Continuity in the advanced and ups and downs in the emerging

On the international scene, attention has returned to the emerging countries, some of which have once again come under considerable financial pressure. The prospect of US monetary policy normalisation and the consequent reduction in liquidity lies behind such fluctuations in the emerging economies. At the other end of the spectrum, the USA and Japan pushed forward without any significant news that would imply a change in our central scenario of gradual recovery and (moderate) soundness, respectively.

UNITED STATES

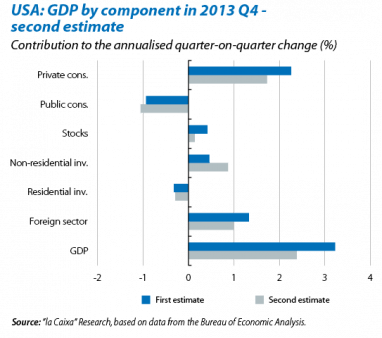

The slight downward revision in the GDP flash estimate

for 2013 Q4 is not worrying and the underlying trend is still one of recovery. In year-on-year terms, growth has gone from 2.7% to 2.5% (from 3.2% annualised quarter-on-quarter to 2.4%). This has not affected the overall calculation for the

year which remains at 1.9%, nor does it affect our forecast

for 2014 of 3.0%. By demand component, of note is the downward revision in the growth of private consumption, exports and stocks.

The approval of a further suspension of the debt ceiling

has eliminated one of the biggest risks for the US economy. The rapid negotiation and approval, by the two legislative chambers, to suspend the debt ceiling until March 2015 has provided the country with stability and allows for a gentler fiscal adjustment. In fact, more moderate fiscal consolidation has emerged as one of the points supporting the improvement forecast for 2014. Doubts remain, however, regarding the future path of investment (another element

that should underpin this progress, which has yet to show

its expected dynamism), and the problems resulting from

the tentative recovery of the labour market announced by Janet Yellen.

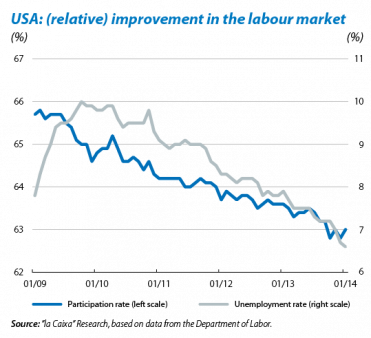

In the words of the Fed's new Chairman, the labour market is continuing its recovery although this process is far from «complete». In her first statement given before Congress, Janet Yellen confirmed her intention to continue Ben Bernanke's mandate, especially in terms of interest rates,

and stressed the incomplete recovery of the labour market (see the Focus: «Janet Yellen: expected continuity at the Fed?»). The fact is, while the unemployment rate has gone from 7.9% in January 2013 to 6.6%, the participation rate has hardly improved (58.6% in January 2013 compared with 58.8% currently), indicating that a significant proportion of the fall

in the unemployment rate has been due to an increase in

the number of discouraged workers. Moderate US inflation (1.6% year-on-year in January) continues to support the Fed's recipe of low interest rates.

The latest business indicators are still distorted by the region's adverse weather. Repeated cold fronts and snow storms this winter have made it difficult to interpret the economic indicators for the months of December and January. Particularly of note are the fall in the business sentiment

index for manufacturing (ISM), which went from 56.5 points

in December to 51.3 in January; and the month-on-month

fall of 0.4% in retail and consumer goods and 0.3% in the industrial production index (for the latter, this is the largest drop since 2009). The bad weather undoubtedly has played

a part in this poor performance but it is difficult to quantify

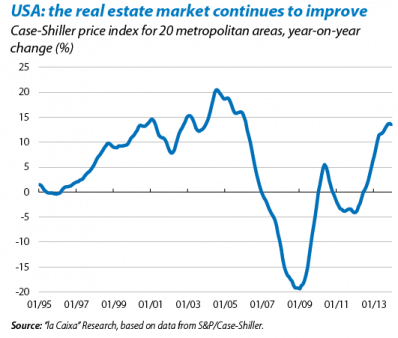

its extent. Surprisingly, the bad weather did not affect the ISM service index, which rose by one point in January to 54.0. The last figure posted for the year by the Case-Shiller house price index confirmed the good pulse of the real estate market (+13.4% year-on-year in December for the index covering

20 metropolitan areas).

JAPAN

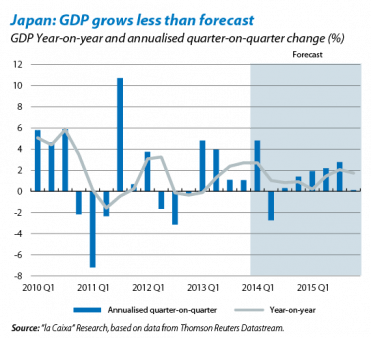

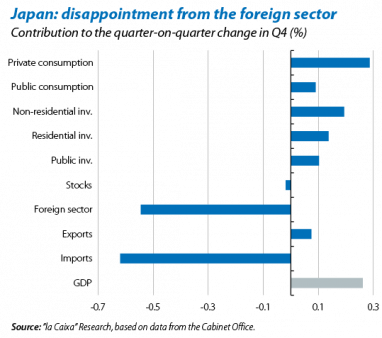

Japan's GDP came as a disappointment in 2013 Q4 due

to exports, although we believe this is only a temporary slump. Japan's GDP grew by a modest 0.3% quarter-on-quarter (2.7% year-on-year), below our forecasts and those

of the consensus of economists. This places the total for 2013 at 1.6% and forces us to slightly lower our forecast for 2014

(to 1.4%). A minimal revision (of 0.1 percentage points) as

we believe the country's consumption and investment to be solid. By demand component, the foreign sector (with exports slowing down and imports inflated by the energy bill) was the main culprit for the weak figures. On the other hand domestic demand (private consumption and investment) looked vigorous, although a large part of its improvement could

be attributed to consumption being brought forward before the VAT hike in April.

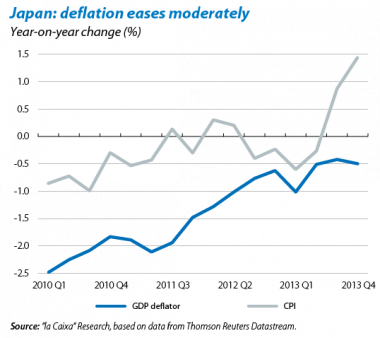

In the area of prices, deflation completely left the Japanese panorama but some qualifications must be made. The CPI rose by 1.4% year-on-year in January, far above 2013's figure of 0.4%. Core inflation (without energy or foods, the most volatile elements) grew by 0.6% year-on-year. Given this situation, it is essential to promote wage rises to achieve the Central Bank's inflation target of 2% , particularly in the basic wage, as this accounts for 80% of the total wages of all employees. To date, the upswing in November and December has been based on increases in overtime. The qualification with regards to prices lies in the GDP deflator, which measures the price level of all goods and services produced by the economy and is still in negative terrain in year-on-year terms (–0.5% in 2013 Q4).

EMERGING COUNTRIES

China has started the year with some signs of weakness but there is no cause for concern given the context of deliberate rebalancing, shifting from industry and investment to services and consumption. In China, few indicators have been published due to the celebrations of the Chinese New Year. The distortion in the figures caused every year by these festivities (which this year have fallen at the end of January and whose celebrations have lasted up to the second week of February)

is the reason why many indicators of a monthly nature are published in bi-monthly form for the whole of January and February. Nevertheless, the published indicators have shown a mixed panorama. Of note is the second consecutive drop in the PMI for manufacturing, both in its official and private versions (produced by Markit/HSBC). On the other hand, the foreign sector continued to perform well. In January exports grew by 10.6% year-on-year despite all forecasts and compared with 7.9% for 2013 as a whole. Imports also rose, up by 10.0%, higher than the 7.2% achieved in 2013.

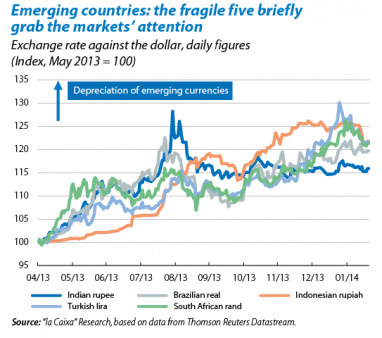

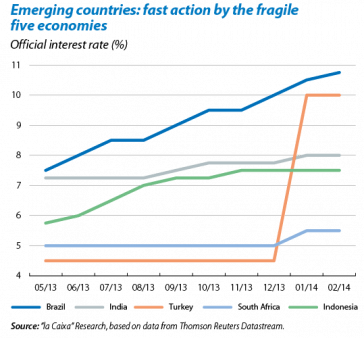

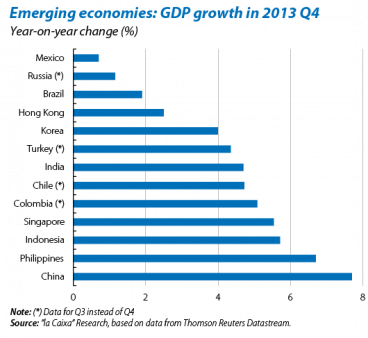

In other emerging countries the episode of financial tension that started mid-January has gradually retreated but the risk is still high. One notable aspect is that there has been no generalised contagion or any escalation in the crisis. Investors are discriminating between countries and the most severely punished coincide with those suffering the greatest stress in May-June 2013 (the «BIITS» or Brazil, India, Indonesia, Turkey and South Africa). These are countries that need to correct considerable macroeconomic imbalances (both internal and external). Also of note is the decisive and resounding action taken by the central banks of the respective countries, helping to ease the pressure.

Given this situation, some of the data being published for the emerging economies are providing more clues as to their performance. A positive note has been struck by India's drop in inflation and improved current account deficit. The wholesale price index, the one followed by this country's Central Bank until last January, went from 7.5% year-on-year in November 2013 to 5.0% in January. Although this decrease is largely due to a momentary reduction in the food component, improvements in the monetary area should help anchor inflation. The country's Monetary Policy Committee has therefore recommended setting a single and explicit inflation target. On the last day of the month we also found out that this Asian country had grown by 4.7% year-on-year

in 2013 Q4, slightly below the 4.8% of the previous quarter. Although this is significant growth, it is still below its potential which we estimate to be in the area of 6%-6.5%. Meanwhile, Indonesia also improved its advance and, with 5.7% year-on-year growth in 2013 Q4, brought its total growth for the whole of the year at 5.8%, higher than our forecasts and those of the consensus of economists. In Latin America, Brazil grew by 1.9% year-on-year in 2013 Q4 (2.2% in Q3), in line with expectations. Overall, the trend in the latest indicators, the interest rate hike (up to 10.75% on 26 February) and the announcement of public spending cuts mean that we only expect growth of 2.0% for 2014 (2.3% in 2013). Mexico grew by 0.7% year-on-year in 2013 Q4, below the forecasts, with an annual rate of 1.1%. However the latest indicators published and the favourable outlook for the USA justify us keeping our 2014 forecast at 3.5%.