International economic scenario: tariff hikes vs. respite in uncertainty

The resistance exhibited by international economic activity, the reduction of uncertainty and the improvement in growth projections indicate a better immediate outlook. However, the world economy is not out of the woods yet.

The international economy started 2025 clouded by the threat of US tariffs, trade uncertainty and geopolitical tensions, at a crossroads amid the reorientation of economic policies and geopolitical strategies.1 This led to a deterioration of the outlook and shook the financial markets. How has the scenario evolved since then? Where is the international economy heading in the coming quarters?

- 1

IMF (2025). «A Critical Juncture amid Policy Shifts», World Economic Outlook, spring issue.

Starting point

So far this year, the scenario has been characterised by volatility in the data and the resilience of the international economy in the face of uncertainty. Initially, the anticipation of new US tariffs triggered a boom in the country’s imports and spurred exports from the other major economies, an effect which was then unwound, causing swings in the data. Despite the volatility, GDP figures have performed better than anticipated, with a common support factor in robust labour markets and a certain recovery in purchasing power and investment, leading to an improvement in economic expectations and investor sentiment.

The improvement in expectations has also been supported by a moderation of uncertainty. The various trade agreements that the US has reached have helped to gradually clarify the trading landscape in which the world economy will operate going forward, while also helping to rule out extreme scenarios, at least in the short term. That said, the global economy will have to adapt to a significantly higher level of tariffs and the uncertainty, although in retreat, has not faded completely (several negotiations remain pending, such as between the US and China, and there are doubts over the durability of the agreements reached, legal uncertainties, etc.).

Key drivers, outlook and risks

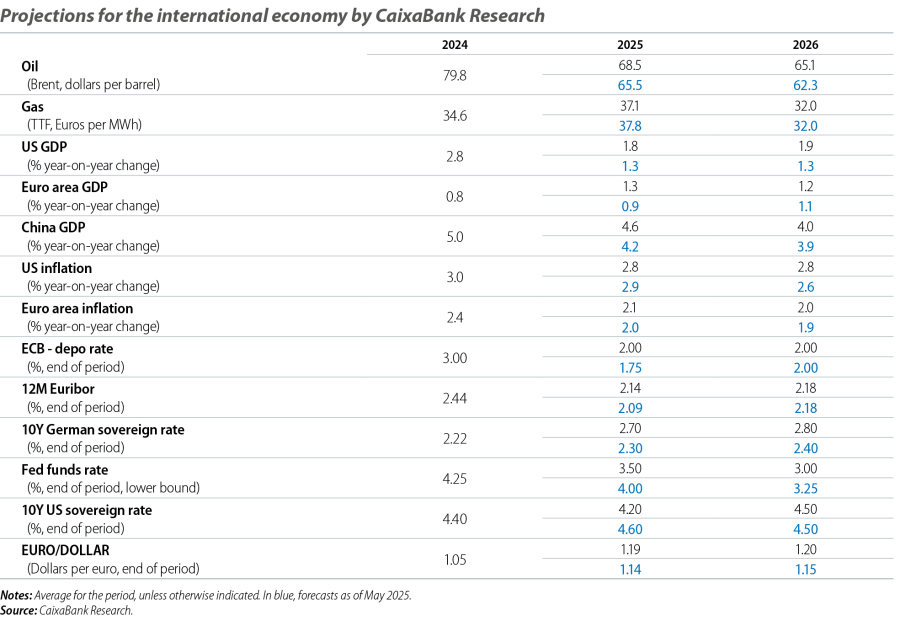

From this new starting point, the outlook enjoys the support of contained energy prices, thanks to an oil market that continues to exhibit excess supply2 and in which the Brent barrel is expected to hover at around 65 dollars per barrel, while gas futures point to a stable European TTF price of around 35 euros/MWh. Also, monetary policy will no longer weigh down the economy. In the euro area, the ECB’s interest rates are at a neutral level of 2.00%, where they neither stimulate nor restrict economic activity. After lowering them by 100 bps between February and June, all the indicators (including both the central bank’s own messaging and market prices) suggest that, with inflation at the target rate, the ECB will prefer to keep rates at their current levels and will reserve the option to alter them only in the event of a significant change in the outlook. The Fed, meanwhile, has resumed its rate cuts after noting a slowdown in job creation3 and a moderate and gradual impact of tariffs on inflation. It is thus exhibiting a different sensitivity to the balance of employment/inflation data, which leads us to expect a gradual pattern of rate cuts over the coming quarters.4 On the other hand, international economic activity is also expected to continue enjoying the support of the Chinese economy. Indeed, despite the tariffs and the country’s persistent housing crisis and weak domestic demand, China’s exports and industry have held up well, while analyst consensus expectations for the country have continued to improve.

- 2

In a context of production increases by both OPEC+ (which has already recovered 2.2 million barrels a day of the cuts implemented in 2023) and other producers and more moderate growth in demand (especially in China and India).

- 3

This has not put pressure on the unemployment rate, which remains low despite the recent increase, possibly reflecting a cooling of the labour market on both the demand and the supply side.

- 4

We expect four more cuts up until the end of 2026 (placing the fed funds rate at 3.50%-3.75% in December 2025 and at 3.00%-3.25% in December 2026).

Thus, our scenario predicts that US economic activity will remain relatively dynamic and that, with a cooling due to the normalisation of the labour market, and fuelled by investment linked to AI and less restrictive monetary conditions, the country’s GDP will approach an annual growth rate of 2%. However, this improvement in the outlook remains subject to downside risks, ranging from inflation resisting the last mile to the 2% target, to the digestion of government deficits that are predicted to remain high, to the transmission of tariffs to economic activity and inflation which, so far, has been modest.

In the euro area, we forecast a moderate acceleration in economic activity, bringing GDP growth to 0.2%-0.3% quarter-on-quarter. This growth will be supported by the effects of the ECB’s recent monetary easing, a reorientation of fiscal policy5 and improved confidence that could spur further growth if it helps households to redirect their high savings rate (15.2%) towards consumption. With regards to the foreign sector, despite the prospect of a stronger euro against the US dollar (1.20 dollars in 2026), the effective real exchange rate has been more stable. This factor, coupled with lower tariffs with the US than in other jurisdictions, could help (in relative terms) to protect exports. However, the growth of the euro area will continue to show significant disparities from country to country, with the strength of Spain’s GDP growth contrasting with the structural difficulties of Germany’s industry and the weakness of France with its public accounts under investor scrutiny.

- 5

Especially in Germany, where the infrastructure and defence spending plans have led the government to project an increase in the federal deficit from 1.1% of GDP in 2024 to 3.3% in 2025 and up to 4.2% in 2026. In France, parliamentary fragmentation and the consequent difficulties in approving budgets suggest that the reduction of the deficit (5.8% in 2024) will be very gradual. In the other two major economies, Italy and Spain, the deficit is expected to decrease slightly, placing it below 3% in 2026 and 2025, respectively.

Overall, the resistance exhibited by international economic activity, the reduction of uncertainty and the improvement in growth projections indicate a better immediate outlook. However, the world economy is not out of the woods yet. The shift in economic policies and geopolitical strategies continues to steer the world toward heightened geopolitical tensions and risks of disruption in global supply chains, in addition to factors that could fuel financial turbulence (such as the deterioration of public finances and institutional quality in the major economies).