Business turnover, a structural challenge for Spain’s catering sector

Since the end of the pandemic, the catering industry in Spain has enjoyed a rapid recovery, supported by the dynamism of tourism and the normalisation of consumption. Revenues have grown and employment has reached historic highs, consolidating its role as one of the pillars of the services sector. Yes despite this strong performance, the sector still faces a challenge: its high business turnover, which limits the stability and maturity of the productive fabric.

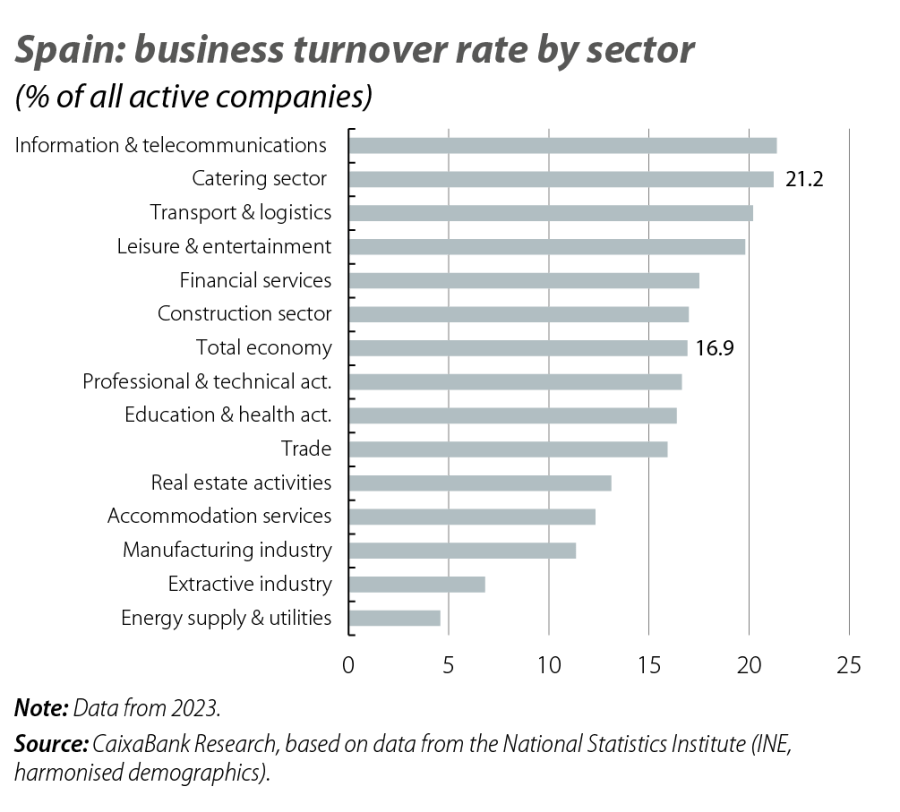

Business turnover in the sector systematically exceeds the average of the economy and surpasses 20% of all active companies.1 The sector is also particularly young: one in every four active companies is one year old or less, while the proportion of those that have existed for 20 years or more is well below average. On balance, although a certain degree of turnover is inherent in the activity of a sector like catering, its intensity calls into question the ability of businesses to consolidate their position, grow and improve their productivity.

- 1

The business turnover rate is defined as the percentage of companies that have registered or de-registered in a given period relative to the total number of active companies. It is an indicator of the degree of renewal or churn in the business fabric.

Why is business turnover so high?

The characteristics of the sector help to explain it. Firstly, it has low barriers to entry. The initial investment is relatively limited compared to other sectors, which facilitates the creation of new businesses but also increases the likelihood that many of them will not manage to become established.

Secondly, Spain has a high density of catering establishments per inhabitant (5.4 per 1,000 inhabitants), especially in tourist regions. This high concentration intensifies competition, puts pressure on margins and makes it difficult for less efficient establishments to survive. Moreover, tourist regions are often more exposed to volatile and seasonal demand, which contributes to higher turnover rates.

Business size is another key factor. The sector is dominated by small enterprises, which experience turnover rates of close to 30%, well above the sector average. As the number of workers increases, the turnover rate decreases sharply, even falling below the average of the economy as a whole in the case of larger firms. All this suggests that size provides stability, as it gives companies greater financial capacity, a more solid organisational structure and greater resilience to adverse disturbances.

The legal form is also relevant. Businesses in the sector are typically managed by individuals, but these types of businesses exhibit a higher turnover rate than those operated by legal entities (23% versus 17%, respectively), indicating that the latter have a greater degree of professionalism and a more structured management approach.

In addition to the aforementioned factors, there are others that affect the entire sector, such as high staff turnover, the difficulty in attracting and retaining qualified staff, and the rise in operating costs, which cannot always be passed on to sale prices without losing customers.

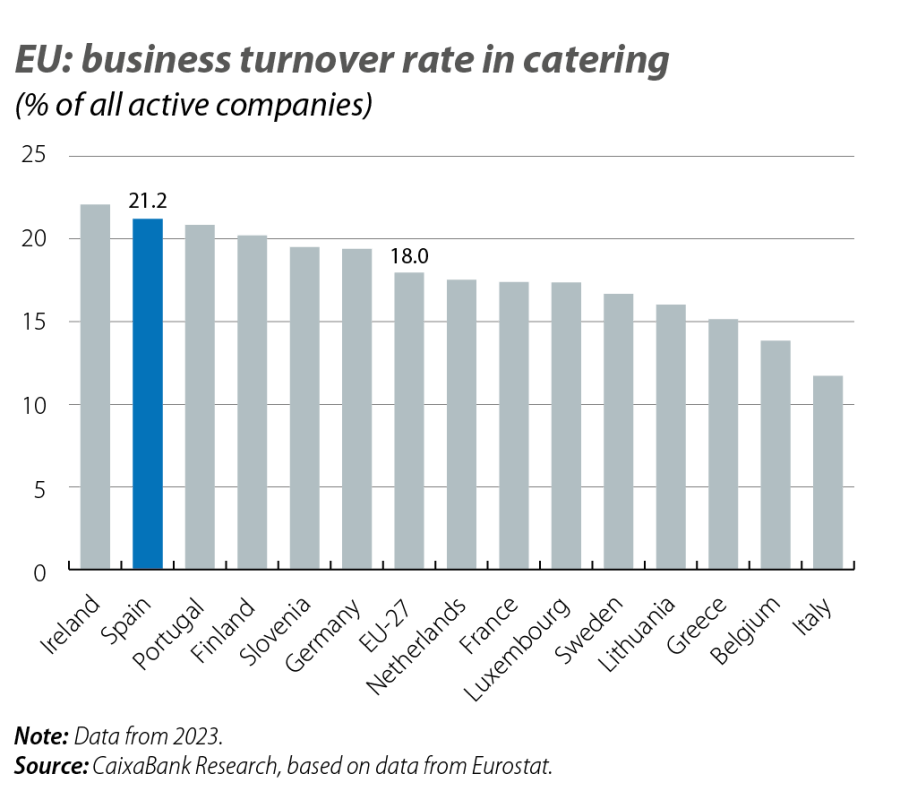

A comparison with Europe

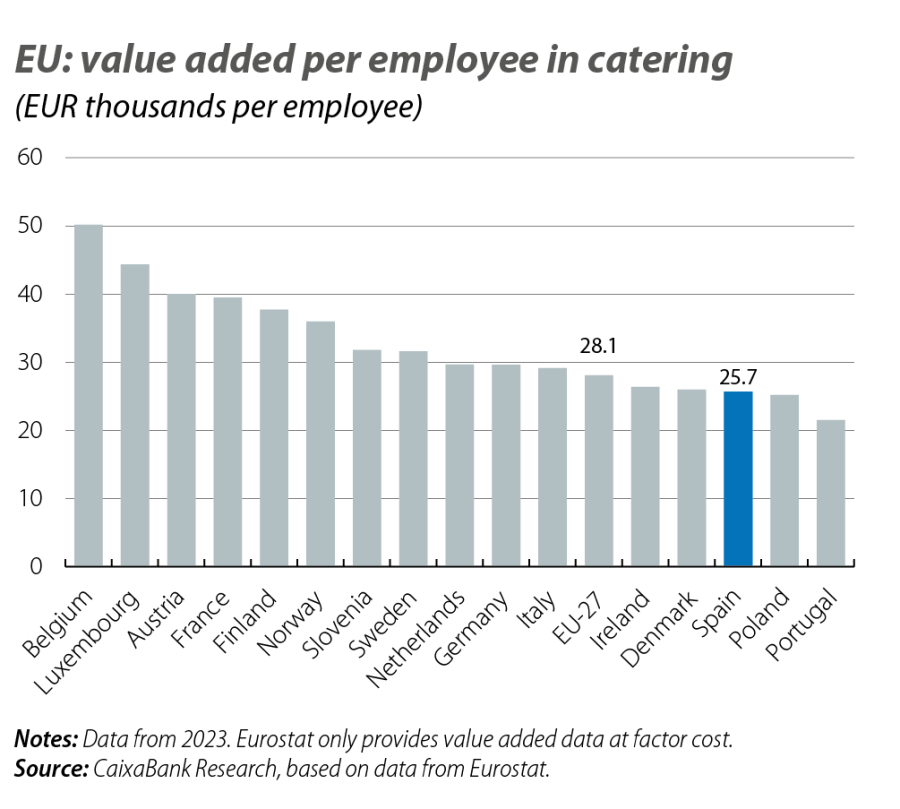

Spain’s catering industry plays a significantly larger role in the economy compared to the EU average, both in terms of the number of businesses and in revenues. Also, the sector’s productivity, measured by value added per worker, compares favourably with the euro area average relative to other sectors of our economy: while the productivity of Spain’s economy as a whole is 15% lower than the euro area average, the catering sector is only 8.5% below. Nevertheless, the sector still has room for improvement.

Compared to France, Germany or Italy, the Spanish sector is more fragmented: micro-enterprises predominate and there is a smaller proportion of larger companies, many of which are owned by individuals. This structure is associated with higher turnover rates and lower productivity. In many European economies, the sector consists of fewer but larger firms, with lower turnover and a greater capacity to generate revenues.

Growth, professionalism and efficiency gains

Ultimately, high business turnover is one of the main structural challenges of the Spanish catering industry. Although the sector’s buoyancy is a strength, excessive business turnover limits business’ ability to consolidate their position, hinders productivity gains and increases vulnerability to changes in the economic environment.

To reduce turnover, new business ventures must be undertaken with a more logical business approach, developing business plans to ensure greater success. It is also necessary to foster an environment in which viable businesses can grow and achieve efficiency gains. Progressing towards a business fabric that is composed of larger, better-managed and more adaptable firms is key to ensuring more sustainable growth. Furthermore, improving training and talent retention and adapting business models to seasonality will help strengthen the sector’s resilience. In this way, Spain’s catering sector will be able to ensure a more solid development path in the medium and long term.