The euro area changes gear and speeds up

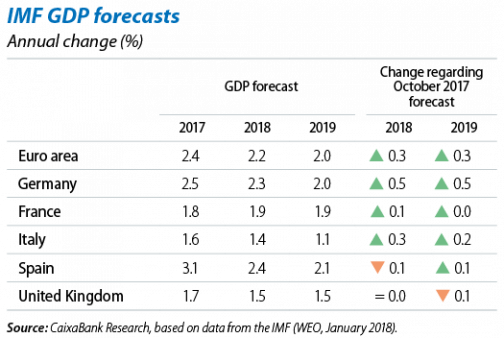

Good economic outlook for the new year. The growth rate for euro area countries as a whole is accelerating substantially. All factors are playing in its favour, both external and internal. One major external factor is the increased global growth momentum, which is also expected to continue for several quarters. On the domestic front, household consumption and investment are performing well, boosted by continuing accommodative financial conditions and the remarkable improvement in confidence regarding the euro area economy’s growth capacity. The IMF was equally optimistic in its forecast update for the euro area, once again revised upwards. The institution noted that the euro area’s recovery is very strong and conditions are right for growth to remain dynamic over the coming quarters.

Political events turn all eyes on Germany and Italy. The German economy continues to post strong GDP growth and all the evidence suggests this will continue throughout 2018 in spite of the country’s political impasse. In fact, if the pre-agreement reached by the CDU and SPD is approved and these two large parties repeat their Grand Coalition, the economy may benefit from a fiscal boost. The pre-agreement also includes notable measures to promote the European project, such as setting up a European Monetary Fund. The situation is quite different in Italy, however. Polls suggest the Italian parliament will probably still be highly fragmented after the general elections on 4 March and it is unlikely that any one party will secure a large enough majority to govern alone. Support is also likely to increase for populist parties. This combination of factors is therefore not conducive to carrying out the reforms needed by the country (for more details, see the Focus «Italy: piano piano non si va lontano» in this Monthly Report).

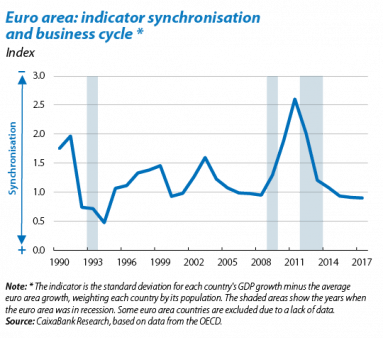

The euro area continues to enjoy solid economic growth in Q4 2017. Euro area GDP grew by 0.6% quarter-on-quarter (2.7% year-on-year) in the last quarter of the year. This rate is slightly higher than the CaixaBank Research forecast, in addition to the good rates posted in previous quarters. In fact, the euro area economy grew by 2.5% in 2017 as a whole, its fastest rate since 2007 and clearly above the 1.8% achieved in 2016. Across countries, the figures for Spain (0.7% quarter-on-quarter) and France (0.6%) have been published, both higher than expected. One of the most surprising elements of the recent trend in euro area country growth rates is the high degree of economic synchronisation. This makes the current expansion more robust and less vulnerable to idiosyncratic shocks that may occur in any given country.

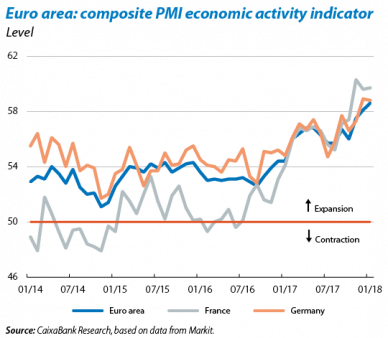

Optimistic start to the year for euro area sentiment indicators. The first indicators available for Q1 2018 point to business optimism continuing to rise. In January, the euro area composite business sentiment index (PMI) rose to 58.6 points (58.1 points in December), the highest since 2006 and comfortably in the expansionary zone (above 50 points). The euro area economic sentiment index (ESI) stood at 114.7 points in January, very close to the previous month’s figure which was the highest since 2001. Across countries, business sentiment continues to improve in Germany in spite of the political impasse: both the IFO business climate index and composite PMI improved on already very high levels. France’s optimism regarding the good economic environment and impact of Macron’s economic reforms are also reflected in the INSEE confidence index and composite PMI, both at very high levels. All this suggests the euro area’s good growth rate should continue in 2018.

Private consumption is still strong. November’s retail sales picked up again, growing by 2.8% year-on-year after October’s temporary slowdown. The European Commission’s confidence indicator also rose to 1.3 points in January, an all-time high. These data, together with the improved economic growth outlook and particularly the labour market, point to household consumption continuing to be one of the main supports for euro area economic growth.

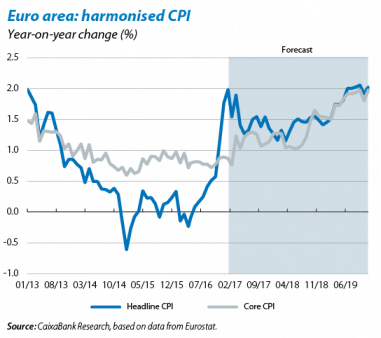

Inflation growth remains moderate in spite of the economic recovery. In January, inflation stood at 1.3%, 0.1 pp below December’s figure, due mainly to the smaller increase in the energy and unprocessed food components. Core inflation reached 1.2%, 0.1 pp higher than December’s figure. We expect inflation to rise gradually as economic growth consolidates. However, it will remain moderate in 2018 and below the ECB target (below but close to 2%). This is largely because several countries still have slack to increase their production capacity without pressurising wages (for more details, see the Focus «Inflation and its determinants: a measure of our ignorance » in this Monthly Report). The appreciation of the euro will also reduce inflationary pressure on imported products.

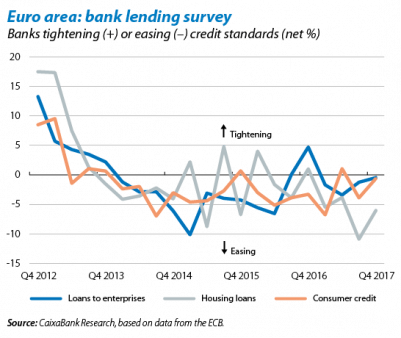

The increase in economic activity boosts credit. The ECB bank lending survey has noted that conditions are ripe for credit to continue growing. The survey shows that there was increasing demand across all loan categories in Q4 2017 and that, at the same time, conditions for new loans also improved. According to the survey, increased investment, the low general level of interest rates and greater confidence will drive demand. It also notes that households are taking advantage of easier credit standards for house purchase, driven by competitive pressure and a decline in risk perceptions.

PORTUGAL

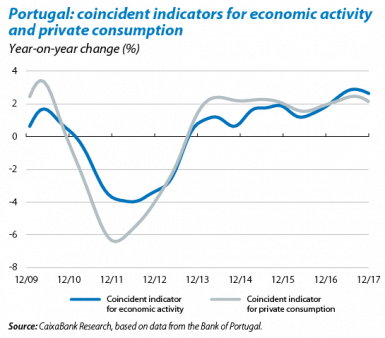

More balanced and sustainable economic growth. The latest economic indicators suggest Portugal’s economic growth rate may ease. Nevertheless, all the evidence points to growth remaining dynamic in 2018 and is very likely to be more balanced, supported both by domestic demand, especially investment, and also exports. There are many signs that the Portuguese economy is buoyant. For instance, the Bank of Portugal’s coincident indicator for economic activity and its private consumption indicator rose by 2.6% and 2.1% year-on-year in December respectively. These rates are slightly lower than in previous months but still high. December’s consumer confidence index also performed remarkably well, standing at 2.3 points, very close to the all-time high reached last July (2.5 points). Given these favourable conditions, Portugal’s sovereign risk premium fell in January to below 140 bp, also supported by Fitch’s upgrade of the country’s issuer default rating to investment grade (from BB+ to BBB). In addition to the favourable macroeconomic context, Fitch also justified its decision by the structural fiscal measures carried out over the past few years and improvements in the banking sector.

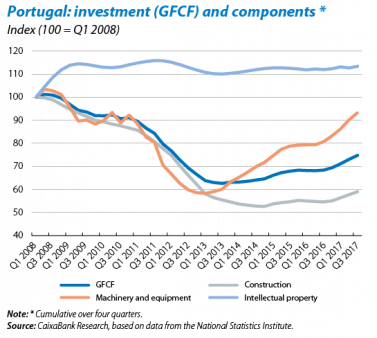

Investment comes to the fore in Portugal. Specifically, gross fixed capital formation grew year-on-year by 10.4% in 2017 (Q1-Q3 average), driven by higher growth in both capital goods investment (16.3% year-on-year) and also residential investment (9.6%). We expect this investment momentum to continue over the coming months, albeit at a more moderate rate. According to the National Statistics Office’s Investment Survey, Portuguese enterprises plan to grow their investment by 1.8 pp less in 2018 than in 2017. Public investment is also expected to pick up, boosted by larger European funds.

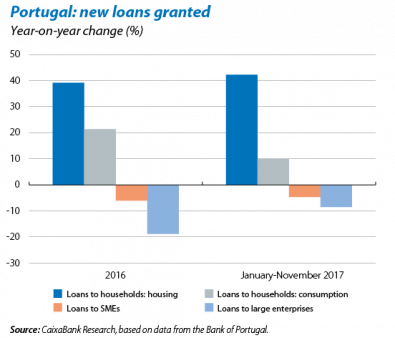

The economic recovery impacts credit, especially for households. The dynamic real estate sector is driving new credit for housing. In November, new housing loans rose by 42.2% year-on-year, cumulative for the year, totalling almost EUR 6.66 billion. This figure is higher than the total for 2016 but lower than the pre-crisis period. Consumer credit also increased (10.0% in the first 11 months of 2017). Loans for enterprises, however, fell by 3.7% for SMEs and 8.5% for large firms. Nevertheless, this decline is a smaller than the one observed during the same period the previous year and it is necessary step to complete corporate deleveraging.