A promising start to the year

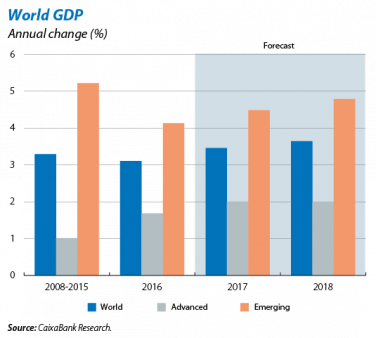

The first few months of 2017 have started strongly. Economic activity indicators for Q1 2017 suggest the acceleration in global growth, observed since the second half of 2016, should continue. Although most of the data available to date are qualitative in nature; i.e. based on consumer and company surveys, according to the historical relationship between soft and hard data, world growth should reach 3.4% in Q1 2017, 0.2 pp higher than in Q4 2016. The recovery in growth is also quite synchronised, affecting both advanced and emerging economies. The good start to the year has been accompanied by a notable rise in global inflation, up by 0.4 pp between Q4 2016 and Q1 2017. This is largely the result of the base effect of energy prices (oil is now 16% higher than a year ago).

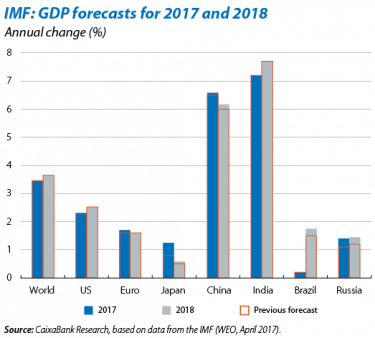

But the balance of risks still leans towards potentially less growth. In spite of the good start to the year, the future is not free from downside risks. Among those of a strictly economic nature are perhaps two potential threats: the rising level of debt in the world and the impact of tighter international financial conditions on those emerging economies more vulnerable to external factors. Political uncertainty also poses a threat (protectionism, populism and geopolitical risks). This two-sided diagnosis, combining a positive start to the year in growth terms but the presence of potentially high risks, is widely shared by analysts. For example, in its recent spring forecasts the IMF acknowledged the solid start to the year and raised its global growth forecast for 2017 (to 3.5%). According to the Fund, this is due to the advanced economies performing better than expected. Nevertheless, it has also upgraded its growth forecasts for emerging countries such as China and Russia. The downside risks noted by the IMF are those of a political nature, protectionism, the impact of the Fed’s normalisation strategy on some emerging countries and China’s debt.

UNITED STATES

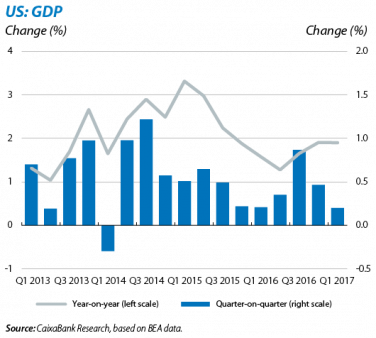

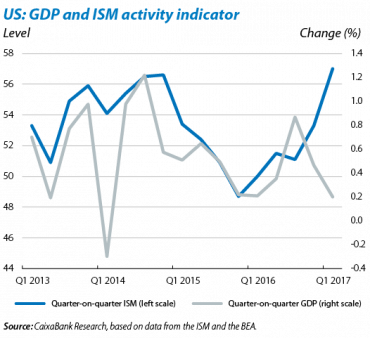

A dip in growth in Q1 2017. In this quarter, GDP grew by 0.2% quarter-on-quarter compared with 0.5% in Q4 2016. In year-on-year terms, growth was 1.9%, similar to the previous figure of 2.0%. This loss of economic pace is mainly due to weaker private consumption and, to a lesser extent, a negative c. Investment increased strongly, however. For veteran observers, such a slowdown in growth is surprising as the monthly indicators available point to higher GDP growth. In fact, this paradox is due to two atypical circumstances, one in the US itself and the other more general in scope. The first is typical of the first quarter of every year in the US. As acknowledged by the country’s statistics institute (BEA), the GDP series suffers from a seasonality problem which makes it repeatedly lower in Q1 and higher in the next two quarters. But this seasonality glitch has been accompanied by another circumstance that sometimes occurs (and not just in the US), namely a discrepancy between sentiment data and real growth figures (known as the gap between hard and soft data). Soft indicators point to an upward trend that does not entirely coincide with actual GDP growth.

So what is the outlook for the coming quarters? In spite of the slowdown in growth seen in Q1, these atypical effects should fade over the next few quarters. CaixaBank Research expects growth to improve, essentially thanks to private consumption recovering from its dip, still supported by accommodative credit conditions and especially by a healthy labour market. In fact, 98,000 jobs were created in March. Although this figure is lower than in previous months, it is still significant given the mature phase of the US cycle. In fact, it is very close to the monthly job creation rate which the Fed Chairman, Janet Yellen, deems to be the equilibrium level under full employment. The unemployment rate fell slightly to 4.5% and wages rose by a considerable 2.7% year-on-year.

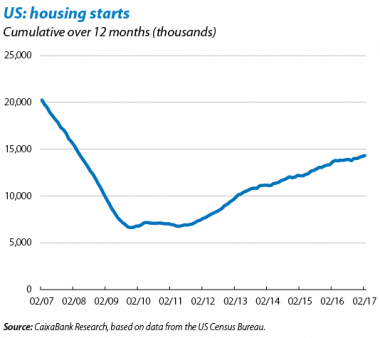

Corporate and residential expenditure will boost the economic expansion. In addition to these factors supporting consumption, the solid performance by the real estate sector and improved corporate capital expenditure will be an additional boost for growth. In short, should the US scenario turn out as we expect, its economy will grow by 2.2% in 2017 compared with 1.6% in 2016. Circumstances will be quite different in 2018, however, as the new administration’s expansionary fiscal policy, which should start to take shape over the coming months, will stimulate growth. For the time being, the White House has presented its proposal to cut corporate tax (from 35% to 15%), as well as personal income tax, especially for higher income brackets. These favourable forecasts should be taken with some caution, however, as there are still significant downside risks to the macroeconomic situation, due to uncertainty regarding the US government’s policies (fiscal stimulus, protectionism and diplomatic tension), as well as its capacity to actually implement them.

Given this complex context, the Fed is expected to maintain the stance shown in its last few meetings. CaixaBank Research predicts a monetary policy scenario with two further hikes in 2017 (June and September), an announcement that the Fed will gradually stop reinvesting maturing assets in Q4 2017 and three more hikes in 2018. March’s surprisingly low inflation figure should be seen as a temporary phenomenon that does not alter the underlying trend in prices.

EMERGING ECONOMIES

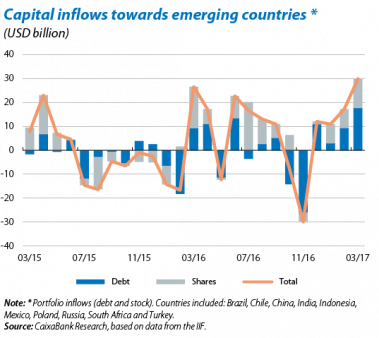

Increasing economic activity in the emerging economies. Although doubts regarding the possible discrepancy between hard and soft data could also affect the emerging countries and these should therefore be interpreted with caution, economic sentiment indicators point to growth in activity speeding up in almost all emerging economies in Q1 2017. In line with this economic improvement, capital inflows to emerging economies have continued to recover and there has even been a notable improvement in capital flows to China.

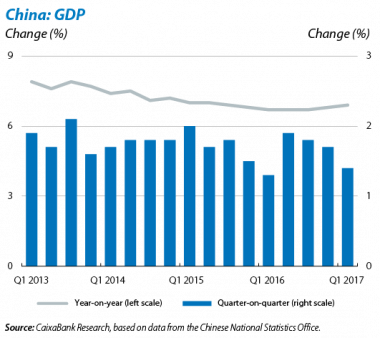

China’s economy performs surprisingly well but risks are still high. Growth in Q1 2017 was higher than expected, reaching 6.9% year-on-year, 0.1 pp above the figure in Q4 2016. CaixaBank Research has therefore raised its growth forecast for 2017 from 6.4% to 6.6% (in line with the target announced by the National People’s Congress last March), and from 5.9% to 6.1% for 2018. But this slightly better scenario does not lessen doubts regarding a large number of risks (excessive corporate debt, shadow banking, real estate bubble, etc.). Inflation is still low, at 0.9% in March (0.8% in February) due to falling food prices.

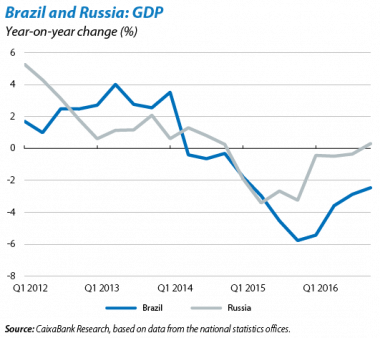

Brazil and Russia, two different ways of going through a recession. Brazil’s data suggest the country is taking some time to fully exit its deep recession in 2014-2016. The country’s poor performance is accompanied by a sharper drop in inflation than expected (due to the combined effect of a reduction in food and government regulated prices) and good prospects for Social Security reform (improving the sustainability of the pension system). In Russia, meanwhile, GDP growth was 0.3% year-on-year in Q4 2016, considerably higher than expected (the annual decrease in GDP was 0.2%, clearly lower than the –2.8% posted in 2015). But in spite of this improvement in short-term prospects at the end of 2016, the country’s medium-term outlook is not good (due to a combination of sanctions, geopolitical uncertainty and dependence on oil and gas).

Mexican growth outperforms expectations in Q1 2017. Although the ultimate impact of the new US policy on Mexico is still uncertain (immigration and the NAFTA revision), Q1 growth was a dynamic 0.6% quarter-on-quarter (2.5% year-on-year), higher than expected. Following the same positive tone, Moody’s decided to maintain its credit rating for the country.

Turkey enters unknown territory (institutionally). GDP grew by 3.5% year-on-year in Q4 2016, much higher than expected, bringing growth in 2016 to 2.9%. Inflation was also surprisingly high, in this case in Q1 2017, due to the combined increase in energy and food prices. But what has grabbed most attention is the country’s constitutional referendum, whose approval of the new Magna Carta has reduced political uncertainty in the short term but marks the start of a period of relatively unprecedented institutional change.