A closer look at the increase in Spanish household savings in 2023

The household savings rate has risen in Spain to even exceed the level reached during the pandemic thanks to the significant growth of disposable income. Where are these increased savings being allocated and what are the consequences?

The savings rate has risen to even exceed the level reached during the pandemic thanks to the significant growth of disposable income. Households’ saving capacity has increased significantly in 2023. Specifically, the savings rate rose to 11.7% of gross disposable income (GDI), well above the 7.6% recorded in 2022 and the historical average of 8.2% recorded between 2000 and 2019 (see first chart). This amounts to 108 billion euros in gross savings, which is 44.76 billion more than in 2022 and 59 billion more than the average in the period 2015-2019. In other words: in a context still marked by high inflation in 2023, households have managed to increase their savings buffer at the aggregate level – a remarkable feat.

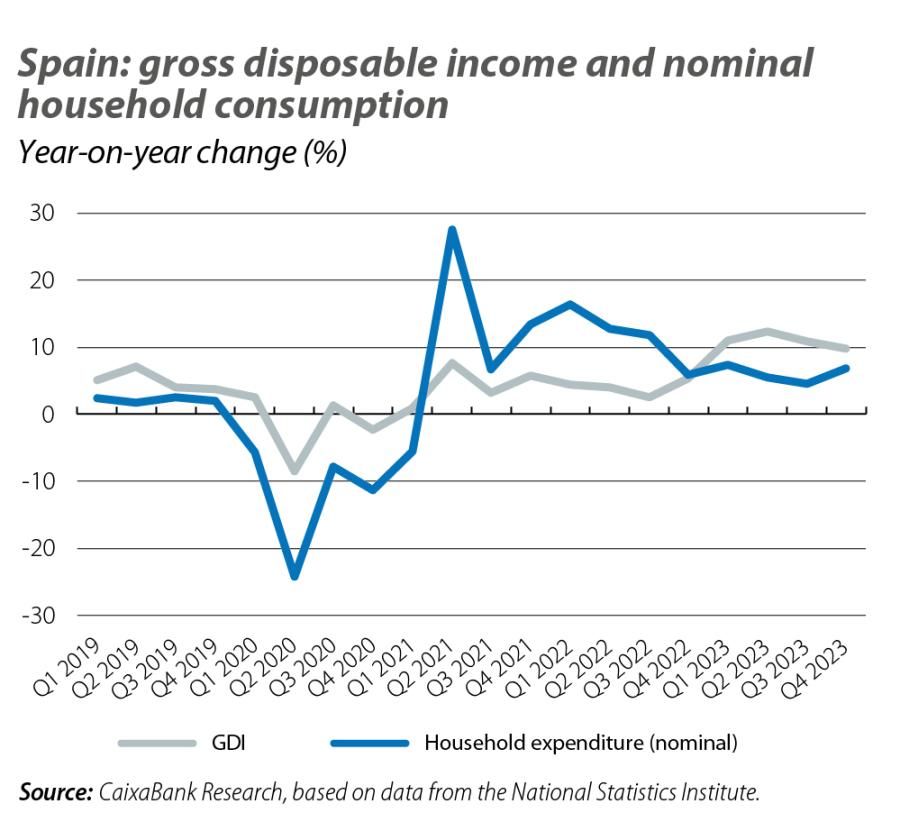

What is behind these figures that may surprise more than one reader? The increase in the savings rate was the result of an 11% year-on-year growth in GDI, which is the highest in the historical series and much higher than the growth in nominal consumption, which rose by 6.1% (see second chart). The increase in GDI was well above inflation (3.5%) and the strong growth in the number of households (1.4%), and this allowed the purchasing power that had been lost with the inflationary shock of 2022 to rapidly recover. Let us not forget that in 2022 GDI grew by 4.1% year-on-year, but inflation stood at 8.5%, and the number of households grew by 1.6%.

The buoyancy of GDI exceeded all expectations thanks to a significant 8.8% year-on-year growth in the remuneration of wage-earners, reflecting the intense job creation in 2023 – with a 3.4% increase in the number of wage earners – as well as the greater buoyancy of wages demonstrated by the 5.4% increase in the remuneration per worker. Other components of gross income which also contributed to the growth in household income included social benefits, which rose by +9.9% year- on-year, driven by the pension increase of 8.4%, self-employed workers’ income, as well as net property income thanks to the increase in the collection of dividends and other investment income. All this has more than offset the higher net interest payments, which rose to 16.6 billion euros, 5.2 billion higher than in 2022, as well as the negative contribution from direct taxes

and social security contributions (see third chart).

2023 was the first year in which real GDI per household has exceeded the pre-pandemic level; whereas in 2022 this variable still stood 4.4% below the 2019 level, in 2023 it was 1.5% above it, as shown in the fourth chart.

As for this year, GDI growth is expected to remain dynamic thanks to the strength of the labour market and the increase in pension incomes, which is expected to reach around 6% when taking into account the entry of new pensioners. In fact, a better-than-expected figure for the 2023 year end, combined with good labour market data in Q1 2024, suggest that GDI growth could reach around 6.0% this year. Thus, if household spending maintains a similar pace of growth to that of 2023, the savings rate would remain at similar levels to last year.

Households’ lending capacity increased significantly in 2023, going from 2.5 billion in 2022 to 42.361 billion in 2023. The reasons for this rally included increased savings coupled with stagnant investment on the part of households (see fifth chart): gross fixed capital formation, which includes the purchase of real estate (new builds) and self-employed workers’ investments in physical assets, was 59.8 billion euros in in 2023, just 800 million more than in 2022, in a context of higher interest rates.

In addition, households’ financial wealth continued to increase in 2023: their financial assets at the 2023 year end amounted to 2.83 trillion euros, compared to 2.67 trillion at the end of 2022. This increase of 159 billion is broken down into a net acquisition of financial assets of 39 billion euros, exceeding the average of 21.5 billion in the period 2015-2019 in which interest rates were very low, and a revaluation effect of 120 billion (see sixth chart). When we look at the breakdown of the net acquisition of assets, since late 2022 there has been a greater appetite for instruments that have increased their yield on the back of the rate hikes, such as Treasury bills and investment funds. In particular, households invested in debt securities – mostly public – amounting to 22.85 billion euros, and in equities and investment funds of 20.25 billion.

As for the structure of this wealth, it is still dominated by equities and investment funds, which accounted for 45.6% of the total, 2 points more than in the previous year (see seventh chart). These assets were followed

by bank deposits, accounting for 35.9% of the total, just over 2 points less than in the previous year but still higher than the average for the period 2015-2019, which was 34.4%. In contrast, the portion allocated to insurance policies and pension funds increased slightly compared to 2022, reaching 12.7% of the total, but it remains below the 2015-2019 average of 15.2%.

On the other hand, households continued to deleverage in 2023 and, at the end of the year households’ financial liabilities1 stood at 51.0% of GDP, compared to 56.7% in 2022. This is the lowest figure since Q1 2001 (see last chart). This decrease, in conjunction with the increase in nominal GDP, shows that in 2023 as a whole households made net repayments amounting to 8.5 billion on their liabilities, which contrasts with the net acquisition of liabilities of +39.7 billion in 2022 and +25.86 billion in 2021. In other words, in a context of higher interest rates, households have reduced their debt positions. Early repayments of mortgages in the face of the increase in rates have also contributed to this trend: in particular, the Bank of Spain2 estimates that, for the quintile of households with the highest incomes, early repayments in 2023 amounted to 5% of the balance of outstanding variable-rate mortgages.

Due to this sharp fall in financial liabilities as a percentage of GDP in 2023, there was a slight increase 0.9 points in households’ net financial wealth compared to 2022, reaching 142.8% of GDP; a ratio which significantly exceeds that recorded in 2019 in any case (136%).

In short, the strength of the labour market has allowed households’ GDI to rapidly grow in 2023. This growth, together with a more moderate pattern of expenditure, has significantly increased households’ lending capacity, and this has been used to acquire financial assets and to repay debts. In this way, households began 2024 with a stronger financial balance sheet, which should support economic activity growth during the course of the year.