The Spanish economy faces 2026 with optimism

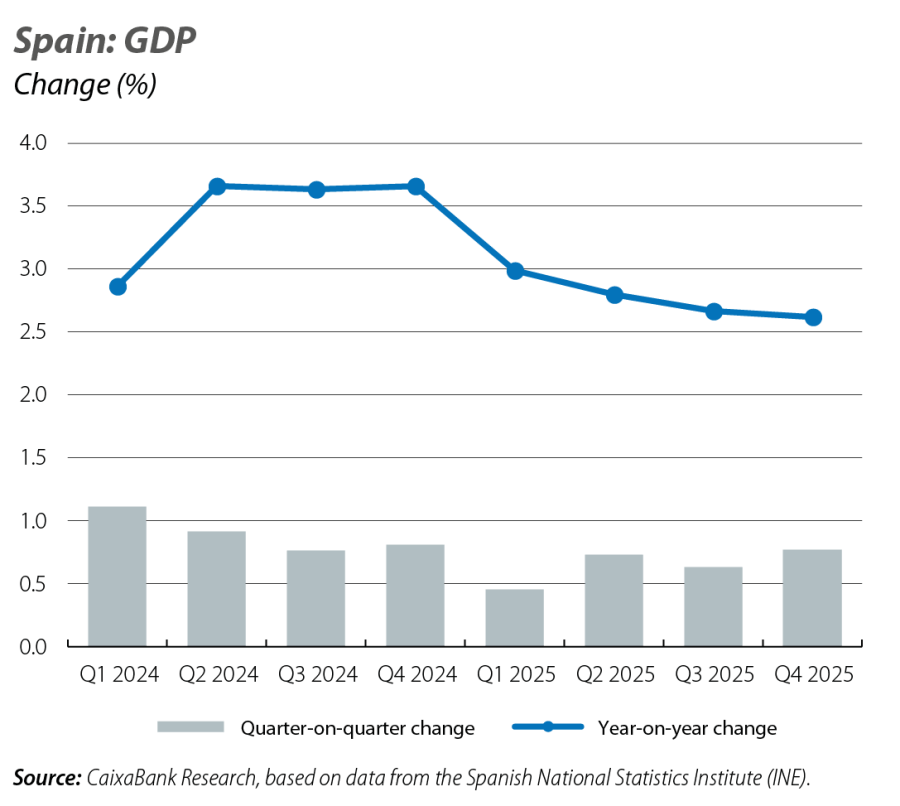

The Spanish economy successfully navigated the trade and geopolitical tensions affecting the global environment in 2025, achieving growth of 2.8%. This figure clearly surpasses both our forecast at the start of year, which was 2.3%, and the euro area’s growth, which stood at 1.5%. This GDP growth was driven by the momentum of domestic demand, which offset the deterioration of external demand resulting from the surge in imports.

Despite the difficulties, activity and employment remain highly buoyant

The Spanish economy successfully navigated the trade and geopolitical tensions affecting the global environment in 2025, achieving growth of 2.8%. This figure clearly surpasses both our forecast at the start of year, which was 2.3%, and the euro area’s growth, which stood at 1.5%. This GDP growth was driven by the momentum of domestic demand, which offset the deterioration of external demand resulting from the surge in imports.

For this year, we expect the economy to maintain its dynamism, with growth exceeding the euro area average, despite the ongoing geopolitical uncertainty. Domestic demand will remain the main driver of growth, supported by an increase in private consumption and investment, which will benefit from still favourable financial conditions. Consumption will also be supported by the improvement in disposable income – in a context of significant job creation, wage growth and high migratory flows – and the solid financial position of households, with a savings rate that will continue to normalise from the current high levels. In the case of investment, the support factors will include the implementation of NGEU funds, along with the strength of construction and the boom in investment in new technologies and intangible assets.

Spain’s GDP beats expectations in the final stretch of 2025

GDP grew by 0.8% quarter-on-quarter in Q4 2025, above the 0.6% recorded in Q3, while the year-on-year rate stood at 2.6%, just 0.1 pp less than in the previous quarter. The latest GDP data, which are better than initially expected, mean a higher starting point for 2026 and create a carry-over effect that will lead us to revise upwards our growth forecast for this year, currently at 2.1%.

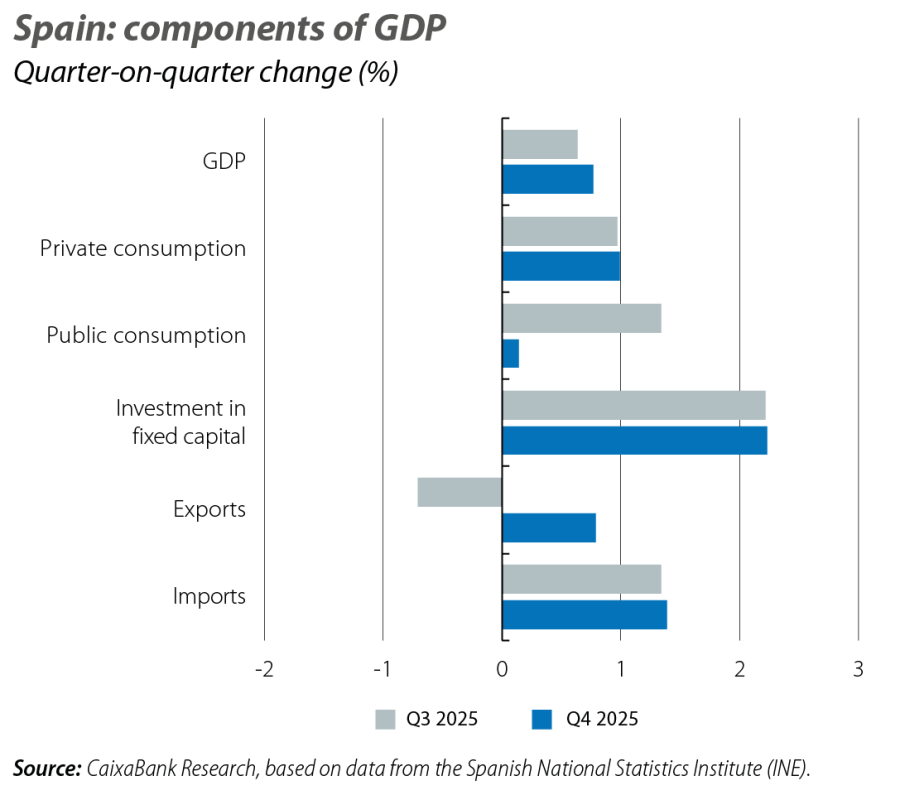

Domestic demand was the main driver of the economy in Q4 2025, contributing 1.0 pp to quarter-on-quarter GDP growth: private consumption grew by 1.0% and investment by 2.2%, particularly in construction (both residential and non-residential) and, above all, in transport equipment. In contrast, foreign demand subtracted 0.2 pps from quarter-on-quarter growth due to the greater dynamism of imports, which, driven by the momentum of domestic demand, grew by 1.4%, compared to the 0.8% recorded by exports. In the case of the latter, the strength of services exports contrasts with the stagnation of goods exports, affected by tariffs and the weakness of our euro area partners.

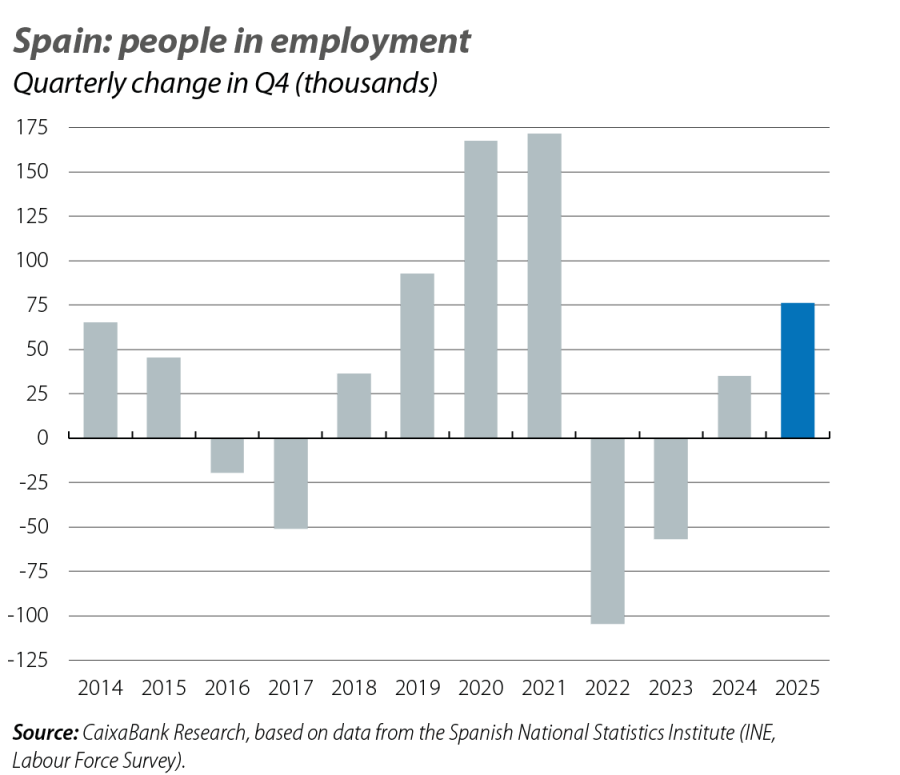

The labour market ended 2025 in a position of strength

According to the Q4 2025 LFS, the number of people in employment increased by 76,200, marking the best Q4 figure in four years and significantly surpassing the 2024 levels (34,900) as well as the 2014-2019 average (28,300). Moreover, in seasonally adjusted terms, growth stood at 0.9% quarter-on-quarter (0.5% in the prior quarter), the strongest since Q2 2023. The unemployment rate, meanwhile, fell by 0.6 percentage points to 9.9%, marking the first time since 2008 that it has dropped below 10%. In this way, 2025 ended with 605,400 more people in employment (+2.8% year-on-year), reaching a new record of 22.46 million, and 118,400 fewer unemployed (–4.6%).

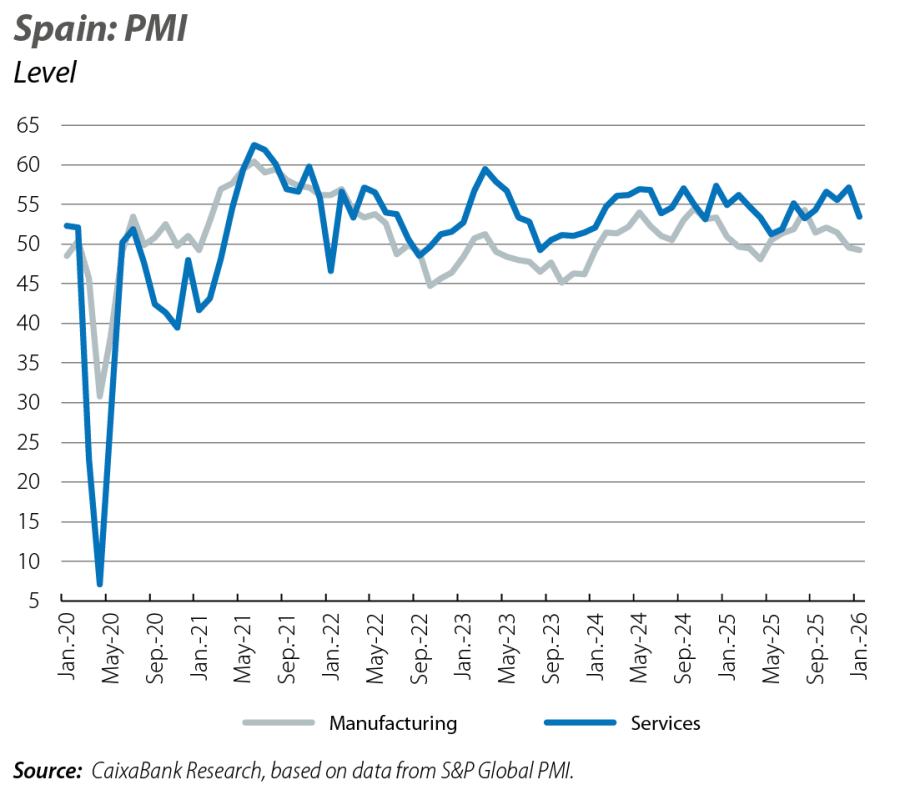

The first available activity indicators for 2026 point to a containment in growth

Firstly, as is commonplace in January, Social Security affiliation fell by 270,782 workers (–1.2%), a slightly sharper decline than in the same month of previous years (–1.1% on average in 2023-2025), while in seasonally adjusted terms it recorded an increase of 17,311 people, compared to a monthly average of 42,875 in Q4 2025. On the supply side, the January PMIs suggest a moderation in growth: in the case of the services sector, it remains in expansionary territory, above 50 points, but slipped to 53.5 points from 57.1 points in December. As for the manufacturing index, it stands at 49.2 points, slightly below the previous figure (49.6). On the consumption side, the CaixaBank Research Consumption Tracker shows a slowdown in Spanish card activity in January, with a year-on-year growth rate (up to the 21st) of 3.4%, compared to 5.5% in December.

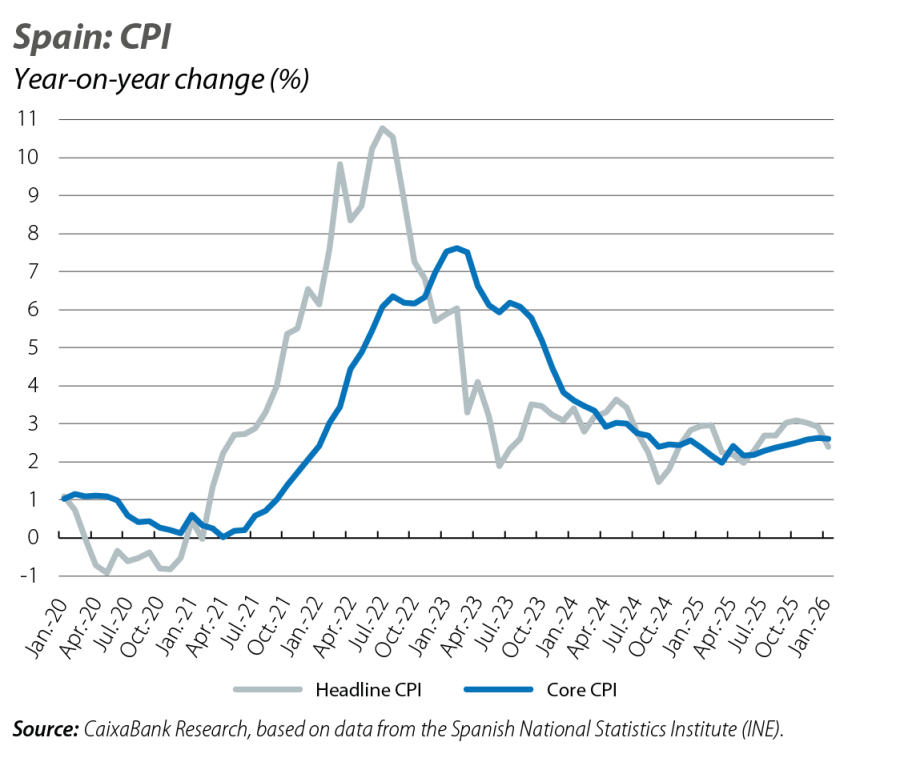

Inflation starts the year with a sharp slowdown, thanks to energy

According to the flash estimate published by the National Statistics Institute (INE), in January headline inflation continued its moderation of previous months and decreased by 0.5 percentage points to 2.4%, the lowest rate since June 2025. Meanwhile, core inflation (which excludes energy and unprocessed food) remained at 2.6%. The decline in headline inflation is mainly explained by electricity prices. This January, the VAT base effect disappeared: in 2025, electricity was subject to 21% VAT, compared to 10% in 2024. Now, when we compare two months with the same VAT rate of 21%, this effect fades, pushing inflation down. Despite this path of moderation, the persistence shown by the services component leads us to anticipate that inflation in 2026 will still remain slightly above the 2% target.

Initial signs of stabilisation in housing demand

Sales transactions grew again in November (7.8% year-on-year), although they have maintained a modest tone since August, far from the double-digit rates recorded in the first half of the year. In any case, the level of activity in 2025 remains very high, with 660,000 sales transactions completed between January and November, representing a 12% year-on-year increase. However, the supply of new housing remains far from meeting this strong demand: in the same period, 127,400 new builds were approved, 7.4% more than in the same period of the previous year but insufficient to absorb the creation of new households (220,000 in the trailing four quarters to Q3 2025). This mismatch between supply and demand will continue to exert upward pressure on house prices in the short and medium term.

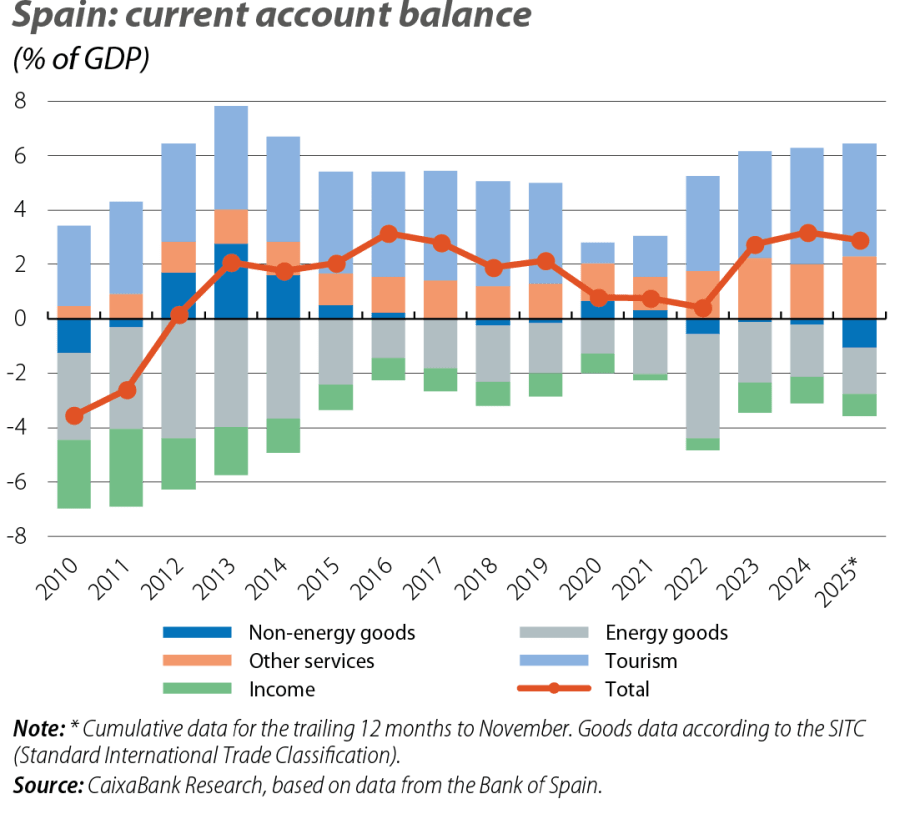

The current account surplus remains at high levels thanks to services

The current account balance in 2025, with 12-month cumulative data up to November, showed a surplus of 2.9% of GDP, slightly below the record high of 2024 (3.2%). On one hand, the trade deficit increased to 2.8% of GDP (2.1% in 2024), due to the deterioration of the balance of non-energy goods in a context of strong import growth to satisfy the burgeoning domestic demand. Conversely, the services balance continues to record high surpluses, both for non-tourism services (2.3% of GDP vs. 2.0% in 2024) and for tourism (4.2% of GDP vs. 4.3%).