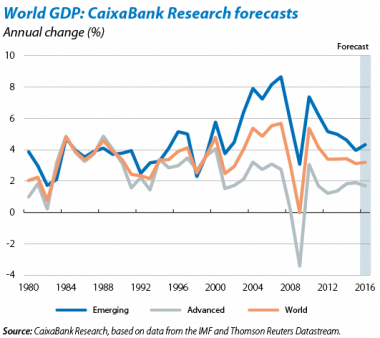

Brexit will have a negative impact on world growth, albeit very slight. The forecasts by CaixaBank Research still place global economic growth at 3.2% in 2016, slightly higher than 2015's figure of 3.1%, and at 3.5% in 2017. The repercussions from the United Kingdom's decision to leave the EU will particularly affect the country itself. Nonetheless, given the UK's economic importance and also its degree of economic, commercial and financial integration, we expect these repercussions to extend beyond its borders and particularly to the rest of the countries within the EU. In the financial area, risk aversion and volatility will remain high for several weeks while doubts persist regarding the exit process. The actions carried out by the different central banks will be key to mitigating the effects of the Brexit. In addition to the UK probably lowering its interest rates and the ECB speeding up its rate of asset purchases, the Federal Reserve (Fed) may decide to delay its next increase of the Fed funds rate a little longer.

UNITED STATES

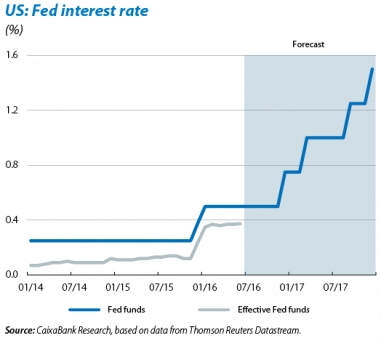

The Fed: from getting ready for a second hike to putting everything on hold. Undoubtedly the surprising outcome of the UK referendum, together with the markedly more dovish tone of the minutes from its June meeting, will affect the decisions taken by the US Fed over the coming months. Those voices most strongly advocating the need to continue with monetary normalisation that were heard in April will surely be quieter at the next few meetings. Given this situation, the second interest rate hike is very likely to be delayed until December 2016 according to CaixaBank Research forecasts, once the strength of the US economy has been confirmed and global tailwind risks have eased. We also expect the rate at which the Fed normalises its monetary policy to be somewhat more gradual with increases of 75 bps a year in 2017 and 2018 (instead of the 100 bps predicted in the previous forecast scenarios), as suggested by the projections provided by the Fed Open Market Committee in June.

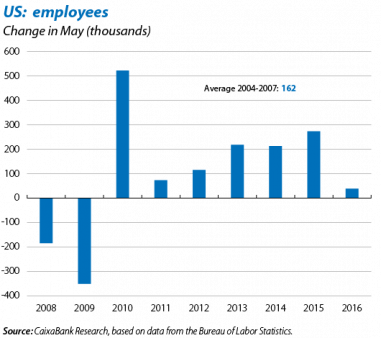

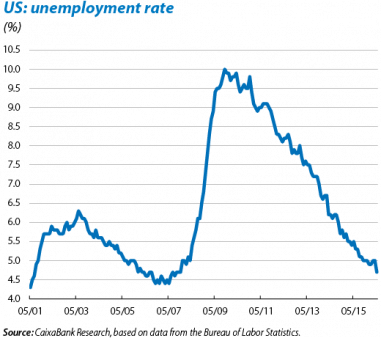

In any case the recovery in inflation and the good performance by the labour market will support interest rate hikes starting again at the end of the year. The US' general CPI grew by 1.0% year-on-year in May, 0.1 pps below the previous month's figure, while the core CPI grew by 2.2%, 0.1 pps above April's figure. In monthly terms (with the series seasonally adjusted), both the general CPI and the core CPI grew by a significant 0.2% month-on-month. Once again the solid advance in energy component was particularly noticeable (+1.2% month-on-month). General inflation is therefore expected to pick up over the coming months (close to 2.0% by December 2016) due to the recovery in oil prices and strong consumption. This upswing, together with continued improvements in the labour market, will help the Fed to restart interest rate hikes at the end of the year. In fact, the negative surprise provided by the labour market figures in May (38,000 jobs were created, the lowest figure in the last six years) is temporary. The potential effect on statistics of the strike by the workers of a large telecom company, the strong recovery in the labour market since 2009 (4.7% unemployment rate) and positive wage rises (2.5% year-on-year) balance out this bad figure (see the Focus «An overview of the improvement in the US labour market» in this Monthly Report).

The US economy continues to expand strongly. Activity data for Q2 point to growth accelerating in the world's largest economy. Growth in retail sales and consumer goods and the strong figures posted by the consumer confidence index published by the Conference Board in June (at 98.0 points, considerably higher than its historical average) reflect the improvement in private consumption, which represents almost 70% of GDP. Similarly, according to the third estimate produced by the Bureau of Economic Analysis (BEA), the US' GDP grew by 0.3% quarter-on-quarter in Q1 (2.0% year-on-year), exceeding the first and second estimates (0.1% and 0.2%, respectively). In spite of this upward revision of Q1, the forecast for the annual figure for 2016 remains at 2.0% as a consequence of the downward pressure resulting from the Brexit process. In 2017, CaixaBank Research has lowered its forecast slightly (by 0.1 pps) to 2.1% for to the same reason.

JAPAN

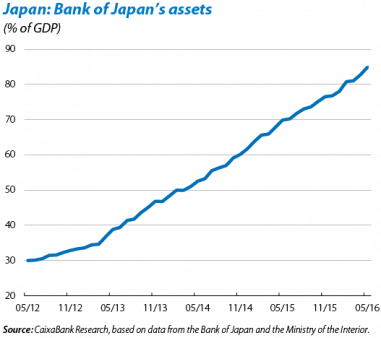

Japan postpones its VAT hike planned for April 2017 (from 8% to 10%) until October 2019, given the country's persistent weakness in domestic demand, deflationary tensions and doubts regarding growth in China. This delay indicates better growth prospects for the Japanese economy in 2017 (now at +0.9%). Given this situation, the Bank of Japan made no changes at its June meeting (before the UK referendum) although the monetary institution is very likely to decide to increase asset purchases (now totalling 80 trillion yen a year) at its July meeting, particularly after the financial turbulence caused by the United Kingdom's decision.

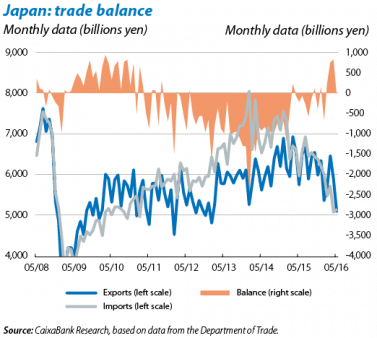

The Japanese economy is still weak. Domestic demand is particularly fragile, affected by poor consumer and business expectations given the country's lack of commitment to reforms. The yen's appreciation is also weighing heavily on the foreign sector. In May exports fell in nominal terms by 11.3% year-on-year due to a drop in sales to China, the countries of South East Asia and the US. They also fell by 2.4% year-on-year in terms of volume, especially because of lower sales to the US.

EMERGING ECONOMIES

China's economic activity indicators stabilise in May but the sources of risk continue. Although exports fell again (–4.1% year-on-year), imports recorded a slight drop (–0.4%) after months of sharp declines (–13% on average between January and April), indicating that domestic demand is stabilising. Similarly industrial production grew by 6.0% year-on-year, in line with the previous month, while retail sales rose by 10.0% year-on-year, without showing either clear improvement or evident deterioration compared with the figure of 10.7% posted in 2015.

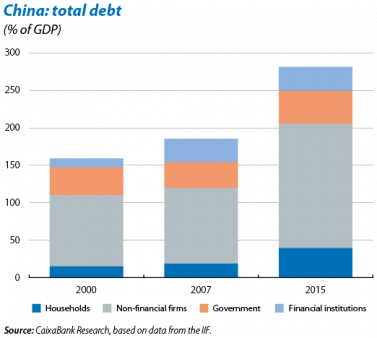

China's high and increasing level of debt is a cause for concern, particularly corporate debt. The country's total debt is around 250% of GDP (while corporate debt is equivalent to about 166% of GDP). The IMF has recommended three actions that should be taken to tackle such a large increase in corporate debt: acting quickly and effectively, sorting out the problems both of lenders (banks) and borrowers (companies) and resolving problems of corporate governance (both in companies and in banks). China has manifest experience in the area of governance. Between 2003 and 2005 the government sorted out a large proportion of its big banks that were seriously affected by high NPL ratios, caused for the most part by state companies: in three years close to 130 billion dollars were invested in restructuring the country's financial system. A decade later, the problem is back.

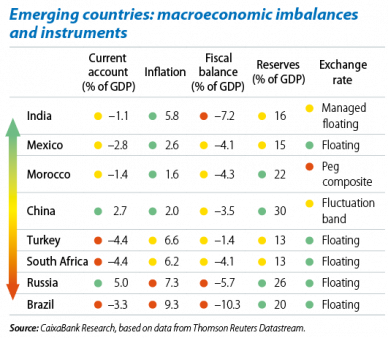

The response capacity of emerging countries is varied. In spite of the risk supposed by the level of corporate debt in China, it is obvious that the world's second largest economy has options to act that are not available to all emerging economies: a high level of reserves (in spite of the drop over the last few months), a current account surplus and contained inflation represent three important points of support to tackle its problems. India and Mexico are two other countries with reasonable macroeconomic imbalances and room to manoeuvre while, at the other end of the scale, we have the case of Brazil and Russia with imbalances that are difficult to correct, particularly given their current recessionary situation.