Treasury funding needs in 2026: high but manageable thanks to strong demand

Spain is facing 2026 with funding needs that remain high, albeit in a relatively more favourable fiscal context than its main European peers. Despite the reduction of the deficit and public debt as a percentage of GDP, the high nominal levels and a volume of maturities similar to that of 2025 mean that funding needs remain at levels comparable to those of recent years. In this context, the strength of demand for public debt – especially among non-resident investors – allows us to anticipate an orderly absorption of the issuance volume.

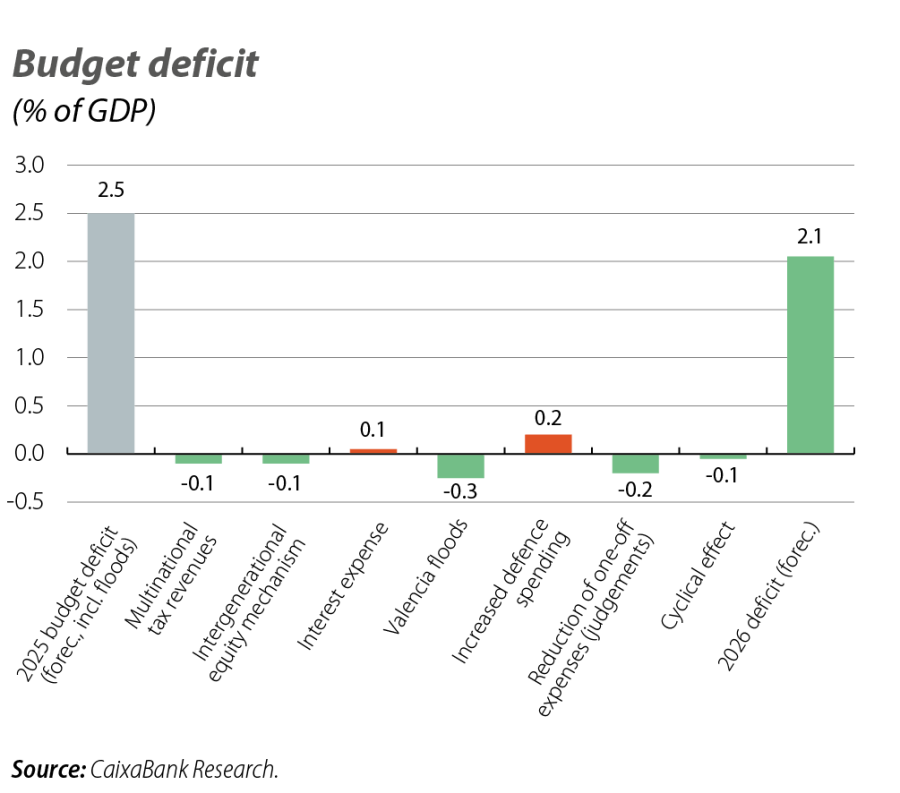

We anticipate that the public deficit will fall from 2.5% of GDP in 2025 to 2.1% in 2026,1 thanks, among other factors, to the reduction of exceptional expenses – such as aid for the Valencia floods and judicial payments (both concepts will represent around 0.5% of GDP in 2025)2 – and economic dynamism, although the increase in defence spending will partially offset these factors. In this way, Spain will be in a better fiscal position than France (fiscal deficit of 4.9% of GDP in 2026 according to the European Commission) or Italy (2.8%).

Public revenues are expected to grow by more than 5% year-on-year,3 slightly above nominal GDP, while the growth of net computable expenditure4 is anticipated to be slightly above 4.0%, exceeding the 3.7% target agreed with the European Commission. According to the Commission’s own estimates, this would entail a deviation amounting to 0.3% of GDP, placing it at the limit of what is tolerated, so it would not constitute a formal breach of the agreed fiscal path nor would it trigger the activation of any formal early warning.5

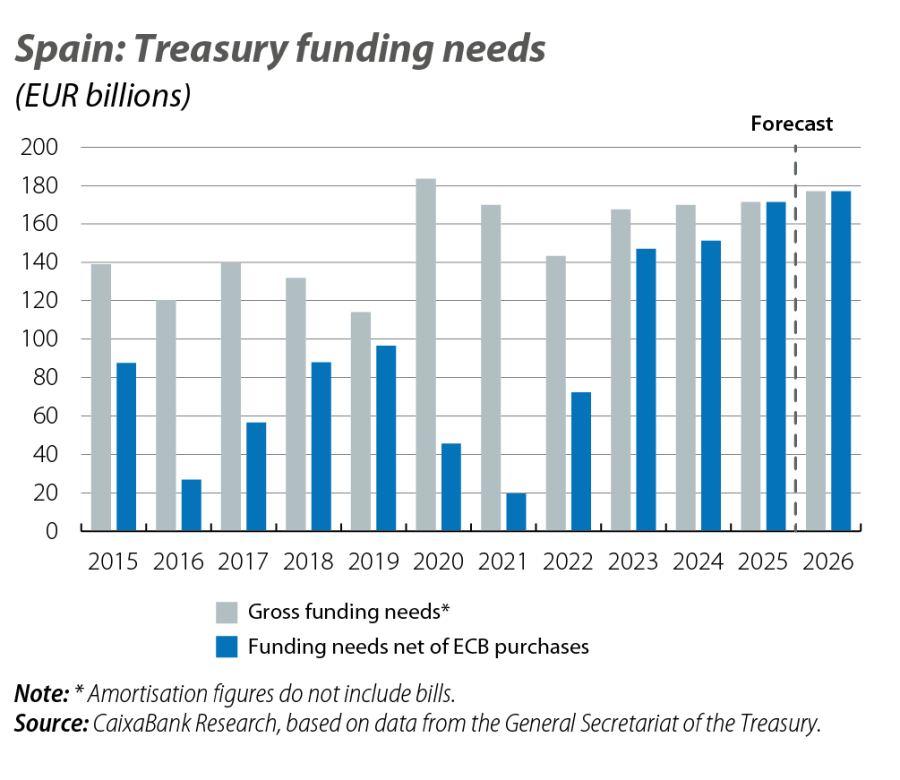

Although the public deficit will continue to decrease, the Treasury’s funding needs will remain relatively high and in line with those of 2025. In particular, in 2026, the Treasury forecasts a net issuance of 55 billion euros, to be funded mainly through medium- and long-term instruments, accounting for 50 billion, with Treasury Bills making up the remaining 5 billion. This figure is very similar to the almost 54.8 billion of 2025 and the slightly more than 55.0 billion of 2024, although it is 10 billion lower than that of 2023. The gross issuance of medium and long-term debt, which is the sum of redemptions and the net issuance, will be just over 176.5 billion euros, 5.6 billion more than in 2025, and will include a planned ESM redemption of just over 3.6 billion euros.

- 3

See the «Report on the drafts budgets and main budgetary lines of the General Government for 2026», published in November by AIReF.

- 4

Net computable expenditure, which is relevant for the European fiscal rules, includes public expenditure net of interest expenses, discretionary measures related to income, expenditure on EU programmes fully offset by income from EU funds, national expenditure on the co-financing of EU-funded programmes, cyclical elements of expenditure on unemployment benefits, and one-off and other temporary measures. Moreover, it does not include the expenses associated with the floods in the Valencia province.

- 5

Under the new European fiscal framework, the activation of more stringent corrective mechanisms does not depend on temporary or one-off deviations, but rather on their persistence and accumulation over time. In particular, the rules focus on identifying sustained breaches of the agreed spending path, assessed through the use of a cumulative control account, as well as the absence of credible corrective measures. In this way, a one-off deviation can lead to an early warning, but what is relevant for escalating the procedure is its persistence and lack of correction. In cumulative terms, the control account – considering deviations for the period 2024-2026 – would show a deviation of 0.2% of GDP in 2026, well below the maximum threshold of 0.6%. This result is favoured by the fact that in 2024 the growth of net primary expenditure was well below the target, with a margin of around 0.4% of GDP.

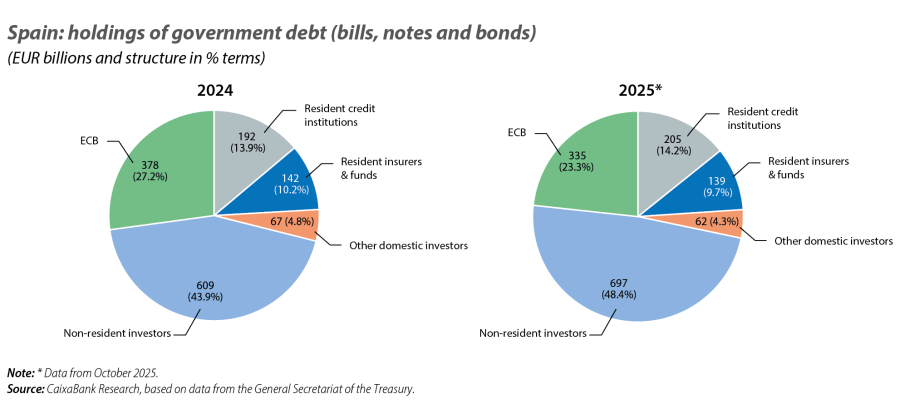

International support and the strength of demand will be decisive. The ECB will continue not reinvesting maturities, which underscores the importance of the attractiveness of Spanish debt in a context of higher rates than in 2016-2022. The reduced role of the ECB is being more than offset by non-residents; in the first 10 months of 2025, non-resident investors increased their holdings of notes and bonds (excluding bills) by 74.3 billion euros, well above the historical average (average annual increase in their holdings of +19.2 billion euros during the period 2003-2023), raising their share of medium/long-term public debt holdings to 48.9%, compared to 44.9% at the end of 2024. Meanwhile, domestic retail investors reduced their positions in Treasury Bills by 5.8 billion relative to the end of 2024. This trend is consistent with the rate cuts implemented by the ECB (although their holdings are 18 billion higher than they were at the end of 2022, in the lead-up to the rate hikes implemented following the energy shock), although it is more than offset by an 11-billion increase in purchases of bills by non-residents. Overall, domestic investors hold 28.3% of the public debt in circulation, a figure slightly below the 28.9% at the end of 2024, but higher than the 26.3% of 2022.

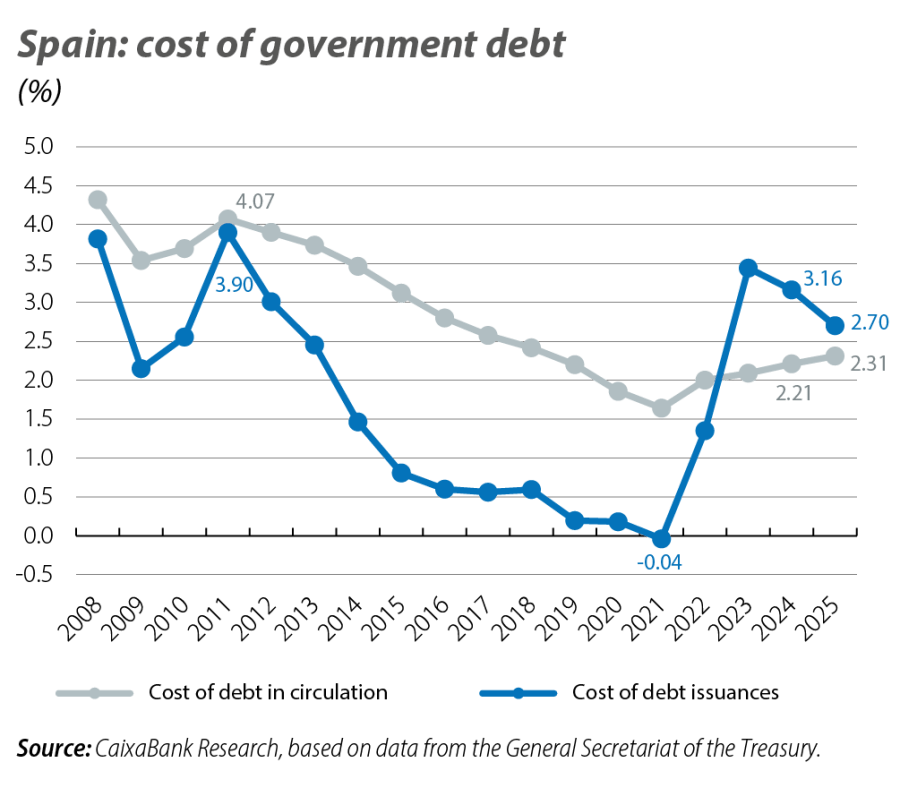

The average cost of new debt issued by the state in 2025 stood at 2.70%, a reduction of 46 bps compared to 2024, consistent with the decline in interest rates. The average cost of the debt in circulation, meanwhile, remained contained and ended 2025 at 2.31%, just 10 bps above the 2024 level. This level, however, remains above the all-time low reached in 2021 (1.64%) and reflects a key phenomenon: although issuance rates have fallen compared to 2024, they remain above the average cumulative cost, leading to a gradual increase in that average cost. The average life remains stable at around eight years, with maturities well distributed and low refinancing risk (13% within one year).6 Finally, we estimate that the total interest payments of the general government as a whole, considering market expectations, could reach 2.5% of GDP in 2026, 0.1 percentage point more than in 2025, although well below the 2014 level (3.5% of GDP). This slight increase is explained by the renewal of the stock of debt: older issuances with lower rates than the current ones are being amortised.

- 6

See AIReF’s December 2025 «Public Debt Monitor».

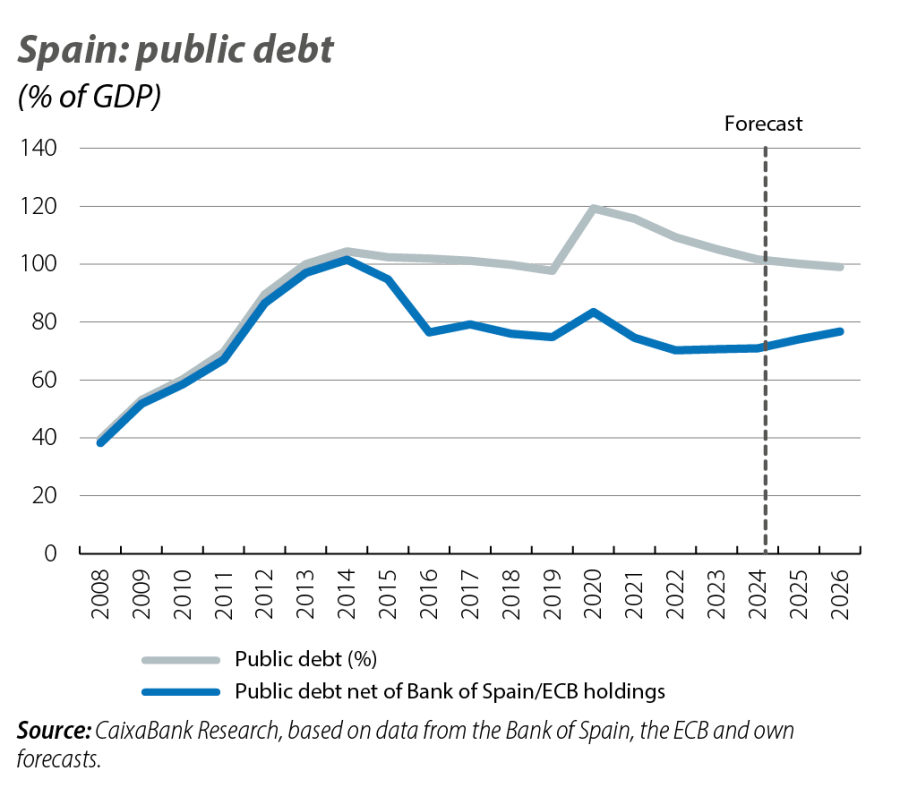

Regarding the stock of public debt, we anticipate that public debt will stand at around 99% of GDP by the end of this year, still more than 1 point above the 2019 level. We estimate that 22.5% of the total will be held by the ECB, leaving 77.5% of the total in the hands of other investors. Thus, the net debt of central bank holdings will be around 76.7% of GDP, compared to much higher levels in the past, such as 101.6% in 2014.

In conclusion, Spain is facing 2026 with high funding needs, but these are fully manageable in the current market environment, supported by a solid investor base. However, beyond the short term, the main challenge lies in the credibility of the medium-term fiscal path. The structural increase in public spending – especially on defence and that associated with ageing – and the full implementation of the new European fiscal rules require a credible, gradual and sustained fiscal consolidation strategy in order to ensure the stability of the public finances beyond 2026.7

- 7

See footnote 3.