The euro area begins 2017 with firmer growth

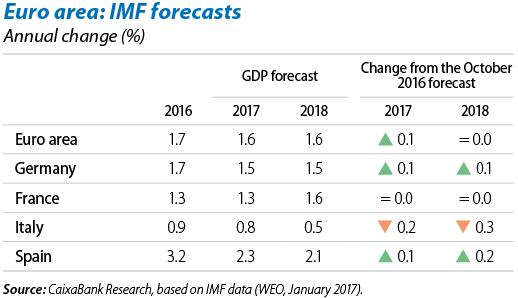

Outlook of a more solid recovery in spite of continuing risks. In 2017, the euro area’s economy will grow at a similar rate to 2016, supported by domestic demand. This can be seen in the IMF’s latest forecasts which point to 1.6% growth both in 2017 and 2018, figures similar to CaixaBank Research’s scenario (1.5% in 2017 and 1.6% in 2018). Although the forecasts indicate a slight slowdown compared with 2016, this is due to the dwindling of temporary factors that have been especially favourable over the last two years (low oil prices and the depreciation of the euro). Domestic demand will become increasingly solid, helped by underlying factors including the gradual recovery in the labour market and greater business confidence. Private consumption and investment will also continue to benefit from highly accommodative financial conditions as no change in the ECB’s monetary policy stance is expected until the end of the year. Nevertheless, in spite of this favourable outlook the euro area is facing high political uncertainty. Brexit negotiations with the UK will start at the end of 2017 Q1 and these are likely to be complex, in addition to a very full electoral agenda in the euro area (elections in the Netherlands, France, Germany and perhaps Italy).

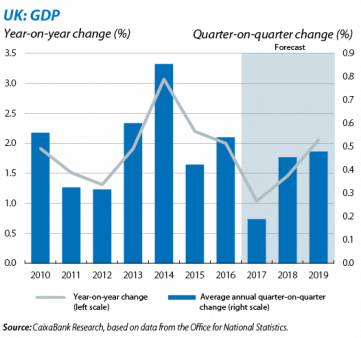

The UK’s GDP increased by 0.6% quarter-on-quarter in Q4 and ended the year with 2.0% growth. This solid activity has surprised the consensus of analysts, which expected a marked slowdown in the economy after the Brexit victory in last June’s referendum. Although the fast change in leadership of the British government and the expansionary policy implemented by the Bank of England have been crucial in reducing the impact on activity, the pound ended 2016 with a 14% depreciation against the euro and 16% against the dollar. This suggests that investor sentiment towards the UK has deteriorated and will also lead to a significant rise in inflation in 2017. The consequent loss of purchasing power, together with uncertainty surrounding the complex negotiations with the EU which will begin in 2017 Q2, could result in a less dynamic economy this year.

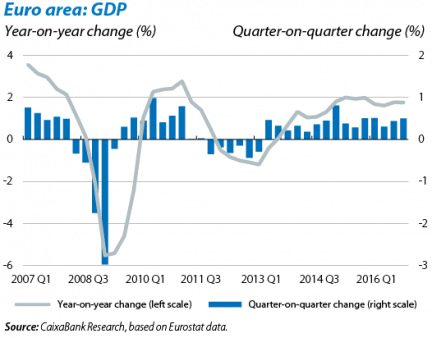

Slight acceleration in the euro area’s GDP in Q4, with 0.5% quarter-on-quarter growth and domestic demand driving the economy. The euro area therefore grew by 1.7% for the year as a whole, a reasonably good figure given the repeated episodes of financial instability and political uncertainty throughout 2016. Across countries, Spain’s figure was published (0.7% quarter-on-quarter) as well as France’s (0.4%). Although the French economy looked healthier in the second half of 2016, growth prospects for 2017 are still moderate (1.1% according to CaixaBank Research), so the extent of the reformist ambitions of the new President from the elections this spring will be vital.

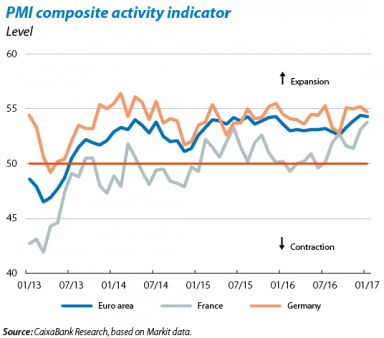

Business indicators point to a slight acceleration in growth in the euro area. The composite business sentiment index (PMI) for the euro area stood at 54.3 points in January, a similar figure to the previous month (54.4) and clearly in the expansionary zone (above 50 points). Across countries, France posted a particularly good figure (53.8), in addition to the improvement already seen in December. Indicators therefore continue to suggest a slightly higher growth rate for activity at the start of the year.

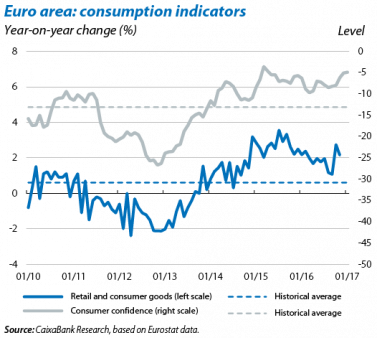

Consumption indicators reflect the good performance by domestic demand. Retail sales in the euro area grew by more than 2% in October (2.8%) and November (2.2%), the best figures for the year. The consumer confidence index also reached –4.9 points in January, its highest for the past 21 months. On the whole, indicators show that private consumption is still the engine of the recovery and this will continue in 2017 thanks partly to the boost provided by the ECB’s expansionary monetary policy.

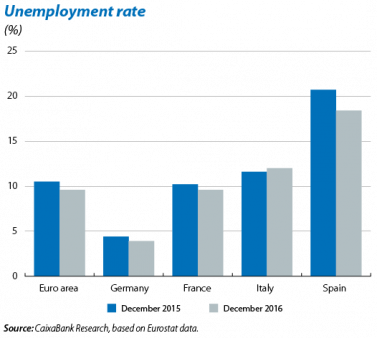

The improvement in activity is gradually spilling over to the labour market. The euro area’s unemployment rate ended the year at 9.6%, 0.9 pps below the figure for December 2015 and the lowest rate since 2009. This fall in unemployment was widespread across almost all euro area countries. The most notable exception was Italy where unemployment increased to 12.0%, 0.4 pps higher than the rate in December 2015. The labour market will continue its gradual recovery in 2017, helping to reinforce growth in domestic demand and activity in the euro area.

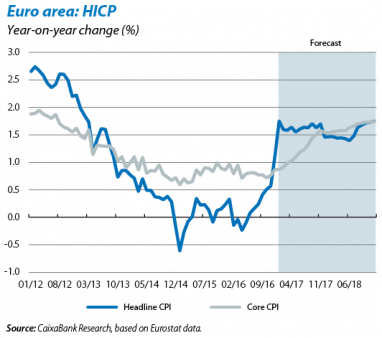

Inflation picks up as predicted. The euro area’s headline inflation, measured via the harmonised index of consumer prices (HICP), stood at 1.8% in January. The substantial recovery in headline inflation observed since June 2016 is mainly due to the correction of the base effect caused by falling oil prices in 2014 and 2015 and will continue over the coming months. The recovery in core inflation, indicative of medium-term inflationary trends, is more gradual (0.9% in January, the same as the previous month). We expect this gradual increase in core inflation to continue throughout 2017 thanks to an expanding economic activity and the improvement in the labour market. Specifically, headline and core inflation will reach values close to 1.5% by the end of the year. Although this is still not sufficiently close to the 2% target, with these figures the ECB will see signs of a sustained recovery in inflation, necessary to begin tapering its monetary policy throughout 2018.

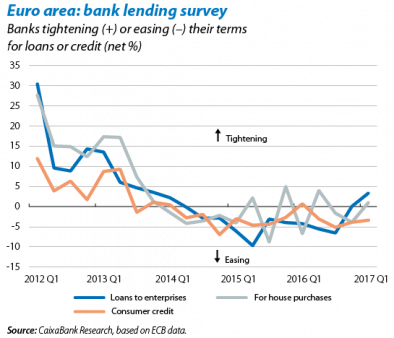

Financial conditions are still very favourable. With the ECB’s renewal of monetary stimulus at its December meeting (extending QE until December 2017 at a lower monthly rate of purchases), financial conditions will remain extraordinarily accommodative throughout 2017. Given this favourable monetary environment, demand for credit continued to rise in all segments in 2016 Q4, according to the bank lending survey of January 2017, and this trend is expected to continue in 2017 Q1. The survey also shows that households found it easier to obtain consumer loans. All this suggests that financial conditions will continue to support growth in domestic demand.

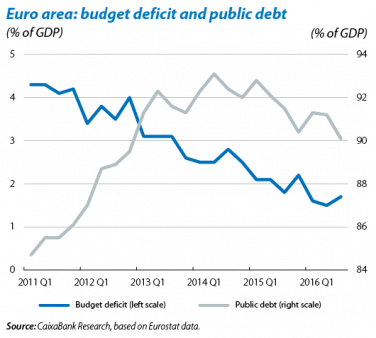

The level of public debt is still high and falling very slowly. In the euro area as a whole public debt stood at 90.1% of GDP in 2016 Q3, almost the same level as in 2015 Q3 (91.5% of GDP). However, this stability hides disparate patterns across countries. Public debt is falling more quickly in those countries which, in 2015, started from a lower level of debt, such as Germany (69.4% in 2016 Q3, –2.6 pps compared with 2015 Q3), Ireland (77.1% in 2016 Q3, –8.5 pps compared with 2015 Q3) and the Netherlands (61.9% in 2016 Q3, –4.3 pps compared with 2015 Q3). On the other hand, in countries with higher levels of debt (Belgium, Spain, France, Italy and Portugal), public debt has remained almost stable or has even increased. In a context where most stimulus measures are disproportionately biased towards monetary policy, those countries with fiscal space can take advantage to boost growth and balance their monetary and fiscal policies. However, it is important for countries with high levels of public debt to reduce this more decisively and approach more sustainable levels.