Spain’s position in the face of global vulnerabilities in public finances

In this article we analyse key aspects of Spain’s public finances, such as the duration of its public debt and the sensitivity of the risk premium to other economies, in order to assess the extent to which the challenging global environment and the fiscal risks in the rest of Europe can impact us.

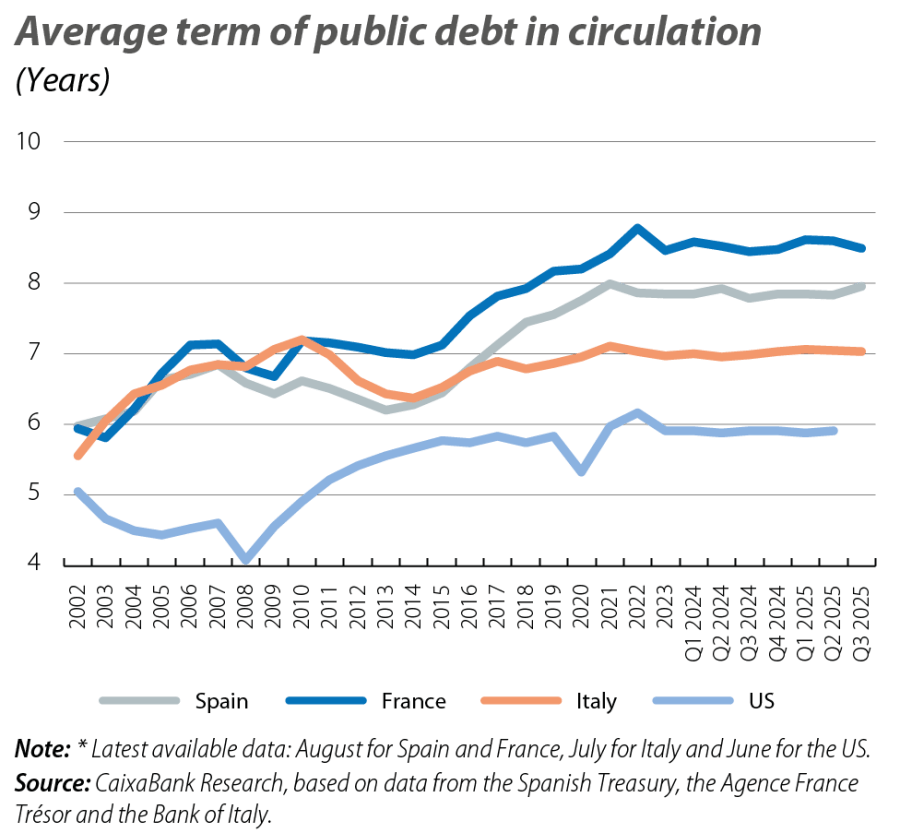

Public finances are once again in the spotlight.1 There are two main factors behind this. The first is the pressures from fiscal dominance in the US. Fiscal dominance is when a country’s stressed fiscal position can put pressure on the central bank to deviate from its price stability target and lower interest rates further than it otherwise would. By influencing interest rates, and thus the cost of debt and government deficits, any monetary policy action has fiscal consequences.2 In the US, two-thirds of the public debt in circulation currently has a maturity of less than five years. Last year, around one-third of the debt issued had a maturity of less than one year. This inclination towards short-term issues has also been observed in Canada, Germany, France and other OECD countries. Over 40% of the OECD’s more than 50 trillion in outstanding sovereign debt will need to be refinanced in the next three years.

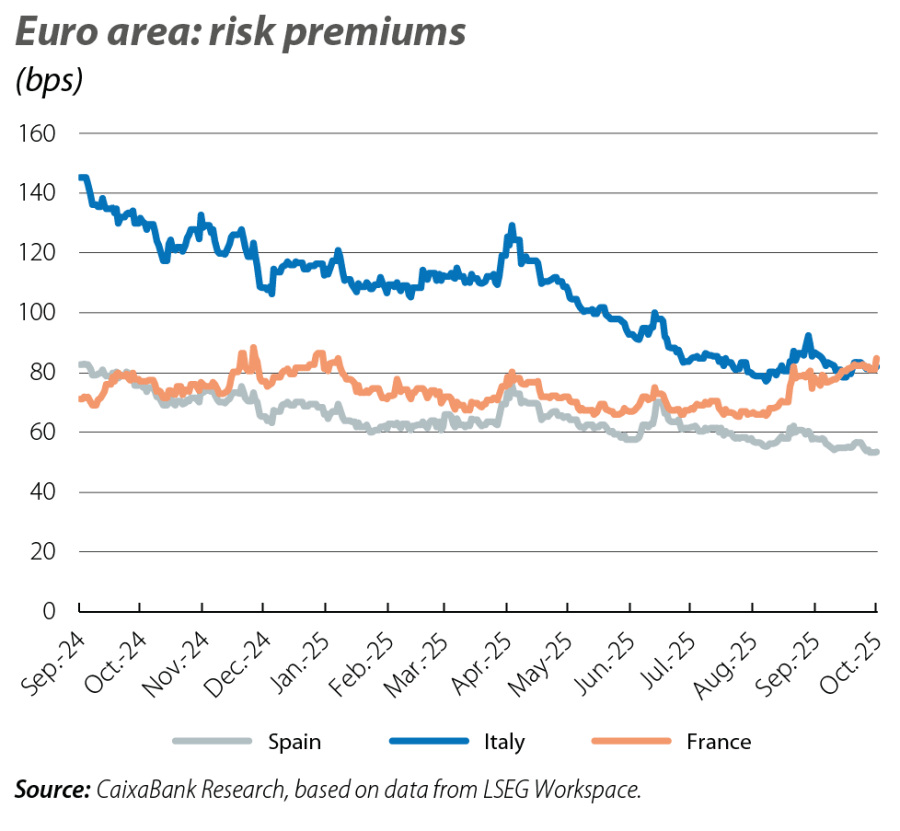

The second factor is the political uncertainty in France over the political impasse that has led to the resignation of three prime ministers in less than a year (Michel Barnier, François Bayrou and Sébastien Lecornu, although the latter has formed a new government and has remained as prime minister). In a context of large deficits and rising public debt, this instability has led to a rebound in the risk premium above 80 bps and it has driven Italy’s premium to far exceed Spain’s, which has fallen to 54 bps (around 70 bps in January). The fiscal situation in France has led to the country being downgraded by Fitch, which lowered its rating from AA– to A+ in September 2025, followed by a similar downgrade by S&P in October and a shift to negative outlook by Moody’s in late October. In contrast, in September S&P, Moody’s and Fitch have improved their credit ratings for Spain: S&P raised it from A to A+, Moody’s raised it from Baa1 to A3 and Fitch improved it from A– to A.

In this article we analyse key aspects of Spain’s public finances, such as the duration of its public debt and the sensitivity of the risk premium to other economies, in order to assess the extent to which the challenging global environment and the fiscal risks in the rest of Europe can impact us.

- 1

See the Focus «Public finances (also) in the spotlight», in the MR07/2025.

- 2

See A. Haldane (2025). «Fiscal populism’ is coming for central Banks», Financial Times, 21 July.

Public finances in Spain and France: revealing contrasts

The public finances of Spain and France show marked contrasts. Public spending in France represents 57% of GDP, some 12 points more than in the Spanish economy. France’s public debt will close the year at around 116% of GDP and has grown significantly in recent years (109.8% in 2023). In contrast, although Spain’s public debt is slightly above 100% of GDP, exceeding the level of most developed economies (75% have a lower level), it has been steadily declining from the level of 115.6% of 2021 and lies below that of several large economies such as Italy, the US and Japan. The debt ratio has declined thanks to economic dynamism – nominal GDP grew by 28.8% between 2021 and 2024 – and the reduction of the primary deficit from 4.5% of GDP in 2021 to an almost balanced position anticipated for 2025. The reduction of the deficit is explained by the rapid growth of public revenues (+27.2% between 2021 and 2024) driven by the strength of the labour market, in a context of more contained expenditure growth (+16.0% between 2021 and 2024, excluding interest and exceptional expenses associated with the floods in the Valencia province) as the measures introduced to mitigate the rise in energy prices have been gradually withdrawn. For 2025, the budget execution in Spain points to a public deficit that will be below the target of 2.8% of GDP (the deficit in 2024 was 3.2%), while in France it is expected to reach almost 5.5% of GDP.

Beyond the reduction of the deficit and debt in terms of GDP in the short term and the upward pressures on the public finances in the long term – issues that we have analysed in detail in these same pages –3 in this article we analyse other key aspects of Spain’s public finances. Beginning with the average term of the public debt in circulation, like the rest of Europe’s economies, Spain took advantage of the years dominated by quantitative expansion programmes to increase the average term of its debt until it reached around eight years. The percentage of Spanish public debt issued up until August 2025 that has a maturity of 1 year or less was 33.9%, similar to the 31.3% of a year ago. And if we calculate the average term of new issues of debt in 2025, we see a small reduction: 6.6 years compared to 7.2 years in the first eight months of 2024. Despite this slight reduction in the average term of new issues, the average term of all public debt in circulation in Spain remains fairly stable, whereas in France it has reduced slightly (see second chart).

- 3

See, for the short term, the Focus «Lower budget deficit in 2025 in Spain, but the structural challenges persist» in the MR06/2025 and, for the long term, the Focus «The impact of ageing on public finances: a major challenge for Spain and Europe» in the MR09/2025 and «Debt limits» in the MR01/2025.

Risk premium and macro fundamentals

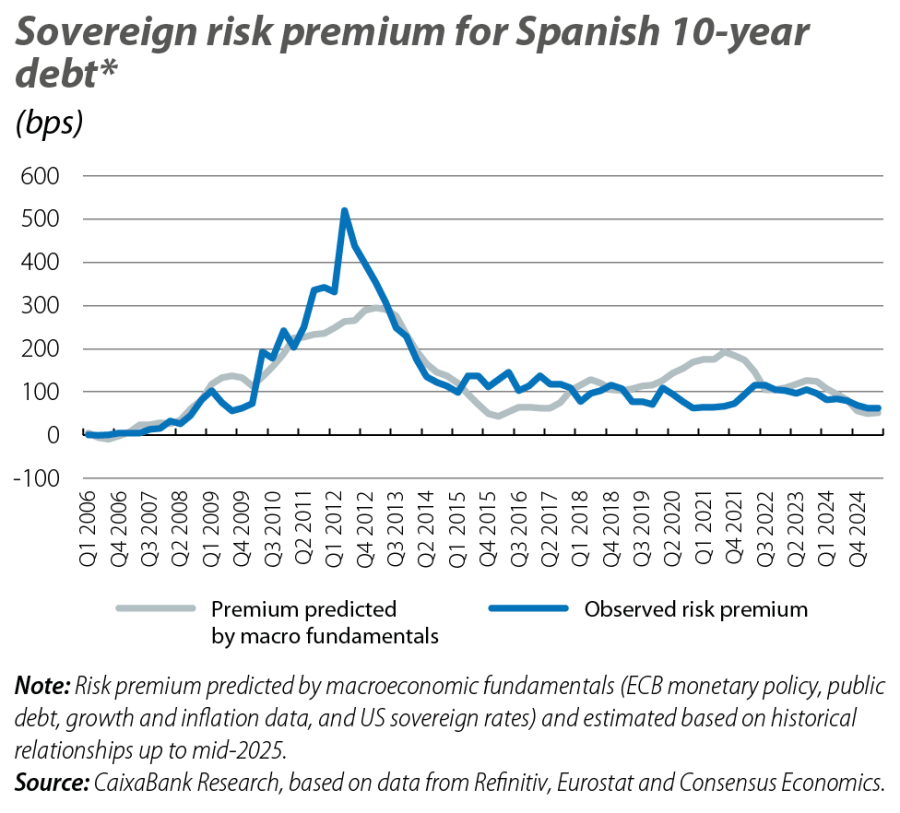

The 10-year interest rate on Spain’s public debt, and thus its spread relative to the German rate – the so-called risk premium – depends on the country’s macroeconomic fundamentals and the global environment.4 For example, Spain’s payment capacity depends on its level of indebtedness and its economic growth. Also, the situation of the European economy as a whole and its inflation determines the monetary policy that is set by the ECB, and this influences the array of interest rates across the continent. Moreover, global factors such as US interest rates also play an important role. With all these ingredients, and based on the historical relationships between them, we can estimate the risk premium that is consistent with the macroeconomic fundamentals: the so-called «macro premium».5

Macro fundamentals are usually good indicators of risk premiums in the market, although in recent years there have been moments of divergence: in 2018, with the deepening of an unconventional monetary policy from the ECB which had started in 2015 and coincided in 2020 with the COVID-19 outbreak, we saw risk premiums that were persistently lower than the macro premium. Beyond these episodes of decoupling, today Spain’s macro premium is very much aligned with the observed risk premium. In other words, the market risk premium is consistent with the macroeconomic fundamentals.

- 4

See the Focus «The macroeconomic fragility of interest rates» in the MR10/2020.

- 5

We obtain an explanatory power of around 70%.

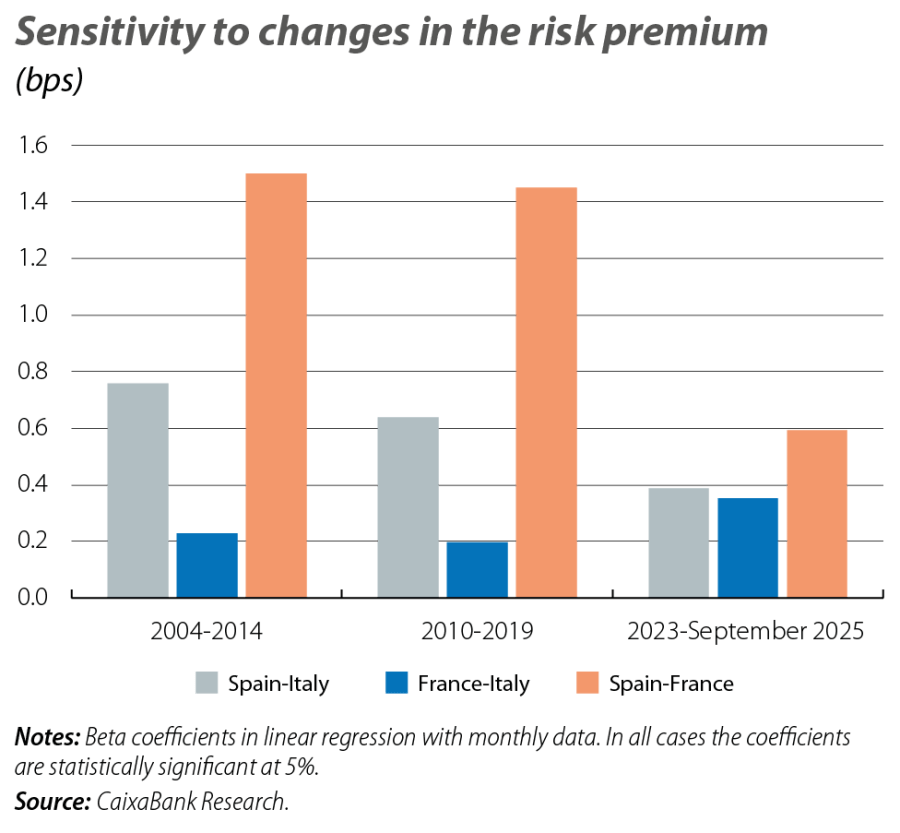

Sensitivity between premiums: reduced in the case of Spain

This alignment of Spain’s risk premium with the macroeconomic fundamentals suggests that the market now shows a lower sensitivity for Spain’s risk premium to other premiums. To test this hypothesis, we looked at the historical sensitivity of the Spanish risk premium to changes in the Italian and French premiums in different periods of time. In the fourth chart we can see that this sensitivity has decreased significantly over the last 20 years, and especially in 2023-2025, precisely when Spain’s risk premium has realigned entirely with the macro fundamentals. In contrast, there has been an increase in the sensitivity of the French risk premium to changes in the Italian one.

In short, we do not observe any clear pattern of a reduction in the average term of Spanish public debt in circulation and, in any case, the pattern is more pronounced in other countries such as France. However, in this challenging environment and with debt and deficits still at high levels, it remains important that Spain carry out a fiscal consolidation in line with the European fiscal rules. Finally, it should be recalled that the analyses in this article are based on historical data, so we do not know for certain how Spain would react to a sharper rebound in France’s risk premium if its public finances deteriorate further. That said, if necessary, the ECB has enough tools such as the TPI6 to relieve the pressure on risk premiums and mitigate the shock.

- 6

The Transmission Protection Instrument can be used by the ECB to purchase public debt from a country whose risk premium has strayed far from the level justified by its macro fundamentals. This offers some protection against the risks of unjustified contagion.