The markets adjust to calls for «patience»

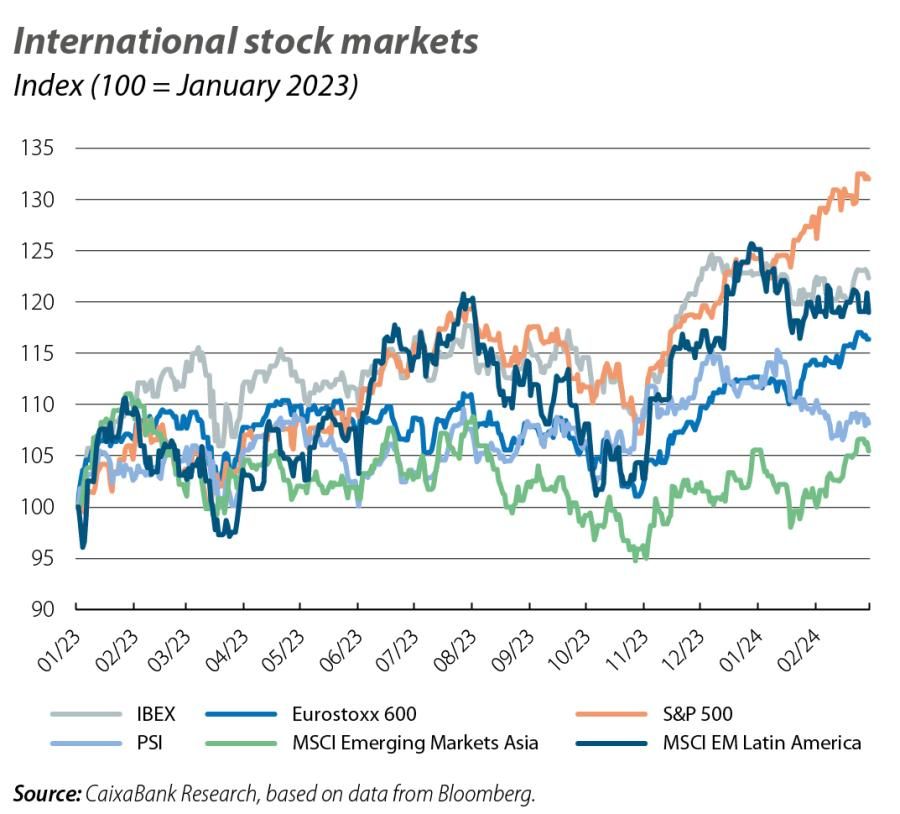

The downward resistance of core inflation in the world’s major economies led investors to revise their monetary policy expectations as February progressed and to reorganise their forecasts regarding the timing of interest rate cuts. Thus, given the insistence of the messages coming from Fed and ECB officials, pointing out that the battle against inflation is not yet over and that the so-called last mile will be more difficult than anticipated, the financial markets began to soften the aggressive rate cut expectations which they had been reflecting earlier in the year, especially in the US. Despite this change of circumstances, and amid abrupt fluctuations in sovereign debt yields, risk-bearing assets continued to perform well, including equities, where the resilience of business earnings led several of the major stock market indices to reach record highs.

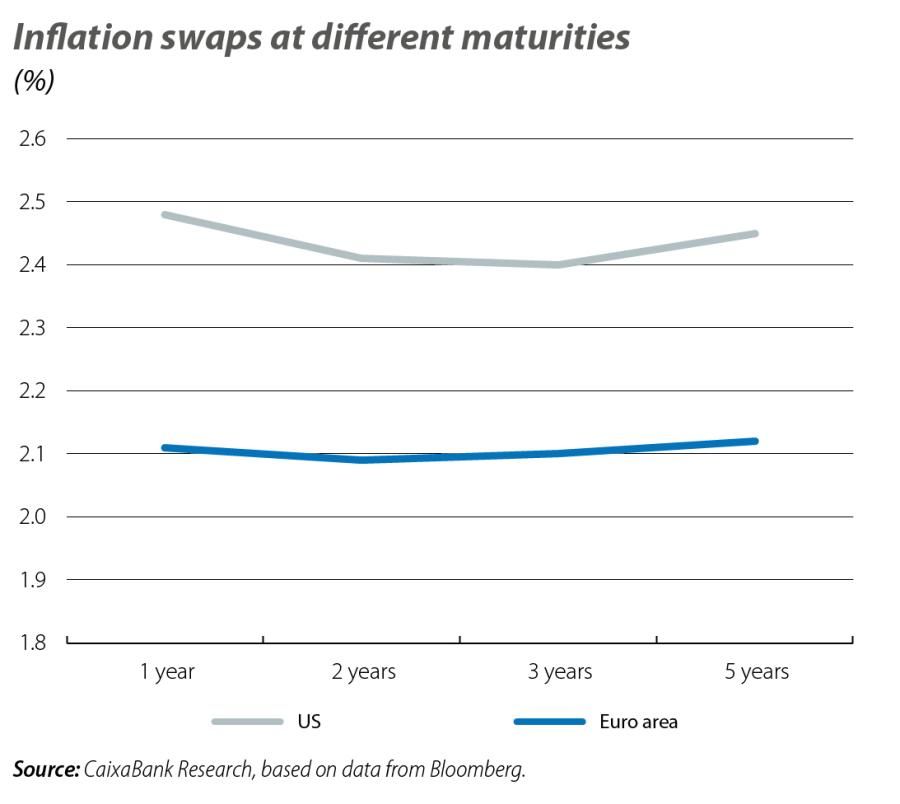

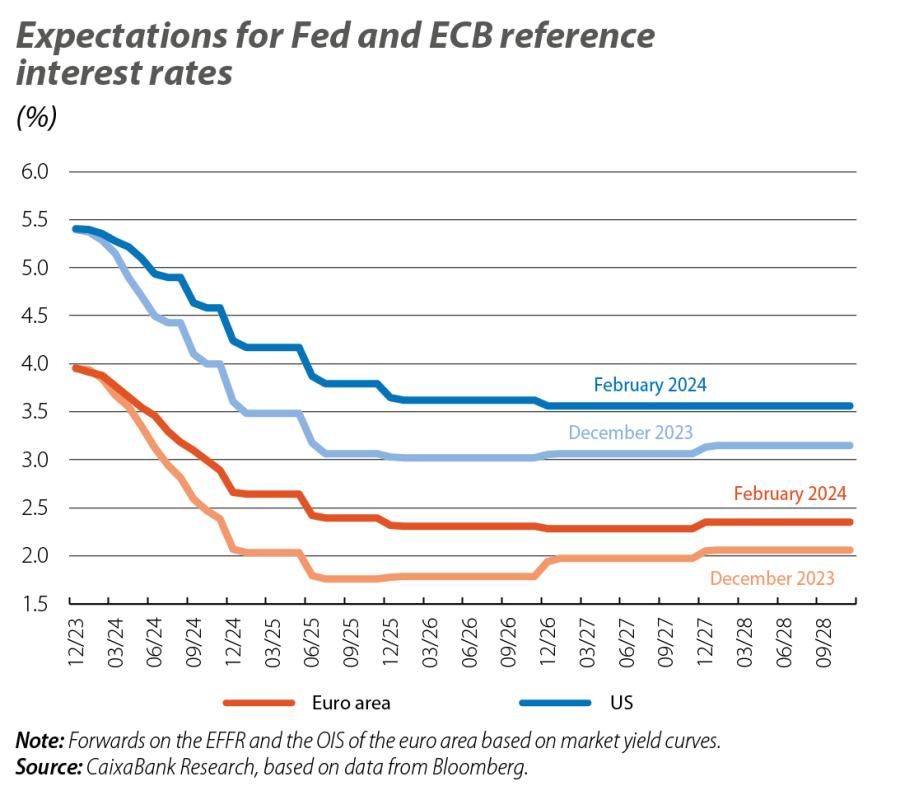

The consumer price and industrial cost data for February confirmed the most cautious investors’ suspicions that the pace of the slowdown in prices had reduced significantly compared to the previous months on both sides of the Atlantic. In both cases, the increased pressures on prices linked to energy and the obstacles in trade (triggered by the tensions in the Red Sea), the recovery of wages in the face of the lost purchasing power, as well as the resilience of the US business cycle all prompted investors to raise their outlook for short-term inflation (1-year inflation swaps in both economies rose by around 40 bps), placing it slightly above 2% for the next few years. In parallel, and as a result of this upward revision of price expectations, the financial markets also began to revise their expectations regarding the timing and magnitude of the Fed and ECB’s planned interest rate cuts. This impetus to revise the outlook was only reinforced by the large number of statements given by members of both central banks.

At the Fed, there is unanimous concern about the risk of lowering rates too soon given the strong employment and inflation data, as was reflected in the minutes of the latest FOMC meeting. The central bank’s messages show an inclination for taking a careful approach, based on the observation of the upcoming data on inflation, the labour market and household consumption, and a slower reduction in interest rates compared to the timing anticipated by the market. In this regard, investors postponed their expectations for the first rate cut in the US from March/May to June, while anticipating a 100-bp total reduction in 2024 as a whole. In the euro area, although the current economic situation in the region is somewhat weaker, ECB members were also very cautious about the risk of lowering interest rates too soon, highlighting the need to keep an eye on the trajectory of inflation, which could be influenced by factors such as wage negotiations, business margins and productivity. Thus, like in the US, the markets also pushed back their expectations regarding the first ECB rate cut to June, anticipating a total reduction of 100 bps during 2024.

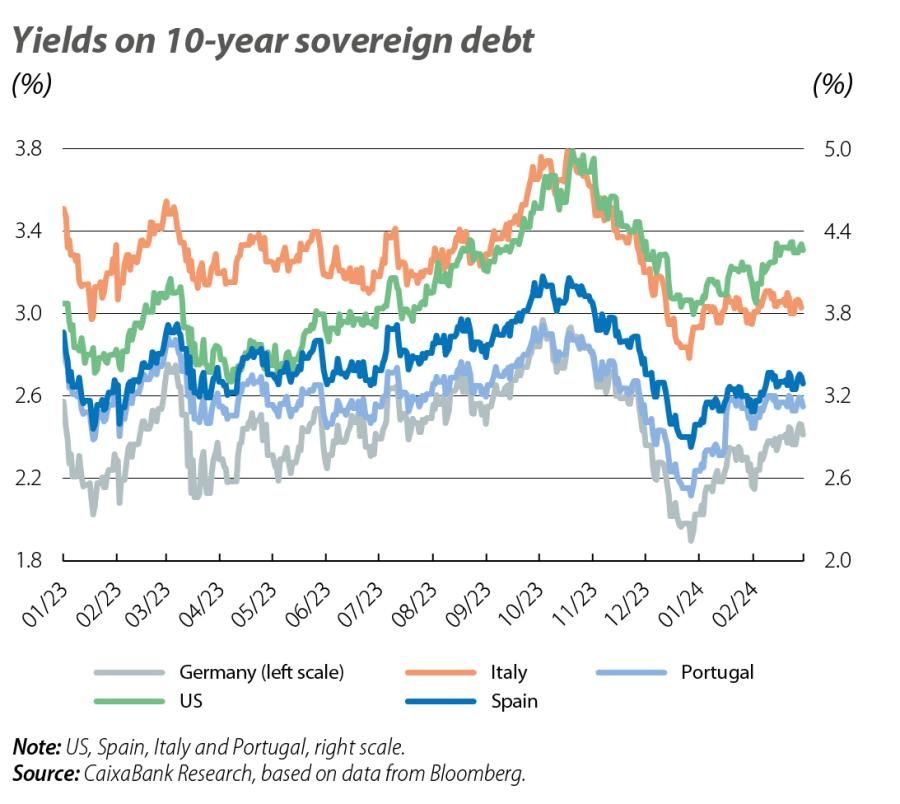

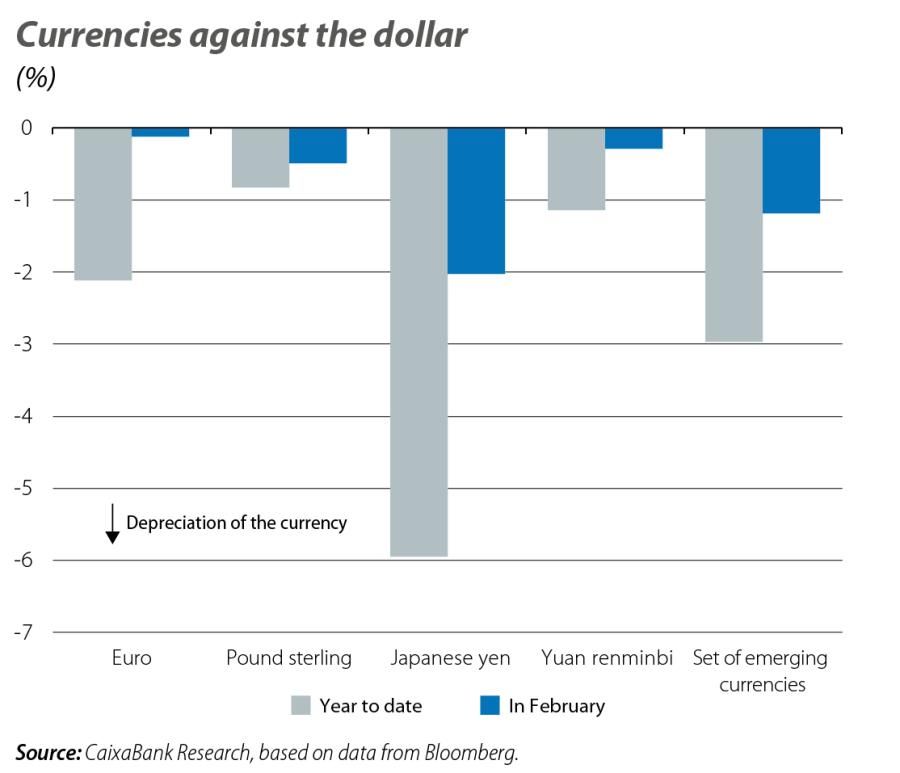

The impact of the postponement of interest rate expectations in the US and euro area was mostly felt in the fixed-income markets, and in sovereign yield curves in particular. The publication of less benevolent than expected inflation data in the US caused a sharp rebound in treasury yields throughout the curve, which shifted upwards and remained at their new levels for the rest of the month, fuelled by the messages of patience from members of the Fed. The interest rate on the 2-year bond, which reliably captures expectations for the fed funds rate, rose to levels not seen since the Fed’s «pivot» in December and ended the month at around 4.6% (+41 bps). This situation was monetised by the exchange rate of the dollar, which continued to appreciate against the rest of the major currencies. Meanwhile, the yield on the 10-year treasury once again surpassed the 4% barrier and exceeded 4.3%. In the euro area, sovereign yield curves behaved much like in the US, induced by the ECB’s reluctance to lower rates. Thus, the German 2-year bond accumulated an increase of some 50 bps in the month, while in the longer stretches of the yield curve the better performance of the peripheral economies’ debt favoured a narrowing of risk premiums.

In February, and despite the monetary outlook, investors maintained their appetite for equities, attracted above all by the broadly positive business earnings announced for Q4 2023. Tech and AI firms provided the greatest support for the main stock market indices, which, in the case of the S&P 500, Germany’s Dax and France’s CAC, reached new all-time highs. Meanwhile, in China, the implementation of measures in the stock markets to regain investor confidence and the deployment of aid to the real estate sector favoured gains in the country’s main indices.

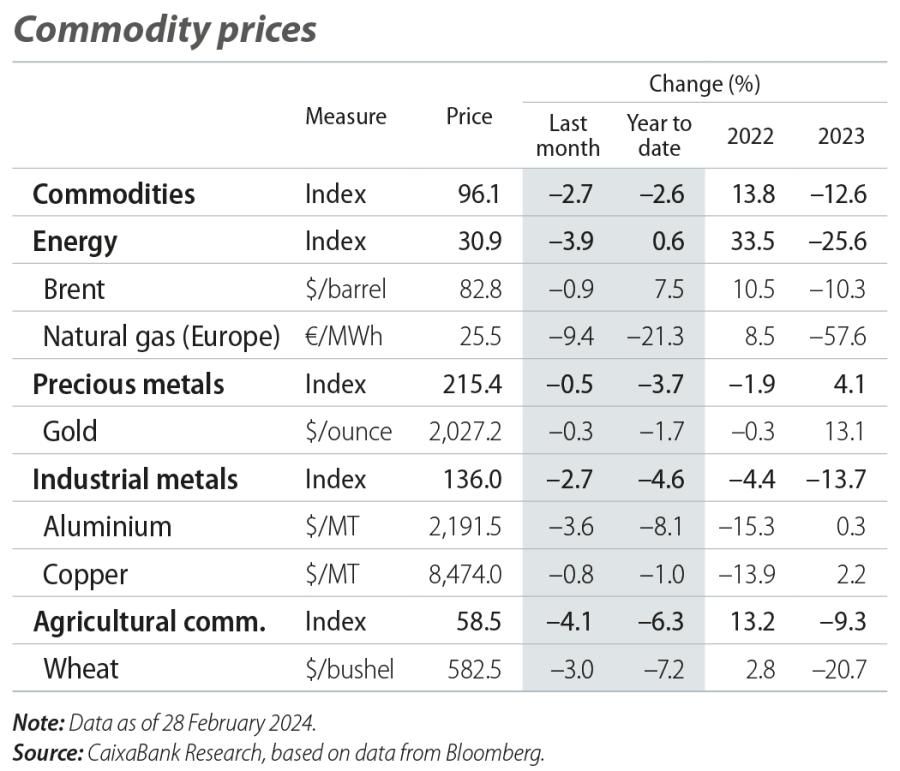

In this context, the strength of the dollar and the fear of cooling demand helped to contain the prices of the major commodities, with the exception of the Brent oil barrel. The easing of the oil supply deficit as a result of an increase in output from non-OPEC countries, especially the US, was almost neutralised in the markets by the rising tensions in the Red Sea, causing the price of a barrel to remain at around 83 dollars for much of the month. On the other side of the coin, European natural gas (Dutch TTF) fell to 25 euros/MWh in a context marked by a high supply of liquefied natural gas and healthy gas reserves, amid milder weather conditions than usual on the continent.