The euro area has abandoned the recession

The euro area has abandoned the recession after posting the first positive quarter-on-quarter growth rate since 3Q 2011. The GDP flash estimate for 2Q 2013 was quite significant, specifically 0.3%, and was widespread in most countries. Germany and France, with growth of 0.7% and 0.5% respectively, surprised most analysts and are at the forefront of the recovery process. Figures also improved in the periphery countries compared with previous quarters. Of note is Portugal, advancing by 1.1%. In many cases these good growth figures are due to temporary factors. In Germany, for example, the bad weather was a drawback in 1Q but has now played a positive role. The rate of growth is therefore likely to be somewhat lower over the coming quarters but, in any case, the underlying dynamics seem to be on track and, provided there are no last-minute surprises, the recovery process should continue apace.

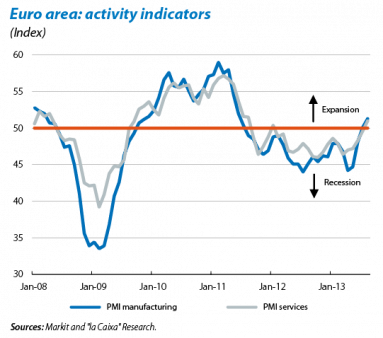

The improvement in activity has livened up in 3Q. The PMI composite for the euro area, one of the best leading indicators for activity, broke through the barrier of 50 points this summer, the figure as from which the rate of GDP growth is usually positive. This improvement is generalised throughout the main subcomponents of the index: services reached 50 points in August and manufacturing, which had already reached this point in July, continued to advance in August. This improvement in activity is also endorsed by other indicators, such as the industrial production index and the industry confidence index, both with clearly positive trends. However, there are still considerable differences between countries. Germany continues to top the pile: its PMI, which was already one of the highest in the euro area, rose sharply in August, recording its highest value for the last 7 months. In France, however, in spite of its good growth figures for 2Q 2013, the trends in the different high frequency indicators do not call for such optimism. For example, its PMI fell in August, continuing to shed doubt over the French economy's capacity to recover.

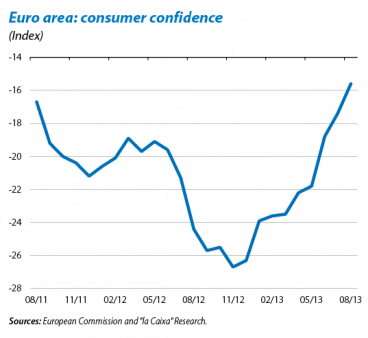

Consumption has also joined the recovery process. To date, consumption had been one of the main brakes on activity, with growth rates clearly below those of GDP. In 2012, for example, household consumption fell by 1.3%, 0.8 p.p. more than GDP. In this respect, the improvement seen in the different indicators for 2Q and 3Q is very encouraging. The positive trend started by the consumer confidence index at the beginning of the year has gradually consolidated over the last few months. The strong advances occurring recently have placed the index at the level of July 2011, before the euro area's double dip recession. Retail sales also illustrate the improved consumption of households, with an average month-on-month rise of 0.2% in 1Q.

Like consumption, inflation is also changing its trend but remains at moderate levels for the moment. After reaching 3% at the end of 2011, inflation embarked on a clearly downward trend up to April this year, when it touched bottom at 1.2%. Since then, the movements have been slightly upward, partly reflecting the incipient changes in the tone of consumption but without this suggesting that the ECB's inflation target is in any danger. In August, the rate of inflation for the whole of the euro area stood at 1.3%. The upwards risks, however, have increased. Growing political tensions in the Middle East, and in Syria in particular, have pushed the price of Brent oil up to nearly 90 euros per barrel. This has increased by more than 10% since June. Naturally, if these figures consolidate or go even higher, they will end up having an effect on inflation. The aforementioned peak for inflation occurring in 2011, with figures reaching 3.0%, was largely due to rising oil prices, with year-on-year percentage changes in excess of 30% for several months and going above 90 euros per barrel.

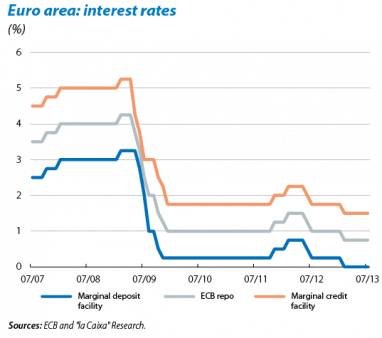

The ECB feels comfortable with the low interest rates. In just one year, monetary policy has effected a 180 degree turnaround. Although the symptoms of a double dip recession were evident in April 2011, the governor of Europe's monetary authority at the time, Jean-Claude Trichet, raised the interest rate by 0.25 basis points, repeating the mistake made in 2008. As was typical in his press conferences, he gave no clue as the course monetary policy would follow in the future, with words that, over time, have become notorious: «we never pre-commit». Since Mario Draghi took over the reins of the ECB in November 2011, interest rates have fallen to all-time lows, the REPO rate stands at 0.5% and now, moreover, he has announced that they will remain at this level, or even lower, for an extended period of time (see the Focus «The ECB: relatively vague «forward guidance» for a fuller discussion).

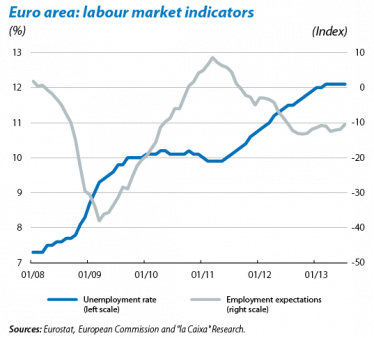

Stabilisation of the labour market confirms the change in tone of the economy as a whole. The euro area's unemployment rate, which had risen continuously since 2008 (except for a slight reduction in 1Q 2011), has stabilised over the last few months, remaining at 12.1% from March to July. Although it is still too soon to observe reductions in the unemployment rate (normally this occurs when economic growth is in a more advanced phase), the index of employment expectations for the industrial sector is already showing clear signs of improvement: in July it stood at –10.5 points, the highest since July 2012. Moreover, the trend of the index has been positive since the start of the year, rising during the last four months consecutively. Although the correlation between the index of employment expectations and the unemployment rate is not perfect, both series are closely related, so these figures are certainly encouraging.

The first signs of improvement are also reaching the credit supply. The ECB's quarterly bank lending survey has provided some good news: the improvement in the supply of credit is widespread in the different sectors of the economy. Of particular note is the improvement in consumer credit, the first since the recession started. This is largely due to the reduction in macroeconomic uncertainty and less volatility in the financial markets. Given that there is still a long way to fall, the supply of credit should also improve much more significantly as the trend consolidates and the improvement in activity is confirmed.

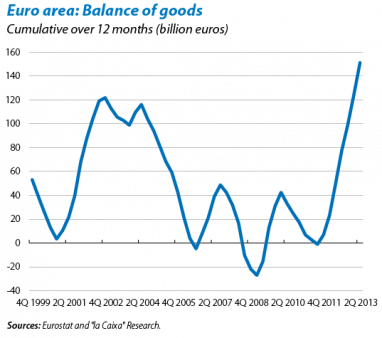

The foreign sector, the recovery's loyal ally. The current account figures for 2Q 2013 show a further improvement in the foreign sector. The euro area's surplus continues to grow thanks to the good trend in credit (1.7%, year-on-year) and the reduction in debit (–2.6%). One of the keys to this improvement is the trend in the balance of goods. This posted an all-time high of 153 billion, 1.6% of GDP, and has been growing continuously since the end of 2011 (see the Focus «Improvement in the euro area's current account: cyclical or structural?» for a more detailed discussion).

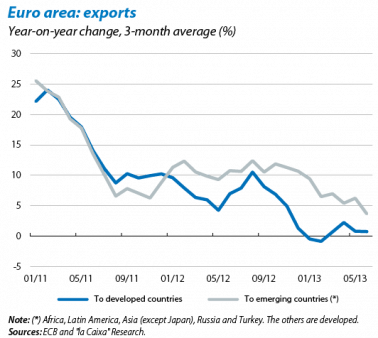

The risk of storm has abated but there are still clouds on the horizon. Growth figures for 2Q 2013 have been better than expected and business and confidence indicators suggest this improvement will continue. However, the factors that might derail the recovery are not slight. The possible impact on exports of the slowdown in the main emerging countries such as Brazil, China or India may be quite significant. For the moment, however, the international trade figures for the euro area are encouraging. In spite of the downward trend shown by growth in exports in the leading emerging countries, trade with developed countries is starting to gain momentum. This, for the moment, is helping exports as a whole to perform well. Another key factor will be the outcome of Germany's federal elections on 22 September. According to the different polls, victory for the current chancellor, Angela Merkel, seems very likely but what is not so clear is whether she will be able to govern by maintaining the current alliance with the liberal party, the FDP, or if she will have to look for alternative solutions. In any case, the leading role Germany has taken in the European reforms is unlikely to become more diluted or change in direction. Lastly, we must also keep a close eye on the progress made in economic policy in the periphery countries. In Italy, the new Prime Minister, Enrico Letta, still has to demonstrate his leadership skills; in Greece, instead of disappearing, the possibility of another bail-out has been gaining supporters; and, in Portugal, the troika must approve the progress made in the country's adjustment programme and reforms after having failed in its June visit.