The Spanish economy, a good start to the year

The indicators made available in the first two months of the year show encouraging signs that suggest an improvement in the pace of economic growth in Q1. In the case of economic activity, they indicate a highly buoyant services sector, with thriving tourism activity, and an improvement in the weak tone that industry had been showing, all while job creation is even accelerating. Real estate activity, meanwhile, is cooling more gradually than expected and inflation is taking longer to moderate.

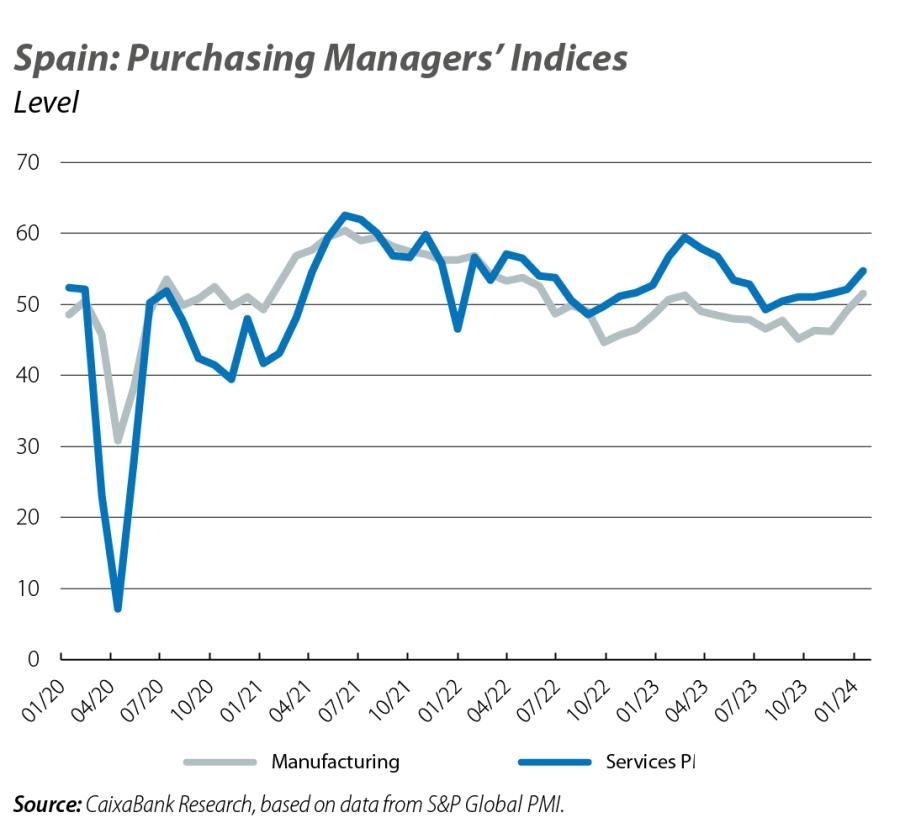

The signs are particularly encouraging in the industrial sector, which had been showing significant weakness. In particular, in February the Purchasing Managers’ Index (PMI) for the manufacturing sector increased by 2.3 points to 51.5, placing it in expansive territory (above 50 points) for the first time in 11 months, thanks to the increase in production and new orders in response to an improvement in demand, mainly from the domestic market. There were also encouraging developments in employment in the industrial sector, where the number of registered workers grew by 1.9% year-on-year in February. The PMI for the services sector, meanwhile, has consolidated its position in expansionary territory, standing at 54.7 points (previously 52.1), the best figure since May 2023. On the consumption side, the outlook for households is improving, and the consumer confidence indicator published by the European Commission stood at –17.4 points in February (–18.8 the previous month), the best figure in six months.

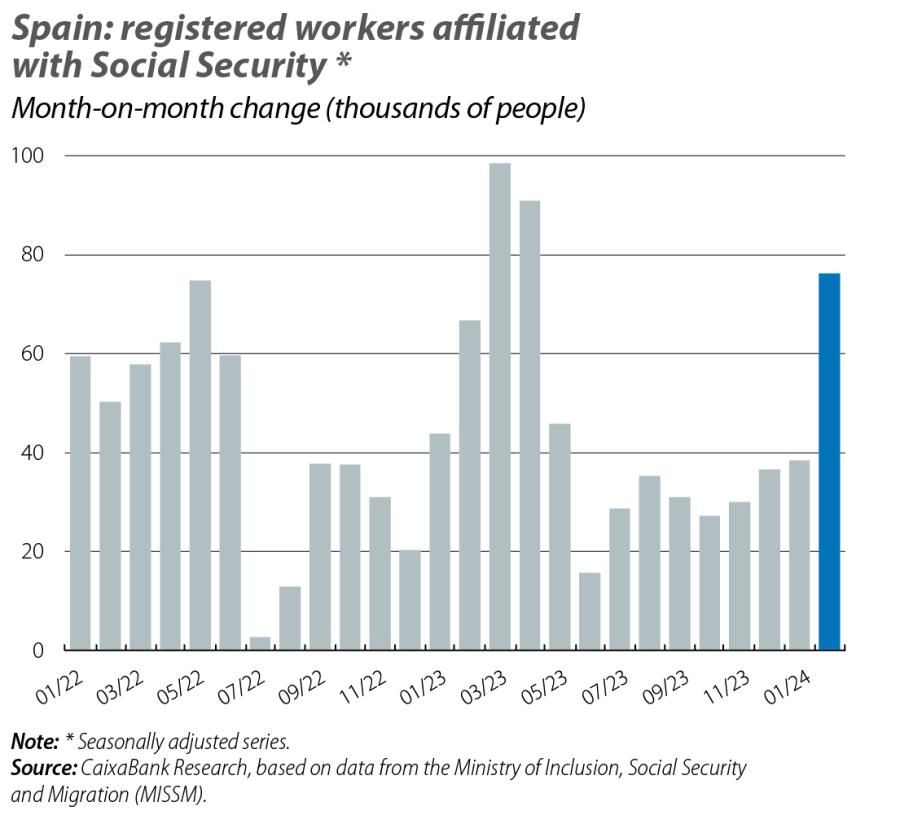

The average number of registered workers increased in February by 103,621 people. This was the best figure in a month of February since 2007 and comfortably surpassing that of last year (88,918) and the typical increase in this month (70,615 on average in the months of February during the period 2014-2019). Correcting for seasonality, employment shows a monthly increase of 73,492 registered workers. This is the biggest increase since April 2023 and places the average monthly growth so far in Q1 at 55,924 workers, a figure significantly higher than the average in Q4 2023 (31,248); the quarter-on-quarter growth rate of effective employment (seasonally-adjusted registered workers not on furlough) intensified to 0.5% (0.4% in the previous two quarters). In addition, there was a marked improvement in permanent hiring, causing the temporary employment rate to continue to fall to 12.7%, 20 pps less than in the previous month. As for registered unemployment, it fell by 7,452 people, a decrease which contrasts with the increase recorded in February last year (+2,618) and which exceeds the average decline in the months of February during the period 2014-2019 (–4,267).

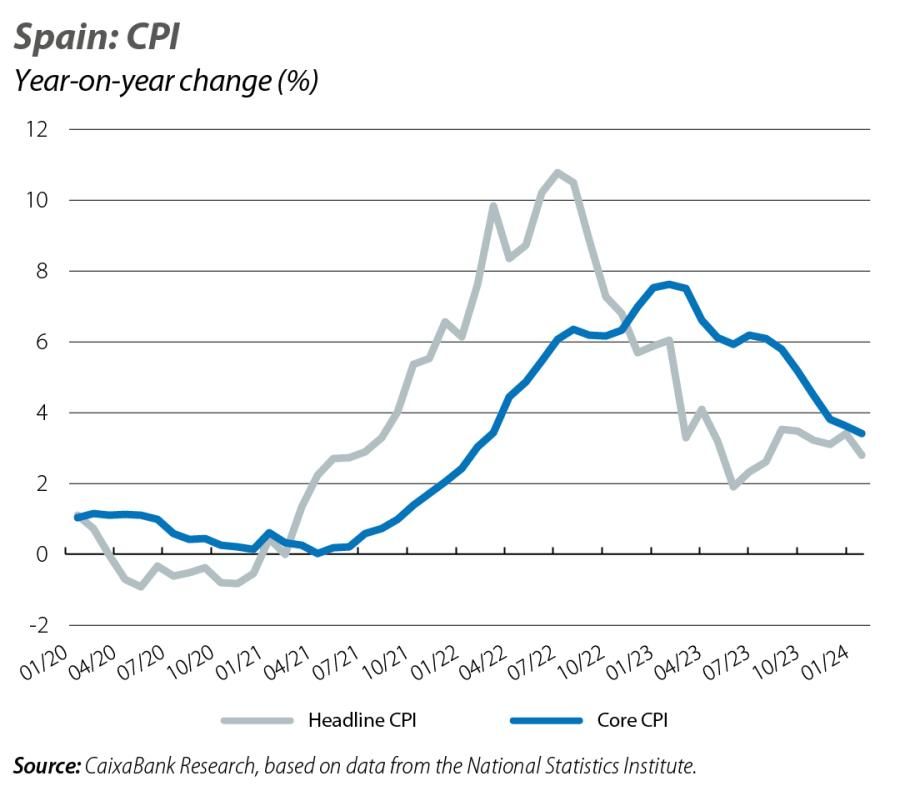

Following the one-off increase in the previous month, headline inflation fell in February according to the flash indicator published by the National Statistics Institute and stood at 2.8%, 60 pps less than in January and the lowest rate since August 2023. In the absence of the breakdown by component, the National Statistics Institute has indicated that this result is mainly driven by the decline in inflation of the non-core components: the stability of food prices – compared to the rise of a year ago – and the fall in electricity prices – partly offset by the rise in fuel prices. Core inflation (excluding energy products and unprocessed food) also continued to decline, albeit less rapidly than headline inflation, falling by 20 pps to 3.4%; we need to look back to March 2022 to find a lower rate.

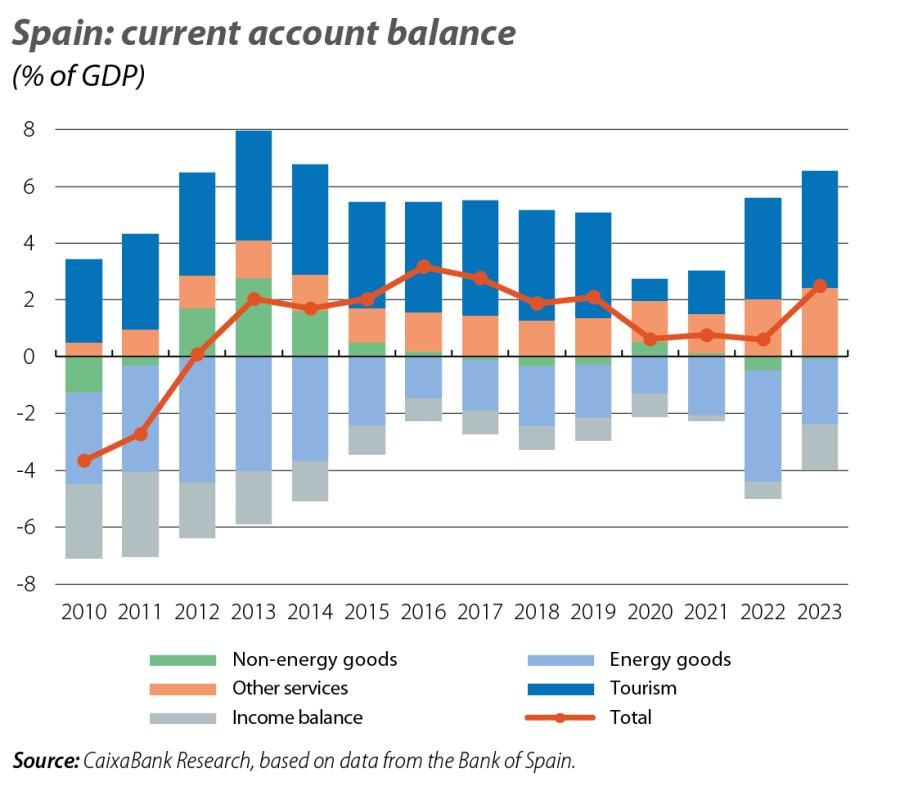

The current account balance ended 2023 with a surplus of 2.5% of GDP, which is 1.9 points more than last year and represents the best result since 2017. With the exception of the income balance, affected by the rise in interest rates, all the other sub-balances contributed to the improvement of the foreign trade balance. On the one hand, the trade deficit of goods fell sharply to 2.4% of GDP (–4.4% in 2022) thanks to the correction of the energy deficit (–2.3% vs. –3.9%), in a context marked by rapid price declines and, to a lesser extent, a reduction in the deficit of non-energy goods (–0.1% vs. –0.5% in 2022), given the fall in imports. In turn, the balance of trade in services recorded historic surpluses, for both non-tourism services (2.4% of GDP vs. 2% previously) and tourism services (4.1% vs. 3.6% in 2022).

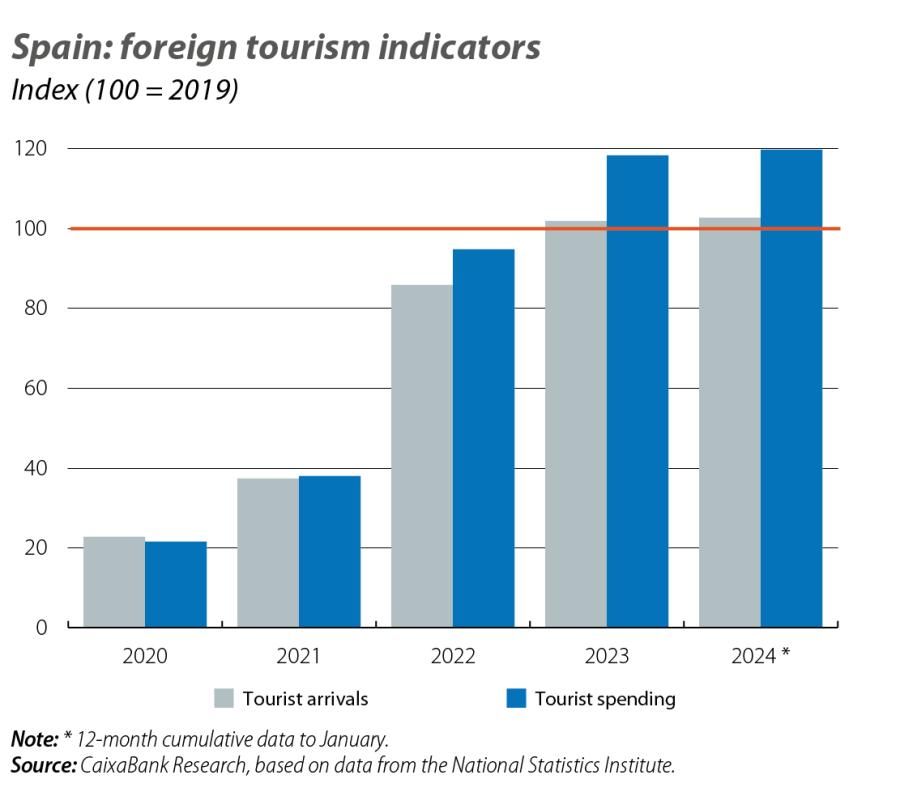

In the case of tourism, following the record results of 2023, with almost 85.2 million international tourists who spent over 108 billion euros, the latest data confirm that tourism activity remains buoyant, even in the low season: in January, the number of foreign tourists arriving in our country reached 4.77 million, representing a 15.3% year-on-year increase and up 13.6% compared to January 2019. CaixaBank’s consumption indicator, meanwhile, showed an increase in foreign bank card activity of 22.6% year-on-year in the first two months of the year, compared to 18.5% in Q4 2023.

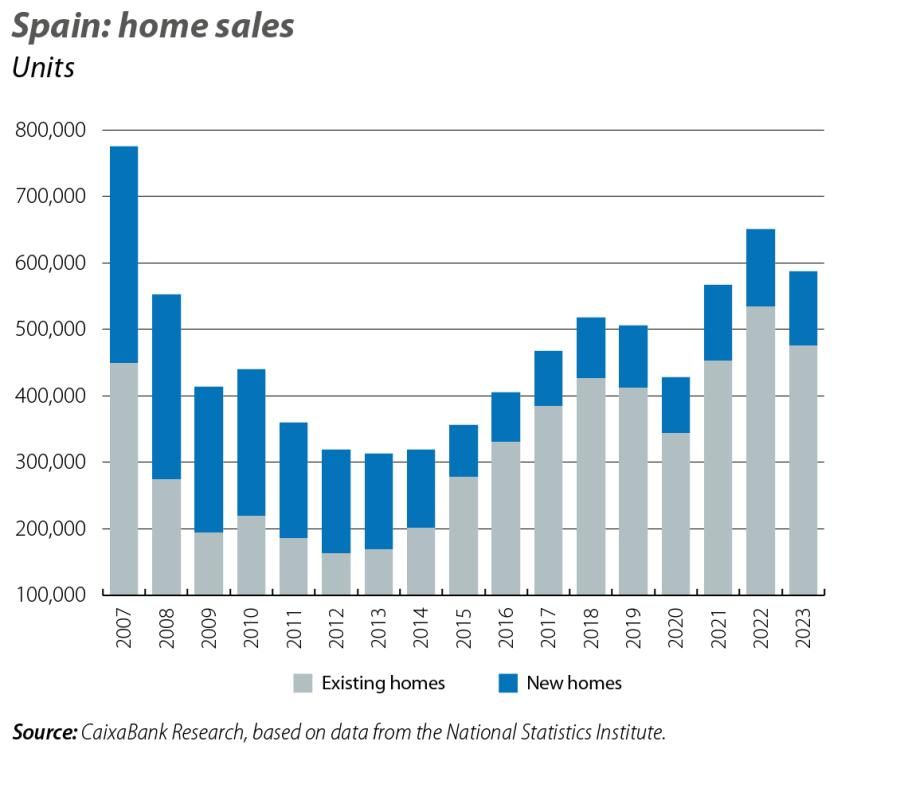

Last year saw the completion of 587,000 sale transactions, making it the second best year since 2007, albeit 9.7% below the exceptional figure for 2022 (650,265 sales). In fact, the cooling of demand has been less pronounced than had been anticipated at the start of the year, thanks to sales of new homes holding up well (–4.8% annual change compared to –10.8% in the case of existing homes) as well as purchases by foreigners, which now account for 15% of all transactions compared to 13% in the pre-pandemic period 2015-2019. In view of this trend in demand, the pace of growth in home prices has once again intensified: the year-on-year rate of change in home appraisal valuations accelerated in Q4 2023 to 5.3% from the previous 4.2%.