Surprisingly high euro area growth

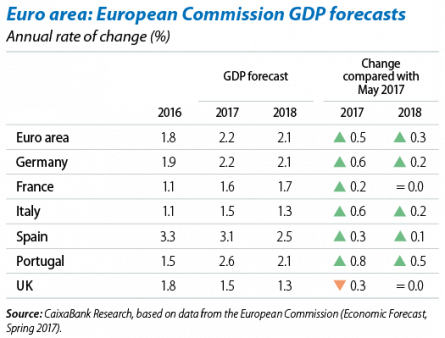

The euro area’s economic outlook continues to improve. After posting good economic data in H1, the figures available for H2 2017 continue to be unexpectedly strong. This indicates continued improvement in the area’s economic outlook. Apart from unexpectedly strong Q3 GDP data, a climate of high confidence has been confirmed, employment growth remains strong and private consumption continues to benefit from favourable financial conditions. Increased economic synchronisation across euro area members is also boosting economic growth. Inflation is the only dark spot in the current economic situation, still below the ECB’s target. This is partly because there is still a lot of room in the labour market, limiting upward pressure on wages. Nevertheless, CaixaBank Research has raised its euro area growth forecasts by 0.1 and 0.2 pp to 2.3% and 2.2% for 2017 and 2018, respectively. The European Commission’s forecasts are also being revised in this direction. However, there are obviously risk factors that could upset this good economic outlook. Externally, particularly geopolitical risks such as tensions arising from the North Korean conflict. In the financial area, risks include faster monetary policy normalisation by the Fed and the ECB and increasingly high debt in several emerging countries, notably China. There is also the risk of an unexpected spike in oil prices. Internally, the failure of Germany’s negotiations to form a coalition government among conservatives, liberals and Greens (Jamaica coalition) increases the likelihood of an election although a repetition of the Grand Coalition with the Social Democrats cannot be ruled out. The data available so far suggests the short-term economic impact of this uncertainty will be limited, although the final outcome may have consequences for the euro area’s reformist drive. A repetition of the Grand Coalition is the most favourable scenario in terms of continuing with the agenda of reforms. Another major risk factor is Brexit. Negotiations have stalled regarding financial aspects of the agreement. Nevertheless, the Conservative government is expected to increase its offer to ensure the EU agrees to move on to the second round of negotiations when it convenes at the next European Council meeting on 14-15 December. This would reduce the likelihood of a disorderly EU exit for the UK.

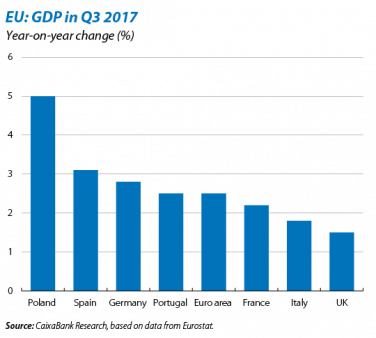

Unexpectedly strong growth in the largest euro area economies. The euro area maintained a solid growth rate in Q3 with a 2.5% year-on-year increase (0.6% quarter-on-quarter). Growth was especially strong in Germany (2.8% year-on-year), France (2.2%) and Italy (1.8%). In fact, Germany is surprising not only because of its good Q3 growth (0.8% quarter-on-quarter) but also because of the upward revision of its Q1 figure (from 0.7% to 0.9%). Spain and Portugal also posted good rates, up by 3.1% and 2.5%, respectively, albeit in line with expectations. Outside the euro area, Poland’s performance was strong, growing 5% year-on-year, while the UK, whose economy is beginning to suffer from the uncertainties and the depreciation of the pound caused by Brexit, advanced by a weak 1.5%.

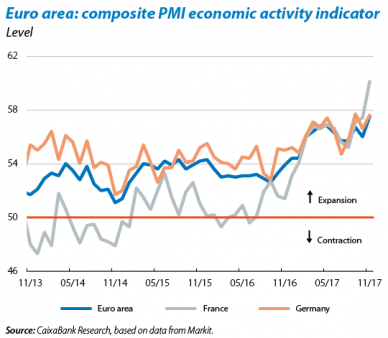

Economic activity indicators point to strong euro area growth continuing in Q4. In general, the data points towards a continuation of the good trend of previous quarters. The composite business sentiment index (PMI) rallied strongly in November to 57.5 points, up 1.5 points from the previous month and significantly above the 56.1 point average for H1. The Economic Sentiment Index (ESI) also rose by 0.5 points in November compared with the previous month, to 114.6 points, its highest level since 2000. Finally, September’s industrial production index grew by 3.2% year-on-year, well above the average of 1.4% in H1.

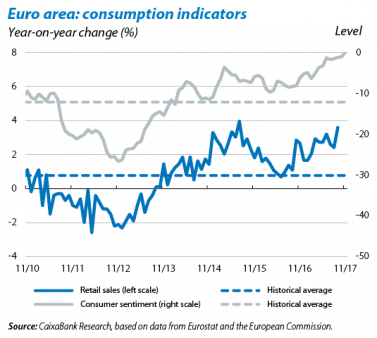

Household consumption continues to drive economic growth. This is due to improved sentiment, a favourable credit environment and good labour market prospects. After contributing 0.5 pp to GDP growth in Q2 (0.7% growth quarter-on-quarter), CaixaBank Research predicts that private consumption will contribute 0.6 pp to GDP growth in Q3 and Q4. Good consumption indicators endorse this scenario. The consumer confidence index reached 0.1 points in November, its highest for the past 15 years. Retail sales also picked up strongly in September with 3.6% year-on-year growth, significantly above the 2.5% average recorded in H1.

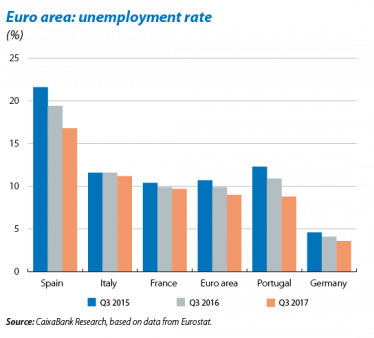

The unemployment rate remains on a downward trend. The labour market’s good performance continues to support household confidence. The unemployment rate fell by 0.1 pp in September to 8.9%, 1 pp lower than September 2016. There is still a long way to go, however. For example, the unemployment rate is still significantly higher than the 7.3% minimum reached before the financial crisis.

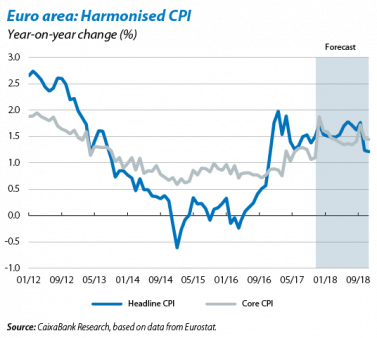

Inflation remains moderate in November. Inflation made up for its slight dip in the previous month and rose to 1.5%. This was due entirely to the higher contribution made by the energy component, which also explains why core inflation remained the same between October and November (1.1% year-on-year). Looking ahead to the next few quarters, we expect core inflation to continue rising in line with the recovery in economic activity. This will more than offset the downward pressure exerted by the euro’s recent appreciation. In any case, all the evidence available suggests inflation will continue to rise very gradually. It will therefore remain below the ECB’s target in 2018 (below but close to 2%).

PORTUGAL

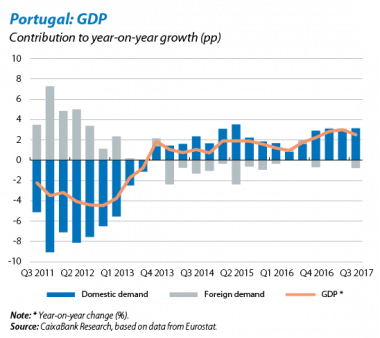

The Portuguese economy is advancing steadily. After a brief slump in Q2 in which GDP growth dropped to 0.3% quarter-on-quarter, in line with CaixaBank Research’s expectations, the economy picked up again in Q3 and grew by 0.5% quarter-on-quarter (2.5% year-on-year). The breakdown by component shows that domestic demand is still the main driver of growth, boosted by the trend in private consumption and investment. Indicators of economic activity available to date suggest the economy will remain in good shape over the next quarter. The Bank of Portugal’s coincident indicator for economic activity, which summarises the trend of Portugal’s high frequency indicators, rose by 2.7% year-on-year in October. This is slightly less than the previous month but above the 2.4% average recorded in H1. November’s Economic Sentiment Index (ESI) also rose by 0.2 points to 115.8 points, well above the average for the first half of the year (111.5 points). Retail sales data also confirm the country’s good economic performance, up by 3.9% year-on-year in September, 0.7 pp more than the previous month. The only negative point comes from industrial production data. In the past four months this had grown by more than 4% year-on-year but it fell in October to 1.2%. Nevertheless, the overall picture is still positive. Proof of this is the European Commission’s upward revision of its growth forecasts for Portugal, now at 2.6% for 2017 and 2.1% for 2018.

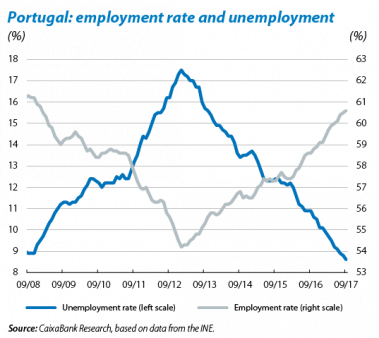

Employment continues to support economic growth.

In September, the unemployment rate fell to 8.6%, its lowest since the start of the recession. Employment grew by 3.2% year-on-year in Q3, equivalent to an increase of 147,000 jobs. Employment has now grown by more than 3% year-on-year in the past three consecutive quarters. Particularly positive is the fact that this improvement in employment prospects is widespread across different population segments and sectors. For example, compared with the same period in 2016, the unemployment rate for young people aged between 15 and 24 has fallen by 1.9 pp to 24.2%, a rate well below the 42.5% maximum reached in Q1 2013. The long-term unemployment rate has also fallen sharply to 4.9%, down 1.8 pp on the same period a year earlier. By sector, the good performance of services and particularly tourism will ensure a good job creation rate for the coming quarters.

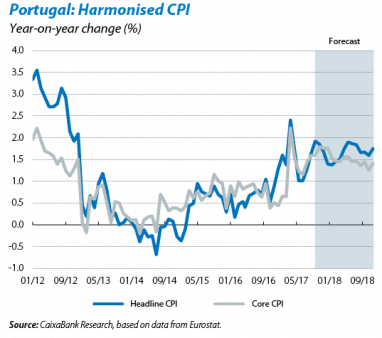

Inflation is on the up. Headline inflation rose for the third consecutive month in October, up by 0.3 pp on the previous month to 1.9%. By component, particularly strong contributions were made by the tourism sector, such as restaurants and hotels, and transport. This effect is likely to be temporary and inflation is expected to slow down to around 1.6% over the next few months.