2023: a year of widespread gains in fixed-income and equity markets

Investors maintain a strong risk appetite in December

The intense market movement unleashed at the end of October, after investors shifted from expecting high interest rates for longer to anticipating rate cuts as early as 2024, continued in December. That said, the momentum seemed to fade towards the end of the month, with investors closing their positions in order to avoid tarnishing their good annual results and to leave for the Christmas break with peace of mind, resulting in a market with low trading volumes and which remained quite flat in the last two weeks of the year. 2023 thus ended with gains in most of the global stock markets, with the global MSCI ACWI up 20%, and with the Chinese indices as the main – and almost exclusive – markets to record losses. In terms of fixed-income securities, the global aggregate bond indices (which encompass both sovereign and corporate bonds) closed the year with gains, with the Bloomberg Global-Aggregate bond index up around 6% thanks to the rally at the end of the year. This index recorded its biggest bi-monthly increase since 1990 in December (above 9%) and the performance in these last two months has made the year a very positive one for these two main asset classes.

The central banks seek to contain expectations of lower market rates

The Fed and the ECB showed a clear divergence at their December meetings: while the Fed announced the end of the rate hike cycle and the dot-plot revealed expectations of three rate cuts (i.e. 75 bps) in 2024 for the median FOMC voter, at the ECB Lagarde was less explicit and stated that, for now, the ECB has not discussed rate cuts. Despite this divergence, after their respective meetings the statements issued by various monetary policymakers from both central banks focused on controlling investors’ expectations of rate reductions, which were reflecting significant cuts (of as much as 120 bps between 31 October and 31 December in the case of forwards on the effective fed funds rate for the next 12 months). However, at the year end, money market futures were pricing in a first rate cut in the US in March, and in the euro area in April, with between five and six rate reductions (i.e. of between 125 and 150 bps) anticipated in 2024 in both regions.

Sharp fall in sovereign debt yields, attenuated towards the end of the month

As with all other corners of the market, towards the end of December sovereign rates also experienced a relaxation of the sharp bearish trend unleashed in November, as investors reassessed their expectations of lower interest rates in 2024, in view of both the sharp correction in prices and the resilience of the US economy. Nevertheless, December’s movements in public debt were still significant, with 10-year benchmark rates on both sides of the Atlantic yielding between 40 and 50 bps in the month. This led to US treasuries closing the year flat, while in the case of the European benchmarks the falls in yields for the year as a whole were significant. This, coupled with the intense narrowing of spreads, allowed the 10-year benchmark rates of the euro area periphery to end the year between 70 and 100 bps below the level at which they closed 2022.

The November stock market rally is still felt in December

Also in the stock market, November’s strong investment rally began to lose steam towards the middle of the month, especially on European trading floors. Despite this, December closed with widespread gains in the major indices, with the main exception once again being China. On the upside, the US indices, particularly Nasdaq and the Rusell 2000 index, stood out. The buoyancy of the US economy and expectations of lower interest rates favoured tech firms in the month, as well as smaller companies, which had performed relatively poorly during the year compared to the tech giants. The exceptional performance of these companies meant that in 2023, the year of the emergence of artificial intelligence, the biggest advances among the major international indices were recorded by the Nasdaq index, following the sharp declines registered in 2022. The year has thus ended with widespread gains in the main stock market indices, in both developed and emerging markets, while Chinese stocks have performed the worst, with the Shanghai CSI 300 index and Hong Kong’s Hang Seng index sliding more than 10% each.

Expectations of lower rates for the Fed weigh down the dollar at the end of the year

If rate expectations and the correlative spreads between economies have been the main factors driving the foreign exchange market throughout the year, December was no exception. Thus, the dollar ended the year with a slight depreciation in its nominal effective exchange rate (just over 2%), although since mid-November it has undone much of the marked appreciation it had amassed in the summer (of over 7%). As a result, the euro closed the year up more than 3%, both against the dollar and in its nominal effective exchange rate. On the other hand, December saw the yen enjoy a significant appreciation. This movement was concentrated in the first few weeks of the month in the lead up to the Bank of Japan’s meeting, which turned out to be more dovish than expected among investors, who continue to anticipate early rate hikes. The Japanese currency ended December up almost 5% against the dollar, thus partially correcting the significant depreciation (of almost 8%) it had accumulated in the year.

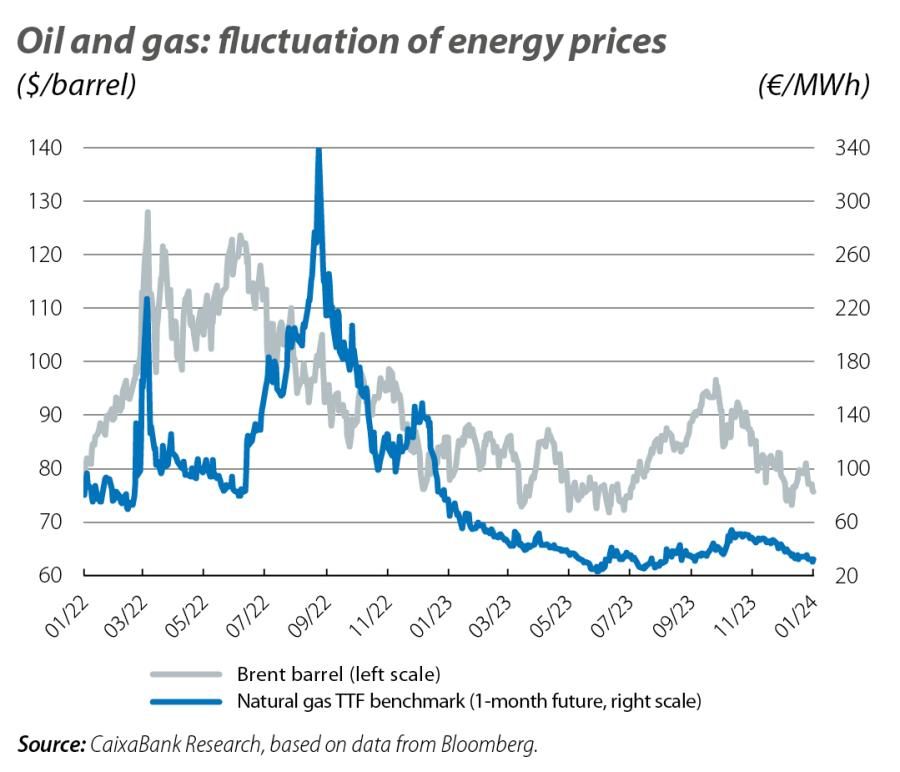

Energy prices close the year with losses

The Brent barrel benchmark price in Europe continued to decline in December, which meant that it closed 2023 10% below the level at which it started the year (almost 10 dollars less per barrel). Despite the outbreak of the conflict in the Middle East, which in December intensified with attacks on vessels in the Red Sea, as well as the production cuts by OPEC members, oil prices were weighed down by a slowdown in global demand and increased production outside OPEC, especially in the US (which reached a record production in December of 13.3 million barrels per day). On the other hand, although the European benchmark gas price is still higher than prior to the pandemic, it currently stands well below the highs observed in 2022 and has plunged more than 50% in the year, thanks to a high level of reserves and lower demand in a milder than usual autumn.