Good growth outlook for the Spanish economy in 2026

Like all forecasts, our scenario is subject to uncertainty. For this reason, we present growth intervals with their respective associated probabilities. Nevertheless, we can state with a high degree of confidence that the Spanish economy will continue to grow at a steady pace next year.

Positive assessment of 2025

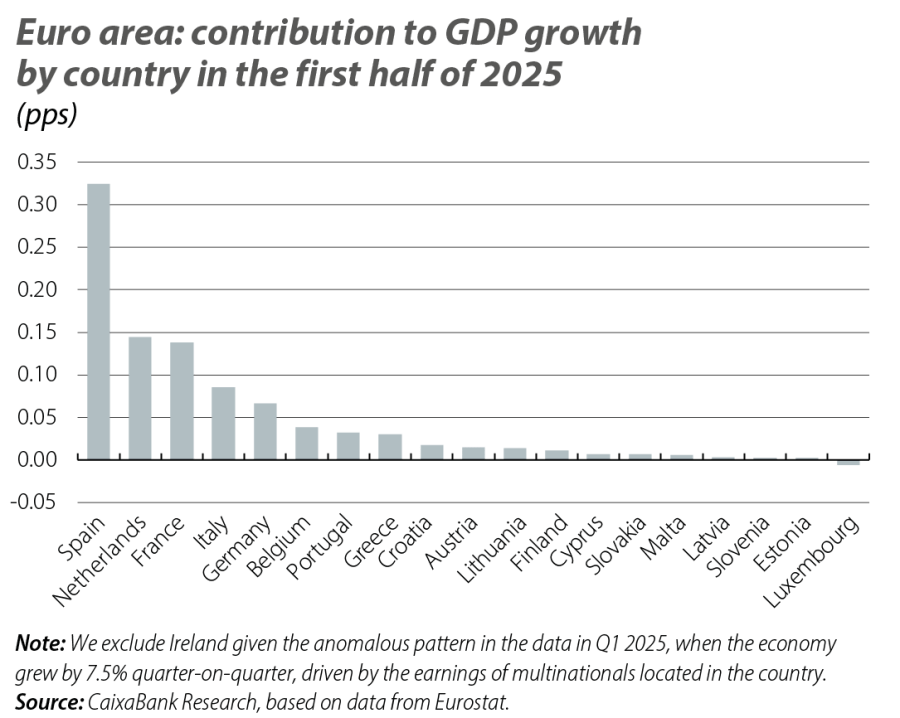

Despite 2025 being marked by global trade tensions, Spain’s economy has shown significant dynamism. It is estimated that GDP will grow by 2.9%, well above the 1.3% for the euro area as a whole, and this makes Spain the bloc’s leading economic driver, alongside Ireland (see first chart).

In 2025, the Spanish economy has completed the shift towards domestic demand as the main driver of growth, stimulated by private consumption and investment. These two components account for the entirety of the increase in GDP in 2025. According to our forecasts, the slight contribution from public consumption, of 0.3 pps, will be offset by the negative contribution from the foreign sector. This negative contribution should not be taken as a bad figure: Spanish exports have maintained a very solid growth rate – we expect them to grow by 4.2% year-on-year – supported in particular by the dynamism of non-tourism services. Exports alone in 2025 will provide 1.5 pps to annual GDP growth, although this contribution will be more than offset by the strong growth of imports, which have had to feed the surge in domestic demand. In short, 2025 is leaving the Spanish economy with strong inertia to face 2026.

2026 outlook: breaking down the growth drivers

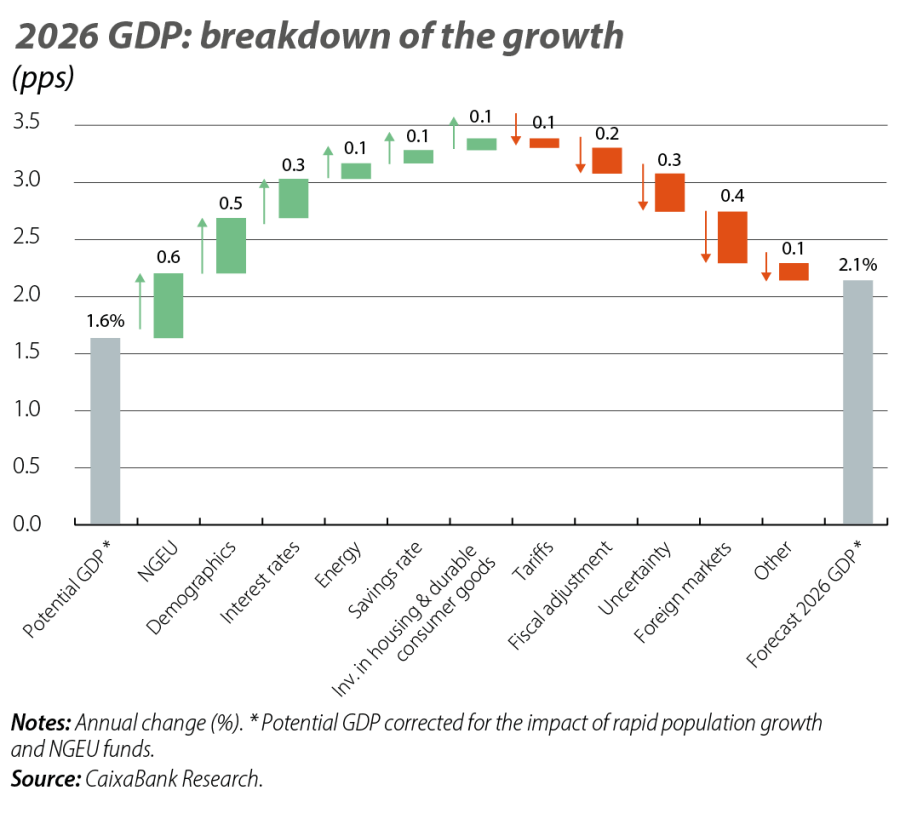

We expect Spain’s GDP to grow by 2.1% in 2026. This growth is broken down into several factors (see second chart). Our starting point is an underlying (or «potential») growth rate that is estimated at around 1.6% per year – i.e. the speed at which Spain’s GDP could grow considering the underlying trend in production – to which other factors are then added.1

- 1

In order to clean up the effect of the rapid population growth of recent years and the impact of NGEU funds, when calculating potential GDP growth we have assumed that since 2022 the population has grown in line with the average rate of 2017-2019, namely 0.3% per year, and we have also reduced the level of annual investment by the amount that is estimated to originate from NGEU funds.

On the positive side, several channels will continue to drive Spain’s economic activity:

- European Funds (NGEU): in 2026 – a key year, as all the milestones of the Recovery Plan are supposed to have been met by August – investment linked to European funds will accelerate. We expect some 17.5 billion in grants to be executed (versus ~15 billion in 2025)2 and progress to be made on projects financed with loans. This injection of funds could contribute 0.6 pps to GDP growth.

- Demographic boost: in 2026, immigration will continue to drive population growth, which is estimated at 0.8%, well above the annual rate of 0.3% prior to the pandemic. By incorporating this differential, the additional population increase is expected to translate into around 0.5 pps of GDP growth. This demographic boost will contribute to the continued strength of the labour market – we expect jobs growth of 2% in 2026.

- Reasonably accommodative financial conditions: monetary policy will remain a net support for the Spanish economy during 2026. While no further interest rate cuts are anticipated, the economy, and especially investment, will continue to benefit from the transmission of the rate cuts implemented in 2024 and 2025. This channel could contribute 0.3 pps to GDP growth, with a particular impact on investment in equipment, which is still only 6.4% pps above the pre-pandemic level, compared to 10.0% pps for GDP.

- Easing energy prices: oil and gas prices are expected to fall slightly in 2026 compared to 2025, and this would reduce costs for businesses and households, thus providing a small boost to economic growth.

- Private consumption and savings: the high growth of gross disposable income, driven by the strength of the labour market, has enabled a substantial increase in the household savings rate. We expect the savings rate to remain at around 13% of gross disposable income in 2025, while for 2026 we forecast a slight decline as a result of a reduction in uncertainty and the recent interest rate cuts. This decrease in the savings rate will help maintain the dynamism of private consumption and will boost GDP growth slightly, by 0.1 pp.

- Residential investment on the rise: housing construction will experience an expansive phase in 2025 and 2026. New construction permits are expected to increase from 128,000 in 2024 to 140,000 in 2025 and to 150,000 in 2026, responding to the high demand. Homes started in 2025 will continue to generate activity in 2026, as the construction of housing lasts more than a year, and the consumption of household-related durable goods will also grow. This channel as a whole could contribute 0.1 pp to GDP growth.3

Of course, not all factors will exert upward pressure on growth. We have also identified several headwinds that will moderate growth in 2026:

- Weakness of the external environment: the main brake will come from the foreign sector, as our export markets will grow below their historical average in 2026, still affected by the aftermath of the recent tariff conflict and the economic weakness of our main European trading partners.4 This could subtract 0.4 pps from GDP growth. In addition, the direct impact of trade barriers must be considered: the tariffs imposed by the US on its imports from Europe during 2025 will still have a negative impact on growth in 2026, subtracting approximately 0.1 pp.

- Global uncertainty and fiscal tightening: other adverse elements, although on a smaller scale, may nevertheless weigh slightly on growth. Global uncertainty – although lower than in 2025 – will continue to weigh on investment and consumption decisions. In addition, a more contractionary fiscal policy (excluding the effect of NGEU funds) is envisaged, with rising government revenues and more moderate expenditure growth, which will entail a reduction of the deficit and a slight containment of domestic demand.

Overall, we anticipate a growth rate of 2.1% in 2026 – a solid figure, albeit slightly below that of 2025. This moderation is explained by the fact that several key support factors already provided a boost to the economy in 2025. In particular, the contribution to growth provided by demographics, interest rates and the tourism sector will be similar in 2026 to in 2025. Only the contribution from NGEU funds is expected to be higher In contrast, factors such as less foreign dynamism and the transition to a more mature phase of the business cycle are now gaining prominence.

- 2

In this way, the 80 billion in transfers anticipated in the Recovery Plan would have been executed.

- 3

This calculation is the contribution to GDP growth in excess of the contribution that would result if this category were to grow at the rate marked by potential GDP growth.

- 4

The growth of our main export markets was 3.5%, in average annual terms, between 2014 and 2024. For 2026, we anticipate a growth rate of 1.9%.

Confidence intervals: quantifying uncertainty

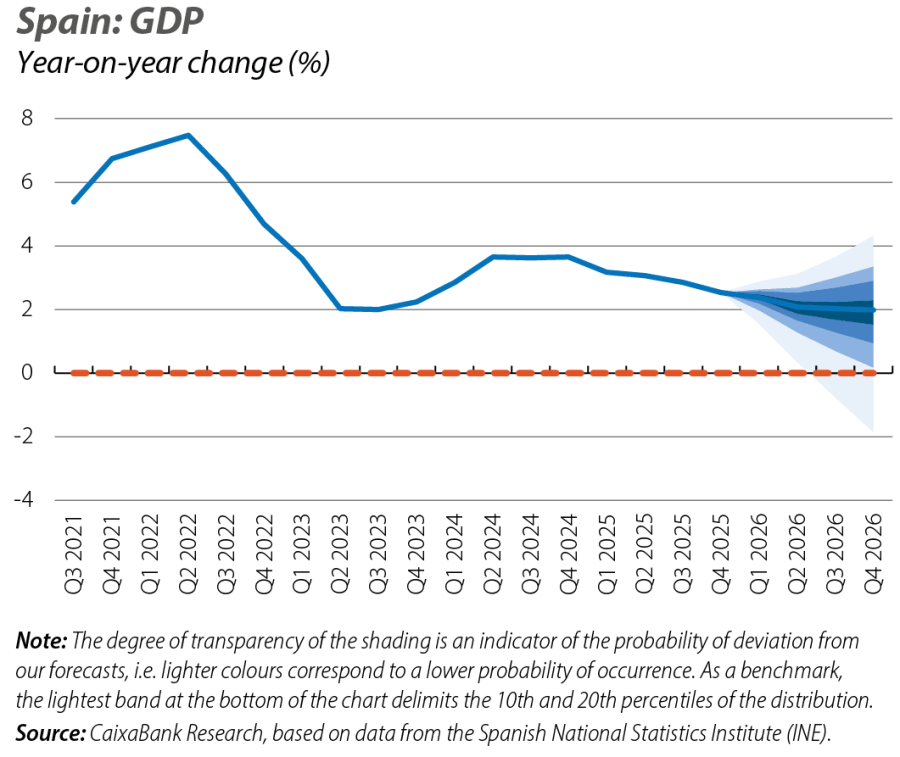

Like all forecasts, our scenario is subject to uncertainty. For this reason, we present growth intervals with their respective associated probabilities. To do so, we use the CaixaBank Research macroeconomic model for the Spanish economy.5 The third chart shows the trend in GDP growth which we expect through to Q4 2026 and possible deviations from our forecasts. According to this analysis, there is a 40% probability that annual GDP growth in 2026 will lie between 1.5% and 2.7%. With a 60% probability, which already incorporates the possibility of relatively major shocks (both negative and positive), growth is expected to be between 1.0% and 2.9%. In this way, we can state with a high degree of confidence that the Spanish economy will continue to grow at a steady pace next year.

- 5

This is a semi-structural general equilibrium model of the Spanish economy, where the short term is determined by aggregate demand, while in the long term aggregate demand and supply are equal. See (content in Spanish): https://www.caixabankresearch.com/sites/default/files/content/file/2022/12/14/34454/wp-320-modelo-semiestructural-de-caixabank-research-para-espana_0.pdf.