The fear of a recession taints the summer

The pessimism of the markets shakes the calm summer season. Far from a quiet summer, the intensification of trade and geopolitical tensions described on the following pages of this report resulted in concern in the financial markets over the global economic outlook and led to an increase in risk aversion. This episode ended with setbacks in the stock markets, an increase in risk premiums on poorer-quality corporate debt and a flight towards safe-haven assets. This, in turn, drove the main sovereign yields down even more and led to capital outflows from the emerging economies (the biggest since November 2016, according to data from the Institute of International Finance). In addition, the exchange of tariff threats between the US and China was accentuated by the depreciation of the renminbi, which crossed the 7 yuan per dollar threshold for the first time since 2008. In this context of concern, investors’ attention turned to the Fed and the ECB with the implicit expectation that they would adopt a broadly accommodative monetary policy over the coming quarters. Both return to the stage in September, when they will have to find a way to balance, on the one hand, the restlessness of prices in the financial markets and the intensification of uncertainty with, on the other hand, economic indicators which, despite having slowed down, do not seem to paint such a negative picture as that which shook the markets in summer.

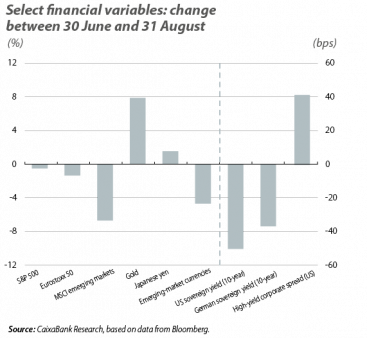

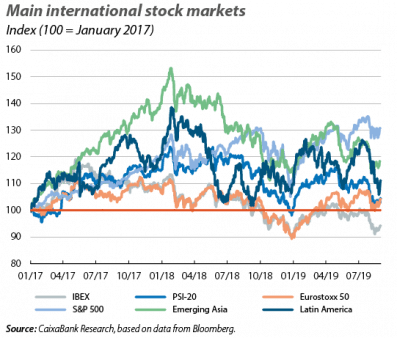

The stock markets suffer corrections but recover. The escalating trade tensions between the US and China shook international stock markets, and in the first week of August the main indices amassed losses of over 5% and registered the worst sessions of the year. This initial anxiety gave way to an erratic tone in the closing weeks of August, with a combination of recoveries (based on conciliatory statements) and renewed setbacks. This, coupled with the more placid performance in July, allowed the trading floors to moderate the losses over the course of July and August as a whole, both in the US (S&P 500 –0.5%) and in Europe (Eurostoxx 50 –1.4%, DAX –3.7%, CAC –1.1%, MIB +0.4%, Ibex –4.2% and PSI –4.9%). However, in both regions, market prices in the «cyclical» sectors (i.e. those that are more sensitive to the business cycle) were hit notably harder than in the «defensive» sectors (in which earnings growth is not so sensitive to the cycle), reflecting the doubts over growth generated by the trade tensions. The emerging economies, meanwhile, ended up with more marked setbacks (Emerging Asia and Latin America MSCI indices: –5.9% and –8.5%, respectively).

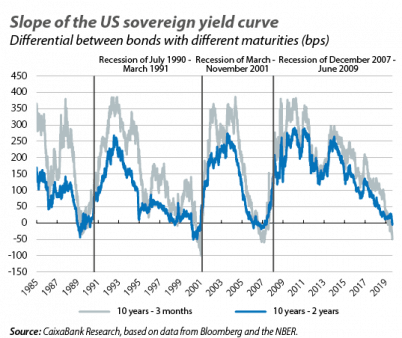

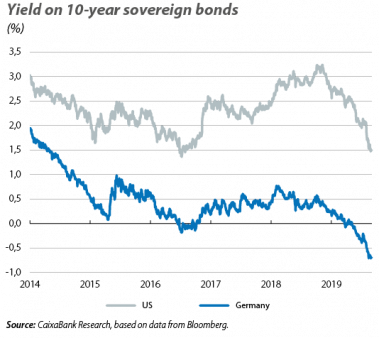

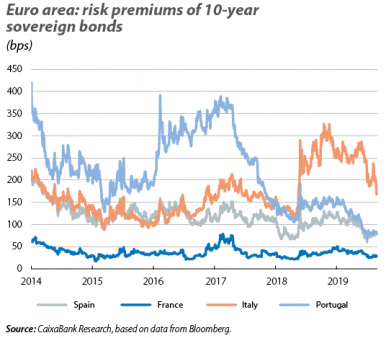

Fears of recession are concentrated in the fixed-income markets. Whereas stock prices remain relatively high (especially in the US) despite the corrections of the summer, sovereign yields reflect a bleaker outlook. While in the previous Monthly Report we pointed out that US and German rates had decreased to low points, during the course of the summer they have continued to decline (–51 and –37 bps, respectively) in view of the fear of a deterioration in the economy and the expectation of easier monetary policies. Furthermore, in the US the inversion of the yield curve was accentuated, with a 10-year sovereign debt yield lying some 50 and 5 bps below the 3-month and 2-year yields, respectively (which, historically, has been an indicator of the onset of a recession, as discussed in the note «On the inversion of the yield curve: a prelude to recession?» available at www.caixabankresearch.com). In Europe, meanwhile, risk premiums remained contained and the reduction in sovereign debt yields to new all-time lows was widespread among both the core countries (10-year yield of Germany: –0.70% and France: –0.40%) and those of the periphery (Spain: 0.11% and Portugal: 0.13%). In Italy, meanwhile, the risk premium fell significantly (–110 bps) at the prospect of a new coalition government that could be less belligerent towards Europe.

The Fed lowers rates and indicates fresh cuts. Although its last meeting (31 July) took place before the skirmish between the US and China that would trigger the turmoil of the summer, the Fed pre-emptively cut its reference interest rates by 25 bps (down to the 2.00%–2.25% range) in the face of a combination of contained inflation and the persistence of risks (it was the first cut in 10 years). Addressing the latest economic indicators, however, the Fed maintained a positive assessment and noted that, despite investment being hampered by uncertainty, private consumption continues to support growth thanks to the strength of the labour market. Probably because of this positive performance among the indicators, the decision to cut official rates was not taken unanimously and the chairpersons of the regional Feds of Kansas and Boston voted to keep them stable. Looking ahead to September, market expectations suggest with a 100% probability that the Fed will cut interest rates again.

The ECB prepares a new monetary stimulus package. In line with the accommodative shift of the Fed, in July the ECB paved the way to announce a monetary stimulus package in September. In particular, despite not altering official rates, it mentioned that it could lower them soon and explained that, faced with the persistence of risks and the weakness of the manufacturing sector, monetary policy needs to be comprehensively accommodative in order to support the recovery of inflation. In this respect, the ECB pointed towards other measures to complement the rate cut, such as shoring up the future orientation of interest rates (which would possibly mean postponing the indicative date for a first rate hike), resuming net purchases of assets and the possibility of mitigating the adverse effects that negative interest rates could have on the financial sector (for instance, with a tiered system in which different tranches of excess liquidity would be charged interest at different rates).

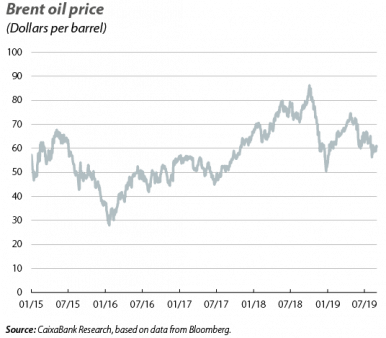

Commodities and emerging-economy currencies are hampered by the financial volatility. In another reflection of the markets’ fears of a marked deterioration in demand, over the summer most of the commodity indices (agricultural products, metals and energy) took a downward turn. In the specific case of oil, the price of a barrel of Brent fell by around 10% in July and August, despite OPEC and its partners having agreed at their meeting on 1 and 2 July to extend the oil production cut agreement until March 2020 (a cut of 1.2 million barrels per day compared to October 2018 production levels). On the other hand, practically all emerging-country currencies weakened against the dollar.