Risk premiums and macroeconomics: a robust and cross-cutting relationship

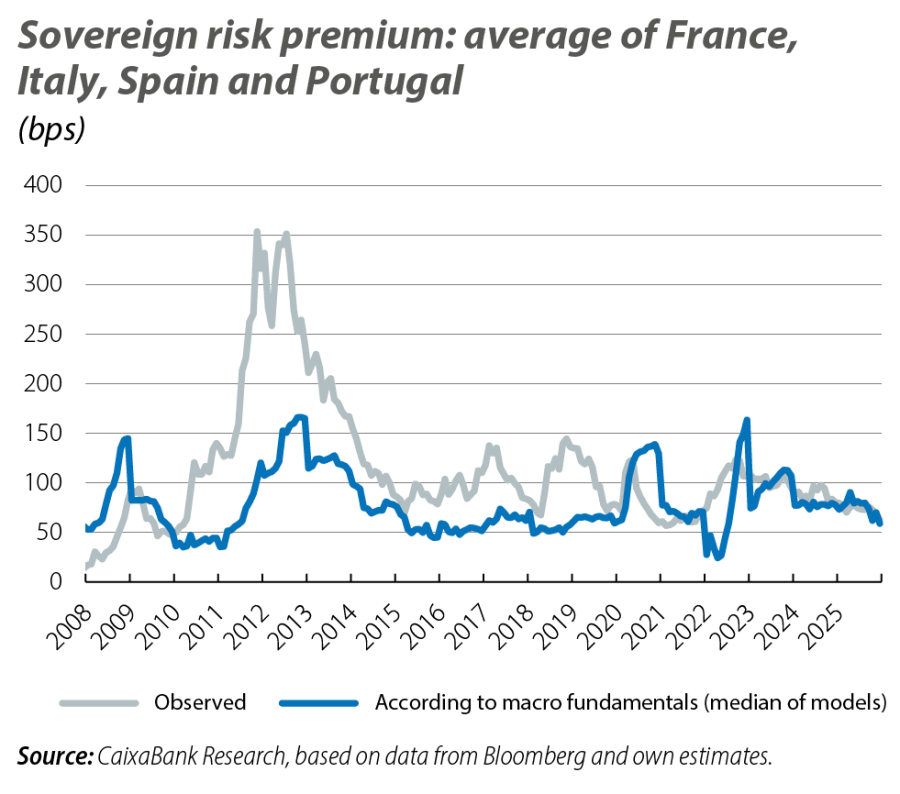

Macro fundamentals have closely aligned with observed sovereign risk premiums in recent years. In fact, the sustained moderation of the main euro area risk premiums clearly aligns with what is predicted by the fundamentals. However, a country‑by‑country analysis reveals a more nuanced picture.

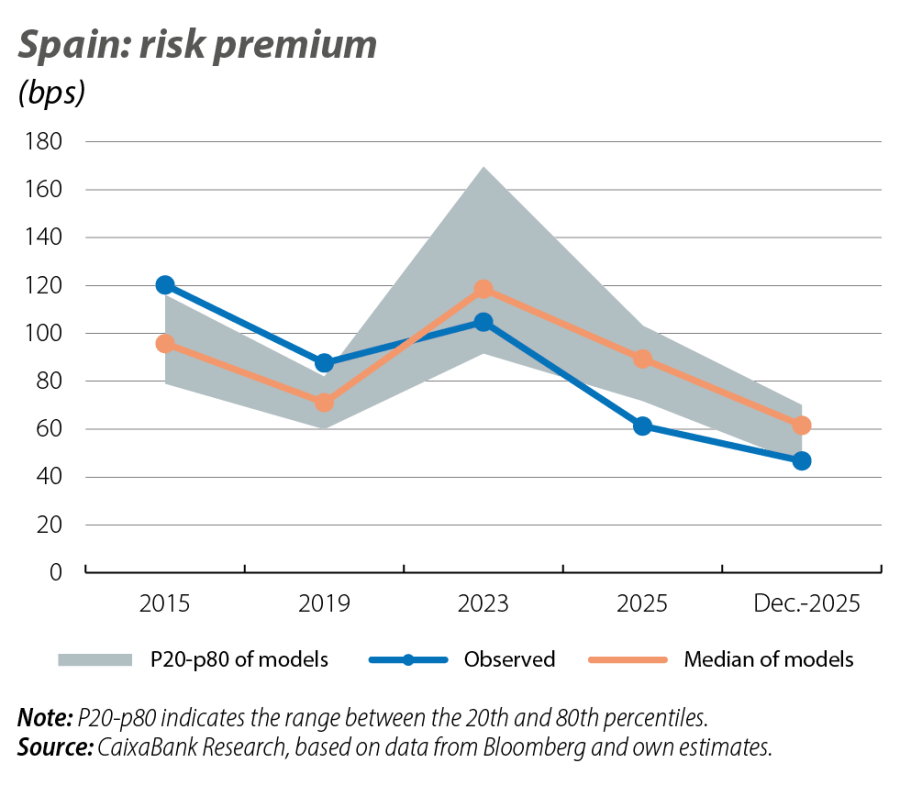

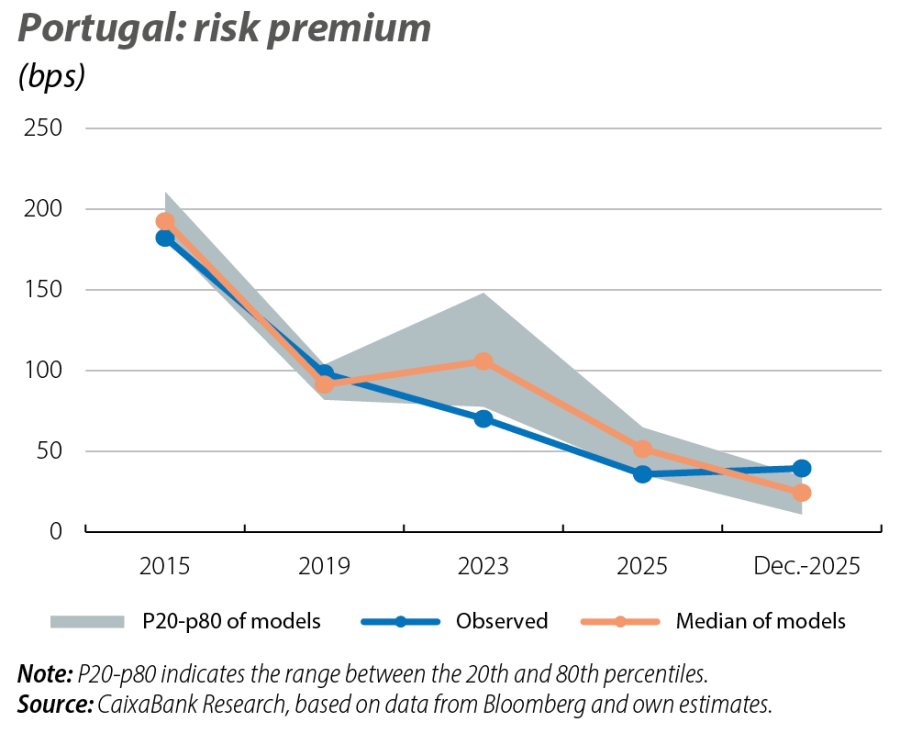

Risk premiums defined an economic and political era of the euro area.1 Stressed to extreme levels between 2011 and 2013, they became an indicator of the risk of a break-up of the monetary union and gave rise to pivotal events such as Mario Draghi’s Whatever it takes speech.2 In recent years, the economic and political landscape has not been easy for the euro area either, yet risk premiums managed to close 2025 at their lowest levels in over 15 years: Portugal, Spain and Italy, which in 2012 – when the German rate was around 1.5% – saw their spreads exceed 1,500 bps, 600 bps and 500 bps, respectively, ended 2025 at 30 bps, 43 bps and 70 bps.

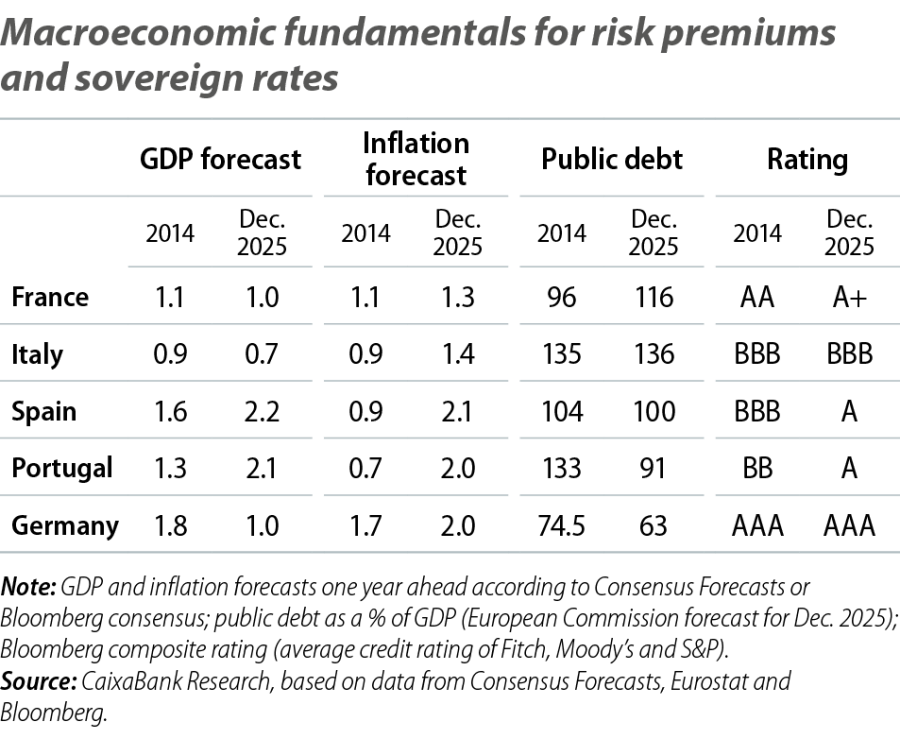

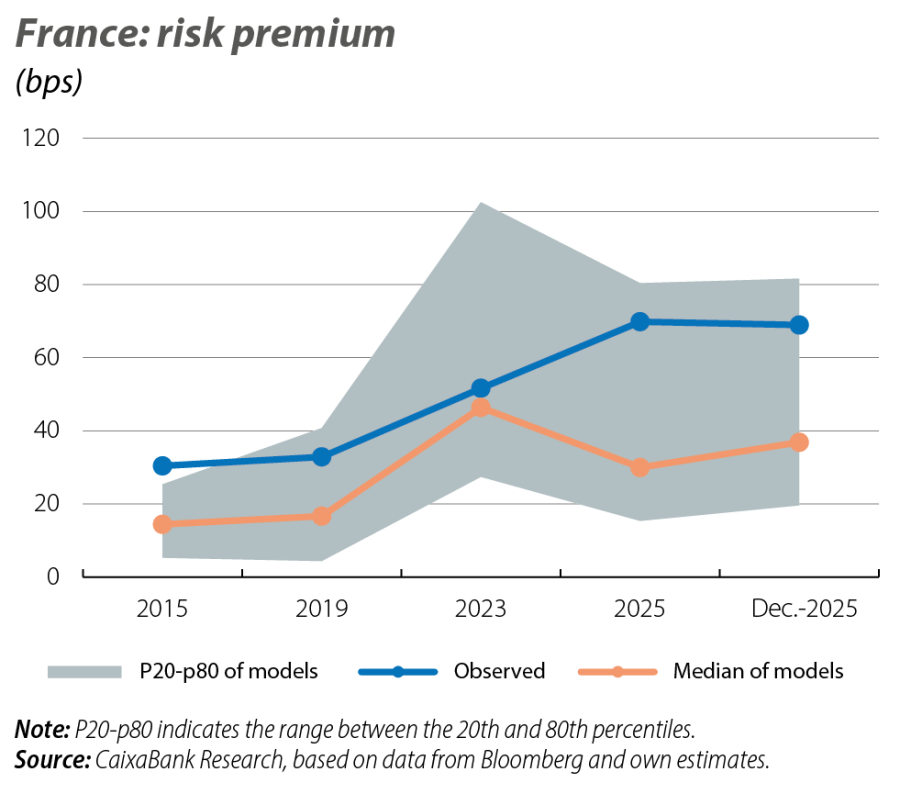

In the last decade, risk premiums have stabilized at an intermediate level between the calm of the 2000s (when sovereign bonds traded in the market with virtually no distinction between countries) and the stress of the sovereign debt crisis of 2010-2012. At this midpoint, investors differentiate based on the macroeconomic and financial health of each country without questioning the survival of the euro. Thus, the easing of Portuguese and Spanish risk premiums has been accompanied by a clear improvement in their macroeconomic performance compared to Germany, a clear commitment to fiscal sustainability, and the recovery of their credit ratings according to the rating agencies (see table). By contrast, France’s sluggish economic performance, deteriorating public accounts and lower credit rating have contributed to an increase in its risk premium (rising from around 30 bps pre-pandemic to nearly 70 bps by the end of 2025).

- 1

In this article, risk premium refers to the spread between a euro area country's 10-year sovereign interest rate and its German counterpart.

- 2

On 26 July 2012, ECB President Mario Draghi declared that he would do «whatever it takes» to preserve the euro. His words became a symbol of the euro area's survival. See «Mario Draghi and his “parole, parole”» in the MR01/2018.

The relationship between macroeconomic fundamentals and risk premiums can be formally established. Interest rates on sovereign bonds depend on fundamentals such as indebtedness and economic growth (which determine a state’s ability to pay), the ECB’s monetary policy, and global factors such as the interest rates of other economies (which offer an alternative investment opportunity) and investors’ risk appetite. Taking advantage of the historical relationship between all these ingredients and interest rates, we can quantify a sovereign risk premium that is consistent with the macroeconomic fundamentals.3,4

- 3

We presented a macro interest rate model in «The macroeconomic fragility of interest rates» (MR10/2020). Taking that exercise as a starting point, we now estimate a panel regression for the risk premiums of Austria, Belgium, France, Italy, Ireland, Spain, the Netherlands and Portugal using data for the period spanning January 2000 to December 2025 and the following explanatory variables: expectations of the 3-month Euribor, real growth of GDP and inflation, the public debt-to-GDP ratio, a stock market volatility indicator, public debt assets acquired by the Eurosystem, sovereign rating and an indicator of stress in the euro area (a binary variable equal to 1 if a sovereign risk premium is markedly strained).

- 4

In addition to the baseline estimate, we reflect the uncertainty surrounding these exercises by conducting 20 alternative estimates, in which we individually exclude GDP, inflation, the 3-month Euribor, public debt, ECB assets and rating and, in each case, with three time samples (up to the year 2019, up to 2022 and up to 2025).

As the first chart shows, macro fundamentals have closely aligned with observed sovereign risk premiums in recent years. In fact, the sustained moderation of the main euro area risk premiums clearly aligns with what is predicted by the fundamentals. However, a country-by-country analysis reveals a more nuanced picture.

Unlike the traditional peripheral economies, in recent years France has suffered from a persistently higher risk premium. This market adjustment is not only due to a certain shift in investors’ outlook,5 but also reflects a change in macroeconomic fundamentals: in recent years, France has experienced a clear deterioration in its public finances (its debt is estimated to be almost 120% in 2025, with a projected public deficit of 5.4% that is also likely to remain high) while losing economic dynamism and seeing its credit rating downgraded by the three major rating agencies.

- 5

Between 2023 and 2025, the premium has shifted from being at the centre of the range predicted by the fundamentals to being in the upper band.

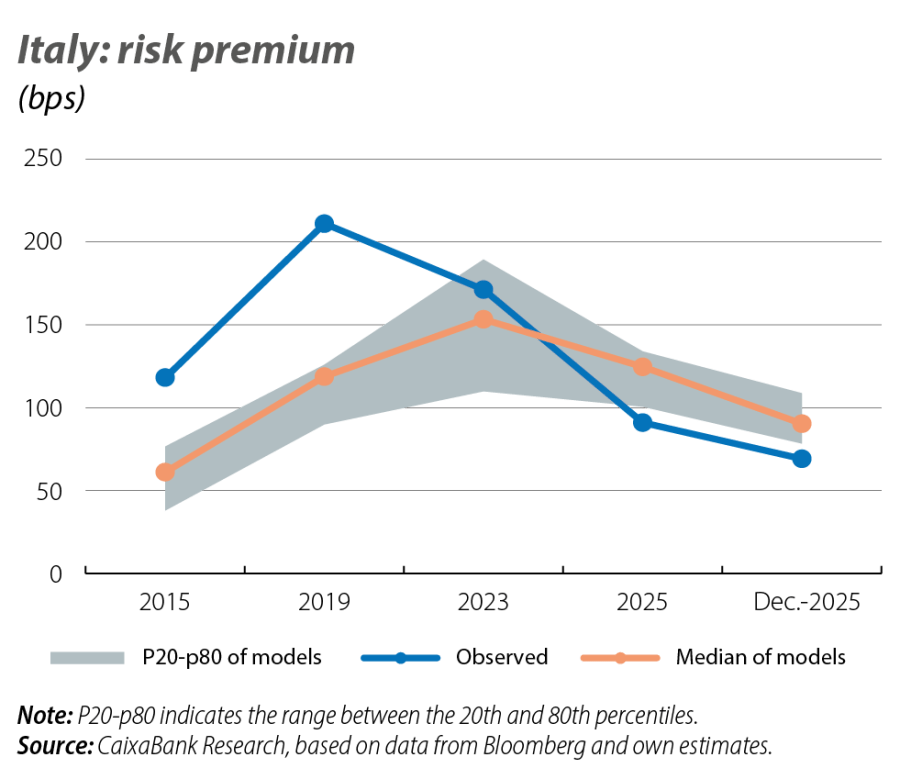

Italy, with a worse starting position in terms of its public debt and credit rating, managed to steer the situation in 2025 and achieve its lowest risk premium since 2008. Of particular note is the significant correction in its public deficit (going from 7.2% in 2023 to a projected 3.0% in 2025) and the resilience that allowed its credit rating to be raised by a notch in 2025 by the three major agencies.

At the other end of the spectrum, Spain and Portugal have shown a much more sustained improvement in their risk premiums. This improvement is very visible in the premiums quoted in the financial markets (lows in line with 2008 in both cases) and is clearly reflected in the evolution predicted by the fundamentals: both economies have led economic growth in the euro area in 2025, have been continuously reducing their public debt and, in the last year, have seen widespread improvements in their sovereign credit rating.

Overall, this exercise suggests that the evolution of macroeconomic fundamentals can explain the behaviour of sovereign risk premiums in recent years, from the improvement of the traditional periphery to the deterioration of France. However, the analysis also indicates that there is a range of risk premiums consistent with a given set of macroeconomic fundamentals.6 Maintaining markets within the most favourable part of this range will require strengthening underlying fundamentals, especially given the demands of the global environment.

- 6

See footnote 4.