Production costs and drought are affecting Spain’s agrifood sector

The agrifood sector continues to suffer from the sharp rise in production costs and the impact of the drought. However, the decline in agricultural commodity and energy prices on international markets from the peaks reached in 2022 should help contain agricultural production costs and thereby moderate inflationary pressures on food. Nevertheless, the severe drought that has been affecting the Iberian Peninsula since last year has reduced the yields of a large number of crops such as cereals and fruits, impacting both prices (up) and the volume of exports (down). All in all, in value terms agrifood exports continued to grow at a good rate in S1 2023 due to the rise in prices, reflecting the high competitiveness of Spain’s agrifood sector despite the adverse conditions.

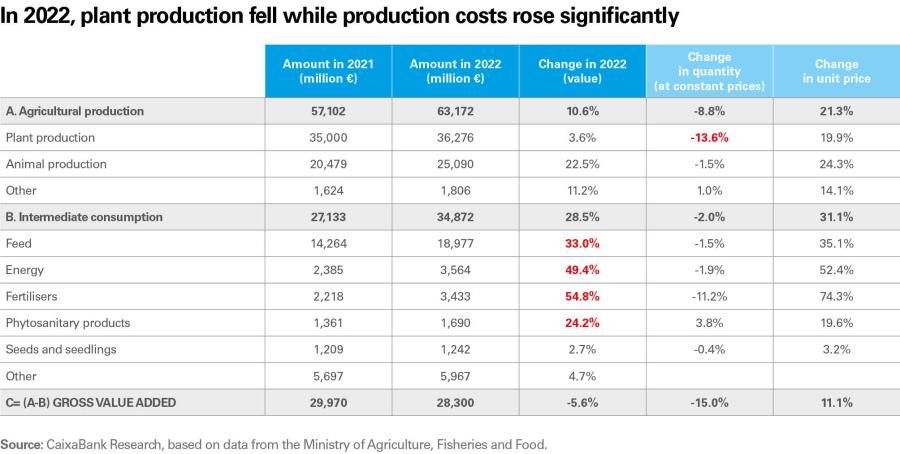

Spain’s agrifood sector is having a tough time due to the drought and the consequences of the sharp rise in production costs in 2021-2022, first as a result of the pandemic and then the war in Ukraine. Both factors significantly affected the primary sector’s gross value added (GVA) in 2022, which fell by 19.8% in real terms (–5.7% in nominal terms). GVA performed slightly better in S1 2023 with a decline of –4.7% year-on-year, thanks in part to the stabilisation of production costs. However, total GDP growth has been higher (3.2% year-on-year), resulting in the primary sector losing share in the economy as a whole: while it accounted for 3.0% of total GVA in 2021, it contributed just 2.5% in S1 2023%.

The agrifood sector is experiencing difficulties due to higher production costs and adverse weather conditions

The prolonged drought that affected much of the Iberian Peninsula in 20221 has continued so far in 2023.2 The persistent lack of rain in spring and warmer than normal temperatures have led to anomalous negative topsoil moisture rates and poor conditions for vegetation and crops in the midst of the growing season.3 As a result, crop yields, which were already severely down last season, are estimated to have fallen further this year.4

- 1. In hydrological terms, 2021-2022 was markedly dry with average precipitation of 478.5 mm in Spain as a whole, 25.3% below the normal value.

- 2. The rainfall in May and June 2023 was not enough to counteract the prolonged drought affecting 33.4% of the territory in June 2023. Likewise, the reserves of water for consumption fell to 30.6% of their capacity by mid-August (compared to 32.4% a year earlier and a 10-year average of 49.4%). See the «Boletín mensual de estadística» produced by Spain’s Ministry of Agriculture, Fisheries and Food (MAPA), July 2022.

- 3. Although it’s true that some areas are showing a recovery, the overall situation is still one of «alert».

- 4. The impact of drought on crop yields is evident, although it must be noted that other factors also affect agricultural production (use of fertilisers, increase in organic farming, new environmental requirements, etc.).

According to the Economic Accounts for Agriculture, plant production in Spain fell by 13.6% in 2022. Specifically, the drought led to lower yields in cereals (–24.3%), fruits (–20.7%), forage plants (–18.2%), industrial plants (–9.9%), vegetables (–7.5%) and potatoes (–7.0%). Only the production of wine and must (+1.4%) and olive oil (+6.4%) grew last year (2021-2022) although, as we’ll see in the next section, estimates for the 2022-2023 season point to a significant drop in the production of these products as well. However, the strength observed in plant prices (+19.9%) meant that their production grew in value (+3.6%). In contrast, animal production was less affected and posted a slight decline of 1.5% in 2022. In terms of value it grew considerably (+22.5%), thanks to higher prices (+24.3%).5

- 5. Despite a notable increase in the value of agricultural production in 2022 (10.6%), the sharp rise in intermediate costs (of 28.5%) reduced the sector’s GVA (–5.6%) and agricultural income (–6.2%).

In 2022, crop production fell by 13.6% in Spain, a much bigger drop than the one recorded in other European countries due to the greater severity of the drought. Animal production recorded a slight decrease of 1.5%

Compared with other European countries, the drop in crop production was much greater in Spain (13.6% compared with 4.6% in the EU as a whole). This is due to the greater difficulties faced by the Spanish agrifood sector because of the aforementioned adverse weather conditions and a somewhat sharper rise in production costs.6 These aspects, and their implications for the competitiveness of the agrifood sector, are analysed in detail in the article «The challenge for Spain’s agrifood sector of remaining competitive in the face of adverse conditions» in this Sector Report.

- 6. To help the sector cope with this drought, Royal Decree-Law 4/2023 was approved on 11 May, adopting urgent agricultural and water measures in response to the drought.

Estimates for the 2023 harvest are not encouraging. According to the preliminary figures for agricultural area and production (provisional, with May’s advanced figures)7, the production of winter cereals (wheat, barley, oats, rye and triticale, the hybrid cereal from a cross between wheat and rye) totals 9 million tonnes (Mt) in 2023, compared with 14.4 Mt in 2022 and 19.3 Mt in 2021. This implies a considerable drop in cereal yields, as can also be seen in the European Commission’s estimates.8 Specifically, the Commission puts Spanish wheat yields at 2.2 tonnes per hectare in 2023, down from 2.8 tonnes in 2022 and far from the average of 3.5 tonnes in the previous 5 years. As can be seen in the table below, barley and rye yields have suffered similar declines in Spain, in contrast to the better performance for the EU average.9

Summer crops, on the other hand, have been less affected by the ravages of climate change. According to the European Commission, sweet corn, almost all of which is irrigated, has not suffered heat stress during flowering and is in a good situation. On the other hand, olive oil production has suffered a significant drop from 1,489,351 tonnes of oil last year to 675,093 tonnes in the 2022-2023 season, representing a 55% decrease in yield, which would explain the notable rise in the price of olive oil observed recently.10

- 7. «Avance de superficies y producciones de cultivos» from Spain’s Ministry of Agriculture, Fisheries and Food, May 2023.

- 8. «Crop monitoring in Europe», JRC MARS Bulletin, vol. 31, no. 8, 21 August 2023.

- 9. For an analysis of the drought situation in Europe, see «Drought in Europe», JCR Technical Report, June 2023.

- 10. «Avance de la situación de mercado del sector de aceite de oliva, aceituna de mesa y aceite de orujo de oliva. Campaña 2022/2023», published by the Ministry of Agriculture, Fisheries and Food, August 2023.

Olive oil production has suffered a significant drop from 1,489,351 tonnes last year to 675,093 tonnes in the 2022-2023 season, a 55% decrease in production

As we have seen, apart from the drought, the second factor affecting the performance of Spain’s agrifood sector is production costs. This aspect is somewhat more favourable thanks to the significant drop in agricultural commodity and energy prices on international markets compared with last year’s record levels.

In fact, the World Bank’s food commodity price index has fallen by 31.5% between its peak in May 2022 and August 2023 (latest available data) and the drop in fertiliser prices has been even sharper (–46.4% since its peak in April 2022). With these reductions, the price hikes that followed Russia’s invasion of Ukraine have largely been reversed. However, prices are still well above the 2019 pre-pandemic average, especially fertilisers which are twice as expensive now as they were in 2019. Despite Russia’s announcement in early July that it would not extend the agreement for grain exports through the Black Sea, spot and futures market prices for agricultural commodities have remained relatively stable, even reporting a slight downward trend this summer. A combination of other factors, such as the slowdown in global economic activity, especially in China, the reorientation of international trade towards commodities from other producers and the publication of very positive world agricultural production forecasts for the 2023-2024 campaign by the United States Department of Agriculture (USDA) may have contributed to this trend).11

- 11. Specifically, the USDA expects world corn production to reach 1,213 million tonnes, up 5.3% from the previous year. Wheat will reach 793.4 million tonnes in the 2023-2024 season, up 0.4% from the previous season. See «World Agricultural Supply and Demand Estimates», USDA, August 2023.

Given the performance by agricultural commodity prices on international markets, the outlook for the trend in agricultural production costs is positive

The fall in agricultural commodity and energy prices on international markets is beginning to be felt in the prices paid by Spanish farmers. Specifically, agricultural input costs decreased by 11.2% between August 2022 (when they reached their peak) and May 2023 (latest available data). Nevertheless, costs are still approximately 35% higher than the 2019 average. Energy costs have fallen the most since their peak (–42.3%), followed by fertilisers (–25.7%).

However, the component that weighs most heavily in the cost structure for the primary sector is feed (54.4% of the total in 2022) and the decline in its price is still very limited (–6.6% from the November 2022 peak). Given that Spain imports approximately half the cereal destined for animal feed, the drop in cereal prices on international markets should help contain its bill for feeding livestock over the coming months.

On the supply side, the food industry is suffering from the pressure exerted by a substantial increase in the price of agricultural products (an essential input for its activity) and, on the other hand, from weak demand due to the sharp rise in food prices. As a result, food industry production fell by 1.8% year-on-year between January and July 2023 and is still 2.3% below its pre-pandemic level (2019 average). Beverage manufacturing also declined in the first seven months of 2023 (–1.7% year-on-year) but this is a correction after the strong recovery posted in 2022 with the post-pandemic reopening of the hospitality channel (hotels, restaurants and cafeterias), a positive trend that has continued this year thanks to the excellent tourist season. In fact, beverage production is now 7.0% above its pre-pandemic level.

The agrifood industry is feeling the effects of higher input prices and weaker demand

Moreover, producer prices have risen less in the beverage manufacturing industry than in the food industry. Specifically, the industrial price index in beverage manufacturing rose by 15.8% in the cumulative period between 2021 and July 2023 compared with 29.1% in the food industry.

The labour market is performing well in the agrifood industry: the number of people registered as employed with Social Security rose to 474,000 in August 2023, 2.1% more than a year ago. In contrast, the primary sector’s labour force has continued to shrink: registration fell by 1.7% year-on-year in August 2023 and the sector has 17,300 fewer workers than a year ago. These data reflect both the difficulties faced by the sector and the possible impact of the increase in the minimum wage on recruitment. In the agricultural sector, 46.9% of employees are on this new minimum wage, a much higher percentage than the 14.4% for the services sector, 7.5% in industry and 3.8% in construction.12

One very positive aspect worth highlighting is the sector’s reduction in temporary employment. In Q2 2023, 39.8% of the workers employed in agriculture were on a temporary contract, down by 13.8 percentage points compared with Q2 2021, before the labour reform came into force. However, this rate is still much higher than in the economy as a whole (14.7%), due to agriculture being highly seasonal.

- 12. See «El salario mínimo en 2023. Un paso más hacia el 60% del salario medio», Análisis y contextos (no. 51), February 2023, by the UGT Research Service (Servicio de Estudios).

One very positive aspect is the sector’s reduction in temporary employment. In Q2 2023, 39.8% of the workers employed in agriculture were on temporary contracts, 13.8 pp less than in Q2 2021

Rising costs in all links of the food chain, from the primary sector to the processing industry, including transportation and distribution, have been passed on to the food prices paid by end consumers. In August 2023, the food CPI grew by 10.1% year-on-year, still an unusually high rate but a considerable slowdown from the peak growth of 15.7% recorded in February 2023. The outlook is for food inflation to ease, thanks to the notable drop in the prices of agricultural products on international markets and in transportation costs (linked to the price of oil), although it will still remain high due to the time lag with which price shocks tend to be transmitted along the food chain.13 There are also some indications of a certain asymmetry in the response of consumer prices. In other words, after the recent drop in price of some commodities, the fall in consumer prices might be slower than the rise when those same inputs became more expensive.14 Nevertheless, there is great uncertainty regarding the trend in food prices since they’re affected by a wide range of factors such as extreme weather phenomena, not only in Spain and Europe but also worldwide. This includes El Niño, a meteorological phenomenon that often causes heat waves and drought in the Indo-Pacific region, reducing harvests and pushing up food prices.15 The recent oil price hike, if it turns out to be more persistent than expected, could also pose an additional obstacle to a moderation in food prices.

Spending in supermarkets and large food stores has increased due to the higher prices, according to CaixaBank’s internal data from Spanish cards

According to the INE retail sales index, food sales grew by 13.5% year-on-year in S1 2023 at current prices (i.e. an increase in nominal expenditure on food) but the increase was just 0.5% at constant prices (the quantity consumed has not changed). CaixaBank Research’s Consumption Monitor indicator, based on card payments in supermarkets and food establishments (nominal expenditure), shows an increase of around 18% year-on-year so far in 2023.

This sharp increase in prices makes it essential to differentiate, in the data for exports, between value and volume. In nominal terms (value), Spanish agrifood exports have continued to grow at a good pace, posting a cumulative 6.3% year-on-year growth in the period from January to June 2023, reaching 71 billion euros (12-month cumulative). However, in real terms (volume) agrifood exports fell by 9.1% year-on-year in S1 2023. This decline was substantial for certain products such as cereals (–45.6%) and oilseeds (–40.3%), whose production was affected by the drought. In any case, the sharp increase in the price of these products has offset the fall in value terms. On the other hand, around 25% of the basket of exports has grown in both volume and value. Such products are beverages (including wine), canned foods, fish products and, with a very significant increase, milling products (56% year-on-year in S1 2023 in volume terms).

In short, despite the price rises in agrifood products, the sector’s export figures are still reasonably positive, especially considering the adverse situation affected by lower yields, production costs that remain high and relatively weak international demand. In this respect, one factor in Spain’s favour is the high competitiveness enjoyed by its agrifood sector, an aspect we will analyse in detail in the next article of this Sector Report.