Slight changes in the forecast scenario for the Portuguese economy

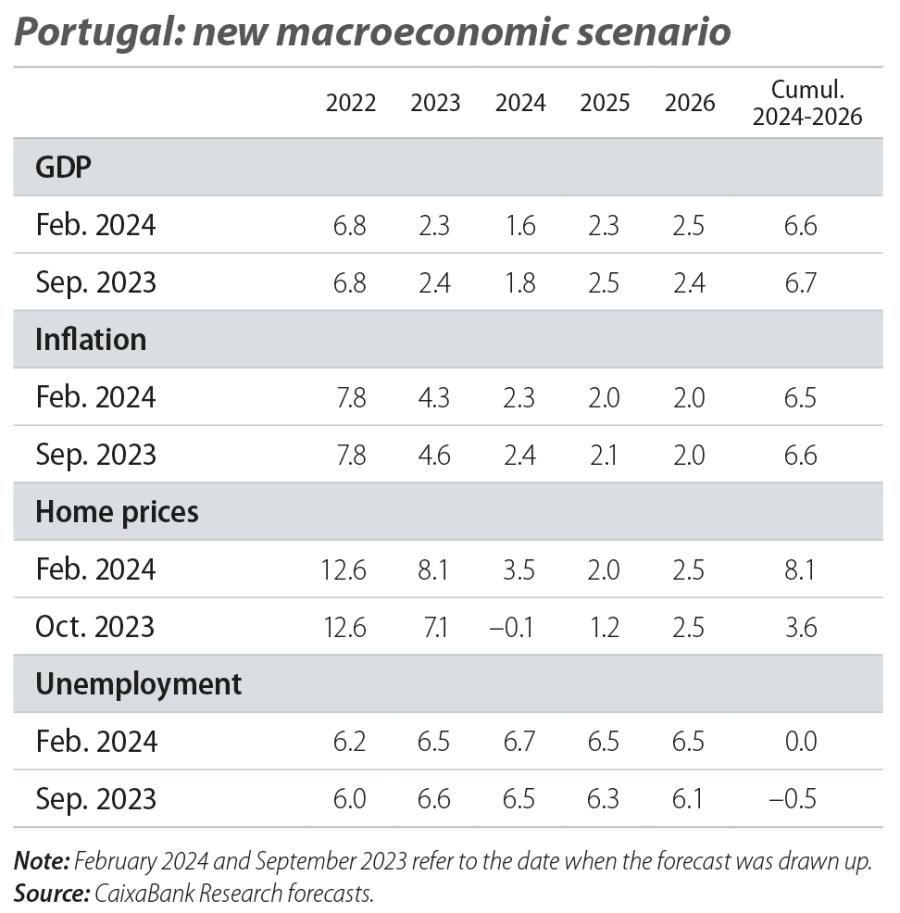

With the 2023 data now published for almost all the main macroeconomic variables, we have revised our macroeconomic forecast scenario for the Portuguese economy for 2024-2026. That said, the changes are not particularly significant, with the exception of the forecasts related to the real estate market.

In cumulative terms through to 2026, we predict that these three years will see GDP grow by 6.6%, just 10 pps less than we expected in the previous scenario. In particular, for 2024 we have reduced the growth forecast by 20 pps to 1.6%, mainly due to more moderate growth in the first half of the year, followed by a more rapid recovery beginning mid-year once the disinflationary process is consolidated and the ECB’s monetary policy softened. This growth will be supported by domestic demand, both in private consumption, propped up by a resilient labour market, and in investment, thanks to the boost provided by European funds. In the case of foreign demand, we expect to see a deterioration due to stronger growth in imports, while exports will moderate slightly, given the weakness of Portugal’s main trading partners.

As for inflation, the better-than-expected figures in the final leg of 2023, coupled with the downward revision of projected oil and gas prices, result in a downward revision of the outlook for 2024. However, other factors, such as the end of the zero VAT rate on food and the rise in some regulated prices (rents and public services) will have an opposite impact. Therefore, the change in our scenario is marginal and the annual average inflation forecast for 2024 is revised 10 pps downwards, placing it at 2.3%; in the case of core inflation, the revision is more substantial, at 2.4% (down 40 pps).

In the labour market, the economy will continue to create jobs, although the shortage of labour remains one of the main obstacles for economic growth, especially in the construction and public works sector. The fact that the ratio of vacancies to unemployed persons remains high relative to its historical level supports the persistence of a resilient context in the labour market. In any case, we have revised our estimate for the unemployment rate upwards, mainly because of the impact that immigration will have on the labour force.

In the real estate market, the revisions are more substantial. Firstly, although the final data for 2023 are not yet known, price growth through to Q3 was more intense than we had anticipated and the preliminary indicators for Q4 suggest that the pace of growth even accelerated. Added to this is the persistence of other factors that favour more rapid price growth, such as greater immigration, which drives up housing demand, and the supply shortage. In any case, our outlook for price growth is moderate, consistent with lower demand, as financing costs will remain high, especially in the first half of the year.

For yet another year, the outlook is mired in uncertainty, this time due to the outbreak of the war in the Middle East. So far, the impact of the conflict on production and transport costs has not been significant, so we do not anticipate any major changes in the disinflationary process, allowing the central banks to begin the rate reduction cycle by the middle of the year. If the conflict were to spread to other countries, the situation could change, as this could trigger an increase in the price of goods or make their supply more difficult, with the consequent delay in the moderation of inflation and the prolonging of the restrictive monetary environment. However, this is not our baseline scenario, so we remain relatively optimistic about the Portuguese economy’s prospects in 2024.