Autumn returns investors to an outlook of high rates

The September FOMC meeting confirmed the upward revision of interest rate expectations for the coming months (and years) on the part of several of its members. This accelerated the recent price adjustments in financial assets which, since the beginning of summer, have been trying to find their equilibrium in an environment in which rates are expected to remain higher for longer. The Fed’s bias towards further tightening, coupled with the strong performance of the US economy, also contrasted with the situation in the rest of the world, since virtually all of Europe, China and Japan exhibited less economic buoyancy in September. Thus, although sovereign rates registered a widespread increase during the month, this movement was particularly intense in the case of the mid- and long-term US benchmarks, with the consequent steepening of the slope of the yield curve. On the other hand, while the dollar has continued to capitalise on this trend, prolonging the appreciation it has accumulated since mid-July, risky assets have been weighed down and the stock markets closed another month with losses, while the oil price rally continued, pushing it to a new peak for the year.

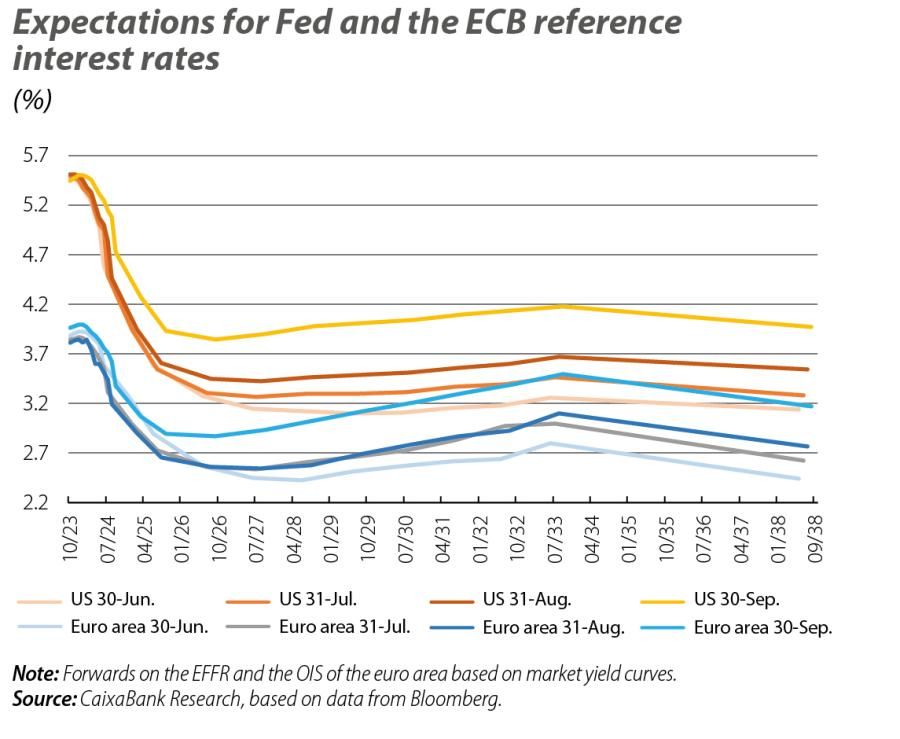

In the case of the Fed, despite taking a pause in the cycle of rate hikes and keeping them within the 5.25%-5.50% range, the new dot plot and a certain recognition by chairman Jerome Powell that the natural rate of the economy will have increased reinforced investors’ expectations that interest rates will remain higher for longer. In the case of the ECB, it did implement a rate hike of 25 bps, placing the depo rate at 4.00% (and the refi rate at 4.50%), albeit explicitly signalling that the current level of rates is considered sufficiently restrictive, meaning that maintaining them at that level ought to be enough to continue to reign in inflation. Elsewhere in the world, the Bank of Japan was uninclined to significantly tighten its monetary policy in the coming months, wary of a rebound in inflation which it does not consider sufficiently persistent, and this further impacted the already depreciated yen. The Bank of England also surprised analysts with a pause in its cycle of rate hikes after inflation in August was lower than expected, despite the fact that it still remains very high.

The higher for longer narrative pushed up the yield on US sovereign bonds during the month, reaching peaks not seen since before the 2008 financial crisis. The rally in longer-term US rates in Q3 has driven the 10-year benchmarks more than 70 bps above their June level, and more than 80 bps higher in the case of the 30-year benchmarks. This steepening of the yield curve is also driven by the resilience of the business cycle, which makes it difficult to envisage declines in the shorter-term sections of the curve, with 2-year yields currently above 5% and close to their peak since 2006. In the euro area, meanwhile, the rise in rates has been more homogeneous across the yield curve, with a less pronounced steepening of the slope (especially in the German yield curve), reflecting the weakness of the business cycle. On the other hand, the Italian risk premium rebounded more than 25 bps in the month after the government increased its fiscal deficit forecast for 2024. British sovereign rates were the big exception in the month, registering sharp declines in the short-term benchmarks.

The major international stock markets recorded yet another month of widespread losses in September, with the MSCI All Country World index down more than 4%. Although this fall was widespread across most sectors, the ones most affected were those that are more sensitive to interest rate rises, such as the tech sector. As a result, the Nasdaq index fell more than 5%, and this decline was also acutely felt in the S&P500. The main exception to this trend was the energy sector, supported in both Europe and the US by the sharp rise in the price of oil in recent months. In Spain, the IBEX showed a better relative performance, although it was still down –0.8% in the month. On the other hand, in Europe the DAX performed particularly poorly at –3.5%, weighed down by the German industrial sector.

The dollar continues its rally and in September recorded yet another month of significant appreciation, particularly against the euro, the yen and the Swiss franc. The US currency is benefiting greatly from the spread in rates that is expected relative to these economies with less dynamic business cycles than the US, on the one hand, and from the lower risk appetite among investors, on the other. As for the euro, its weakness against the dollar was not as pronounced as with other currencies in the month, and its nominal effective exchange rate recorded a depreciation of 0.5%, in contrast with the –2.5% it reached against the dollar.

Oil prices continued to climb in September, rising almost 10%, closing the quarter 27% above June levels and reaching a peak for the year at around 95 dollars a barrel. Production cuts in Saudi Arabia and Russia have achieved their goal in the face of steady growth in Chinese demand for crude oil and the rapid reduction in global oil inventories. This, together with the fact that the cuts have not yet found a counterweight in US shale producers, which are unable to boost production after several years of underinvestment, has resulted in a clearly upward trend in the market in recent months. As for natural gas, supply risks at different points (Australia, Norway, etc.) continue to generate significant volatility in the European benchmark, the Dutch TTF, and despite finding a stabilising factor in the good level of inventories for the time of year, the price rallied almost 20% in the month.