Spain’s current account balance in the European context

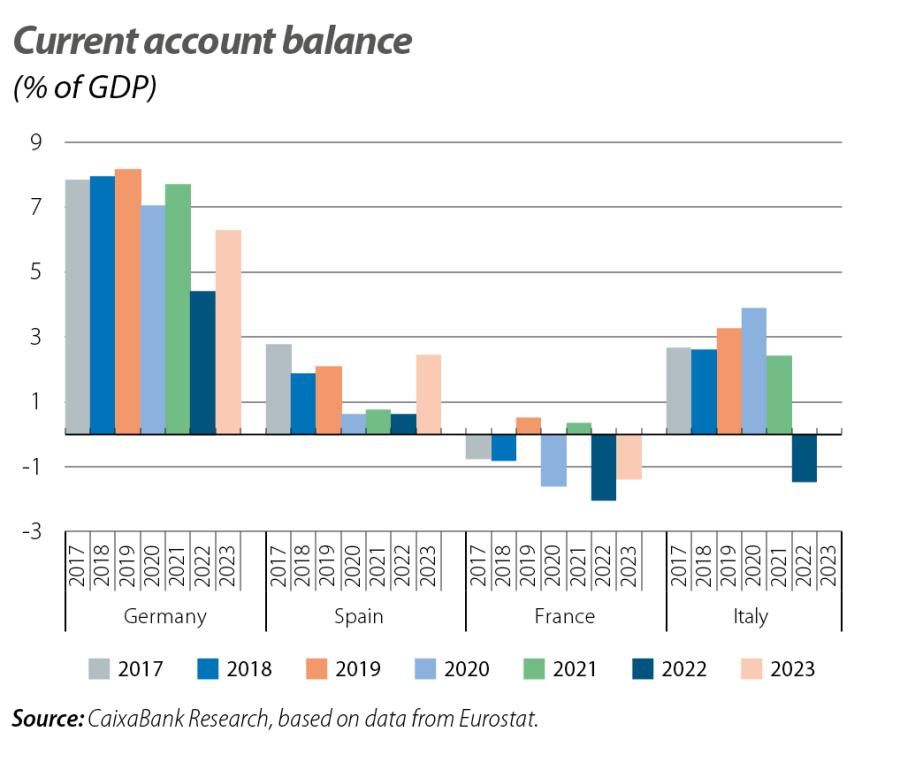

Following the rise in the cost of energy imports in 2022, the recovery of the foreign sector was particularly rapid in 2023 and the four largest economies in the euro area have improved their current account balances, although only Spain has managed to surpass the 2019 figure.

2023 was an exceptional year for Spain’s foreign sector. With a current account surplus of 2.5% of GDP, the strong performance of Spain’s foreign sector is particularly noteworthy when compared to the other large European economies. The Spanish economy has now accumulated 12 consecutive years with a current account surplus, surpassed only by Germany among Europe’s major economies.

From 2019 to 2022, the current account balances of the major European countries deteriorated significantly due to the outbreak of the pandemic and the energy shock. However, neither the impact of these shocks nor the subsequent recovery has been equal across all countries. In particular, during 2022, a year greatly affected by the increased cost of energy imports, Spain’s current account balance registered the smallest decline. Moreover, besides the German economy, Spain was the only other major European economy that managed to avoid a foreign deficit for the year as a whole. The deterioration of the balance between 2019 and 2022 amounted to 4.7 pps of GDP in Italy, 3.8 pps in Germany and 2.6 pps in France, while in Spain it was just 1.5 pps.

Following the rise in the cost of energy imports in 2022, the recovery of the foreign sector was particularly rapid in 2023 and the four largest economies in the euro area have improved their current account balances, although only Spain has managed to surpass the 2019 figure.

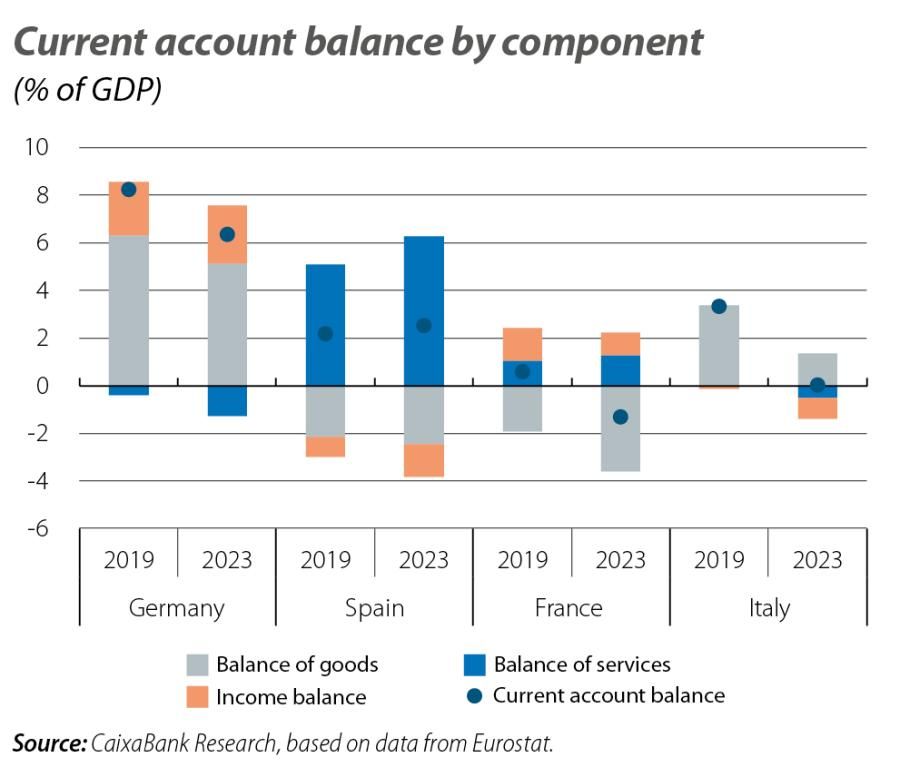

The second chart shows, for each of the four major euro area economies, the role that each sub-balance has played in the change in the overall current account balance since 2019.

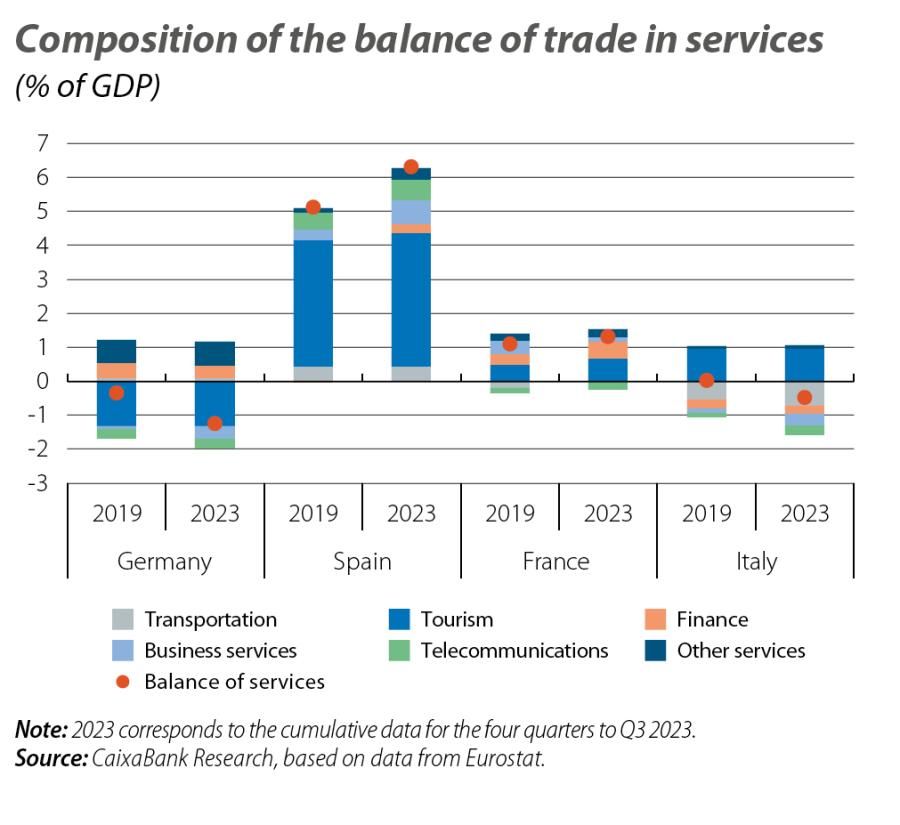

In the case of Spain, the marked increase in the surplus of the trade in services balance stands out, having gone from 5.1% of GDP in 2019 to 6.3% in 2023 (with data up to Q3 2023), offsetting the deterioration of the trade deficit in goods and the income balance. This pattern contrasts with that of other European countries, where services account for relatively small deficits or surpluses.

In the case of Germany, the lower current account surplus in 2023 is attributable to reductions in the balance of trade in both goods and services, partially offset by a slight improvement in the income balance. The French economy, meanwhile, has gone from a slight surplus in 2019 (0.5% of GDP) to a deficit of 1.4% of GDP in 2023, mainly caused by the increase of the trade deficit in goods, which has reached –3.6% of GDP. Finally, Italy is the economy that lies the furthest from the surplus it recorded in 2019, having gone from a large surplus (3.3% of GDP) to a slight deficit in 2023 of 0.04% of GDP, mostly due to a very substantial fall in its trade in goods surplus (1.3% of GDP in 2023 vs. 3.4% of GDP in 2019), although its services and income balances have also deteriorated.

Within Spain's services balance, both tourism and non-tourism services have performed very well. While tourism is the biggest contributor to the overall surplus, contributing a surplus of 3.9% of GDP up until Q3 2023 (3.7% in 2019), telecommunications, transportation and other services, including commercial services, have also made a positive contribution. In fact, 65% of the improvement in the balance of trade in services since 2019 is attributable to the improvement in non-tourism services, which have driven up the pre-pandemic surplus by 1 pp, compared to a 0.23-pp increase provided by tourism services.

The performance of Spanish tourism is particularly impressive when compared to that of France and Italy, where tourism revenues also play a significant role in the economy. Along with tourism, all other branches of activity in Spain’s services sector generated a higher surplus than in any other European economy, with the exception of the financial sector in France and other services in Germany. This certifies the exceptional performance of Spain’s services sector in the context of the euro area and its ability to act as a driving force for foreign trade.