The global economy remains firm

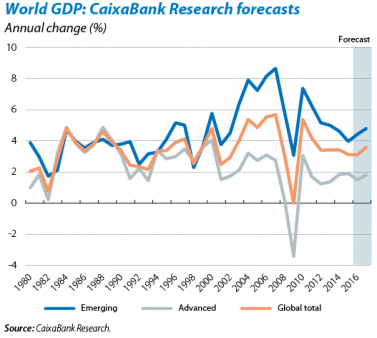

Growth in 2016 will be similar to the figure in 2015. Although the forecast for the medium-term rate has not essentially changed (in other words, the world economy will speed up in 2017 and 2018), the short-term trend is slightly more contained than predicted. This is fundamentally a reflection of a slightly weaker trend than expected in the US economy. Nonetheless it should be noted that part of this relatively less dynamism in the US will be offset by the better performance of European economies while the group of the emerging economies is tending to recover gradually, although commodity exporters are being penalised by a more adverse price scenario than initially expected (and, in some cases, shocks of political uncertainty).

UNITED STATES

A somewhat less expansionary end to the year. As indicators are announced for 2016 Q3 it can be seen that the dynamism of the US economy is somewhat less than expected. However, these figures do not detract from the view that the third and fourth quarter will see better quarter-on-quarter growth in GDP than the figure for the first half of the year, even though the rate of acceleration will not be as much as expected. As a consequence, CaixaBank Research’s forecast for 2016 has been changed from 1.7% to 1.5% and the one for 2017 from 2.2% to 2.1%, while in 2018 growth will be 2.0%. With regard to the longer term view, CaixaBank Research predicts that growth will remain slightly above 2% annually.

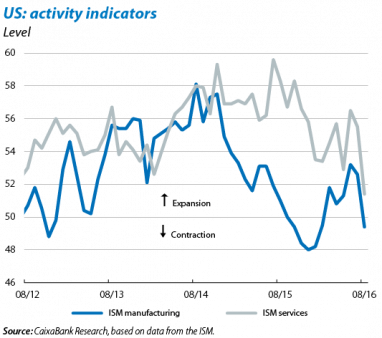

Industrial activity and services are the weaker areas in the economic outlook. Indicators for manufacturing and the tertiary sector point clearly to the more subdued tone of the US business cycle stage. In August the ISM indicator for manufacturing fell below 50 points, which would indicate a contraction in activity. However, for the quarter as a whole this indicator is offset by the figures posted in June and July, which were slightly better. A similar conclusion can be drawn from the trend in the ISM indicator for services: a drop in August (although in this case it is still above the 50-point threshold) which is offset by dynamic figures in the preceding two months. For its part the real estate sector, although continuing to advance, has also looked less vigorous than expected, apparently confirmed by the fact that, in August, only 0.9% more residential properties were started than one year earlier.

The bastion of the economy, private consumption, is holding firm. Nonetheless we should contrast this affirmation of a temporary deterioration with evidence that the mainstay of the US economy, namely private consumption, continues to appear solid. The consumer confidence index produced by the Conference Board stood at 101.1 points in August, its best figure in almost one year and clearly above its historical average (90.3).

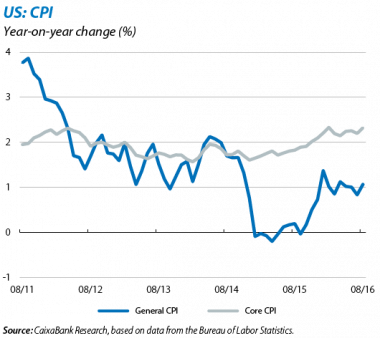

The Federal Reserve (Fed), closer to a second hike. Does this temporary adjustment in the rate of activity mean the Fed is likely to delay its monetary normalisation once again? In our opinion the upward outlook for inflation and the good tone of the US labour market justify the Fed making a move at the end of the year, a decision that has become more likely after its meeting of 21 September. At this meeting the Fed provided economic agents with information that points more explicitly to another hike in the federal funds rate at the end of this year. In short, according to CaixaBank Research forecasts 2016 the Fed will more than likely raise the benchmark rate by 25 bps in December, a movement that will open the door to a more continued, albeit gradual process of interest rate hikes in 2017 and 2018 (75 bps in each of these years).

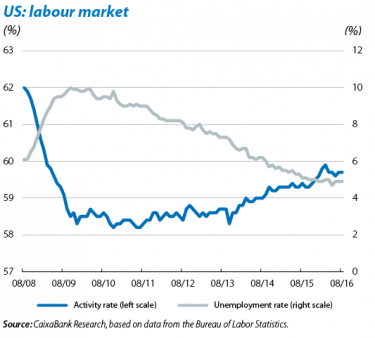

On the brink of an appreciable rise in inflation. In August inflation stood at 1.1% year-on-year, 0.3 pps above the previous month’s figure. A notable rise in inflation is expected over the coming months and, if forecasts are accurate, this will reach 2.3% year-on-year by March 2017. Core inflation was 0.1 pp above the previous month’s figure, at 2.3%. The labour market continues to look strong. 155,000 jobs were created in August, a significant number and even more so if we take into account the upward revision of July’s figure (to 275,000). Unemployment remained at a low 4.9% and wages continued to rise appreciably (2.4% year-on-year).

JAPAN

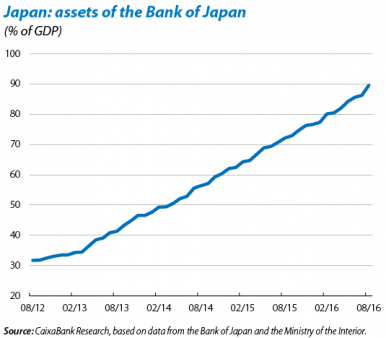

Has monetary policy reached its limit? The revised figure for GDP in 2016 Q2 has placed growth at 0.2% quarter-on-quarter compared with 0.05% in the first estimate. Nonetheless the fragile data for activity and persistent deflation (August’s CPI without food, the benchmark for the Bank of Japan, fell by 0.5% year-on-year) reaffirm the fact that Japan’s nominal growth is by no means reviving. Given this situation the Bank of Japan has opted for a relatively minor modification of its monetary policy. Far from focusing on more ambitious targets of a general nature, the institution realises that the financial sector’s profitability is being damaged by a negative and very flat yield curve. It therefore announced that it will readjust bond purchases to make the yield curve sharper and ease pressure on the financial sector.

EMERGING ECONOMIES AND COMMODITIES

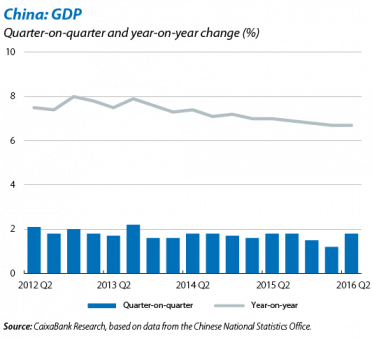

Asia continues to be the positive face of the emerging economies. China’s activity data for August were slightly lower than those of June and July, confirming the credibility of the scenario of a soft landing predicted by CaixaBank Research. Nonetheless there are still some sources of risk over the medium to long term, in particular the trend in the accumulation of private debt and doubts regarding part of its sustainability (see the Focus «China’s corporate debt: a reason for concern?» in this Monthly Report). India’s prospects are even better and the country looks like growing by more than 7% in 2016 and 2017 thanks to strong advances in consumption, both public and private. The first decisions made by the new governor of the central bank, Urjit Patel, should also be judged as positive, inaugurating his new role with an extension of the mechanisms to improve the banking system.

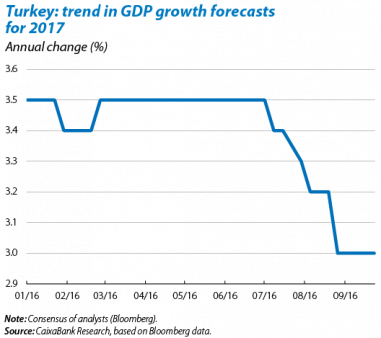

Turkey is accelerating but the outlook is not encouraging. In 2016 Q2 GDP grew by 3.1% year-on-year (0.3% quarter-on-quarter) compared with 4.7% year-on-year previously and far from the 5.7% achieved in 2015 Q4, although this slowdown was offset by the strong drive from public consumption (up by 15.9% year-on-year in Q2). In the short term the combination of domestic momentum (particularly boosted by public expenditure) and accommodative international financial conditions suggests the economy will remain relatively vigorous for the rest of 2016. Nonetheless the outlook becomes more negative for 2017. The international financial environment will presumably be more adverse from the time the US Fed tightens up its monetary policy, at the same time as growth in public consumption is likely to be more subdued. If we also add the country’s continued political uncertainty (in fact, the main reasons why Moody’s has downgraded Turkey’s sovereign debt rating to below investment grade are of an institutional nature), then doubts increase even further.

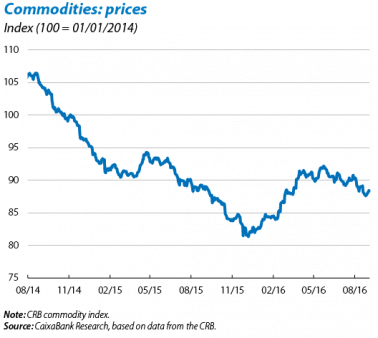

Commodities: a change in scenario for oil. In September commodities tended to fluctuate without any definite trend so the CRB indicator, representative of commodities as a whole, ended the month at an almost identical level to the start of the year. Although this is the overall situation, of note was the downward trend in agricultural commodities. Nonetheless the star of the month has been oil. On 28 September, and after several unsuccessful attempts, OPEC proposed an adjustment in oil production that seems realistic: a reduction in production of around 700,000 barrels a day in 2017, leaving Iran, Nigeria and Libya out of the extraction limit. In response to this agreement, Brent quality oil went from 46 to 49 dollars per barrel, a trend that reaffirms the CaixaBank Research scenario of a recovery in the price of oil for the remainder of the year. However, large stocks, the resistance of shale and the expected deceleration in the growth in demand suggest that, in the medium term, this recovery will be slower than predicted.