The fall in China's reserves

After years of relentless growth, by mid-2014 China's international reserves started to diminish steadily, a situation which, should it continue, could affect one of the most important buffers for the Asian country to defend its currency against the volatility dominating the markets. But should we be worried about this fall in the reserves and how reasonable is it to expect this decline to get worse?

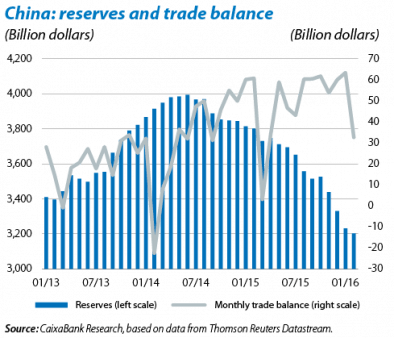

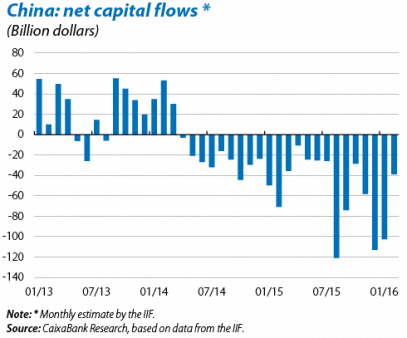

Between July 2014 and January 2016 China's reserves fell by 762.32 billion dollars, reaching 3.23 trillion dollars. Part of this fall was due to the valuation effect suffered by the stock of reserves:1 the depreciation of the euro, the yen and other emerging currencies pushed down the value expressed in dollars although the latter was the predominant currency for the reserves. However, the main factor behind this huge drop in reserves is the capital outflows over the last few months. Neither the considerable limitations that still restrict flows of capital to and from China nor the huge current account surplus of 293.2 billion dollars (equivalent to 2.7% of GDP) in 2015 have been able to offset the net outflows abroad which totalled 637 billion dollars in 2015 and have come close to a trillion dollars since mid-2014.2

This situation is a cause for concern not only because of the size of the outflows but also because of their acceleration, in spite of the fact that the country's level of reserves is still comfortable according to several measurements used by the IMF. In 2015 China's reserves covered the equivalent of 20 months' imports, a ratio below the 27 months reached in 2009 but still much higher than the 3 months established by the IMF as a benchmark. As a percentage of short-term external debt, the figure, close to 600%, far exceeds the 100% set as a benchmark. The M2 monetary aggregate is the only measurement that considers the size of the country's reserves to be slightly vulnerable: in September 2008 they were equivalent to 28.7% of the M2 aggregate but, since then, have almost halved (down to 15.0% in January 2016), below the 20% set by the IMF as the upper limit of a prudent range. Nonetheless it is worth noting that this last measurement is particularly suitable for economies which, in addition to having a large banking sector, also enjoy a very open capital account, something that is still not the case in China.

In this respect the first reaction by the Asian giant to these capital outflows has been to increase controls on some of them, which will help to stabilise reserves in the short term but denotes a level of intervention which the government had promised to minimise. In the medium term it is essential to restore confidence in the Chinese economy's growth capacity. This is ultimately the best remedy to retain local capital and attract international investors.

1. Calculating the valuation effect as the difference between the stock of reserves according to the People's Bank of China and foreign reserve holdings in the balance of payments, in 2015 one third of the loss of reserves can be put down to this effect: a percentage which has fallen over the last few months.

2. Calculated as the balance of the financial account (excluding reserves) plus errors and omissions. One part of the capital outflow is due to the repayment of debt in dollars held by Chinese firms with local banks (see BIS, Quarterly Review, March 2016, Box 1).