Spanish exports and world trade slowdown

Global trade is not growing like it used to. Between 2000 and 2007, the world trade volume grew at an average annual rate of 7.4%, faster than the 3.3% growth in global GDP. But these roles have reversed after the Great Depression, with the volume of trade growing less than GDP: 3.0% compared with 3.3% in the period 2012-2016. So far Spanish exports have not been affected by this reversal. The country has maintained a substantial growth rate (4.7% in 2000-2007 and 4.4% in 2012-2016 in volume terms), achieving a current balance of around 2.0% of GDP in 2016. As this positive balance will be hit by rising oil prices in 2017 and 2018, will there also be a faster slowdown in exports due to the deceleration in world trade? There are reasons to believe Spanish exports will continue to perform relatively well in spite of such setbacks.

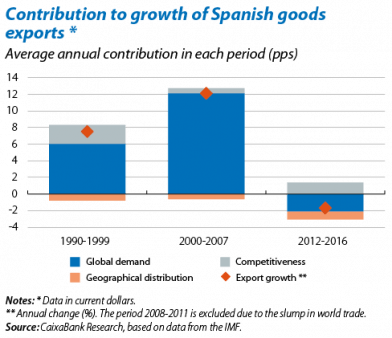

Growth in goods exports1 can essentially be affected by three factors. Firstly, global demand; secondly, the geographical composition of exports and, finally, changes in competitiveness. The first, global demand (defined as growth in global imports) is the most important in quantitative terms but is exogenous, so little can be done to rectify it. However, geographical composition and competitiveness are also important and here action can certainly be taken.

A good geographical spread consists of exporting more to those countries with the highest growth in imports. The idea is to focus the larger share of Spanish exports on those countries whose imports are growing faster than world trade.2 This geographical factor has worked against Spain in the last few years, however. In aggregate terms, it deducted 0.8 pps from the growth in exports 1990-1999, 0.6 pps in 2000-2007 and 0.9 pps in 2012-2015. This suggests that Spanish exports are concentrated in markets that are growing less than world trade.

This unfavourable composition is mostly due to Spain’s large share of exports to the euro area. These account for 50.9% of all the country’s exports, a much higher percentage than its global share (23.4%). Given the euro area’s lower growth in imports compared with the world average, it comes as no surprise that lack of geographical diversification outside the euro area is harming the performance of Spanish exports. The other obstacle is Asia’s little importance as a destination for Spanish exports: it receives 4.1% of all Spanish exports compared with 10.0% in the case of Germany and France. As emerging Asia’s long-term growth is much higher than that of the euro area, a larger share of Spanish exports to this region would have a positive effect. For instance, if the share went from the current figure of 4.1% to 10%, it would add 0.5 pps to the growth in Spanish exports.

Finally, the third component results from the difference between the growth observed in Spanish exports and the two components mentioned previously (global demand and geographical distribution). This residual figure, which reflects changes in competitiveness (the capacity to sell products at competitive prices that are in line with the trends in global demand), contributed an average of 2.3 pps to export growth between 1990 and 1999 (one third of the total). The rise in unit labour costs between 2000 and 2007 reduced this contribution by 0.6 pps. After the Great Recession, however, this trend has reversed and, in the period 2012-2016, the contribution made by this factor to export growth picked up again to 1.4 pps.

1. The rest of the article is based on nominal data (current dollars) provided by the IMF.

2. Specifically, this factor is calculated as the growth resulting from adjusting each destination country’s growth in imports by its share of total Spanish exports, less the growth in global imports.