China's economic liberalisation: next stop, the bond market

China has been at the epicentre of numerous turbulent financial episodes throughout the last year and the first few months of 2016. Given this situation the government has decided to boost its agenda of reforms. In August 2015 the authority made the mechanism to establish the yuan's exchange rate more flexible. In October they suppressed the limit on bank deposit interest rates. Now the People's Bank of China (PBoC) has surprised with an announcement that it is opening up the domestic debt market, the third largest in the world, to the community of international investors. A decision that has created huge expectation and is likely to become one of the landmarks in the liberalisation of the Asian giant's financial account and the internationalisation of its currency.

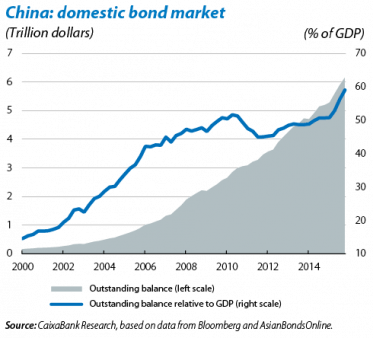

One of the particular features of China's bond market is that, in spite of being large (equivalent to 6 trillion dollars in 2015, 60% of GDP), the share of foreign investors is only 1.9% of this sum and just over 1% of GDP, which can be put down to the restricted access to China's domestic bond market. To date, foreign investors could only acquire assets from this market via three programmes: the Qualified Foreign Institutional Investor (QFII), the Renminbi Qualified Foreign Institutional Investor (RQFII) and a specific facility of the PBoC. One common feature of all these systems is that they have quotas for the amounts invested and each transaction requires approval from China's regulatory authorities.

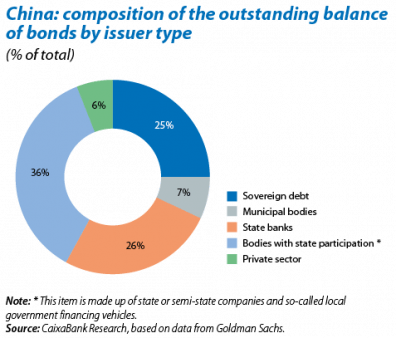

From now on, however, almost all non-resident institutional investors will be able to access the local bond market without being subject to quotas.1 Although some technical aspects have yet to be specified, the opening up of such a large market is an important event, both for international investors and also for the domestic agents themselves. For China, a more open bond market will attract global funds and widen and diversify its investor base, which could particularly benefit Chinese private companies whose access to the capital market had been limited since domestic banks tend to prefer public or semi-public issuers (see the second graph).

In the short term there is unlikely to be a large inflow of investment into the Chinese bond market given the uncertainty surrounding the trend in the renminbi. However, over the coming years international exposure to this market could increase considerably. In comparison, foreign investors hold debt in yen and Canadian dollars totalling 10% and 15% of the GDP of Japan and Canada, respectively. Similar exposure by international investors to debt instruments in the renminbi would result in an inflow of capital of between 0.8 and 1.3 trillion dollars. This expectation alone could help stabilise the value of China's currency, one of the goals pursued by the Chinese authorities.

1. Banks, mutual and pension funds, insurers, sovereign wealth funds and brokerage firms will be able to access China's debt market while restrictions will remain in place for hedge funds.