Uncertainty and stock markets

The British referendum on the EU has been one of the big focuses of attention for stock market investors, leading to large gains and losses in shares. Questions regarding the terms and conditions for the country’s exit, the populist tone of the debate and the possibility of «contagion» to other countries have helped to increase uncertainty regarding economic policy in Europe as a whole.1 Gauging to what extent this variable affects stock markets is a complex task but a preliminary analysis points to its influence increasing considerably over the last few years.

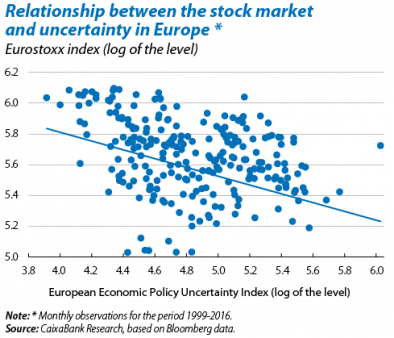

As might be expected, and as illustrated in the first graph, an increase in the uncertainty index is associated with a drop in the European stock market index. In other words, the (unconditional) correlation between both variables is negative. Naturally uncertainty is not the only element affecting how the stock market behaves. Consequently our analysis must be enhanced by including other factors that help to explain the trend in stock market returns over time. To this end, we have explained the monthly returns of the Eurostoxx according to three variables.2 The first is a «macroeconomic factor» (M), which aims to capture investor expectations regarding the future trend in fundamental variables, and ultimately corporate earnings. This factor, in turn, combines several variables associated with the economic cycle, such as the euro’s real effective exchange rate, the euro area’s real interest rate and the relative share price among cyclical, defensive companies. The second is an index of «financial conditions» (FC) which attempts to measure the stress levels in the financial system. The third is the aforementioned «European Economic Policy Uncertainty Index» (PU).

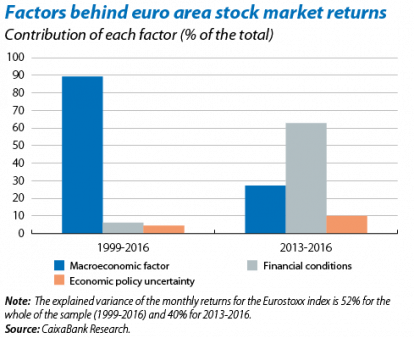

It is not surprising that the variable associated with macroeconomic fundamentals has been the key determining factor in European stock market performance during the period 1999-2016. More specifically, and as can be seen in the second graph, the contribution of this variable to explaining Eurostoxx returns is 90%. However, what is noteworthy is that the relative importance of the three components has altered substantially in the last three years. Specifically, since 2013 the contribution made by the variables FC and PU has increased dramatically to 60% and 10% respectively, while the contribution by M has fallen to 30%. On the one hand, this highlights the importance of more accommodative financial conditions in the euro area (attributable mainly to the ECB’s expansionary policies) in sustaining returns on equity. On the other hand it also shows the modest but growing relevance of policy uncertainty as a factor behind recent stock market performance.

The political agenda over the next few quarters is packed with important events, such as the formation of a government in Spain, Italy’s constitutional referendum in the autumn, German and French elections in 2017 and the Brexit negotiations themselves. Undoubtedly the stock market would appreciate the European authorities, both nationally and supranationally, reducing the current level of uncertainty regarding the direction of Europe’s economic policy.

1. European Economic Policy Uncertainty Index, produced by Baker, Bloom and Davis. For more details, see the Focus «Post-Brexit uncertainty and its impact on economic growth» in this Monthly Report.