Financial markets leave the optimism of summer behind

Investor sentiment once again tilts towards risk aversion

Following a summer in which investors were optimistic about the revival of economic activity and the support from economic policies, in September the mood turned. The rise in COVID-19 cases, a less vigorous economic recovery and a lack of agreement in the US Congress on a new round of fiscal stimulus dampened risk appetite and impacted assets most closely linked to the business cycle. Thus, the major stock market indices registered widespread declines and commodity prices fell, while demand for safe-haven assets (such as the dollar, the Japanese yen, or German and US sovereign debt) increased. Nevertheless, the volatility of the financial markets is now much more moderate than it was in March and April, partly thanks to the continued support from the major central banks. However, in a highly demanding macroeconomic and financial environment dominated by the pandemic, volatility remains higher than prior to the outbreak, especially in the equity and currency markets.

Stock markets register losses not witnessed since March

In this context of risk aversion and reduced optimism among investors, the major international stock indices registered widespread declines, slowing down the recovery that began in April. The setback was particular notable in the US, where just a few months earlier technology and e-commerce stocks had been trading at unusually high levels. In September, the stock price corrections of the main companies of these sectors dragged down the S&P 500 index, which registered its first monthly losses since March. In the euro area the declines were smaller, but there was significant disparity between regions. While the German stock market index fell by around 1%, the indices of the periphery fell by between 3% and 5%. Emerging economies also registered widespread losses in the equity markets, although, as has been the case since COVID-19 reached Latin America, the declines in the Latin American indices were greater than those in Asia.

The dollar strengthens once again while the euro tempers its rally

Following the gains registered in the summer by the main currencies against the US dollar, in September the fading of investor sentiment led to an appreciation of the currencies considered safe havens. The dollar thus appreciated 2% against a series of major currencies, while the Japanese yen appreciated even against the dollar. In contrast, there was widespread weakening of emerging-economy currencies, with the Russian rouble and, as was the case in July and August, the Turkish lira suffering the most. In the latter case, the marked macroeconomic imbalances and investors’ lack of confidence in the Turkish authorities’ ability to reverse the economic crisis brought the exchange rate against the dollar to new all-time lows. The euro, on the other hand, undid some of the progress it had made since the beginning of July, when the European Council had finally approved the Next Generation EU fiscal stimulus, and stood above 1.17 dollars per euro.

The ECB remains on the course set in June

The ECB’s September meeting went without major announcements, and the Governing Council (GC) reiterated its intention to provide accommodative financial conditions to support the euro area’s economic recovery. This continuity comes in response to economic activity performing in line with the ECB’s projections in recent months. Its new macroeconomic forecasts thus reflected no major changes, although both the expected decline in GDP in 2020 and the rebound in 2021 are now more moderate. On the price front, Lagarde stated that there is no risk of deflation in the euro area, even if disinflationary pressures dominate the scenario. In particular, the ECB president expressed concern (but also a disparity of views among GC members) over how the appreciation of the euro in recent months could affect inflation. However, Lagarde assured that the ECB will use the full amount of the PEPP (1.35 trillion euros) by June 2021 and that it is prepared to provide additional monetary stimulus if necessary.

The Federal Reserve adjusts its communications to its new strategy

After recalibrating its inflation and employment targets in August (see the Focus «The Fed’s new strategy» in this same Monthly Report), the Fed changed its forward guidance on the first interest rate hike to bring it in line with the new strategic framework. Now, following the September meeting, the Fed assures that rates will remain at their current level at least until full employment is reached, and inflation is both at 2% and on track to be slightly above this level for some time to come. Based on the new macroeconomic table, this first rate hike would not occur until at least 2024. The Fed’s new forecasts also indicate that its members now expect economic activity to perform better than previously, although Jerome Powell continued to emphasise the downside risks. The chair of the Fed reiterated that the economic scenario is highly demanding, that the pace of the recovery will be determined by how the pandemic develops and that the Fed will act with all its tools if necessary.

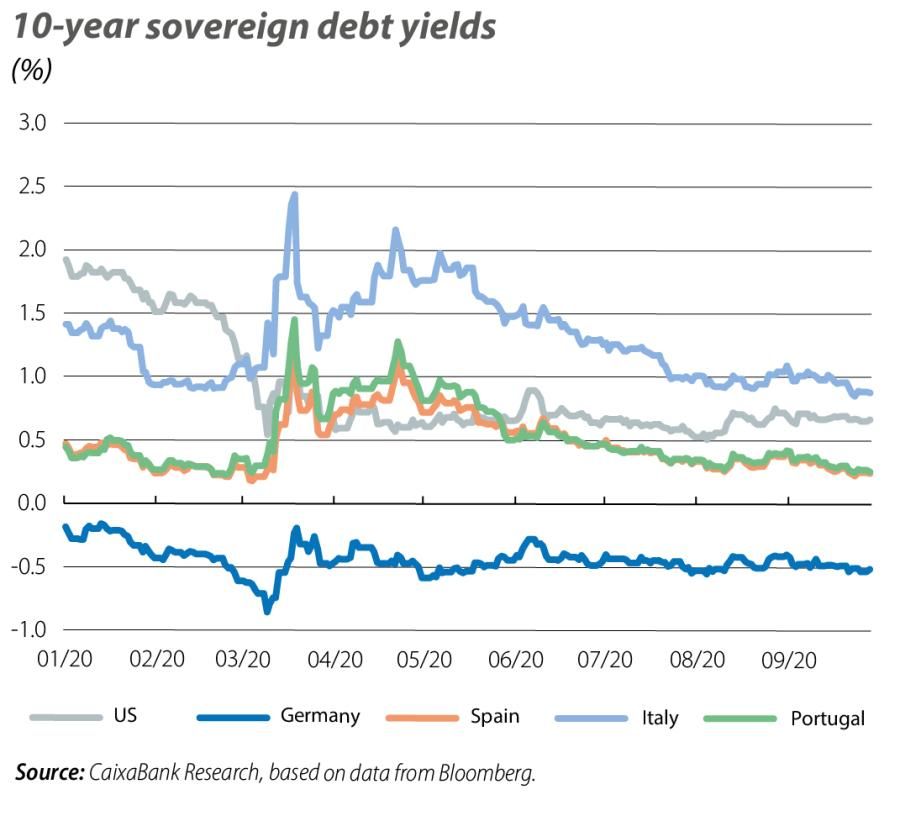

Sovereign rates remain at very low levels

The exceptionally dovish monetary policy being offered by both the ECB and the Fed places US and German sovereign interest rates at very low levels. On top of this, during September the increase in risk aversion plunged the sovereign rates of safe-haven countries even further, with yields on the US treasury and the German bund falling by 2 and 13 bps, respectively. On the other hand, risk premiums in the euro area periphery narrowed, allowing sovereign interest rates in Spain, Italy and Portugal to recover to close to their pre-pandemic levels. In the case of Spain, this occurred despite S&P Ratings downgrading the economic outlook for the sovereign rating from stable to negative, while keeping the credit rating unchanged at A (still one and two notches higher than Fitch and Moody’s, respectively).