A start to the year with cross-currents in the financial markets

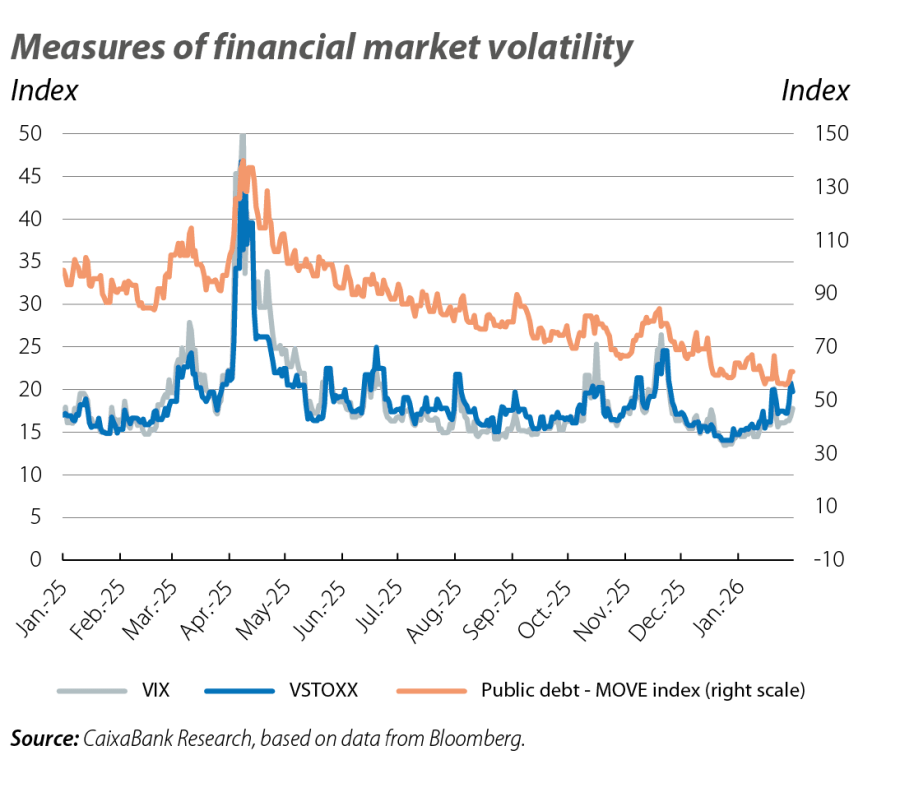

Geopolitics marked the beginning of the year in the financial markets. The resurgence of tensions, from Venezuela to Iran, and the diplomatic clash between the US and Europe over Greenland generated risk aversion and triggered a temporary spike in market volatility.

January inherits currents from 2025 and opens up new fronts

Geopolitics marked the beginning of the year in the financial markets. The resurgence of tensions, from Venezuela to Iran, and the diplomatic clash between the US and Europe over Greenland generated risk aversion and triggered a temporary spike in market volatility. In Asia, a renewed focus on Japan's fiscal outlook led to exceptional movements in interest rates and the Japanese currency. At the same time, sources of uncertainty from last year remain, such as tariff tensions between major blocs, expectations surrounding AI, and the focus on the ability of the big tech firms to monetise their investments. All this occurred against a backdrop of the central banks continuing with their data-dependent strategies.

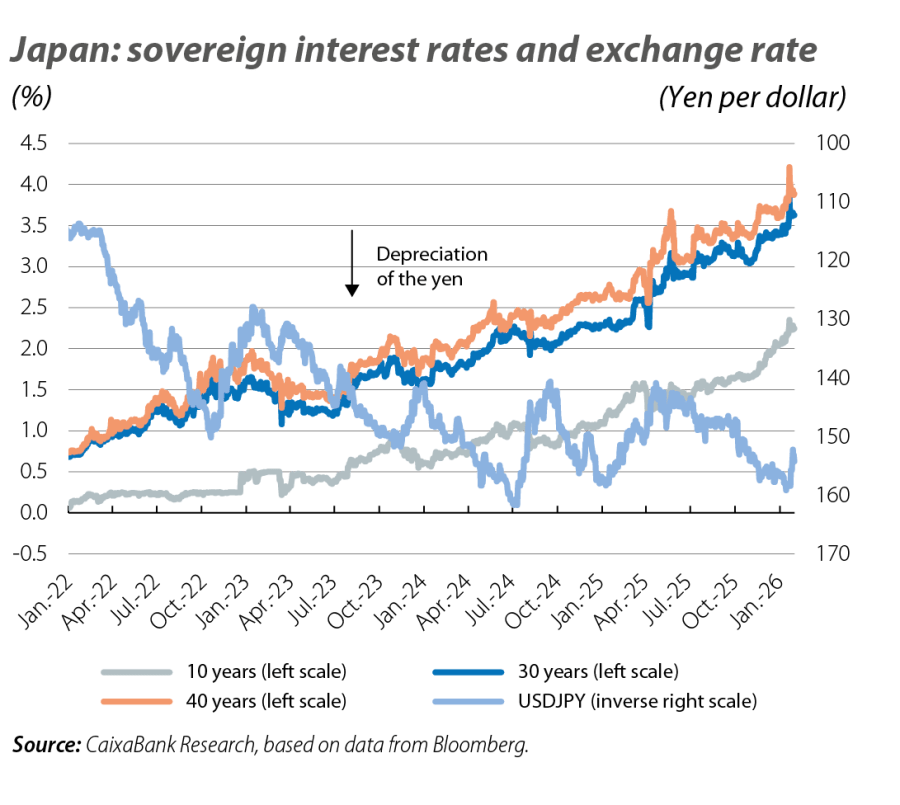

Japan returns to the spotlight due to its fiscal outlook

Prime Minister Sanae Takaichi's decision to call a snap election and plans for fiscal expansion reignited investors' concerns surrounding fiscal sustainability in Japan. Long-term sovereign interest rates soared to all-time highs, with the 40-year benchmark exceeding 4% for the first time. At the same time, at its January meeting, the Bank of Japan kept the official rate at 0.75% (following the 25-basis-point hike in December) and indicated that it will continue to raise rates if its growth and inflation forecasts materialise (markets are pricing in two 25-bp hikes in 2026). Nevertheless, the yen weakened sharply, falling to an eighteen-month low against the dollar (nearing 159 yen per dollar) and reaching levels not seen since the 1990s against the euro (183 yen per euro), penalised by investors amid perceptions of fiscal deterioration. Only rumours of a joint intervention by the Japanese Ministry of Finance and the US Treasury at the end of the month halted the yen's decline.

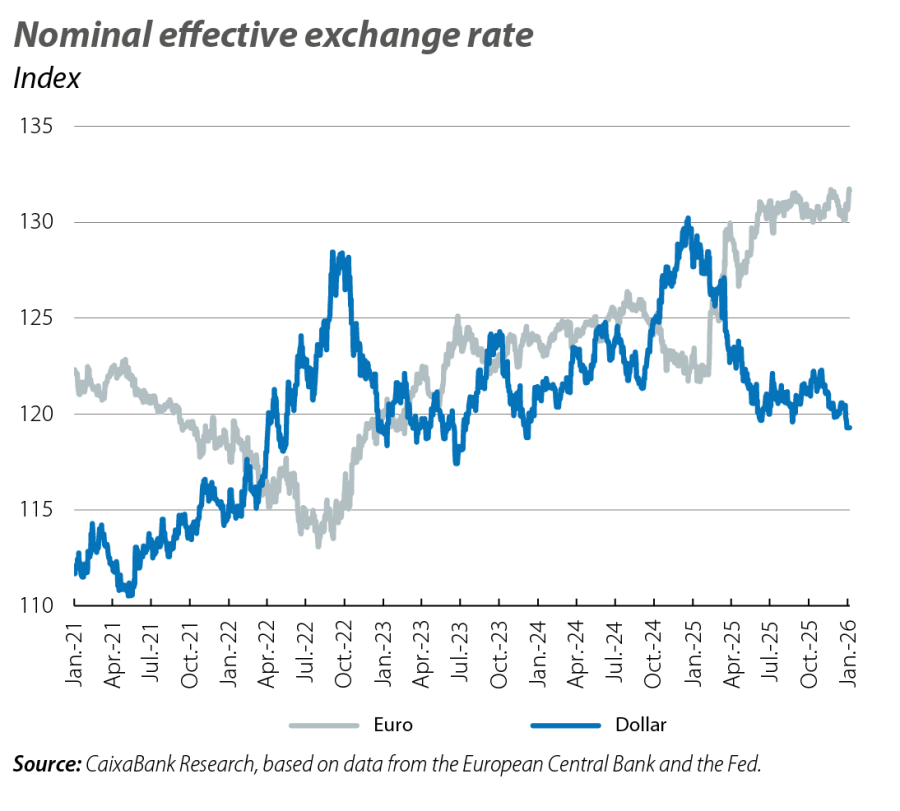

The dollar in the spotlight amid the resurgence of geopolitical noise

Weighed down by geopolitical uncertainty and tensions in US foreign and trade policy, the US dollar suffered widespread depreciation in January. The DXY dollar index closed the month with a decline of nearly 1% and the euro traded above 1.20 dollars for the first time in four years. Other safe-haven currencies capitalised the situation and the Swiss franc reached historic highs against the dollar (exceeding 1.30 dollars per franc). The US currency was also pressured by concerns over the Fed's independence. On the one hand, Department of Justice is conducting an investigation into President Jerome Powell and his testimony to the Senate regarding the refurbishment costs of two Fed buildings. In response, Powell stated that the real motivation behind the investigation was not linked to his testimony, but to the fact that the Fed sets interest rates based on economic conditions and not President Trump's preferences. However, the dollar regained some ground in early February after Trump announced the nomination of Kevin Warsh as the candidate for Fed Chair once Powell's term expires next May. Warsh was a governor of the Fed between 2006 and 2011 and maintained a critical stance on its balance sheet expansion and a restrictive bias on interest rates, although in the last year his statements have been aligned with Trump's thesis in favour of lowering interest rates. The markets received this announcement favourably, with a strengthening of the dollar, and stability in interest rate expectations for 2026 (two cuts of 25 bps).

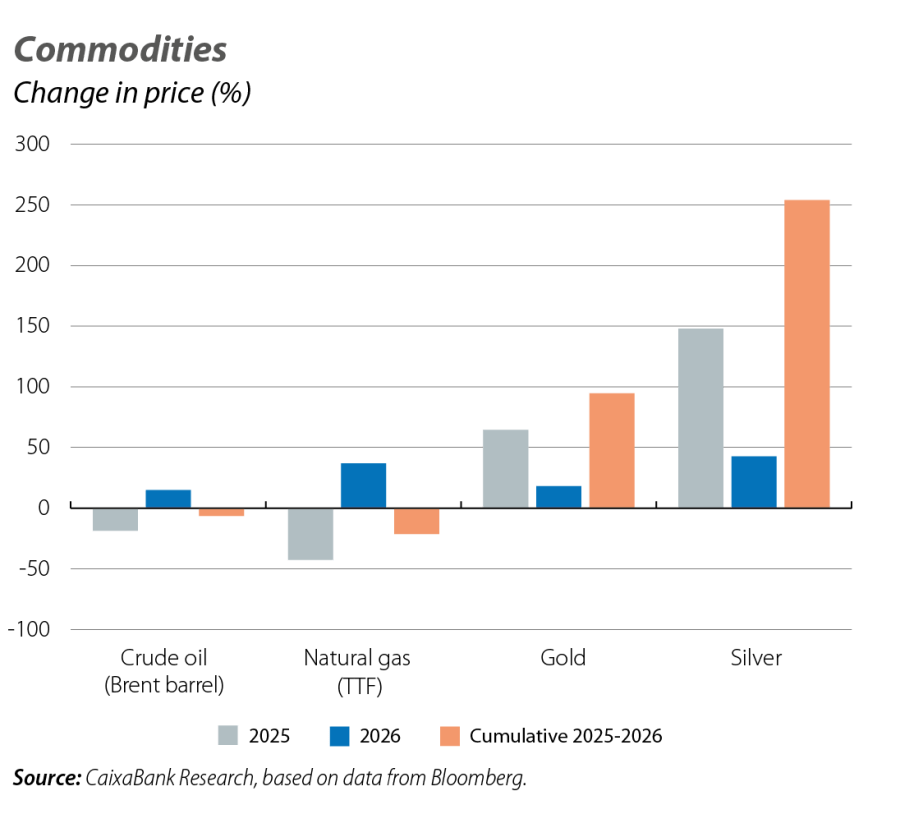

Commodities capitalise on global uncertainty

As is usual, spikes in geopolitical tensions lead to episodes of volatility in energy markets. In this case, the price of a barrel of Brent, which had begun the year at around 60 dollars in an environment of oversupply, rose to 70 dollars amid tensions in Iran and fears of possible supply disruptions. Similarly, the European gas benchmark reached €42/MWh, with an additional boost triggered by fears over supply linked to a winter storm in the US. In early February, both oil and gas prices moderated following news of a de-escalation in the US’ conflict with Iran. On the other hand, amid rising global uncertainty and a weak dollar, precious metals capitalised on the flight to safe-haven assets. In particular, gold surpassed the $5,000/ounce barrier, even reaching close to $5,600/ounce, and silver appreciated by as much as 42%. In cumulative terms, between the beginning of 2025 and the peak in late January they amassed gains of almost 100% and 300%, respectively, although in early February both metals suffered a sudden and sharp correction.

The markets keep the central banks in view

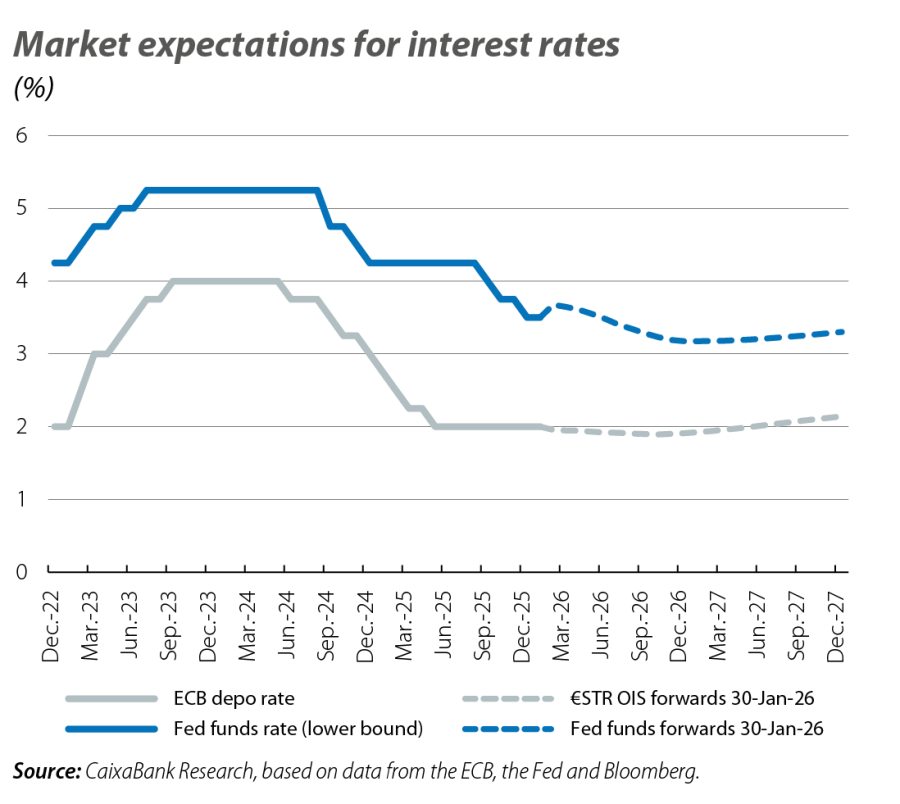

The other major development in monetary policy was the change in tone from the Fed, with a more positive assessment of the macroeconomic environment following its January meeting (at which, unsurprisingly, the Fed kept the fed funds rate at 3.50%-3.75%). This change left the impression that the Fed is in no hurry to lower rates in the short term, and pushed back the expected timing of the first cut, as priced in by the futures markets, from March to June 2026. The ECB, for its part, acted as expected and kept the depo rate at 2%, emphasising the need not to overreact to small variations in the data, and presenting a more balanced map of inflationary and deflationary risks. The financial markets' expectation regarding the ECB remains one of stable monetary policy throughout 2026. In this context, euro area sovereign yields remained relatively flat, with stable peripheral risk premiums except in France, where the premium fell some 15 bps, placing it around 58 bps, its lowest level in 18 months. This reflects a positive market reception to the approval of the 2026 budget, (this budget would allow the deficit to be reduced in 2026 to 5.0%of GDP, from the 5.4% estimated in 2025).

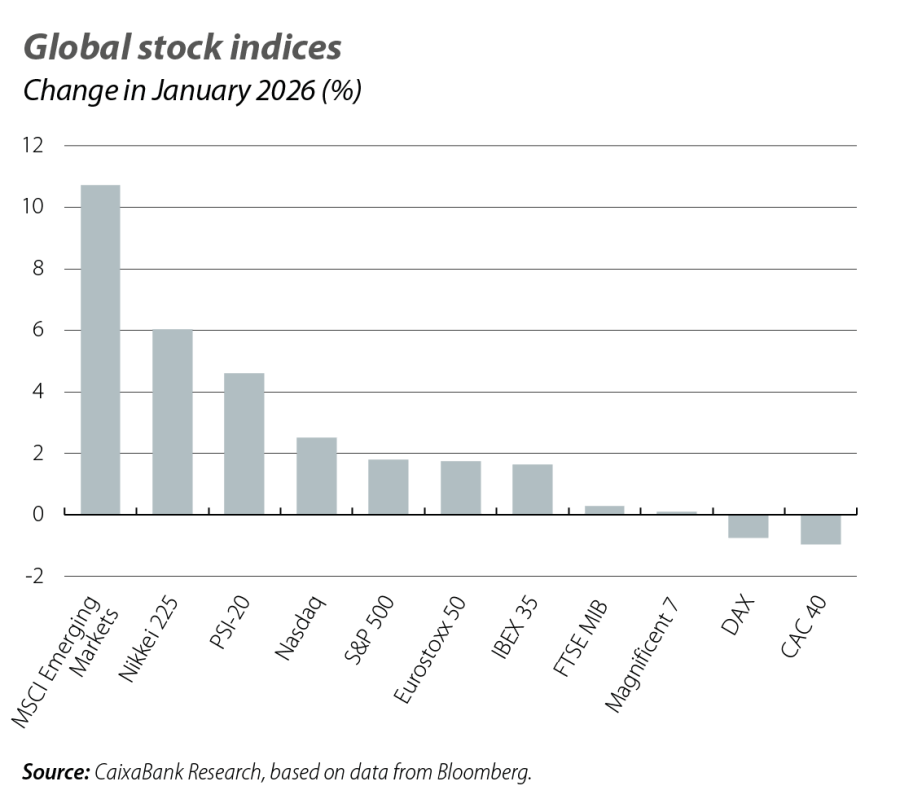

Mixed behaviour in global stock markets

Stock markets ended January with generally positive results, albeit with episodes of volatility linked to geopolitical events. The S&P 500 ended January with small gains, although it began February with corrections, weighed down by the technology sector, the adjustments in commodities and the strengthening of the dollar. At the sector level, a clear dispersion was observed over the month of January: cyclical sectors such as energy, materials, and industrials benefited from the dynamics in commodities markets, while the financial, technology and healthcare sectors performed less favourably. Within the technology segment, the heterogeneity was even more pronounced: firms that did not meet growth expectations suffered significant setbacks, while others linked to high-demand AI segments recorded notable gains. In Europe, the advances were led by the peripheral markets, with the PSI-20 and the IBEX 35 driven by the financial sector.