Calm amid the political uncertainty

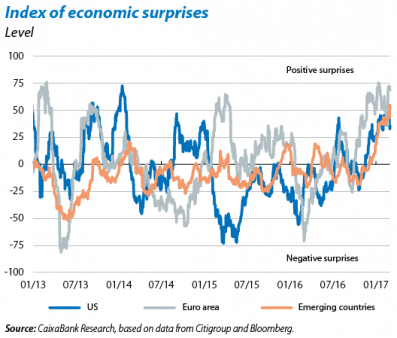

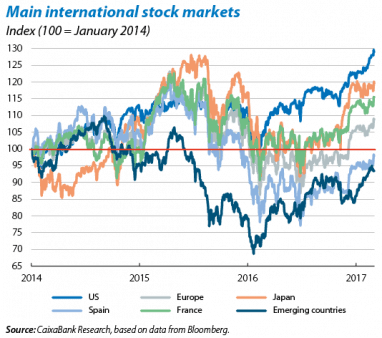

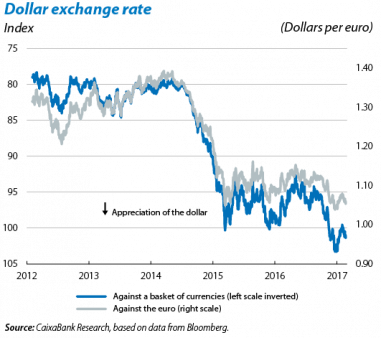

International markets performed well in February. The risk-on mood and low volatility witnessed since the US elections continued, albeit with some hiccups. In general, risky assets (stock markets and corporate bonds) continued their upward path, risk-free interest rates looked stable and the dollar and commodities stood firm. The main reason for this pattern has not altered over the past three months and is partly due to expectations of renewed growth and inflation in the US thanks to Trump’s policies. But other factors have also come into play recently, such as positive economic indicators in key regions and the good corporate earnings season in the US. Given this situation, the performance of some assets has been superb. This is the case of US stocks, for instance, reaching all-time highs, as well as emerging shares and currencies.

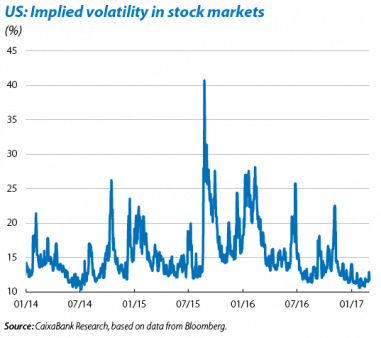

Paradoxically, the exuberance shown by some kinds of assets might well turn out to be a source of instability. The US stock market outdoes the rest in this respect. Signals of overbought conditions and technical indicators for the US stock market advise caution. Should the current stock market momentum not ease of its own accord and in an orderly fashion, then a substantial correction will be increasingly on the cards. The potential triggers are not clear but it is revealing that the main catalyst of this stock market rally is the anticipation of expansionary measures by the US government. The market seems to be betting more on the «pros» than the «cons» of Trump’s economic programme. If investors start to question the former and focus more on the latter, we may see a sharp adjustment in portfolios and notable disruption. This is illustrated by the divergence between the perceived levels of political uncertainty in the US and the implied volatility of its stock market (see the Focus «Caution, the US stock market reaches historic levels» in this Monthly Report).

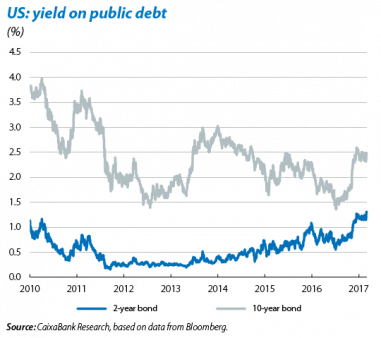

No clear trend in Treasury bills. Unlike the trend in equity, the performance of US sovereign debt has been rather up and down. The 10-year yield has fluctuated around 2.4% while the 2-year bill has remained close to 1.2%. Such calm in US Treasury bills is probably due to the absence of any concrete news regarding fiscal policy. In the short term, this lack of definition in government bond rates will be interrupted by modest decreases. Especially if the new US government delays in specifying its strategy for taxation and public spending. The long-term investor position on US government stock may also push yields down even further. Bearish positions (expecting bond yields to rise) on these assets by speculative investors have reached record levels. In any case, we still expect interest rates to rise over the medium term. Good activity data, a vigorous labour market and strong inflationary pressures endorse this view.

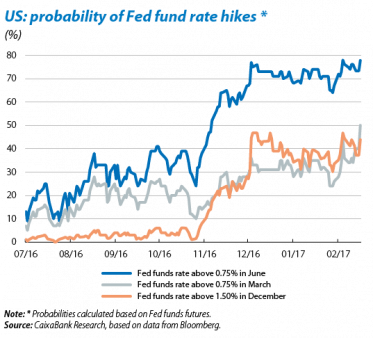

The Federal Reserve (Fed) repeats that it is ready to continue normalising interest rates. Although the monetary authority did not meet in February, recent statements by members of the Federal Open Market Committee (FOMC) have stressed that it would be better not to delay the hikes. Even the Fed Chair, J. Yellen, made a firm statement to this effect. The recent and expected macroeconomic trend suggests the Fed will follow its plan to carry out three Fed funds rate hikes this year. The current calm in the global financial environment, together with improved investor confidence, should encourage the Fed to implement its strategy. In fact, towards the end of February leading FOMC members stressed that the next rate hike would be «fairly soon». Markets have therefore advanced the date expected for this hike from May to March (with more than 50% probability). The market probability of the central bank carrying out three or more hikes in the Fed funds rate in 2017 has increased from 30% to 45%.

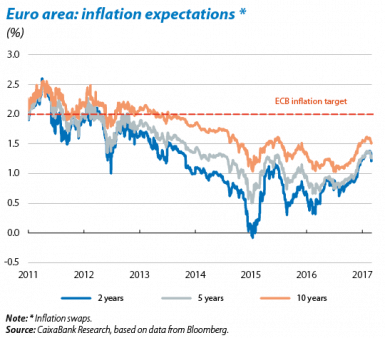

The ECB keeps to its stimulus policy in the euro area but investors are wondering how long this will last. Like the Fed, the ECB Governing Council (GC) did not meet in February either but statements made by GC members have been broadly in line with Draghi’s messages in January, albeit with some slight differences. They confirm the need to continue asset purchases, in calendar and form, to consolidate the recovery in core inflation which is still sluggish. But those who are most critical of prolonging unconventional measures have been spurred on by higher inflation and activity figures than expected. For the time being, money market expectations suggest investors are not so nervous as to accelerate the end of QE. But debate on this issue is likely to intensify over the coming months.

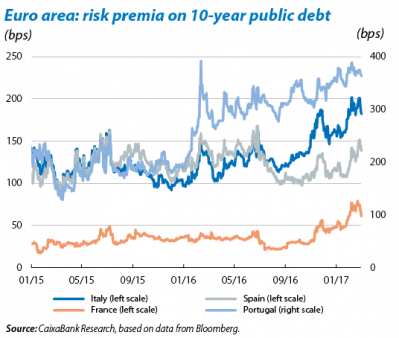

Political uncertainty hits European sovereign debt. In just a few months the overriding risks in the euro area have gone from macroeconomic (or financial) to political. Political uncertainty is still very high due to a host of reasons. Elections in the Netherlands and France and complex Brexit negotiations are the main sources of tension but they are not alone. In particular, investors have been concerned about a potential surprise in the French presidential elections. This has pushed up yields on the German bund and turned around periphery risk premia, as well as the risk premium on French debt rising. At around 75 bps, the level is no cause for alarm but has not been reached since 2012.

Equity picks up but with differences between regions and sectors. In addition to the key factors already mentioned behind the momentum in shares we should also note the recovery in corporate earnings and renewed search for yield. This upward trend has been particularly sharp in the US, where the four large indices (S&P 500, Dow Jones, Nasdaq and Russell) are at all-time highs. Regarding corporate earnings, profit growth in the US has been reasonably satisfactory (5% year-on-year) after the lacklustre previous quarters. The initial estimates for earnings in the technology and financial sectors are particularly good (around 10% in both cases). Stock market gains have also varied considerably between sectors, with information technology, financials and construction leading the charge. Euro area shares have once again lagged behind those of the US (2.1% compared with 5.5% this year so far), a pattern that has become standard over the past few years. However, the region’s profits are showing clear signs of recovery and, with just over half the companies having reported their earnings, year-on-year growth was 12% in 2016 Q4. This situation, together with the improved economic outlook for the euro area, contrasts with the poor performance of most European stock markets. The high political uncertainty in Europe seems to be having an effect on investor appetite for the Old Continent’s stock.

Emerging assets successfully handle the complex political panorama of the advanced bloc. As noted at the beginning of this article, emerging stock markets and currencies have reported solid gains. Emerging stocks grew by 5% overall in February. The J.P. Morgan index for emerging currencies appreciated 2.5% during the month, making up the dip occurring after the US elections. The bond market has followed the same pattern and sovereign and corporate risk premia have fallen. Good activity figures for the emerging economies, the gradually correction of imbalances (internal and external) and attractive share prices (in general) are helping to sustain this constructive trend. The perception of emerging risk has also been boosted by oil prices settling above 55 dollars per barrel. Nevertheless, risks are still high. Particularly the potential consequences on investor appetite of the Fed’s interest rate hike, especially if this ends up being faster than expected by the market. Mexico and Turkey are still the exception to this emerging boom, weak links due to various idiosyncratic features.