Steady growth with risks on the downside

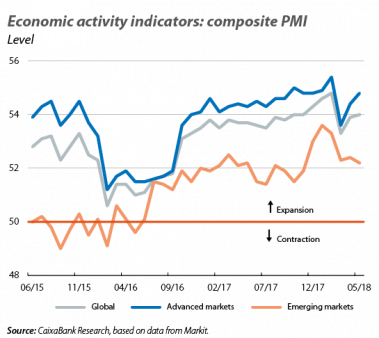

The latest global economic indicators point to a positive growth outlook for the remainder of 2018. The global composite business sentiment index (PMI) clearly remains in expansionary territory and in May, it increased slightly to 54.0 points. In addition, CaixaBank Research’s indicator that estimates global growth suggests that in Q2 2018, the global economy will have grown at a very similar rate to that of previous quarters (see Focus «Drivers of global growth: a comprehensive analysis» in this Monthly Report). Indeed, the latest global data support the hypothesis that global growth remains solid, supported by high sentiment and confidence indicators, accommodative financial conditions and contained commodity prices, for both exporters and importers.

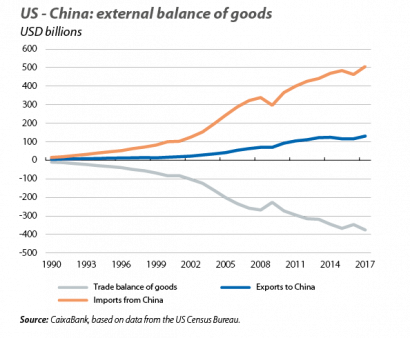

Downside risks, however, are rising. The positive dynamic in global activity coexists with significant risks related to trade and in the macrofinancial sphere. In particular, after weeks of negotiations with China, the US announced a tariff increase on Chinese imports (of around 50 billion dollars), arguing that it would reduce its hefty trade deficit with the Asian country. Moreover, the announcement provoked an escalation of declarations from both sides, with China threatening to introduce an equivalent increase in tariffs, and Trump threatening (via Twitter) to increase tariffs to 200 billion dollars. In addition, the US introduced tariffs on imports of steel and aluminium from the EU, Mexico and Canada, and Europe responded with an increase in tariffs on US imports of 3.3 billion dollars. Although all these actions only affect 1.5% of total trade flows of goods, they generate uncertainty, which could dent confidence and, therefore, global growth. On the other hand, in the macrofinancial sphere, outflows of capital from emerging markets in May highlight concerns regarding their resilience in a less accommodative financial environment. Finally, June was also marked by the European political agenda. At the European Council meeting, a common plan for managing the EU immigration crisis was agreed, which will involve greater cooperation with origin and transit countries and measures to limit the movement of immigrants within the EU. However, there were no significant changes on other fronts towards greater European integration.

US

The latest data confirm a solid pace of growth in Q2. GDP Nowcasting models of the Federal Reserves of Atlanta and New York predict a Q2 growth much higher than that of Q1 (when annualised, quarter-on-quarter growth stood at 2.0%, or at 0.5% when not annualised) and well above US potential growth (close to 2%). In this regard, over the medium term, the economy faces the challenge of coping with the fading of the cyclical factors that are supporting the economy’s current momentum, such as expansionary fiscal policy. We expect a relatively gentle slowdown, from a growth rate of 2.7% in 2018 to 2.2% in 2019 and 1.9% in 2020. However, the risk of things not panning out as expected are not negligible, particularly if we consider the low productivity growth of recent years, the negative effect of the ageing of the population and the doubts surrounding the country’s ability to boost both physical and human capital (see the Focus «US growth: the power of human capital» in this Monthly Report).

At this moment of cyclical maturity, the focus is on inflation, since unexpected price increases also pose significant risks. In May, headline inflation stood at 2.8%, 3 decimal points above the figure of the previous month. Over the next few months, we will continue to see relatively high figures due to substantial base effects (owing to a sharp drop in wireless telephone prices experienced in 2017), after which headline inflation should moderate to levels closer to 2.0%. On the other hand, core inflation, which is exempt from the most volatile price components, such as energy and food, stood at 2.2%, 1 decimal point above April’s figure. In this context, the Fed once again increased the reference rate by +25 bps, up to the range of 1.75%-2.00%.

EUROPE

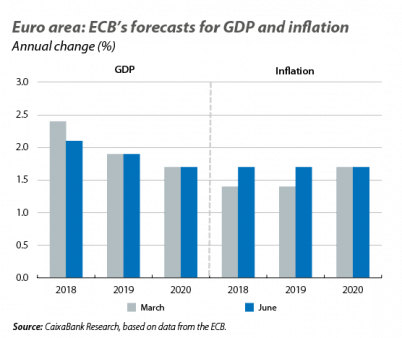

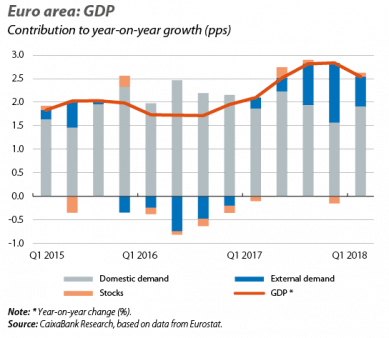

The outlook for the euro area remains positive, despite a less dynamic start to the year. The slowdown in euro area growth in Q1 was due to temporary factors (adverse weather conditions, strikes and flu episodes) and a return to more moderate rates of growth following an exceptionally positive 2017. Over the next few quarters, the economic expansion in the euro area will remain solid, with higher-than-potential growth rates, supported by very favourable financial conditions, a healthy labour market and the dynamism of global economic activity. This was the outlook reflected by the ECB in its latest macroeconomic projections quarterly update, in which it revised its growth forecasts for the euro area for 2018 down by –0.3 pp to 2.1%, but maintained its forecast for 2019 at 1.9% (a scenario that is very similar to CaixaBank Research’s).

Domestic demand remained the main driver of growth in Q1. The breakdown of the euro area’s GDP shows that Q1 growth (2.5%) was driven by a 1.9 pp contribution from domestic demand (1.6 pps in Q4 2017), supported by positive trends in both private consumption and investment. On the other hand, the contribution from external demand fell to 0.6 pps (1.3 pps in Q4), largely due to lower growth of exports of goods and services (which grew by 4.5% year-on-year, 2.1 pps less than in the previous quarter).

Economic activity indicators remain high and point towards solid growth in Q2. Specifically, the composite PMI index increased in June to 54.8 points, 7 decimal points above May’s figure and well within expansionary territory (above 50 points). Likewise, business confidence remains high. In particular, the Economic Sentiment Index (ESI) stood at 112.3 points in June, compared to an average of 110.7 in 2017. Meanwhile, retail sales rose by 1.7% year-on-year in April, 3 decimal points above the figure for the previous month. Similarly, consumer confidence is well above the2017 average (–2.5 points), despite dropping to –0.5 points in June (0.2 in May), which suggests that private consumption will remain a key factor for euro area growth.

Inflation continues to rise and stood at 2.0% in June, 1 decimal point above the figure for the previous month, due to the higher growth of the energy component (8.0% year-on-year, compared with 6.1% in May). Meanwhile, core inflation dropped slightly to 1.2%, 1 decimal point below May’s figure. On the other hand, hourly wages in the euro area grew by 1.8% year-on-year in Q1, 2 decimal points above Q4 2017 figure. Over the next few quarters, we anticipate that wages will rise at a more sustained pace, as the labour market enters into a more mature phase of the cycle. This, in turn, will help to gradually bring inflation closer to the ECB’s target rate (close to, but below, 2%).

EMERGING MARKETS

In China, the economic activity indicators show signs of a slight slowdown. Industrial production grew by 6.8% year-on-year in May – a noteworthy figure, but below analysts’ expectations. Retail sales, meanwhile, rose by just 8.5%, the lowest figure since June 2003. Despite these signs of slight deceleration, the government still has a reasonable amount of scope to encourage economic activity (for example, with a slightly more expansionary fiscal policy or by relaxing restrictions on the financial system), while it continues to try to curb the macroeconomic and financial risks which the Asian economy is suffering from.

In the meantime, Turkey is experiencing strong growth, albeit in an unsustainable manner. In Q1 2018, GDP grew by 7.4% year-on-year (similar to the 7.3% recorded in Q4 2017). The main driver of this strong growth is domestic demand, which is benefiting from the boom in private consumption and investment. However, this is an unsustainable growth path, since the economy continues to show significant macroeconomic imbalances: inflation accelerated in May and reached 12.1%, while the current account deficit exceeded 6% of GDP in Q1.