The markets weigh an easing in geopolitics and vertigo in technology

In October, the main stock market indices reached all-time highs, the dollar appreciated, sovereign debt yields declined and euro area peripheral spreads narrowed. Commodities exhibited disparity between the rise in metals and the decline in crude oil prices. The central banks fulfilled expectations: the Fed cut rates and the ECB kept them unchanged.

A rebound in risky assets, not exempt from swings

The US-China trade truce, the ceasefire in Gaza and the progress in the budget negotiations in France offered support to investor sentiment. In October, the main stock indices reached all-time highs, the dollar appreciated, sovereign debt yields declined and euro area peripheral spreads narrowed, while commodities exhibited disparity between the rise in metals and the decline in crude oil prices. Despite this broadly positive tone in the month, market prices were not without volatility and suffered back-and-forth movements, especially in the case of stocks, sovereign interest rates and some commodities. In this context, the central banks fulfilled expectations: the Fed cut rates, the ECB kept them unchanged and investors’ monetary policy expectations remained relatively stable.

The central banks stayed on track

The Federal Reserve cut rates by 25 bps, placing the fed funds rate in the 3.75%-4.00% range, and announced the end of the balance sheet reduction programme from December. However, Chair Powell’s tone was more cautious and he warned that further cuts are not a foregone decision, especially in a context of incomplete data due to the government shutdown. In addition, the statements of various Fed members revealed a notable disparity of views within the FOMC. Nevertheless, investors are still betting on another rate cut in December (although they lowered i ts probability slightly, to around 70%) and maintain the expectation of two more cuts in 2026. As for the ECB, it kept rates at 2.00% and reiterated its «meeting-by-meeting» and «data-dependent» approach to policy decisions, refusing to provide any clues about the future path of interest rates. While the ECB noted an improvement in the balance of risks surrounding the euro area economy, the markets kept their expectations unchanged, pricing in a near 95% probability that the depo rate will remain at 2.00% in December, but with a slight dovish bias for 2026 (implicit probability of 45% that the ECB will end up cutting the depo rate to 1.75% in the first half of next year).

Indecisive falls in sovereign interest rates

The month was marked by swings in sovereign bonds, which finally ended with a widespread decline in sovereign interest rates on both sides of the Atlantic (and a sharper drop at the long ends of the curve). In the US, sovereign rates racked up falls of 20 bps, although they rebounded at the end of October, following the FOMC meeting and Powell’s more cautious tone, as well as finding support in the trade truce with China. In Europe, the pattern was similar: the bund was under pressure in the first half of the month, but regained some ground in the second half. On the other hand, risk premiums in the euro area periphery decreased (not only in Italy, Spain and Portugal, but also in France, amid progress in the negotiations over the 2026 budget).

Widespread appreciation of the dollar

Following the sharp depreciation suffered in the first half of the year and a practically flat summer, the dollar appreciated in October, supported by solid activity indicators in the US (despite the lack of public statistics, suspended by the government shutdown) and the slightly hawkish bias in the comments of some Fed board members at the end of the month. Specifically, the euro depreciated to 1.15 dollars and reached its lowest levels since June. The Japanese yen, meanwhile, weakened in the month, also penalised by expectations of a continuity in the Bank of Japan’s dovish policy stance after it kept rates unchanged.

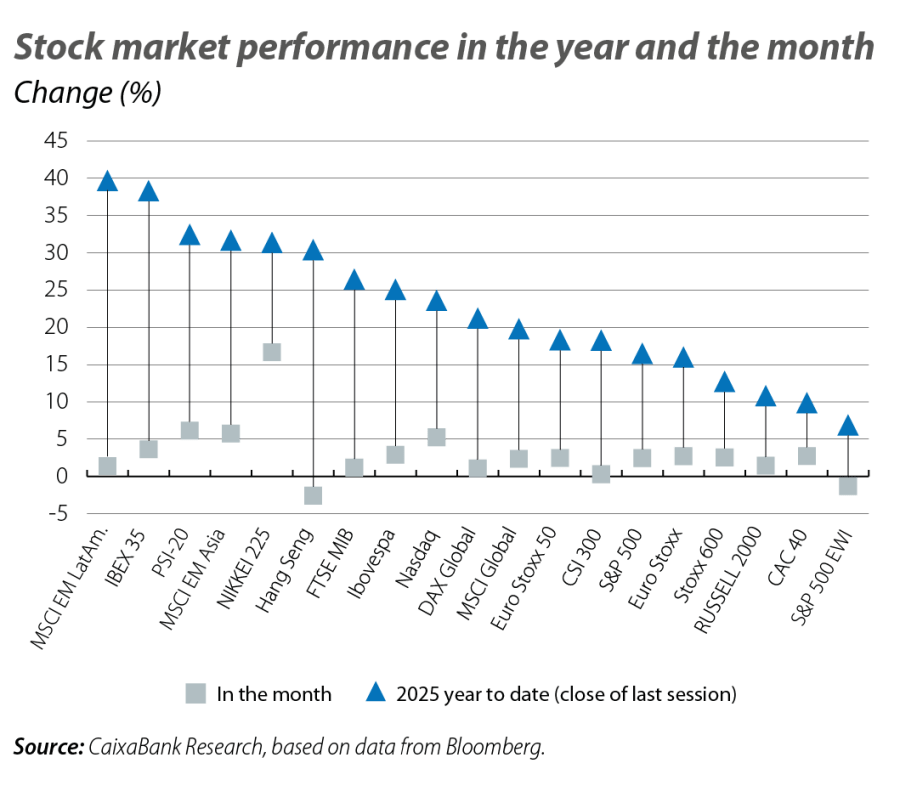

Gains in the stock markets, but with signs of caution amid high tech stock valuations

The main US and European indices reached all-time highs in the month, driven by the resilience of the global economy, the US-China trade truce and solid business earnings. Although the technology sector was one of the main drivers of the US stock markets for the month as a whole, there were some episodes of correction and market commentary focused on tech firms, their high valuation multiples and the demanding expectations regarding investment in artificial intelligence. In Europe, the performance of the various sectors was somewhat more balanced, with a good contribution from stock prices in the financial sector, while by country the IBEX 35 and the PSI-20 were among the indices with the greatest gains for the month as a whole.

Diverging dynamics among commodities

While industrial metals and agricultural products rose sharply in October, energy commodities retreated and gold recorded significant setbacks in the month. Specifically, after accumulating significant gains in the first few weeks of the month, gold suffered a correction towards the end of October, falling nearly 10% from the mid-month highs. Industrial metals recorded widespread increases, with sharp rises in aluminium and copper. Oil, on the other hand, closed the month down amid the prospect of an oversupply in the market (the International Energy Agency revised its global surplus forecasts for 2026 upwards). This outlook prompted OPEC to pause its increases in output, announcing that there will be no increases in Q1 2026, after a relatively moderate output increase planned for December (137,000 barrels per day). However, oil also experienced price swings, ranging from 61 dollars per barrel of Brent up to a peak of 67 dollars (after US and EU sanctions were imposed on the Russian oil firms Rosneft and Lukoil).