The appreciation of the dollar and American and European interest rates

The US interest rates have risen steadily and significantly, galvanised by the Federal Reserve’s rapid and aggressive monetary tightening policies. However, this does not necessarily mean that US bonds are more attractive than their European counterparts. A key factor in the comparison is the exchange rate.

Since the outbreak of the war in Ukraine and the intensification of inflationary pressures, US interest rates have risen steadily and significantly, galvanised by the Federal Reserve’s rapid and aggressive monetary tightening policies. However, this does not necessarily mean that US bonds are more attractive than their European counterparts.

A key factor in the comparison is the exchange rate. Specifically, exchange rate movements between the moment when an investor sends capital abroad and when they repatriate that capital or the associated interest payments are another factor which determines the return on investment, in addition to being a source of uncertainty. In order to eliminate or «sterilise» the risk of exchange rate fluctuations, one possibility is to secure a future exchange rate at the same time that currencies are exchanged in the spot market.

As a result of the interest rate hikes in the US, in 2022 the dollar registered a significant appreciation. However, the appreciation was more intense in the spot market than it was in the futures market. The gap that opened up between the two implicitly generated an appreciation of the euro. For instance, at the beginning of 2022 the spot rate was 1.13 dollars per euro while the three-month future rate was 1.14, assigning the euro an implicit increase in value of 0.7%. In the autumn, however, the euro/dollar exchange rate fell below 1 in the spot market and was above parity in the futures market, so the implicit appreciation of the euro reached over 3%.

The opening up of this gap and the greater implicit appreciation of the euro tended to reduce the effective interest received by a European investor holding US bonds: for example, when the spot exchange rate was virtually 1 dollar per euro, a European investor could get 100 dollars in exchange for 100 euros; but as the future exchange rate was greater than 1, when exchanging those 100 dollars back into euros they would become less than 100 euros.

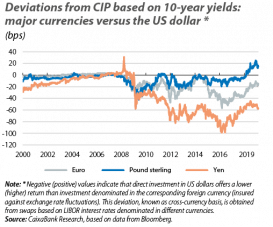

Looking at the overall picture, we are faced with two forces. On the one hand, rising US interest rates increased the appeal of the dollar. On the other hand, the exchange rate movements in 2022 gradually dampened this appeal factor.1 To see which force was more dominant, in the second chart we compare the German sovereign interest rate with its US counterpart «sterilised» against foreign exchange risk.2 This shows how, apparently, despite lower interest rates, German rates were found to be higher from the point of view of a European investor once the foreign exchange risk is factored in.

- 1. Assuming that investments are «sterilised» against foreign exchange risk. An investor choosing to assume this risk and opting to repatriate the interest income at the spot exchange rate, rather than securing a future exchange rate, would have benefited ex post due to the fact that the dollar steadily appreciated between January and October 2022.

- 2. The relationship between the domestic interest rate and a foreign interest rate adjusted for the foreign exchange risk between the foreign and domestic currencies is known as Covered Interest Parity (CIP). See the Focus «Why do similar assets have differing yields?» in the MR03/2019.

In short, the rise in US interest rates is a factor which causes the dollar to appreciate. However, the appreciation of the US currency in 2022 went well beyond this, reinforcing the view, as set out in this same report,3 that the appreciation of the dollar was supported by other forces, such as its position as a safe-haven asset in a highly uncertain environment.

- 3. See the Focus «On the round trip movement of the (king) dollar» in this same Monthly Report.