The good times continue for the Spanish economy

Q2 2025 began with all bets placed on a slowdown in the growth of the Spanish economy. In early April, and after months of threats, the Trump administration announced bilateral tariffs and catapulted the main uncertainty indicators to all-time highs. Weeks later, a blackout left the Iberian Peninsula without electricity for a day. Moreover, all this happened in an environment in which the euro area economy was once again showing signs of cooling.

The Spanish economy exceeds expectations once again in Q2 2025

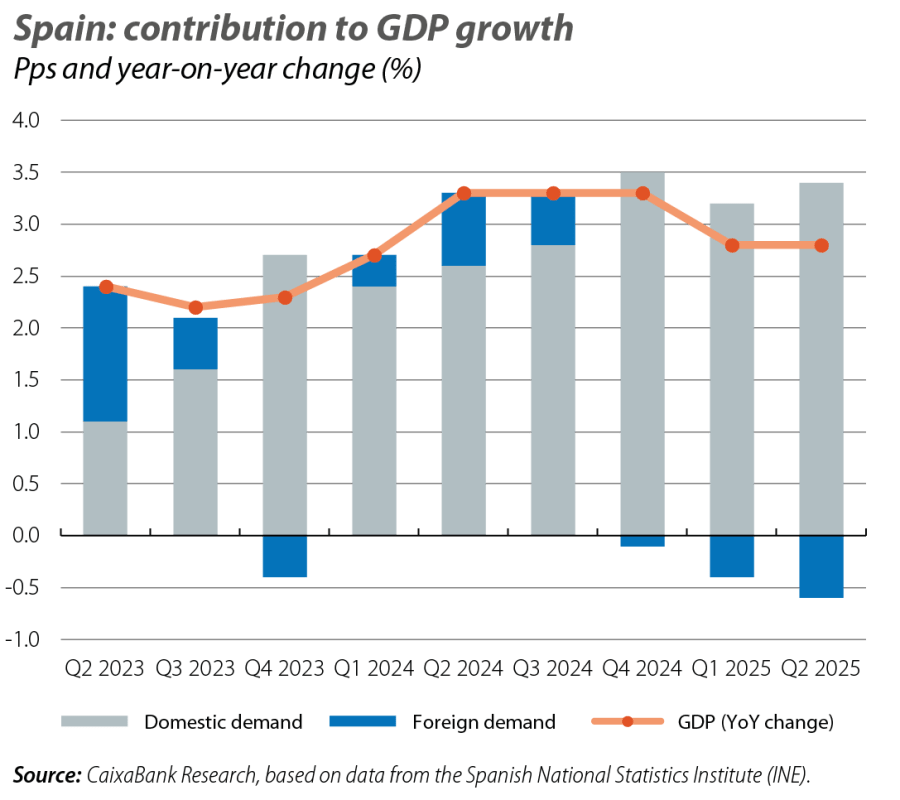

Despite this unfavourable context, the Spanish economy not only maintained its buoyancy, but accelerated relative to the previous quarter. In Q2, GDP grew by 0.7% quarter-on-quarter, 0.1 pp more than in Q1. The breakdown of this figure also stands out due to the strength of domestic demand, which contributed 0.9 pps to quarter-on-quarter GDP growth. Private consumption was one of the main drivers of domestic demand, growing 0.8% quarter-on-quarter and accelerating compared to the 0.5% recorded in Q1. Investment, meanwhile, grew 1.6% quarter-on-quarter, thus outpacing GDP growth for the third consecutive quarter. Exports also advanced at a steady pace of 1.1% quarter-on-quarter, despite the uncertainty surrounding trade and the weakness of our main trading partners. However, the growth of domestic demand, especially investment, boosted imports, which grew by 1.7% quarter-on-quarter, resulting in a negative contribution from foreign demand.

Positive signals in the main economic activity indicators for Q3

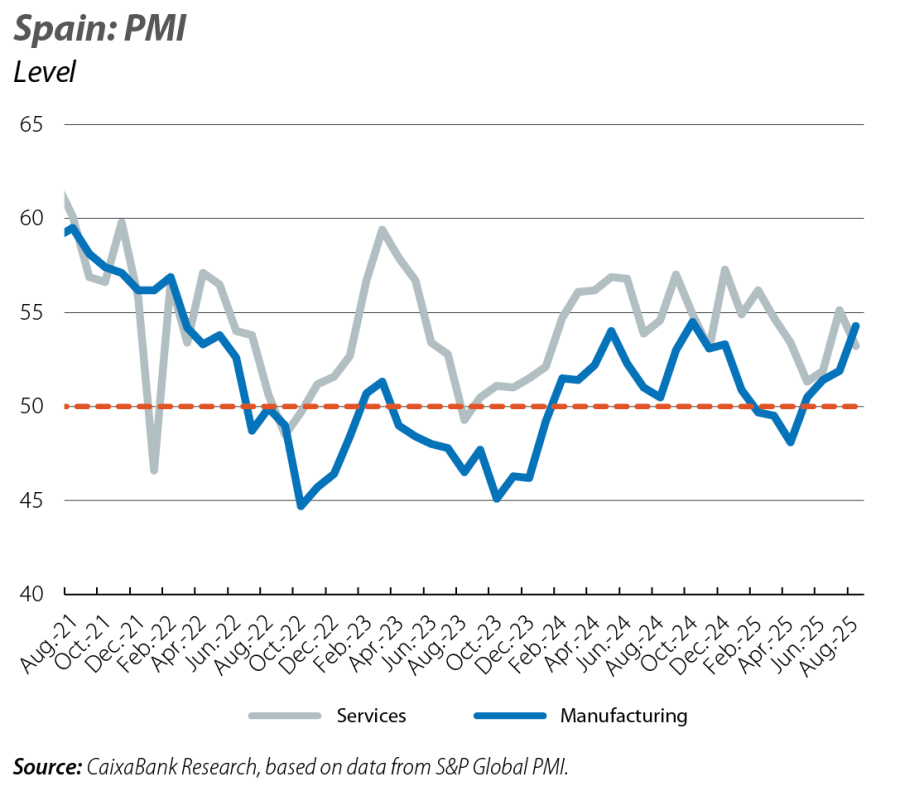

The first indicators for Q3 show mixed signals between supply and demand. On the one hand, business confidence indicators point to a solid growth rate for Q3. In August, the manufacturing sector’s PMI rebounded to 54.3 points, the best figure since October last year and well clear of the contractionary zone below the 50-point threshold in which it stood between February and April. Also, the PMI for the services sector remained in the expansionary zone with 53.2 points, a slightly lower figure than in July.

On the other hand, the CaixaBank consumption tracker points to a moderation in consumption, following the good performance in Q2. So far in Q3, domestic consumption has grown by 2.8% year-on-year, 1.5 pps less than in Q2. However, correcting for seasonal and calendar effects, the tracker points to a growth rate in private consumption similar to that of Q2.

The labour market holds up despite the adverse seasonality of the end of summer

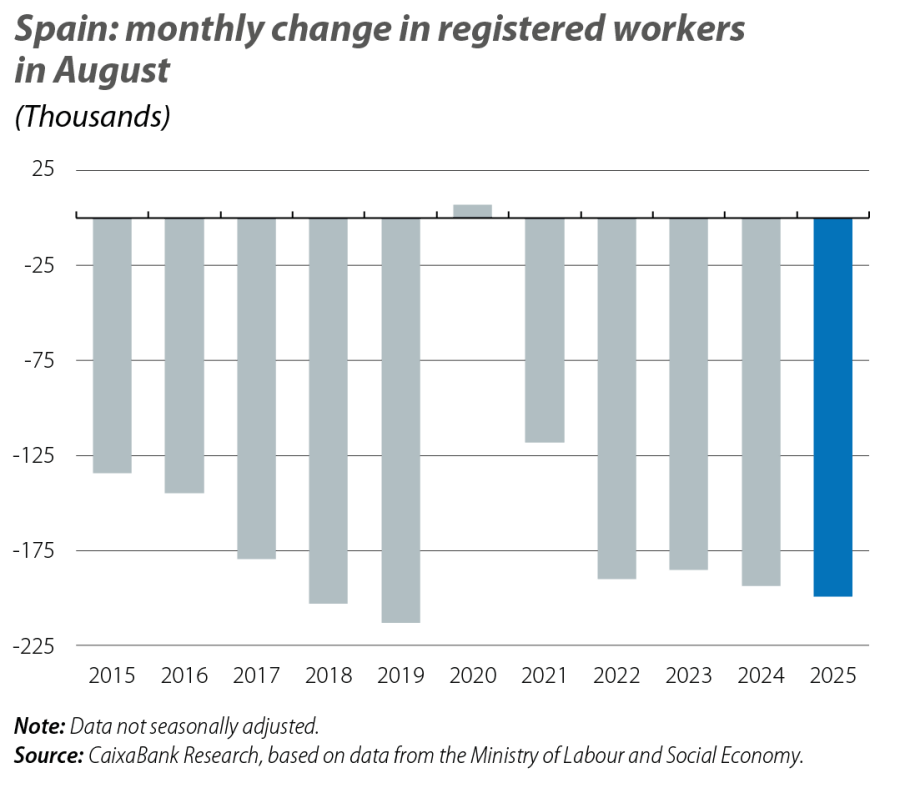

Following a record Q2, Spain’s labour market continues to show signs of strength, consolidating itself as one of the pillars of economic growth in recent years. In August, the number of Social Security affiliates fell by 0.9% month-on-month, as is commonplace in a month marked by the end of summer contracts and the temporary halt of some economic activities. This fall is similar to the one recorded in August last year and also to the average of the months of August between 2014 and 2019. In year-on-year terms, the number of registered workers has grown at a rate of 2.3%. By sector, job growth has been particularly strong in construction, with a year-on-year rate that accelerated by 0.4 pps to 3.5%, while in industry and services the rate has stabilised.

Electricity and food prices give inflation a respite

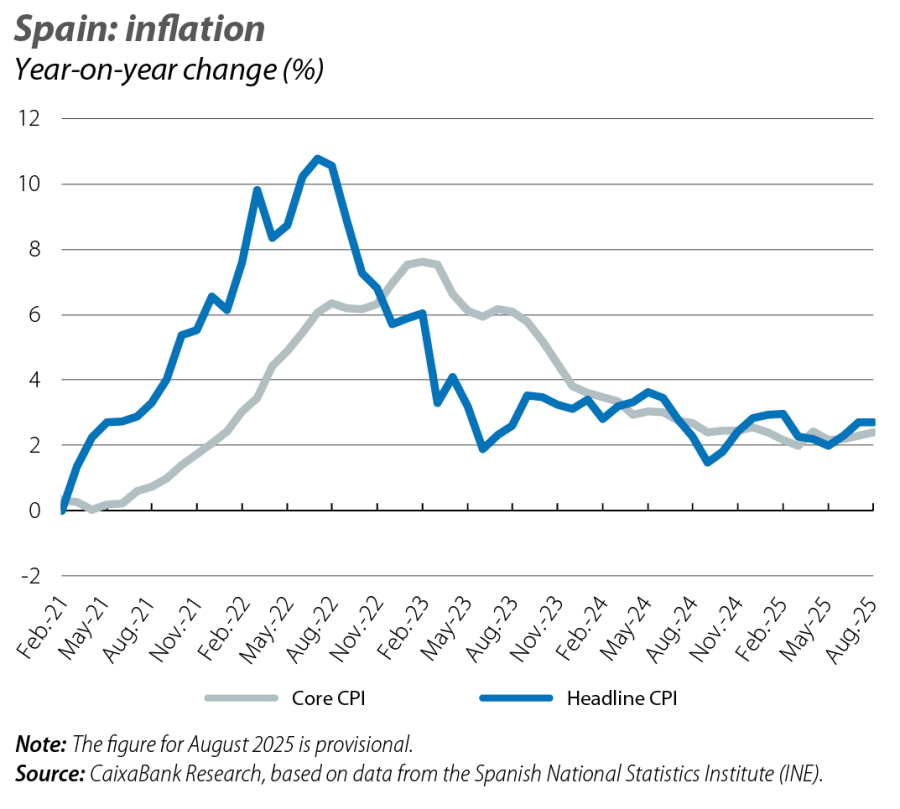

In August, headline inflation remained at 2.7%, according to the CPI flash indicator published by the National Statistics Institute (INE). This stabilisation is in response to two opposing effects: the upward pressure exerted by fuels, which is offset by the downward contribution from electricity and food. Meanwhile, core inflation (excluding energy and unprocessed food) increased by 0.1 pp to 2.4%. Thus, after two months on the rise, headline inflation lies 0.7 pps above the figure of May, when the current price rebound began. This rebound has been driven by rising prices of fresh food and, to a lesser extent, electricity. Currently, the futures markets suggest that energy prices will remain stable during the remainder of the year. Also, the decline in food prices this month advanced by the INE could indicate a pause in their upward trend. If the current dynamics are maintained, we could see inflation peak in September.

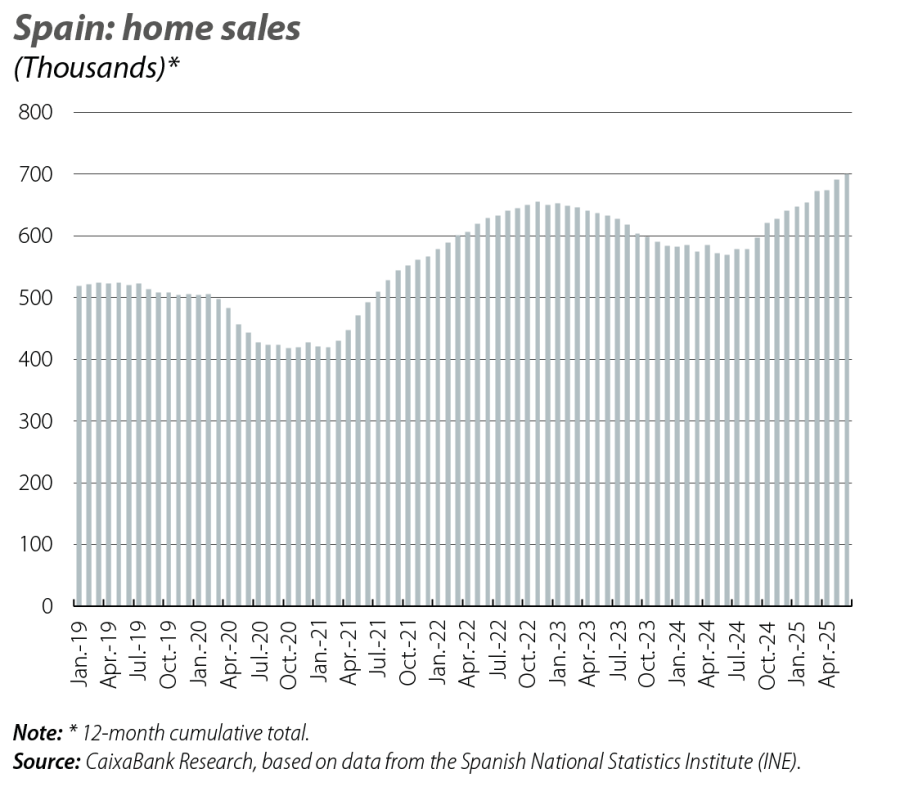

The housing market closed its best first semester since 2007

In a context marked by the recovery of purchasing power and lower interest rates, housing demand continues to show significant strength. In June, sales grew by 17.9% year-on-year, maintaining the buoyancy observed in previous months. The cumulative balance for the year to date reinforces this trend: between January and June, some 358,000 sales transactions were recorded, representing a 19.7% increase over the same period last year and marking the best first half of the year since 2007. The combination of dynamic demand and a supply which, although reactivated, is growing at a more moderate rate, is causing the price tensions to persist. In Q2 2025, the Association of Registrars’ repeat home sales price index rose by 14.8%, up from the previous 14.2% and marking the highest rate since 2006.

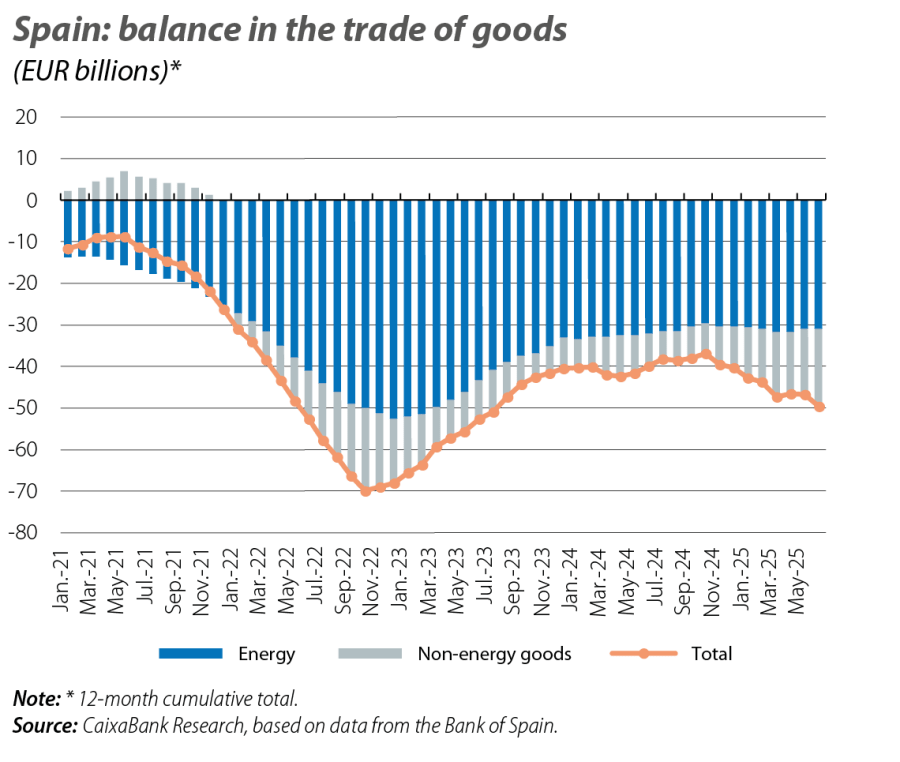

The trade deficit rises sharply in the first half of the year

Unlike the real estate sector, the current context does not favour the foreign sector. The strength of domestic demand is driving up import growth. Added to this is the uncertainty over trade, as well as the weakness of the euro area, which are adversely affecting exports. In the first half of the year, exports of goods grew by 1.0% year-on-year, but the 5.4% increase in imports has led to a deficit of 25.1 billion euros in Q1 2025, a figure that far exceeds that of the same period last year (–15.8 billion). By component, the deterioration stands out not only due to the increase in the energy deficit, which is commonplace in Spain’s balance of trade, but also due to the sharp deterioration in the balance of non-energy goods, which shows a deficit of 8.78 billion, versus just 138 million in 2024. The widening of the non-energy deficit is explained by the greater dynamism of imports, which are up 7.4% year-on-year, far outpacing the 2.6% growth in exports.