A resurgence of risk appetite brings an end to a year marked by swings in investor sentiment

Good tone in the markets at the end of the year. As we leave 2019 behind, we look back on a year in which the financial markets were marked by the trade tensions between the US and China, the resolution of Brexit, the slowdown in global growth and the return to the scene of monetary stimuli on the part of the major central banks. December was no exception, and the year ended with progress being made in the field of trade (with a first agreement between the US and China) and in the British political situation (where Parliament has approved the EU withdrawal agreement). Furthermore, the central banks strengthened their commitment to the accommodative measures of the previous months. Thus, in a scenario of stabilisation of the economic outlook, December saw a reduction in volatility in the financial markets, while investors showed a greater appetite for risk-bearing assets. All this led to widespread gains in the stock markets and commodity prices, as well as to a certain recovery in interest rates. However, despite the better performance in the closing stages of the year, the risks affecting the economic and financial scenario will remain present in 2020. Furthermore, the sensitivity that the markets have shown throughout 2019 to geopolitical events and to messages from the major central banks suggests that they will continue to determine the investor mood in the new year.

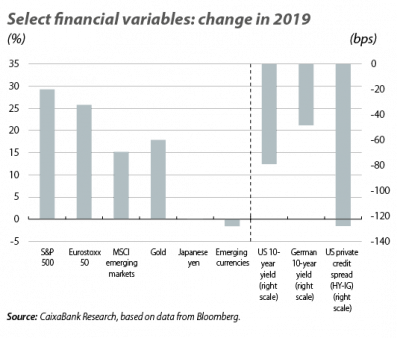

A good year for the stock markets, despite the ups and downs. While 2019 began with fears that the turbulence of late 2018 would continue to weigh down on stock prices, finally the year ended with notable and widespread gains: around 30% on a cumulative basis in the case of advanced economies and around 15% in emerging economies. These figures go beyond the rebound effect following the turmoil of the autumn of 2018. In fact, the main indices are well above their peaks reached in the summer of 2018: more than 10% above in advanced economies and around 6% above in emerging economies. The gains have been supported by the dovish measures taken by the central banks during the course of the year and a certain calm in the geopolitical uncertainties surrounding the US and China and in Europe (Brexit and Italy), as well as the finding that the risks of economic recession have been placated by the resilience of domestic demand. Nevertheless, the year has not been without difficulties and on various occasions the stock markets have registered major corrections to the sound of geopolitical tensions (such as in the episode of risk aversion of last summer). In addition to this risk factor, some western stock markets are showing high multiples (such as price-to-earnings ratios), highlighting the fears that some assets may be overvalued, as repeatedly emphasised by institutions such as the IMF and the BIS.

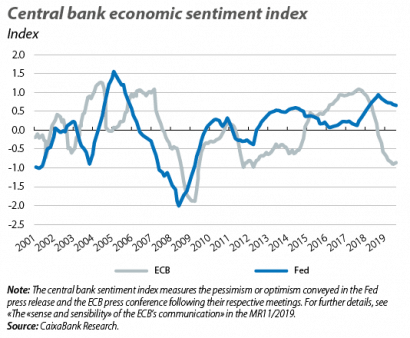

Interest rates take root in accommodative territory. At their December meetings, both the ECB and the Fed conveyed a message of continuity of the dovish measures taken during 2019. On the one hand, on the occasion of Christine Lagarde’s debut as the new chair, the ECB opted to keep its monetary policy unchanged and reiterated its commitment to the stimulus package announced in September (a depo rate cut down to –0.50%, a resumption of net asset purchases and more favourable conditions for the TLTRO). Furthermore, backed by its reading of a scenario marked by weak growth and a persistence of risks, the ECB reiterated the need to maintain the favourable financial conditions for a long period. The Fed, meanwhile, kept the interest rate within the 1.50%-1.75% range, after three cuts in the months of July, September and October. What is more, the Fed’s latest projections show that 13 of its 17 members do not anticipate any change in rates in 2020 (while the remaining 4 expect only one increase of 25 bps). This reduces the apparent likelihood of further cuts in 2020 that are built into the valuations of financial securities. However, these messages contrast with those sent a year ago when, in December 2018, the ECB put an end to net asset purchases and the Fed stated its intention to implement three rate hikes. Indeed, in the fixed-income markets 2019 was marked by sharp falls in sovereign yields (of around-75 bps and –40 bps in the 10-year yields of the US and Germany on a cumulative basis, respectively). That said, the latter months of the year saw a moderation of these declines thanks to the recovery of investor sentiment: in December, the 10-year yields of the US and Germany rose by around 15 bps, culminating a recovery of around 50 bps from their low points of last summer.

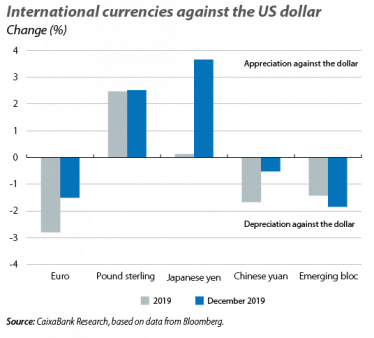

Emerging currencies lose ground against the dollar. During 2019, the US dollar showed greater strength against most global currencies, which were penalised by economic uncertainty, trade tensions and long-term interest rate spreads. These factors took a particular toll on emerging countries, whose currencies depreciated notably against the US dollar (also weighed down by various idiosyncratic factors). The most noteworthy cases included those of the renminbi (its depreciation led it to break the barrier of 7 yuan per dollar for the first time since 2008) and most Latin American currencies (whose average depreciation in December was 4%, according to the JP Morgan Latin America index). On the other hand, in December the pound sterling appreciated by around 2% against the dollar, boosted by the result of the UK general election and the greater prospects for an orderly Brexit on 31 January.

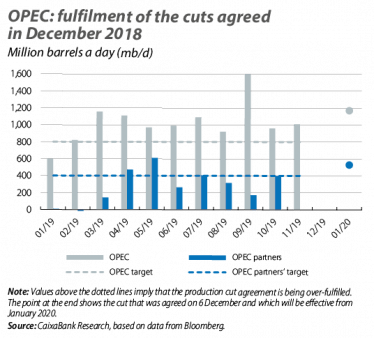

End-of-year rally for commodities. The improvement in investor sentiment drove up commodity prices in the final straight of the year. In the oil market, in December this improvement was added to by the decision taken by OPEC and its partners (led by Russia) to cut their crude oil production by an additional 500,000 barrels per day beginning in January 2020. This raises the total cuts to 1.7 million barrels per day compared to the levels of October 2018 (for further details, see the article «Oil: piecing together the puzzle» in this same Monthly Report). In addition, although the duration of the agreement was not prolonged (it is due to end in March 2020), Saudi Arabia expressed a desire to continue to lead the production cuts, which favoured the rise in the price of a barrel of Brent oil above 65 dollars.