InflatiON, inflatiOFF: 2024 outlook

This article sets out CaixaBank Research’s new forecasts for inflation in Spain in 2024 and 2025.

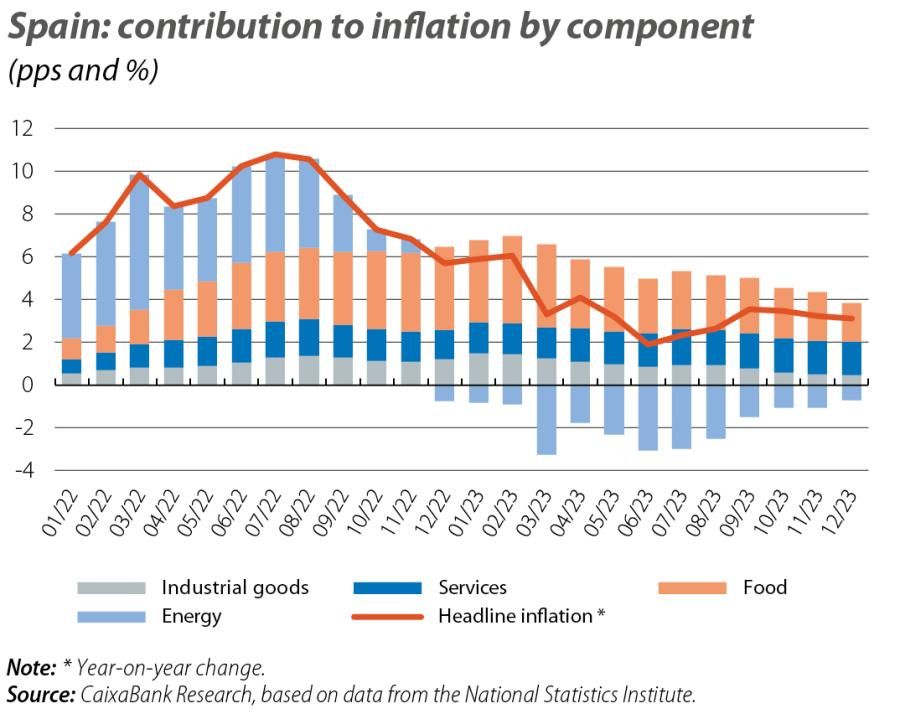

For several months now, the Spanish economy has been immersed in a process of moderating inflationary pressures. After reaching peaks in mid-2022 not seen since the 1980s, by the end of 2023 inflation had fallen to 3.1%. This correction was largely due to the fading of the energy shock exacerbated by the war in Ukraine. In fact, as we can see in the first chart, the energy component’s contribution to the CPI was negative in every month last year, largely thanks to the sharp fall in electricity prices.1 In contrast, in 2023 food was the component with the greatest impact on headline inflation, although its contribution dwindled during the course of the year, followed by services.

- 1. In 2023, the price of the regulated PVPC tariff fell by an average of 48% compared to 2022.

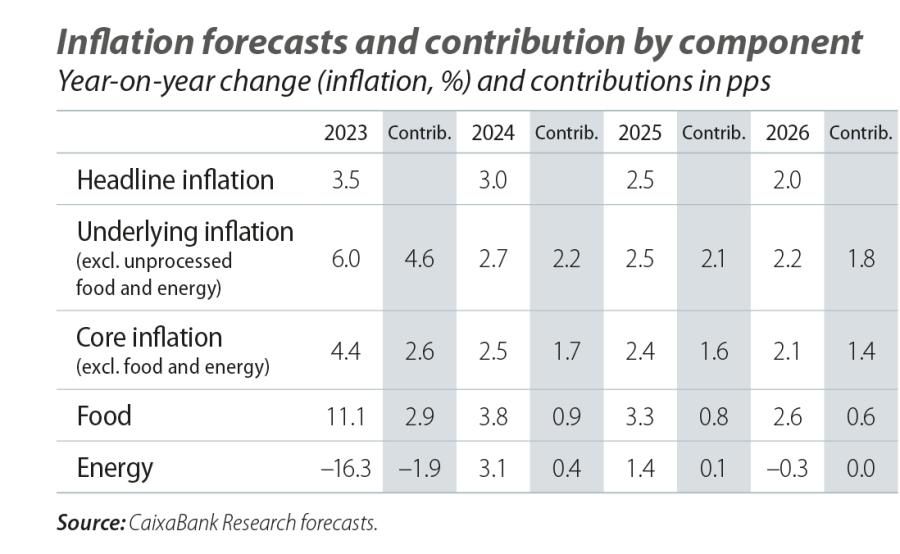

What dynamics do we expect to see in inflation over the coming months? The table shows our new forecasts, reflecting how we expect headline inflation to average around 3.0% this year, before steadily falling next year to fully converge with the 2.0% target on average in 2026.

The fact that core inflation (which excludes energy and food) lies below headline inflation in 2024 indicates that energy and food will be the components that will limit the decline in inflation.

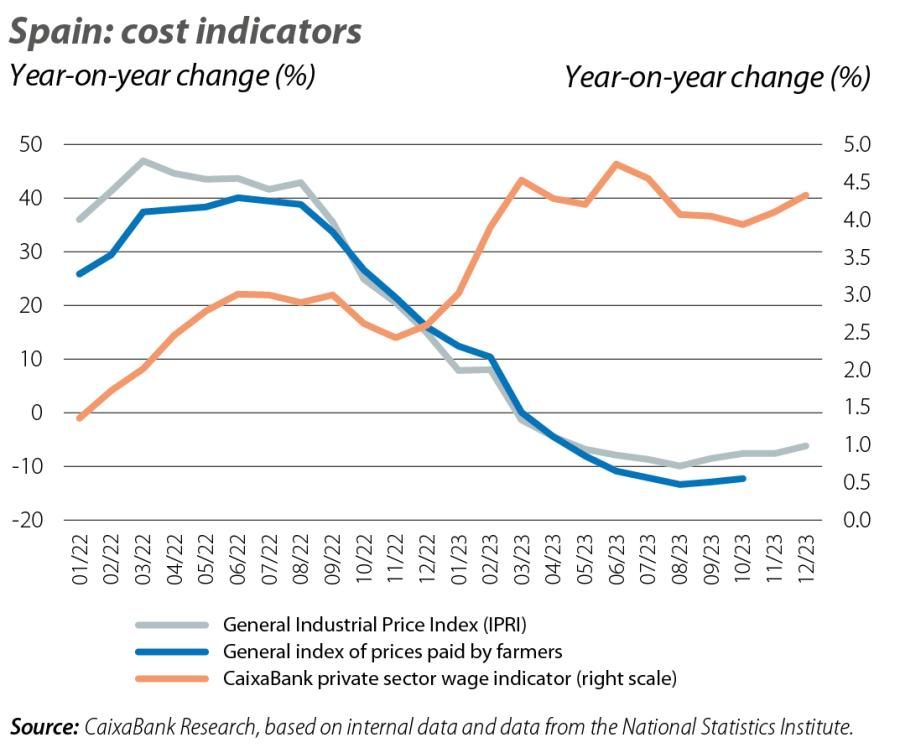

As far as food is concerned, we anticipate a marked decline in the inflation rates, from an annual average of 11.1% in 2023 to 3.8% in 2024. In part, this is the result of a base effect generated by last year’s sharp price increases, which drives inflation down.2 Furthermore, as we can see in the second chart, the agricultural cost data have been showing a negative year-on-year rate of change for several months now, and this should alleviate some of the pressure on food prices.3

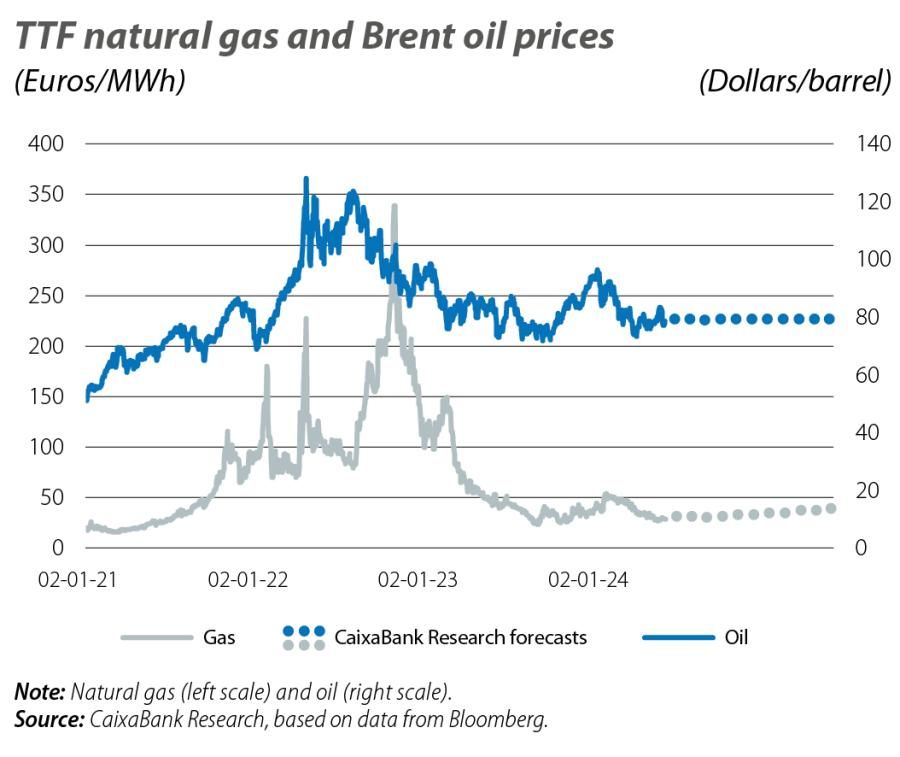

The energy component, meanwhile, already recorded a sharp correction last year and all the indicators suggest that energy prices will remain contained this year. Specifically, we expect the price of a barrel of Brent to average 79 dollars in 2024, 2 dollars below what we expected in our previous forecast scenario. In the case of natural gas, we expect the TTF price, which is the main European benchmark, to be around 30 euros/MWh. That is a whole 20 euros less than in the previous scenario. If these oil prices are maintained, the fuel component of the CPI would remain in negative territory for the second year. As for the electricity component of the CPI, we expect the favourable effect of low gas prices to be offset by the planned tax increases.

With regard to core inflation (which excludes energy and food), there are three factors that give us reason to be optimistic. Firstly, the sharp moderation of energy and food inflation rates since the peak of the energy crisis reduces the likelihood of price increases filtering through to core inflation. Secondly, the general industrial price indices published by the National Statistics Institute have been in negative territory for months now. Thirdly, according to the CaixaBank Wage Indicator, private sector wage growth has stabilised at around 4% year-on-year. The evolution of the latter two indicators (see second chart) suggests that the indirect effects of the increase in intermediate costs have already run their course and the likelihood of significant second-round effects appears to be limited.

In January 2024, the Spanish Congress validated a decree to extend the fiscal measures that had been implemented in 2022-2023 to mitigate the impact of inflation. This extension entails a more gradual with-drawal of the tax cuts applied to various products and therefore we expect it to have an upward impact on inflation.4

In the current context of disinflation, the withdrawal of these measures could lead to tiered price effects, that is, one-off price increases in the months in which tax rates are raised. In January 2024, we already saw a first upturn in inflation caused by the withdrawal of some of the fiscal measures. In particular, the CPI of electricity rose 9.6% year-on-year (26.9 pps more than in December). For the remainder of the year, this component will show relatively high inflation rates. Also, as prices in the wholesale electricity market have fallen faster than expected, VAT on electricity will rise to 21% in March. However, the tax rate could return to 10% in the following months, depending on the price in the wholesale market (until December 2024). Even so, our forecast is that gas prices will have dropped significantly by the end of 2025, so the energy CPI should stabilise below 2%. The other component affected by the fiscal measures is food. In this case, our forecast for 2024 is that there will be a temporary peak in inflation in June 2024, coinciding with the rise in VAT on essential products.

The gradual and partial withdrawal of the fiscal measures will allow the impact on inflation to be less pronounced and more tiered than if they had been withdrawn completely at the beginning of the year. In fact, we estimate that if the withdrawal of the package had occurred suddenly in January 2024, its upward contribution to average inflation this year would have been around 1 pp. Instead, with this more gradual withdrawal of the measures, we estimate that the impact on inflation in 2024 will be somewhat smaller, at 0.6 pps.

For 2025, we expect annual average inflation to be 2.5%, although by the end of that year we expect it to be approaching 2.0%. There are two factors that will limit the decline in inflation during 2025. Firstly, in services, the process of price moderation tends to be more drawn out, so its inflation will remain high throughout the year. On the other hand, the postponement of the restoration of ordinary tax rates means that part of the inflation associated with the withdrawal of these measures will be transferred to 2025. In an alternative scenario with all the measures withdrawn in January 2024, our estimates indicate that average inflation in 2025 would be 2.0%. Some geopolitical factors, such as the tensions in the Red Sea, could also pose upside risks due to the possible rise in energy commodity prices if the situation were to escalate.

- 4. In January 2024, the first increase in VAT on gas and electricity was already implemented, raising it from 5% to 10%. VAT on gas will return to its usual rate of 21% on 31 March, while VAT on electricity will return to 21% by 31 December at the latest (or earlier, temporarily, following any month in which the price of electricity lies below 45 euros/MWh in the wholesale market, as will occur this very month of March). Excise duty on electricity and the tax on the value of electricity production will gradually return to their usual rates of 5.11% and 7%, respectively, during the first half of 2024. VAT on essential foods will return to its usual rate from 30 June. The discount on public transport has been extended throughout 2024.