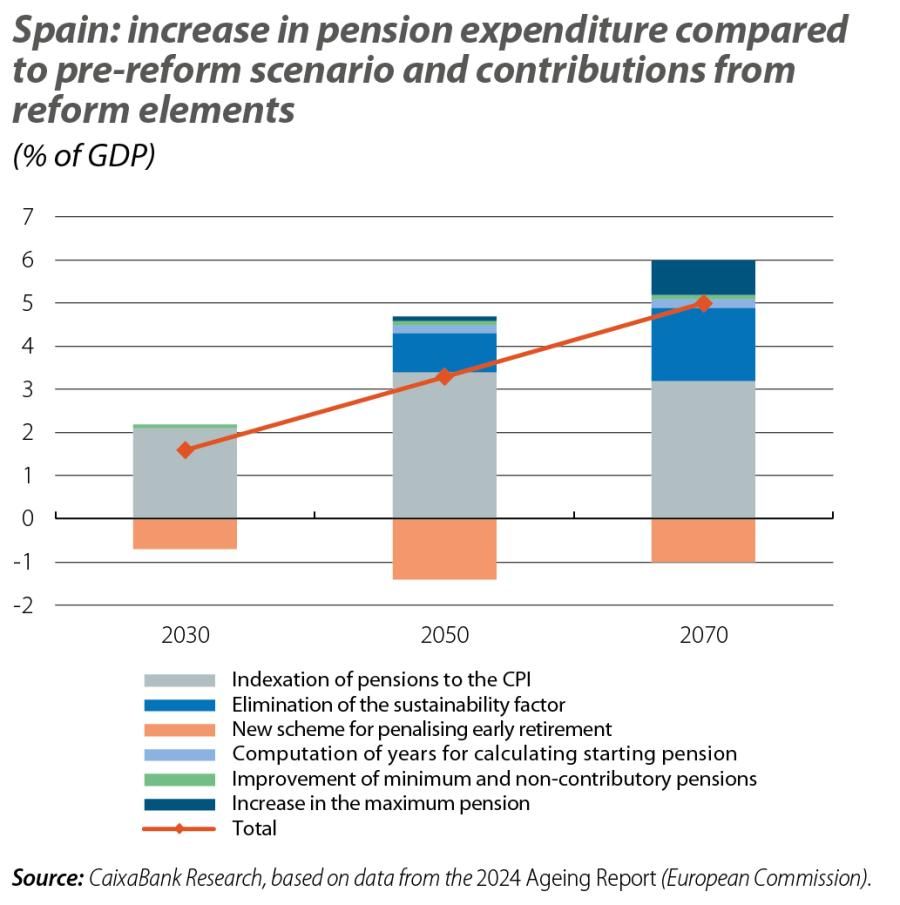

This is a higher average expenditure than we would have in a scenario without the 2021-2023 pension reforms

(see second chart), due to the increase in expenditure associated with the indexation of pensions to inflation and the elimination of the sustainability factor.3 However, these reforms are not the main factor behind the increase in pension expenditure as a percentage of GDP. In fact, adverse demographics, especially up until 2050, will be the main factor behind the increase in expenditure: the Commission estimates that demographics will push up pension expenditure by 10.5 pps between 2022 and 2050, which will be partially offset by the projected fall

in the replacement ratio (the ratio between the average pension and the average wage will go from the current 64% to 56% in 2050), as a result of the increase in the employment rate and for the incentives to delay the retirement age. The reason for the importance of demographics is that the number of retirees will increase significantly in the period 2022-2050 and this increase will not be offset by new entrants into the labour market, even with significant migration flows. It should be noted that the Commission projects that the ratio between the population aged over 64 and the population between 20 and 64 years of age will increase from the current 0.33 to 0.64 in 2050, where it will stabilise between 2050 and 2070.

- 3. This mechanism automatically linked the pension increase to life expectancy, which ensured the balance of the social security accounts in the long term, but meant a cut in the initial pension ranging from 2% for a person who is 60 years old today to 10% for a person who is 25 years old today.

In the event that AIReF finds there is an imbalance between income and expenditure, the government must propose a menu of potential measures which AIReF will evaluate. These conclusions should be used by the government to negotiate with the social partners a proposal for the Toledo Pact, whether it be an increase in incomes, a reduction in expenditure or a combination of both. In 2025, the government will have to present a bill to parliament and, if it is not approved, the contribution of the Intergenerational Equity Mechanism will increase linearly for five years to compensate for the excess estimated by AIReF.

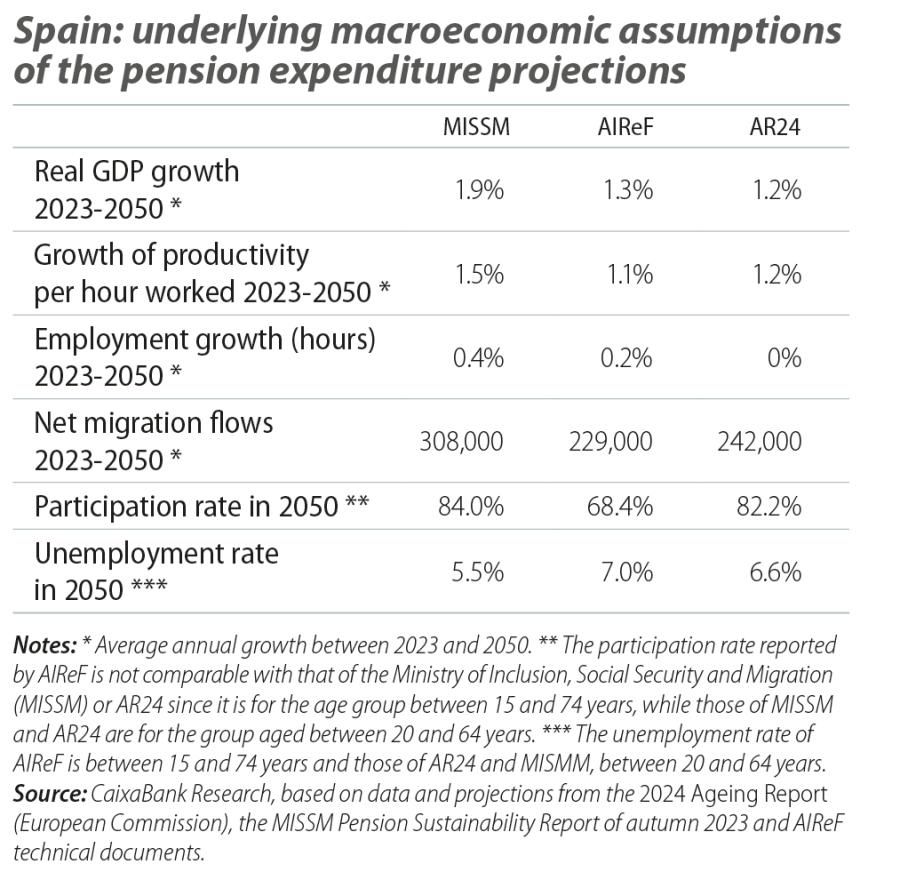

To see in practice how the pension expenditure rule works, an example (or in this case, three) is worth a thousand words. We will compare what adjustment the expenditure rule would entail based on the expenditure projections set out in the 2024 Ageing Report and the income projections from the report itself, those produced by AIReF in the spring of 2023 and those from the Pension Sustainability Report of autumn 2023 produced by the Ministry of Social Security (MISMM).

The Ageing Report forecasts average pension expenditure in 2022-2050 of 15.1% of GDP. It does not explicitly mention its estimate of the contribution of the income measures, but it does envisage an increase in incomes from social security contribution of 1.2% of GDP on average over the period 2022-2050, which is expected

to predominantly come from these new measures.4 With this figure, the maximum pension expenditure on average in the period 2022-2050 would be 13.3%+1.2%, or 14.5% of GDP. This 14.5% compares with the average expenditure of 15.1% envisaged in the Ageing Report, which, foreseeably, corresponds mostly to these new measures in order to cover this deviation of 0.6% of GDP (8.8 billion euros).

AIReF, for its part, initially quantified (a year ago, before the revision of the National Statistics Institute’s historical GDP series last autumn and the strong labour market data of the last year) the impact of the new income measures at 1.0% of GDP, which would allow for pension expenditure of 14.3% of GDP (13.3%+1%). Thus, and again comparing with the 15.1% expenditure figure given by the Ageing Report, and which coincides with the estimate given by AIReF a year ago, the adjustment would be 0.8% of GDP (11.7 billion euros).

- 4.

In previous ageing reports, the income from social security contributions as a percentage of GDP remained flat throughout the projection horizon, as they did not yet incorporate the new measures.

Finally, MISMM quantified the new income measures at 1.7% of GDP, which means that expenditure on pensions could amount to 13.3%+1.7% = 15.0% of GDP. Taking the expenditure benchmark of the Ageing Report of 15.1%, the adjustment required would be minimal. It should be noted that this 1.7% is in the high band of the various estimates made and reflects a more optimistic macroeconomic scenario than that envisaged in the Ageing Report, with higher potential growth, higher net migration flows and a more buoyant economic activity rate (see the differences set out in the table).

In short, in order to determine whether additional pension measures will be required in 2025, we need only two numbers. One is the average pension expenditure in 2022-2050 provided by the Ageing Report, and we already have it. The other is AIReF’s final estimate of the average impact over the same time horizon of the income measures included in the recent pension reforms, and we will know this within a year.